Context

I have been writing about Earth observation (EO) - this largely, misunderstood and underreported part of the space industry - for a while now. Both those within the industry and those outside the ‘space bubble’ do not pay a lot of attention to this market (although that’s changing a little, with a lot of money being thrown into EO startups lately). Some in the space community usually see EO as just another segment in the satellite market to be launched with the ~200 launchers/rockets, in development, while others think of EO as images taken from space that (mostly) look beautiful and can be used in “solving problems in various industries on Earth.” The expert community, on the other hand, (remote sensing, geospatial, artificial intelligence) considers EO as this incredible source of scientific data from different type of sensors in space holding the key to solving a number of global challenges of our time. Finally, there are a few who think the job in Earth observation is done as soon as the satellites are launched and they start collecting data. Recently, I even heard a space expert* say: “EO is a saturated, overcrowded market, where mostly everything has been figured out. Soon after launch, EO companies usually start making millions of $ in recurring revenues with the data they collect.”

Much of this is true, except for the last part - unless satellites are launched for use in the defence sector or with another anchor customer.

No, EO companies do not magically make millions of $ in revenues right after their satellites are launched (I have worked with some big names in EO and I guess, they would agree). No, EO is just not about pretty pictures whose prints you can order online and hang in your wall. No, EO is not a saturated market (In fact, I don’t think the market has been figured out at all, in the commercial sense).

Yes, EO has been around for decades - starting from the Landsat program of the US in the 1970s, the Copernicus programme of Europe in the 2000s and other institutional EO programmes around the world - and much of the EO data is being used extensively by the scientific community, across the world. However, I reckon that the commercial era of EO is just getting started (what I call the iPhone moment for data from space), and we have a lot of questions to answer. Some of them have been on my mind:

- Is EO part of the space industry, geospatial sector or the wider software world? Where do we draw the line?

- Is EO data yet another source of data available in the tech stack to build software with? So, what then are the types of EO data?

- How do different industries approach integrating EO data into their businesses leading the way to get EO to become this multi-billion market*?

In this post, I make a humble attempt to answer these questions.

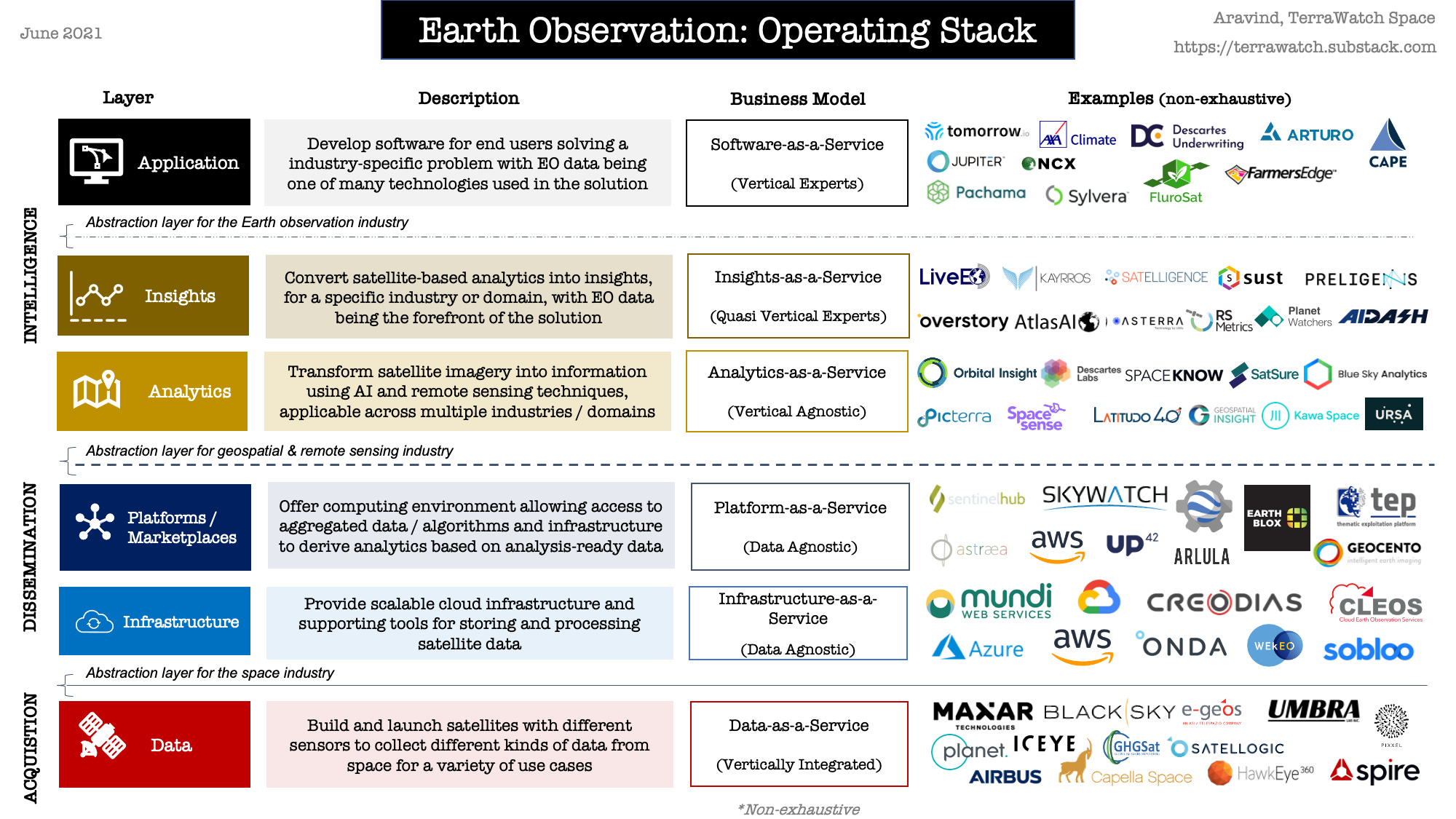

Earth Observation: Operating Stack

Fundamentally, I organise the EO market into 3 major layers in its Operating Stack: Acquisition, Dissemination and Intelligence (this is an upgrade of what I proposed before).

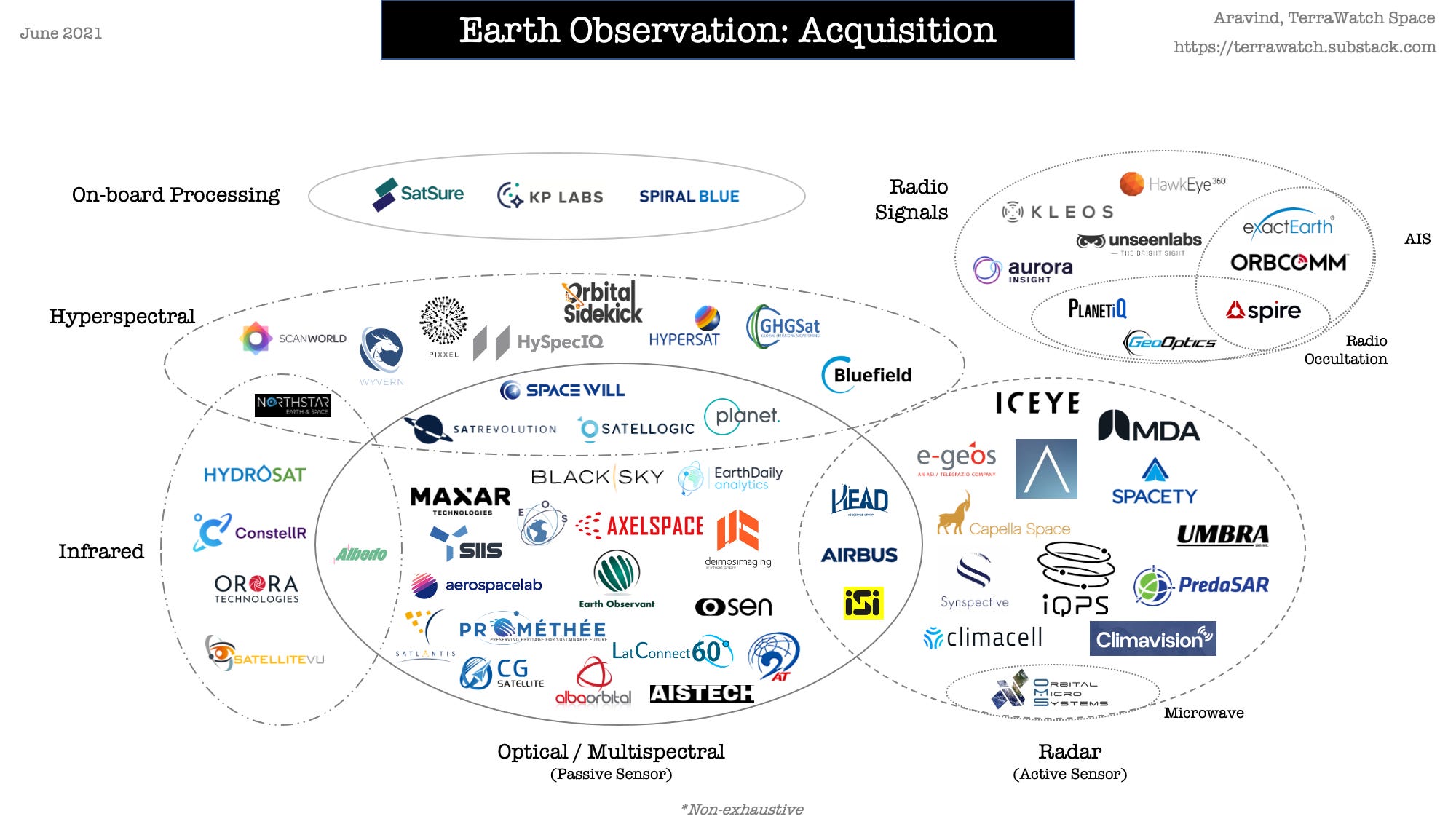

Acquisition

The layer that has everything to do with the space industry - designing the payload (with the help of remote sensing experts), building the satellites (increasingly constellations), launching them and getting them to be operational. There has been a significant boom (or a bubble?!) in the formation of EO companies in this Data layer, so much so that, even as a consultant I find it hard to track them (which is why I decided to created my own EO hype cycle). It is interesting to note that some of the companies here are increasingly becoming vertically integrated: On the Dissemination front, Maxar tried with the GBDX platform, Airbus is experimenting with Up42 and OneAtlas, while on the Intelligence front, Blacksky & Spire (on the verge of going public through SPACs) are offering analytics products, along with just data. I am guessing that this experiment of vertical integration will continue with the new & upcoming Data players, but in a few years time, I (shamelessly) predict the game will be fought in the Intelligence layer (competing on value as opposed to competing on infrastructure).

Below you can see a non-exhaustive mapping of EO companies by sensor type - I tried my best to be exhaustive, but please feel free to let me know if I have missed a company here. Also, I am human and I can make mistakes. So, please correct me (politely) if I have committed a blunder. As you can see, we are going to generate a ton of data about our life on Earth (and the Earth itself) - what a time to be alive!

Dissemination

Unlike communication satellites which could start making millions of $ in revenues right after launching*, EO requires extensive efforts to extract commercial value out of the data collected by satellites. This starts with a dissemination layer consisting of:

- an Infrastructure component to store and process data collected by satellites. Obviously, exclusive partnerships exist between the big players here and the EO companies - Maxar and AWS, Planet and Google. As cloud is always going to play a key role in storing and processing EO data, I see this layer becoming a cash cow for the Googles, AWSs and Azures of the world, until the processing shifts to the edge - processing data on-orbit (we are just getting started here!).

- and a Platform/Marketplace component to aggregate different types of EO data (a Booking.com for EO?) and offer a computing environment (an XCode / Eclipse IDE for EO?). Some interesting mix of companies working on making satellite data easier to access and work with. I expect the geospatial and remote sensing community to keep this layer going through pay-per-use models, but I expect the majority of the value from EO to be realised through the Intelligence layer.

Intelligence

This is the layer where most of the value of EO is realised (probably, not applicable to the defence sector, but usually, I don’t include them in my analysis even though they are the largest user of EO). In general, I see this layer consisting of 3 components:

- Analytics, which includes a set of companies transforming satellite imagery into information - essentially using the science of remote sensing and the power of AI to extract analytics from EO data (cars, trees, buildings etc.), potentially useful across any industry or domain, depending on the need/problem i.e. “breadth-first” as opposed to “depth-first” Given the scalability associated with this model, it is likely that companies in this layer will generate recurring revenues, in the short-term through pay-per-use / subscription models, until the end-users decide to build in-house teams to perform these tasks, as needed (or) decide to acquire products directly from companies part of Insights or Application, explained below.

- Insights, which includes companies that have decided to go “depth-first”, attempting to solve a problem (or multiple) within a specific vertical. With EO data as their primary source of data, companies in this layer attempt to “use EO data in solving problems.” As neither the applicability of EO data to the different industries nor the scalability of the solution has been fully figured out, most of the revenues tend to be project-based*. Essentially, this means the vast majority of companies in this layer start out acting as consultancies working on projects within a specific vertical, as opposed to building scalable solutions with a high Annual Recurring Revenue (ARR) - the fancy KPI used by VCs and investors. However, as EO data starts to become mainstream, my hope is that companies in this layer figure out a scalable product, that can be sold like a software solution essentially transitioning them into SaaS-like companies. I predict (shamelessly, again) that some of these companies will attempt to scale by integrating with enterprise software companies (the IBMs, SAPs and Oracles of the world), essentially getting EO to power products in the background.

- Application, which basically also includes companies that go “depth-first” within a specific vertical, but the biggest difference being, they focus to “solve a problem” where EO may or may not play a prominent role. As such, I consider these companies to be outside the realm of the EO industry - similar to how Uber, Deliveroo and Airbnb are outside the realm of the space industry, even though they use space technologies in their products. It is highly likely that these companies are funded by non-space, vertical-specific investors providing them with a strategic advantage over the other layers, in unlocking the end-user market. Given that these companies are attempting to use a problem-first approach rather than an EO-first approach, they are more likely to find a scalable SaaS-based business model, especially if they are working on a problem with a large addressable market. I would imagine that companies in “Insights” will transition into “Application”, as soon as they have identified a product-market fit with a scalable solution - which I believe is more likely to happen when EO is considered just another source of data, and the focus is on solving the problem.

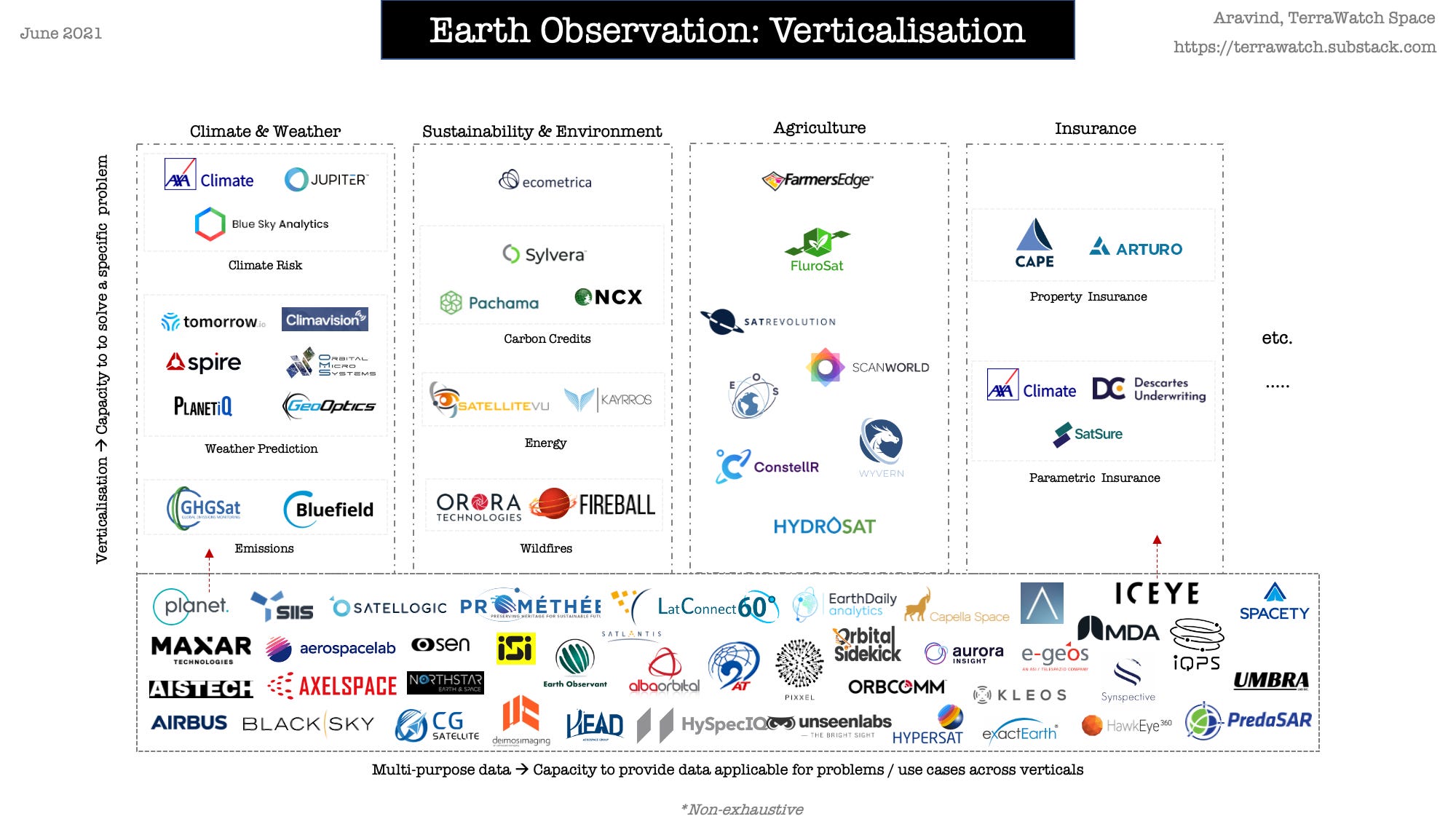

My Spiky Point of View: Verticalisation in EO

“A spiky point of view is a perspective others can disagree with. It’s a belief you feel strongly about and are willing to advocate for. It’s your thesis about topics in your realm of expertise.” - Wes Kao.

My spiky point of view is that the future of EO will be “verticalised” - meaning companies will focus on developing capabilities to solve a problem within a specific vertical as opposed to providing multi-purpose data capable of solving various problems across industries and use cases. This may not be so unique after all, as this is exactly what happened in the software world - horizontal SaaS and vertical SaaS. Nevertheless, I believe the multi-billion dollar market* of EO can be unlocked only through verticalisation, albeit with significant support from the horizontal EO companies - after all, they are the ones supplying the fundamental, multi-purpose EO data, which can then be combined with vertical-specific EO data to create scalable solutions, for solving particular problems.

I highlight in the figure below, some examples across verticals to make my point. Historically, there has been only one vertical of interest in EO - defence & intelligence. But that is changing and I (once again, shamelessly) predict that companies will verticalise even more i.e. go “depth first” further. The current “horizontal EO companies” have already shown some promise in verticalisation - Planet deciding to diversify into building emission satellites, Iceye strategically partnering with Swiss Re. You also have companies outside the realm of EO entering into EO to fill in their data gaps or to build solutions based on EO, for their specific vertical/domain. Some examples - Tomorrow.io (formerly Climacell), a weather company deciding to build EO satellites to improve their service, and a similar case with ClimaVision. AXA establishing AXA Climate to offer parametric insurance, based on insights from EO data. Plenty more examples in the figure. I am certain that this would be an interesting space to watch in EO, with more to come!

Final Note

In this article, I made an attempt to summarise some thoughts and insights I have gathered over the years. Please do not take this article as an advisory note for investing. I am an independent consultant in the space sector, and I make my living primarily through working on consulting assignments with space agencies, startups and investors. So, I would happy to work on specific questions you might have.

If you liked this article or found it useful, please feel free to share. Over time, I have learnt that distribution is as important (or more important) than content.

“A great blog post that nobody sees is a great product with terrible distribution. Conversely, a really dumb article, or whatever, that is a piece of content that is in a feed that is seen by millions is a terrible product with great distribution” - Balaji Srinivasan.

Thanks for reading!