Happy New Year, everyone. We will be back to our regular, weekly editions of ‘Last Week in Earth Observation’ from next week.

It is that time of the year when we try to make sense of what happened in 2024 and try to prepare for what is coming up in 2025. So, that’s what I have done taking an orbital view of the EO sector.

1. Governments will continue to be the largest customer of EO data and analytics 🏛️

While EO sector continues to gradually crack adoption across commercial use cases, the reality is that, according to our analysis, about two-thirds of the EO market is still government-driven - and, that share is not going to change.

Looking Back at 2024

Large contracts to acquire satellites, data and analytics dominated the year including the $1.8B contract from the US National Reconnaissance Office (NRO) for SpaceX to build and launch at least 100 spy satellites (with 6 launches already completed), the $476M contract from NASA to acquire commercial satellite data and the $290M program from the US National Geospatial-Intelligence Agency (NGA) to acquire analytics for continuous global monitoring. A similar trend was seen internationally with contracts from Indonesia, Morocco, Poland and others.

Outlook for 2025

Government-led contracts are the foundations for the business plans of most EO companies, and hence are the most important driver for their financial sustainability. We will continue seeing more contracts, from authorities worldwide for acquiring data as well as a continued shift towards directly acquiring analytics directly from the market. We may see large contracts for SAR and hyperspectral data acquisition by the NRO (like this one), but also expect to see more partnerships (like this one between Maxar and Satellogic) between EO satellite companies as they aim to capture the largest share of the contract values.

2. Sovereign EO initiatives are not going away, but their long-term sustainability will come into question 🚩

The last few years have seen the trend of countries investing in sovereign EO satellite constellations (different from scientific EO missions) and last year was probably the peak of this trend.

Looking Back at 2024

According to our data, there are over 40 countries that have either announced or have invested in national EO constellations. In 2024, we saw Greece invest over €120M into its EO programme (including thermal and SAR capabilities), India announce plans for military satellite constellation, Saudi Arabia and Hungary make similar plans along with Netherlands and Oman starting their programmes. While most of these initiatives largely have an economic rationale (know-how, jobs etc.), very few of them have shared details on the activities that come after the launch of the satellites - dissemination, interoperability, awareness adoption etc.

Outlook for 2025

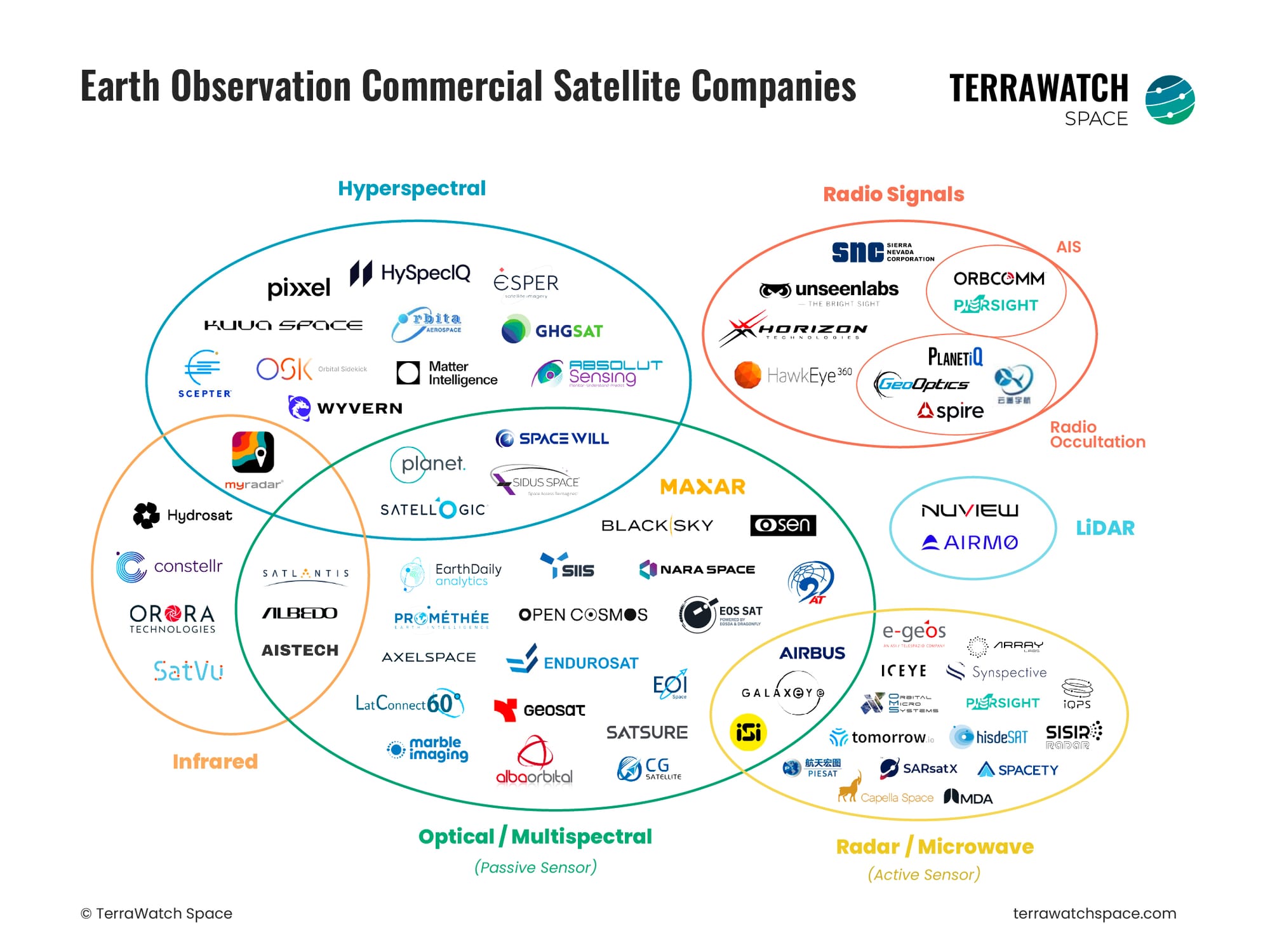

The geopolitical state of affairs mean that countries are more likely to favour data independence, and as a result, the trend of sovereign EO is not going away. Along with 40+ countries with their EO programmes, we also have the 60+ companies (see below) launching their own constellations. It begs the question: "How many is too many?" So, in 2025, we might see more focus on the long-term sustainability of these initiatives - whether they are actually future-proof, whether there is (and needs to be) an RoI and whether EO awareness and EO adoption activities are included in their strategies (or whether they are purely proud achievements).

3. A new future for civilian EO could emerge with the rapid growth in the commercial remote sensing satellites 🌍

Civilian EO programs have received plenty of scrutiny, especially in the US, where missions have been cancelled and reprioritised, while the commercial EO sector continues to grow (at least with respect to number of companies).

Looking Back at 2024

The EO sector has evolved from primarily working with prime contractors on EO satellite development through traditional cost-plus contracts to procuring data from commercial EO companies through indefinite/defined data contracts. 2024 saw contract awards (totalling over $3B) for NOAA's GeoXO weather satellites, long-term contracts for thermal data for OroraTech and constellr by the Germany space agency, DLR as well as the complete funding allocation confirming the Copernicus Sentinel Expansion Missions.

Outlook for 2025

While the trends on one side of the Atlantic appear to be nominal (with ESA's EO budget remaining steady), the other side is waiting to see the impacts of the new administration. The last edition saw several attempts to cancel NASA's Earth Science missions (the US Congress restored their funding) as well as funding cuts for NOAA. Some in the community assume that the future of EO will be driven by commercial satellites, and that we will see a decrease in funding for public EO missions, pointing to the explosion of EO companies with satellites with better specifications than publicly funded missions.

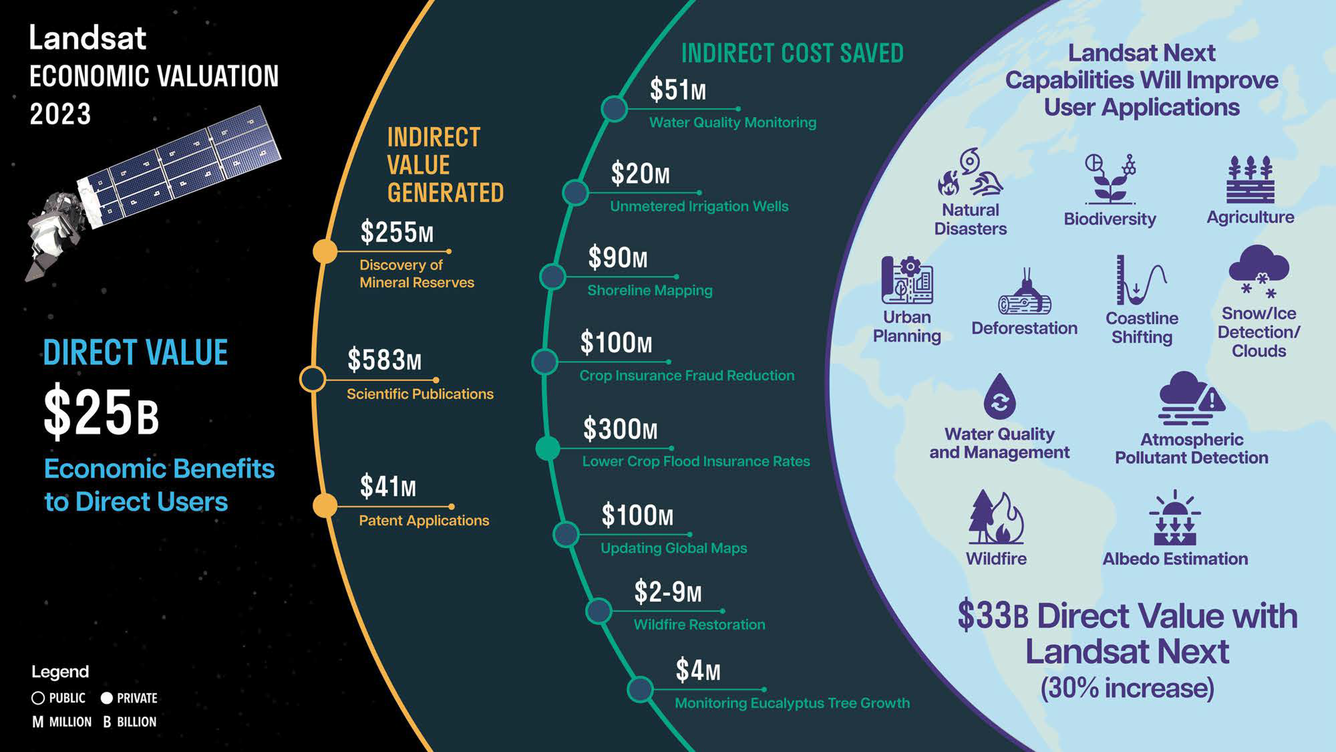

But, the truth is Landsat is still the gold standard for satellite imaging, and together with Sentinel-1 and Sentinel-2, these missions represent the benchmark for EO data and are hence the foundation for several EO foundational models. While commercial EO may have started providing data with more advanced specifications, there is significant work to be done before they can replace publicly funded missions. 2025 will see some evolution in the interplay between the private sector and the public sector in the US, which may affect EO policies and investments in Europe and beyond.

4. Private investments in EO may pick up again, but probably will not peak 💸

While the general perception for EO funding remained neutral following the performance of publicly traded EO companies and important milestones by others, it looks like we may have peaked as some investors are taking a more cautious, wait-and-watch approach with EO upstream investments.

Looking Back at 2024

The total investments in EO for 2024 are estimated to be $1.7B, with the Data and Application segments contributing to 95 per cent of the overall funding raised, of which downstream firms that leverage satellite data to build vertical-specific solutions received over $1B. This is a slight decrease, compared to the $1.9B raised in 2023, and the overall deal count - however, funding for EO satellite companies (Data segment) grew by about 10%, despite the pessimistic sentiment around EO.

A detailed review of 2024 EO investments (like this one for 2023), which includes in-depth analysis by segment, startup stage, market vertical and geography - will be published next week, for the paid subscribers of the newsletter. Become a premium subscriber to receive the complete analysis!

Outlook for 2025

Expect funding for EO companies focusing on the defense and intelligence sector to grow as newfound optimism hits the US, with a potentially, business-friendly administration. Some investors will continue to play it safe as they wait for companies to validate both their technologies and business cases. Downstream companies (the Application segment) will continue to see more interest and funding, due to their focused nature, while the middle Platform segment, normally overlooked by investors, will be on the spotlight again, as focus shifts to unlocking the value of terabytes of data downlinked - by fusing, analysing and visualising.

5. Consolidation will shape the EO market more than ever before ↕️ ↔️

You would have probably heard this many times: consolidation in EO is inevitable, especially given that EO companies are continually integrating forward (from Data to Applications) or backwards (from Applications to Data).

Looking Back at 2024

2024 saw a few surprising and a few unsurprising deals - primarily horizontal consolidation i.e. when two similar type of EO businesses, on a sensor-level or on a segment-level, join hands. Some examples of transactions included Safran acquiring Preligens (unsurprising), Privateer acquiring Orbital Insight (surprising), EarthDaily acquiring Descartes Labs (unsurprising), New Space Group acquiring EO platform company UP42 (surprising), maritime intelligence provider Kpler acquire Spire's maritime business along with a few smaller transactions involving NuView, KSAT and Maxar.

Outlook for 2025

We will continue to see more acquisitions in 2025 - more specifically vertical consolidation i.e. an enterprise market leader in a specific vertical acquiring an EO downstream firm, as they discover and validate the strategic value of EO for their business or an EO data company acquiring a specialised EO downstream firm, as they reinforce their go-to-market strategies and decide to verticalize in specific industries.

6. EO for climate may take a back seat but climate will not 🌍

Analysis, using EO data, has repeatedly shown that the climate and biodiversity crisis have significantly worsened in 2024, however it is unclear whether they will continue to have a place in the political and economic agendas.

Looking Back at 2024

We will soon have confirmations that 2024 will be the first year to exceed 1.5ºC above the pre-industrial average levels. This, along with, rising deforestation (despite decreases in Brazil and Colombia) and underestimated methane emissions, is just more bad news. This was evidenced by record-breaking floods, wildfires, droughts and heatwaves that killed tens of thousands of people, globally. As climate dropped in priority for governments and private investors, large corporations and philanthropic organisations stepped up with some investment (MethaneSat and Carbon Mapper). However, while EO satellites (old and new) continue to monitor the planet and contribute to our understanding, they can only do so much - actions taken by humans, continued to remain insufficient.

Outlook for 2025

While we are poised to detect and potentially mitigate more greenhouse emissions in 2025 than we have ever before (thanks to MethaneSat and Carbon Mapper), it is unsure how much large-scale action and eventual decrease in emissions this would lead to. More generally, as some enterprises see climate as a strategic value enabler (such as insurance and agriculture), others might resort to viewing climate risk disclosure, biodiversity impact assessments and deforestation reports as a formality. As a result, while EO will have a role in all of this, its part in leading to actual impact may be slower than expected.

7. More satellites, more data but increased focus on leveraging data from existing missions 🛰️

As always, we had an exciting 2024 for new EO satellites and I am confident we will have a more exciting 2025 when it comes to showcasing the capabilities of the Data layer.

Looking Back at 2024

We saw the launch of some important public EO missions such as NASA’s PACE ocean monitoring mission, NOAA's GOES-U weather satellite, ESA's EarthCare climate mission and the EU's Copernicus Sentinel-1C and 2C satellites. Several private EO companies including Kuva Space, PierSight, and Maxar (Legion), Planet (Tanager) launched the first satellites of their constellation

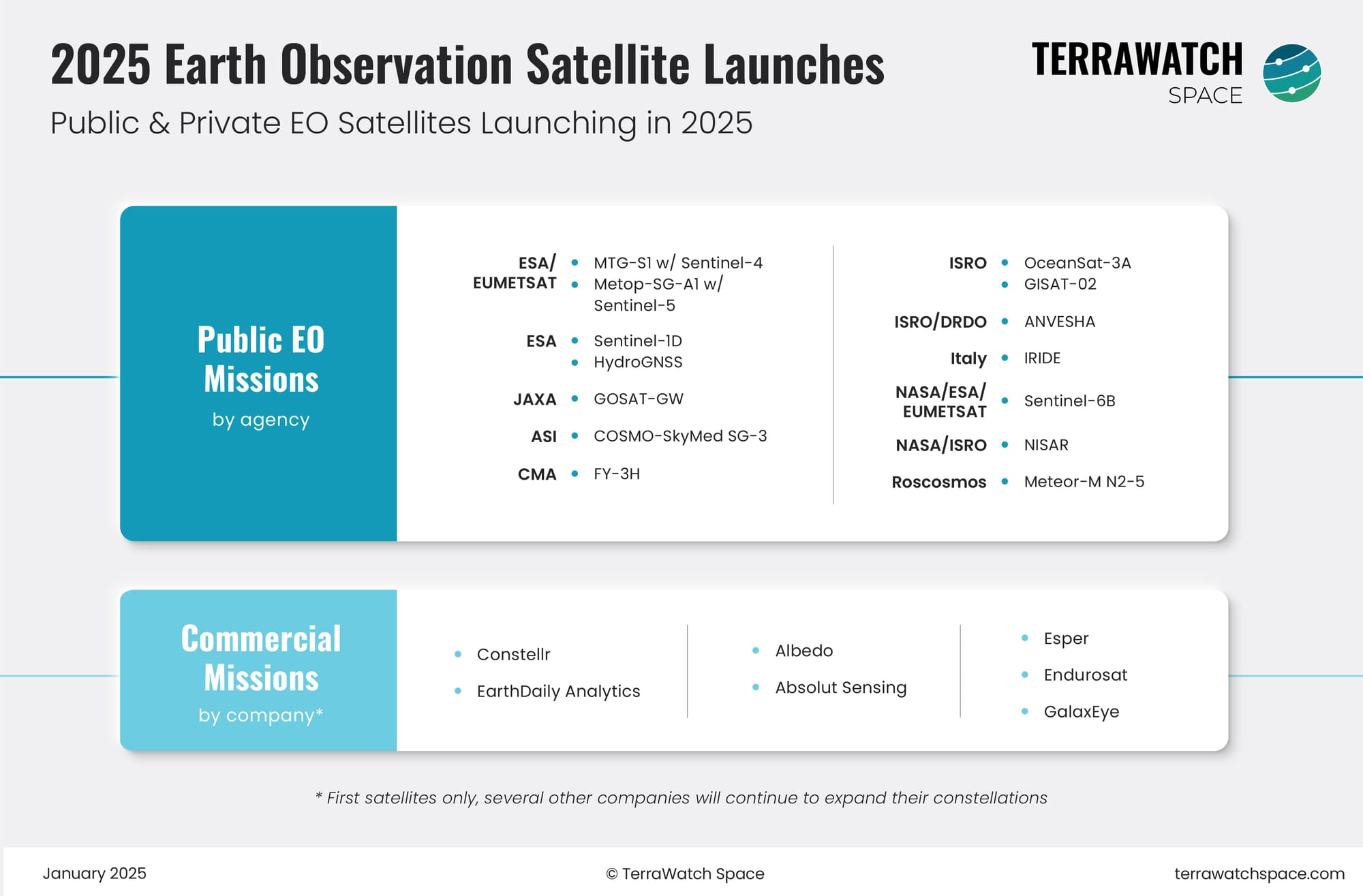

Outlook for 2025

Here are some exciting missions to look forward to in 2025. Note that this is the best-case scenario outlook, but a disrupted launch sector (specifically in Europe) and other space industry dynamics might delay a few missions to next year.

8. Commercial adoption of EO will grow rapidly for 'value driving' use cases, but slowly for 'operational enablers' 📈

Revenues of EO companies (like Planet) saw a growth in share from the defense and intelligence (D&I) sector while that from commercial market verticals (non-defense) are decreasing.

Looking Back at 2024

The growth of EO market in the D&I sector is not a surprise - after all there are more validated needs for satellite data in D&I whereas for emerging commercial use cases, there are only assumed needs. Some of those needs are met relatively well by open data (Landsat, Sentinel etc.). So, while the fundamental assumption of EO being a critical component of commercial use cases was not incorrect, the assumption that commercial EO data is a big part of the addressable market might have been overestimated. As a result, while commercial adoption grew for some use cases (see here and here), overall adoption of EO by enterprises is still slower than anticipated.

Outlook for 2025

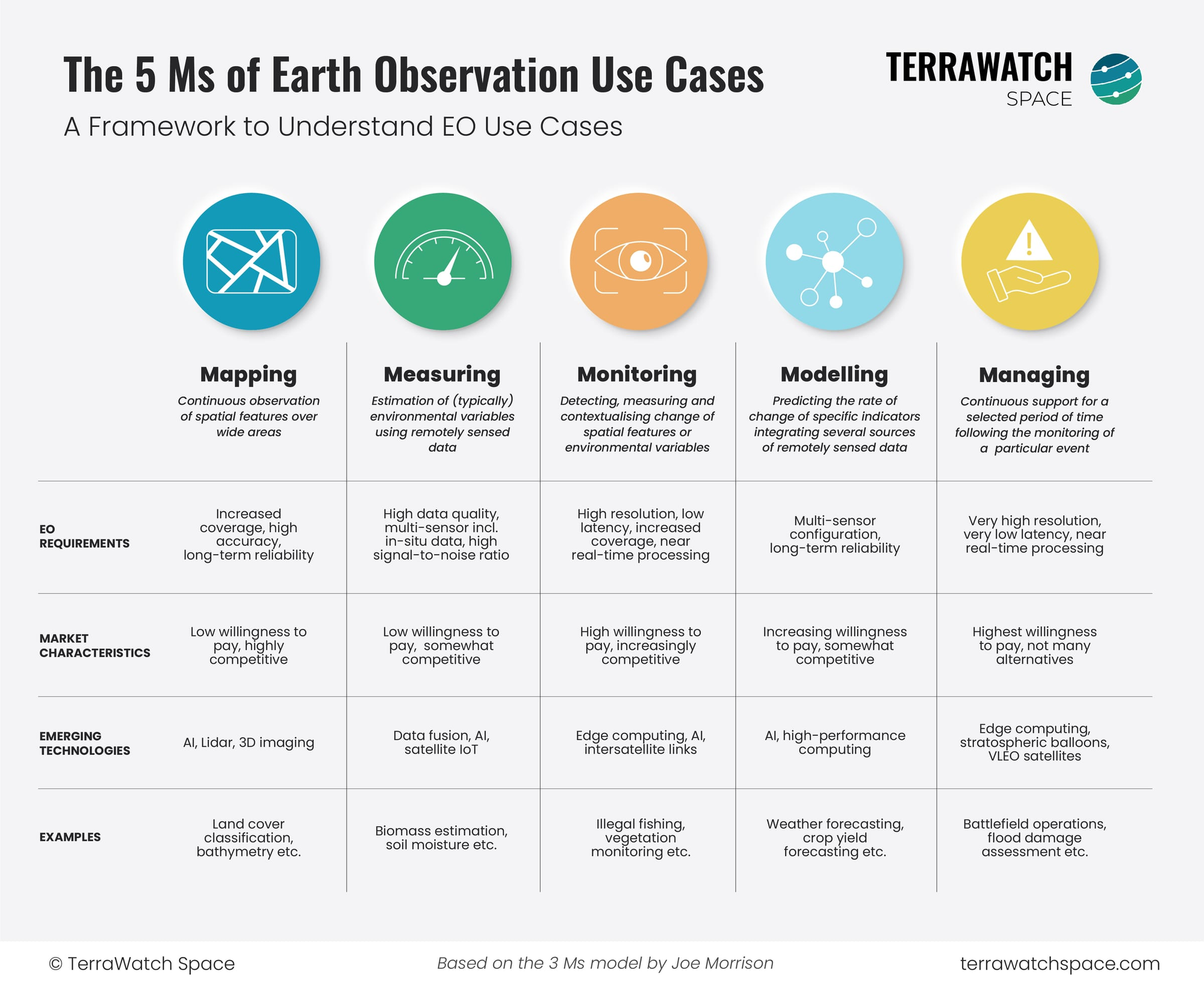

There are two types of use cases: “value drivers” and “operational enablers.” In 2025, we will see growth in use cases that are "value drivers” that lead to the creation of economic value for the organisation or result in cost savings due to the integration of EO, given the potential RoI for end-users (vegetation risk management, crop yield forecasting, parametric insurance, commodity trading etc.). However, for "operational enablers" that may not directly result in value creation or cost savings and considered overheads (biodiversity risk, deforestation, climate risk, emissions etc.), the growth is not a given. However, given that organisations have to comply with regulations (like EUDR, CSRD etc.), 2025 will validate the business case for companies focusing on the latter category.

Commercial use cases of EO will be the spotlight at EO Summit, the world’s most user-focused, application-driven EO conference taking place in New York on 10 – 11 June 2025. Learn more about EO Summit and register here!

9. Foundation models, generative AI and other buzzwords might stop being just buzzwords 💬

AI was certainly the word of the year, not just in EO, but in every sector, but we might reaching a tipping point in the use of AI for EO.

Looking Back at 2024

It was all about genAI and foundational models, as the year saw NGA announce a $700M initiative to use AI for data labeling, NASA and IBM collaborate on building a foundational model for weather and climate applications, Microsoft and NASA team up on making satellite data accessible and other non-profit initiatives such as Clay and Earth Index among others. There was even an AI-based flood prediction tool to visualize future flooding. But how do we validate and assess the quality of all these models? We saw the start of the benchmarking phase with research on the evaluation of foundation models.

Outlook for 2025

There will be more foundation models and the introduction of geospatial AI agents, but there will be special emphasis on purpose-built AI agents that are capable of solving very specific EO problems. Taking the 5Ms framework as an example, some agents will be a good fit in mapping applications, others in measuring specific variables through multi-sensor data fusion and others in being able to enable better monitoring i.e. detect change accurately. And, 2025 might be the year in which edge computing, enabled by AI, might see some level of mainstreaming through validated demonstrations of specific use cases.

10. The value of EO as a public good will become more prominent ❗

The value of EO has always been taken for granted, which is not necessarily wrong, but as the economic, technological and political realities change, we might need to start acknowledging the impacts of public investments in EO.

Looking Back at 2024

EO, whether in the form of weather forecasts, wildfire alerts, flood warnings, drought information or otherwise, is a public good and has been so since its inception. However, 2024 saw advancements in each of these areas by private companies - new weather satellites, real-time wildfire alerts, global flood forecasts and more.

Outlook for 2025

How do we continue to provide EO-derived applications as a public good yet incentivise and leverage the innovations from the commercial EO sector. Or, are we looking at an (unfortunate) future in which weather forecasts, wildfire alerts, flood warnings, drought information etc. become entirely private services, with a pay-to-use model? As we try to find our answers for these tough questions in the new year, it might be worth understanding the value of EO as a public good - both when the raw material (satellite imagery, weather reanalysis data etc.) and the derived products (flood risk, weather forecasts etc.).

Some Special Mentions

- Standards, analysis-ready data, black boxes and other boring problems might get more attention 🥱

Boring problems are those that are underrated, underfunded and underappreciated, but unless we find a way to solve them EO will not be mainstream. We saw the release of more global datasets, some open enough to share their methodologies, including by companies. Some solutions remained black boxes, but there will be some pressure on them to open up. And, we might finally see an officially accepted definition for analysis-ready EO data.

- Operationalizing AI weather models and filling weather data gaps will remain an open discussion 🌦️

2024 was probably the most significant year for the weather segment, seeing the launch of multiple AI models (including from Google and Microsoft), but there is interestingly only one fully operational system, and that is from the European weather agency, ECMWF. It was also the year when the commercial weather sector saw uptake from military, civilian and commercial sectors. Global weather data gaps still remain, and there global initiatives to reduce weather inequality, but whether it will be achieved is less certain.

On a personal note ...

TerraWatch will continue to be a voice and a company that is independent, objective, and realistic about the state of EO while continuing to remain enthusiastic, passionate, and evangelistic about the potential and impacts of EO for society, businesses, and the environment.

We had a great 2024, and we look forward to doing more EO user conferences, community happy hours, side events, and of course, more deep dives and more analysis – all focused on our vision to make EO mainstream.

Wish you all a fantastic year ahead!

Until next time,

Aravind.