Welcome to the first 2026 edition of Earth Observation Essentials, the free biweekly newsletter from TerraWatch covering key highlights from the EO market along with insights and analysis.

If you would like a more detailed, comprehensive market briefing with exclusive analysis, delivered every week, become a Pro subscriber, or a Premium subscriber, for more deep dives on EO markets, technologies and applications.

📈 EO Market Highlights

Major developments in EO

🇩🇪 German defense firm Rheinmetall and Iceye were awarded a contract valued at €1.7B by the German Armed Forces to supply space-based reconnaissance data via exclusive access to a SAR constellation.

💰 Array Labs, a SAR-satellite startup, that plans to launch clusters of radar satellites that fly in coordinated formations and image the same area from multiple angles to generate 3D imagery, has raised $20M in Series A funding.

🇺🇸 The recently released text of a final appropriations bill for fiscal year 2026 showed that US Congress stepped up and restored NASA Earth Science and NOAA budgets – NASA Earth Science will get about $2.15B (almost flat vs last year) and NOAA about $6.17B (also roughly flat), instead of the ~50% cut that was originally proposed.

- What this means? Funding is preserved for Earth System Observatory, Landsat Next and GeoXO missions, commercial data procurement programs and climate research and modeling initiatives.

Get a weekly market briefing with the most comprehensive developments in Earth observation, analysis on why they matter and more exclusive insights!

💡 Insight Bytes

A quick dose of analysis from TerraWatch

What to Expect in EO in 2026

EO in 2025 clarified three things: governments are the organizing customer, the product is assured capability (access, delivery, analytics), and commercial markets remain small outside sovereign procurement of EO.

Three determinants for EO in 2026

First, the product becomes operational guarantee, not imagery. That means EO vendors who can deliver contracts around coverage, delivery time, and reliability - not just image quality - and operate at that bar; manufacturers who can replenish fast as buyers shift toward constellations that absorb failures; and downstream that EO-based intelligence as a standardized package rather than rebuilding the service for each customer.

Second, distribution becomes the gate. Procurement consolidates around defense primes and platforms owning budgets and pathways. Technical excellence won't matter without channel access. For commercial use cases, 2026 will reward those where loss, liability, or price depends on the answer, delivered by EO.

Third, model-driven exploitation separates vendors. The 2025 foundation models/embedding wave matters in 2026 because buyers will pay for repeatable outputs with error rates and traceability that hold across regions and sensors. If vendors can't make outputs stable across model versions, embeddings stay research primitives and work stays analyst-heavy. If they can, procurement shifts from buying standalone imagery to buying abstracted outputs.

Upgrade to a Premium subscription to read this piece containing a detailed review of what happened in EO in 2025 across defense, civilian EO programs, EO adoption for commercial use cases, the evolution of the middle layer and advancements in AI for EO.

Hiring: Operations Lead

I am hiring a full-time Operations Lead to support TerraWatch across our upcoming course, newsletter, and events, with an expected start in February.

🔍 Recommended Reads

Interesting links to check out

- This article that presents the new global reanalysis dataset from the China Meteorological Administration.

- This paper presenting lessons from Uganda's EO-based disaster risk financing program, especially how prioritizing institutional setup and sustained financing is more important than technical perfection.

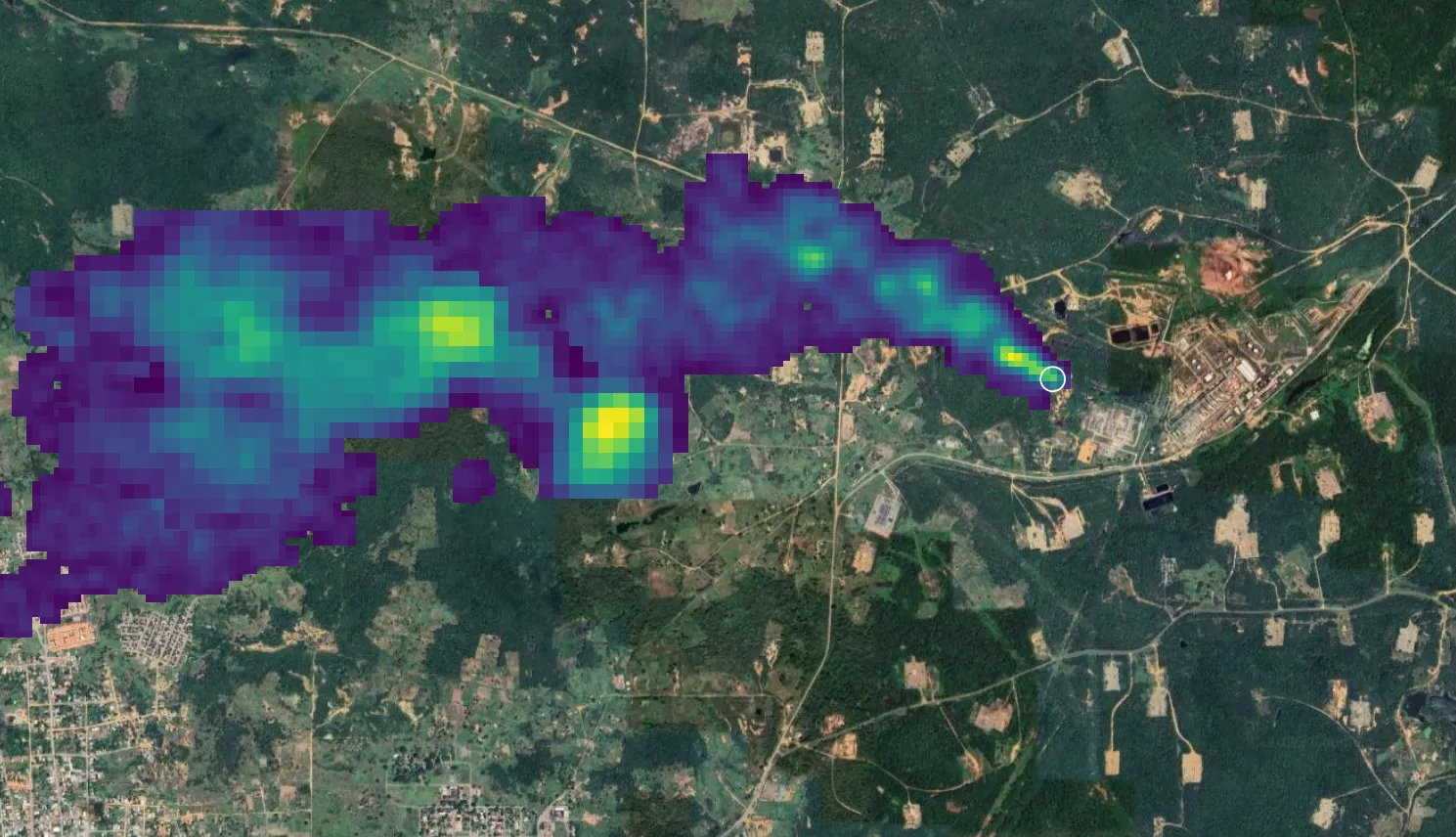

- This piece from Bloomberg that discusses the methane problem in Venezuela showing how much work is required to revive oil production.

🛰️ Scene from Space

One visual leveraging EO

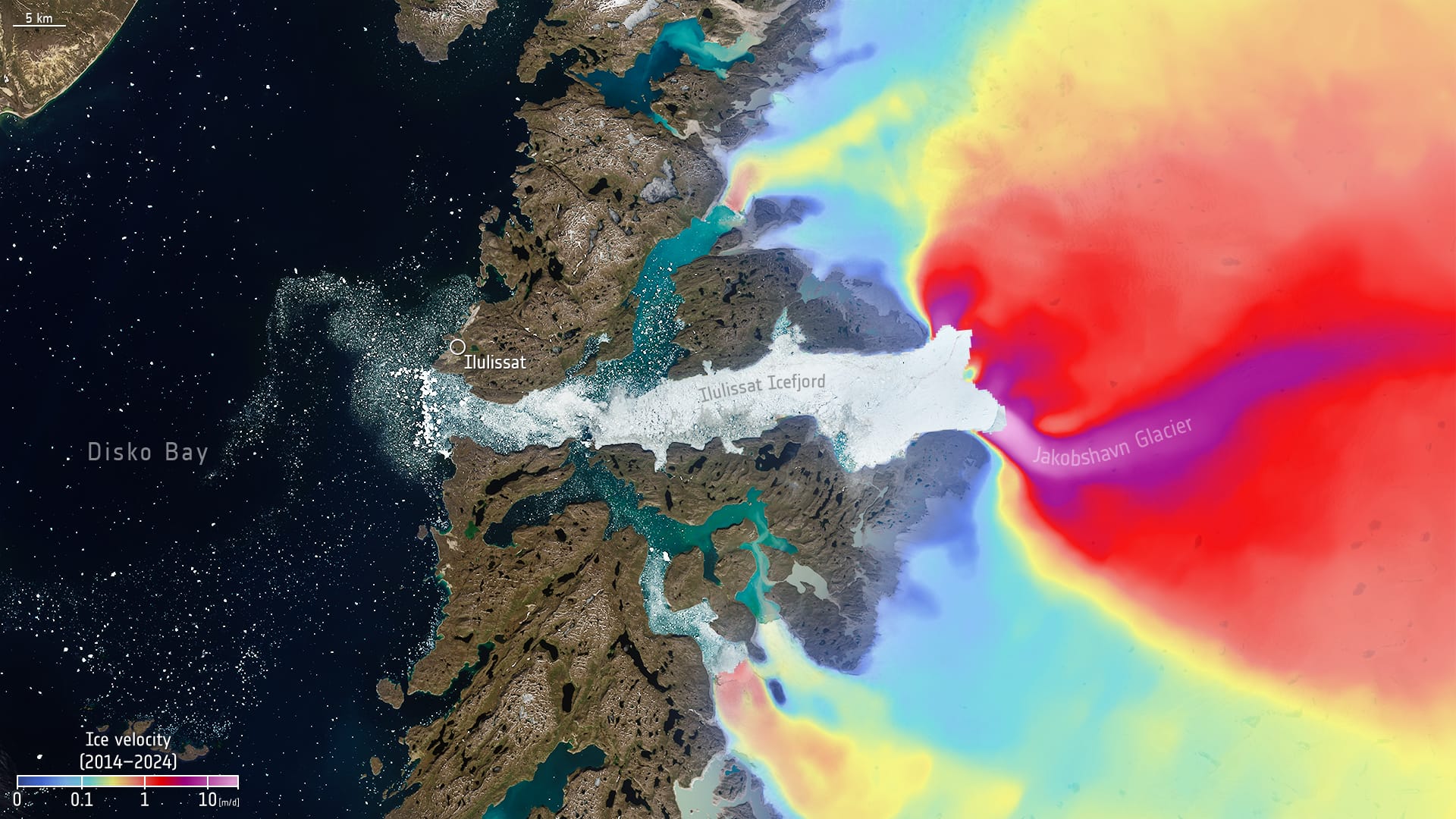

Ice Velocity Maps

This map, based on Copernicus Sentinel-1 data, shows the speed at which ice is moving horizontally in Greenland. Sentinel-1's continuous monitoring through the year contributes to producing such ice velocity maps, by analysing satellite images of the same location at different times to track ground movement.

Until next time,

Aravind.