Welcome to a new edition of Earth Observation Essentials, the free biweekly newsletter from TerraWatch covering key highlights from the EO market along with insights and analysis.

If you would like a more detailed, comprehensive market briefing, delivered every week, become a Pro or Premium subscriber.

📈 EO Market Highlights

Major developments in EO

🗺️ Maxar and Ecopia AI, a mapping, firm are teaming up to launch an AI-powered product that keeps digital maps accurate with new satellite imagery, ensuring roads, buildings, and land cover stay aligned with the real world and avoiding costly errors.

This is really about maps that evolve continuously instead of static datasets patched up every few years. The winners in this space won’t just sell sharper imagery, but seamless fusion of imagery, AI, and vector accuracy - everyone else risks falling behind.

💰 NATO is planning to invest $728M in new space capabilities, including a new ‘data lake’ to be populated with data from the national surveillance satellites of allied states via a virtual constellation, along with the potential acquisition of commercial satellite imagery.

🇩🇪 Planet announced plans to begin production of the high-resolution Pelican satellites in Germany, following an investment of more than 8 figures, which would add up to 70 employees. This comes after Planet won a contract for €240M earlier this year to provide dedicated capacity over Europe for the German government.

🛰️ ESA selected WIVERN as the next mission for its science programme – WIVERN, short for wind velocity radar nephoscope, will provide the first measurements of wind within clouds together with information on the internal structure of clouds, filling a significant gap in the global satellite observing system.

The Pro editions provided exclusive insights on i) EO Business Models: SaaS vs Outcome-Based vs Hybrid and ii) Why EO-Based Risk Analytics Solutions Struggle to Scale.

Upgrade today to a Pro subscriptions for more exclusive analysis!

💡 Insight Bytes

A quick dose of analysis from TerraWatch

Three Reasons Why EO Struggles on Public Markets

As someone who has tracked the financial performance and outlook of the four EO companies that went public, I can’t help but wonder if EO might be one of the least suitable sectors for the public markets. Here are three reasons why, based on conversations with both retail investors and large funds trying to make sense of this industry.

1. Hard to Explain, Harder to Differentiate

Even for those who follow EO closely, it takes time to unpack the nuances. A 30 cm satellite doesn’t mean three times the revenue compared to 1 m, and 30 bands aren’t automatically more valuable than 10. Most investors don’t “get” the real differentiation. Add a crowded field with dozens of companies pitching the same market and the same J-curve growth charts, and confusion only grows.

2. Commercial Potential Still a Mirage

Defense and intelligence revenues keep growing, but most commercial sectors, agriculture, insurance, mining, and energy remain in the “lots of potential, little to show” category. I believe the potential is real and worth betting on (my thesis behind TerraWatch), but public markets generally don't like waiting years for proof. EO is inherently long-term, while public investors want near-term returns.

3. Business Models That Don’t Fit the Spreadsheet

Some EO companies sell raw data, others subscriptions to analytics and insights, some build satellites for sale, and many mix these models. Unlike a number of other sectors, you cannot easily forecast EO revenues on a simple spreadsheet (this is why I have a job). Investors struggle to make sense of the business logic, and only the most patient dive deep enough to understand it.

My Take

EO is a long-term game. The short-term volatility has cost the sector credibility with public investors, but those who endure will create real impact. We are in a golden era where EO data is more essential than ever – the challenge is less about convincing the market that EO matters, and more about proving it can generate predictable, scalable returns.

Want more exclusive analysis of the EO market and a comprehensive weekly market briefing with curated news and insights? Upgrade to a Pro subscription for only $49/year.

🔍 Recommended Reads

Interesting links to check out

- The US National Academies have released a new climate report concluding that the evidence for current and future harm to human health and welfare created by human-caused greenhouse gases is beyond scientific dispute.

- Climate TRACE has released a new tool to track their air pollution exposure, along with their region’s biggest sources of planet-warming pollution.

- Kazakhstan signed a partnership agreement with the Global Methane Hub to use satellite data to reduce methane emissions through national planning, monitoring, and regulations.

🛰️ Scene from Space

One visual leveraging EO

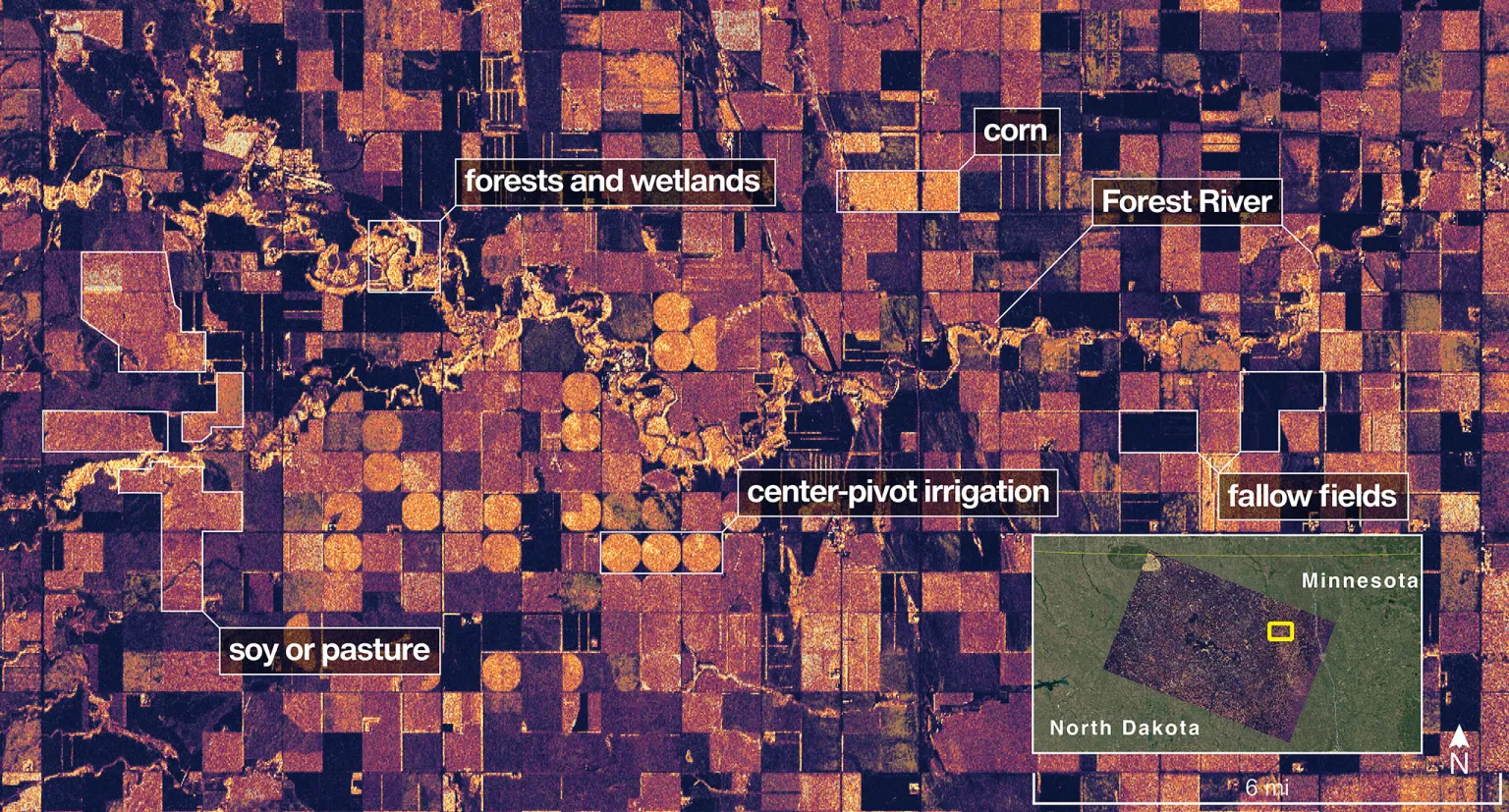

NISAR's First Images

NASA and ISRO have released the first images from the recently launched NISAR satellite that showcases its L-band SAR instrument.

The image below shows land adjacent to northeastern North Dakota’s Forest River – the dark agricultural plots show uncultivated fields, while the lighter colors represent the presence of pasture or crops, such as soybean and corn.

Until next time,

Aravind.