Welcome to the new format of the TerraWatch newsletter. A few quick housekeeping notes before we get into the real content.

📢 The TerraWatch Newsletter Is Evolving

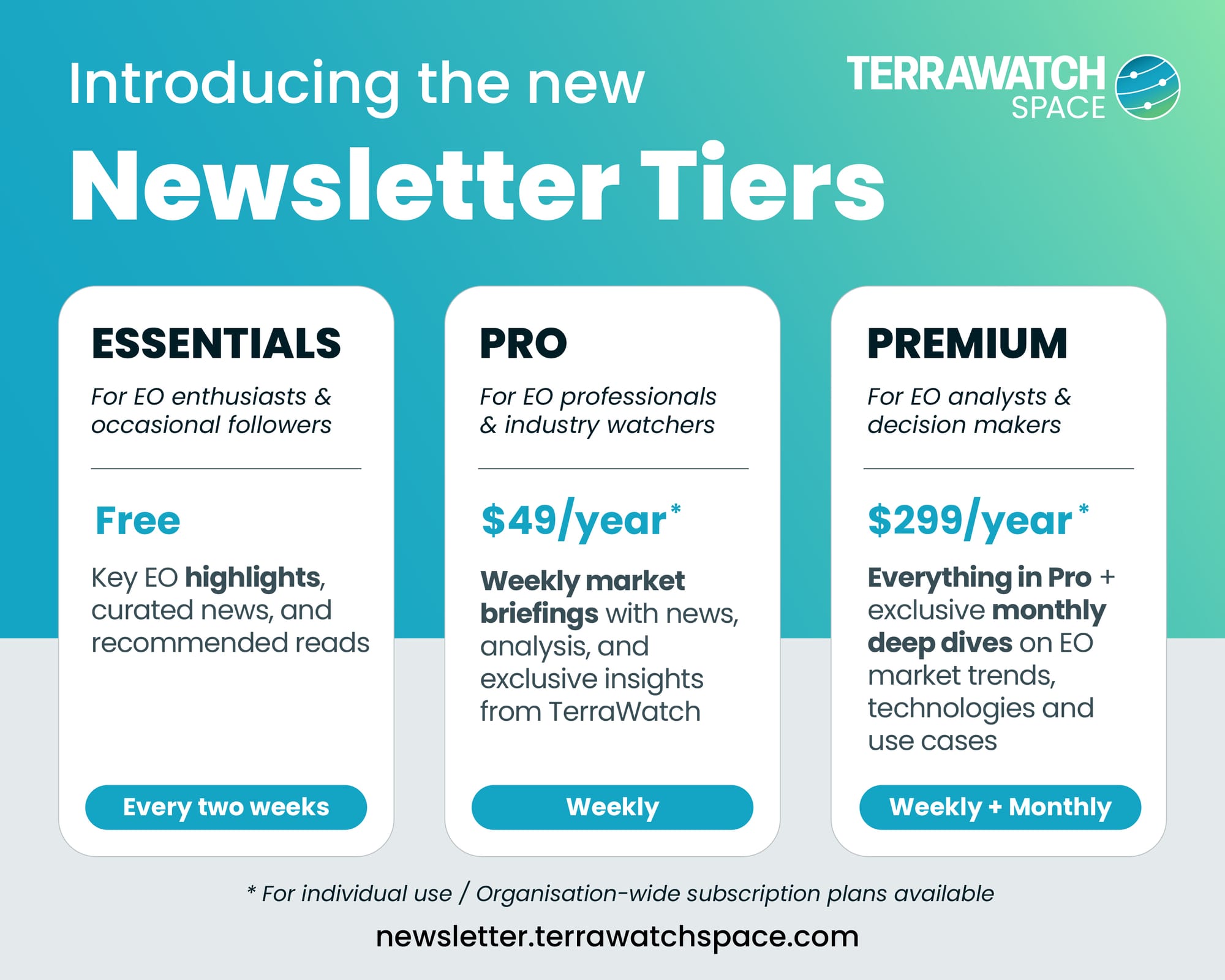

As announced, the TerraWatch newsletter is moving to a new model starting September 1.

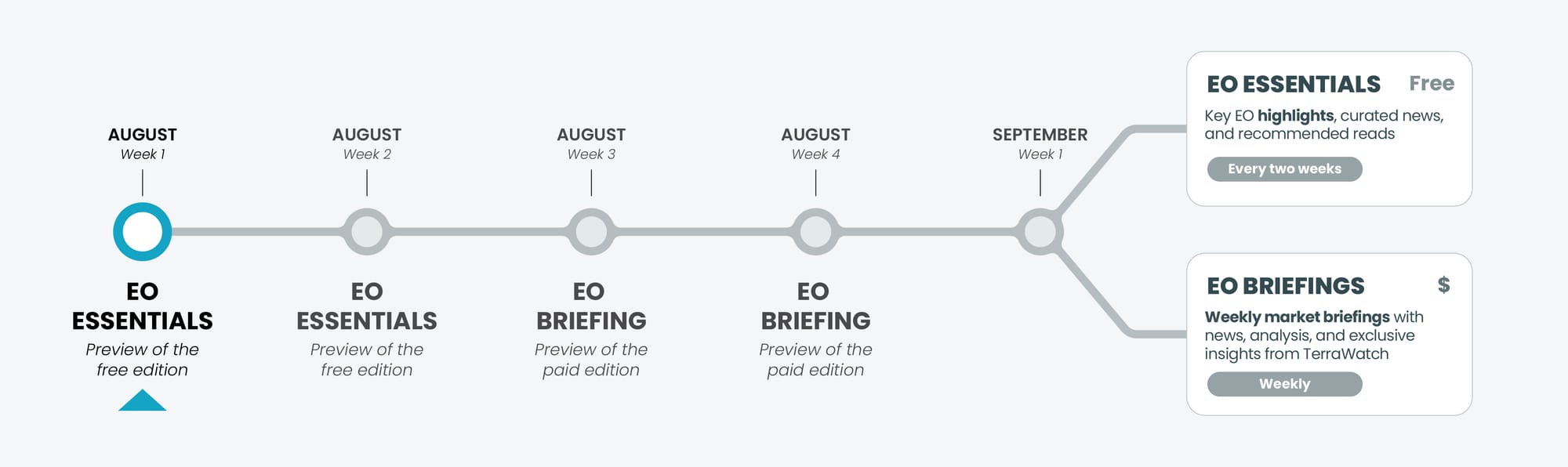

To help you get familiar with what’s coming, this month you will be receiving previews of the new formats:

- Today and next week, you will get the new Essentials edition that will go out every two weeks – shorter, sharper, and focused on key EO highlights, curated news, and recommended reads.

- Later this month, on August 18 and 25, everyone will receive two Pro editions for free, showcasing the weekly paid briefing with deeper analysis and exclusive insights.

📈 EO Market Highlights

Major developments in EO

🚨 Google DeepMind unveiled AlphaEarth Foundations, an AI-based 'building blocks' trained on satellite imagery, aiming to support a wide range of use cases.

My take: While this is quite a big deal in how EO is accessed and used, I think the real magic will happen when models are wrapped in purpose-built applications designed for specific user workflows. There is still a long way to go before we have custom-built AI-driven wrappers like Harvey (for law) and Abridge (for healthcare).

💰 EarthDaily Analytics has secured $60M from Trinity Capital to support the launch of its EO constellation and expand its geospatial solutions.

🤝 Dutch software solution provider Itility Group acquired a majority stake in Sensar, an EO firm specializing in satellite-based infrastructure monitoring.

🛰 NOAA will continue to maintain long-term access to data from US Department of Defense satellites significant for hurricane forecasting.

💡 Insight Bytes

A quick dose of analysis from TerraWatch

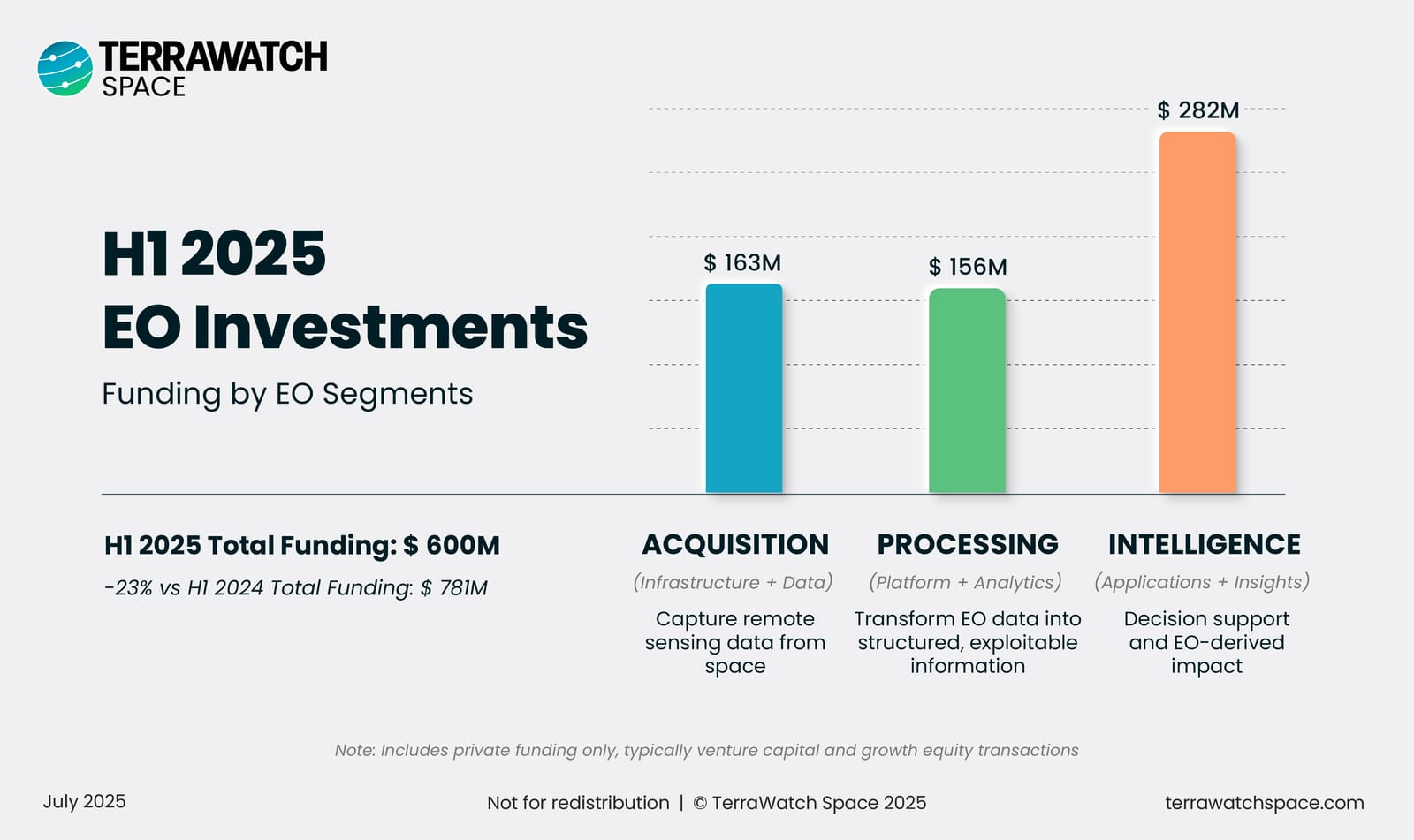

Earth Observation Investments Dip in H1 2025

The total investments in EO over H1 2025 are estimated to be $600M, with Acquisition and Intelligence segments contributing to 75% of the funding raised – 23% decline from the same period in 2024.

Despite a high number of deals, funding for Acquisition companies was subdued in H1 2025, totalling $163M. The largest rounds came from Muon Space, Urban Sky, and Insight M.

The Processing layer saw a quiet resurgence, boosted by the AI wave. Xoople led the charge, emerging from stealth with a $129M raise and announcing partnerships with Esri and Microsoft.

Funding in the Intelligence segment reached $282M, reflecting a cooling in climate tech investment. Pano AI, BeZero, and Treefera led the largest rounds in an otherwise softer half-year.

Read the full piece Earth Observation: H1 2025 Review that includes funding trends, summary of major developments, and what’s ahead for EO budgets, climate, consolidation and sovereign constellations.

Become a Premium subscriber to unlock full access.

🔍 Recommended Reads

Interesting links to check out

- The AlphaEarth Foundations paper from Google, if you would like to dig deeper into the methodology behind their model and embeddings;

- This paper that highlights the satellite requirements to better track how water moves through rivers around the world for better flood forecasting;

- Air travel turbulence is getting worse, with satellite data revealing a sharp rise over the North Atlantic over the past 40 years.

🛰️ Scene from Space

One visual leveraging EO

Wildfires in Portugal

Europe's Copernicus Sentinel-2 satellite captured this image of the wildfires burning in northern Portugal, along with the grey smoke from the fires.

Until next time,

Aravind.