If you are a Premium subscriber, this piece is free to read. Thanks for your support!

If you are a Pro subscriber and want to read this deep-dive (and the upcoming ones), upgrade to a Premium subscription.

If you are a free subscriber, this is a short preview of the full piece. If you would like to read more, please upgrade to a Premium subscription.

Heading into 2025, the EO investment thesis was clear: defense pays, commercial is coming, the sector keeps growing. The question was whether anything would change.

2025 didn't change that story, it sharpened it. Defense is not just the anchor for EO anymore, it became the entire boat. But where those boats are being built - and how many - has shifted dramatically. This was reflected in the largest rounds of the year.

The numbers broke records, but the patterns broke expectations. For example, late-stage funding exploded while early-stage deal count dropped, perhaps showing signs of a market maturing faster than many expected.

The headline is that EO had a record year in terms of funding. But headlines obscure more than they reveal. The real story is in the details: the composition of the investments, where the money was raised geographically, which segments attracted it, and at what stages.

This piece breaks down EO investment in 2025: by segment, by year, by region, and by growth stage. We will look at the largest rounds, what they signal about investor conviction, what kind of M&A happened in EO and what it all could mean for the year ahead.

As always, the analysis below includes only funding from venture capital and other private funding – government contracts are not part of the figures, but they also tell a story. We explored some of those dynamics in our comprehensive review of EO in 2025.

Here is what we have in store for this deep-dive:

- EO Investments in 2025

- By Segment (Acquisition vs Processing vs Intelligence)

- By Year (2020 - 2025)

- By Region (NAM vs EU vs APAC vs MEA vs LATAM)

- By Growth Stage (Early vs Growth vs Late)

- The Highest Funding Round (by Segment)

- Investment Outlook for 2025

- Acquisition

- Processing

- Intelligence

- M&A Activity

- Looking Back at 2025

- Looking Forward to 2026

- Public Markets Snapshot

EO Investments in 2025

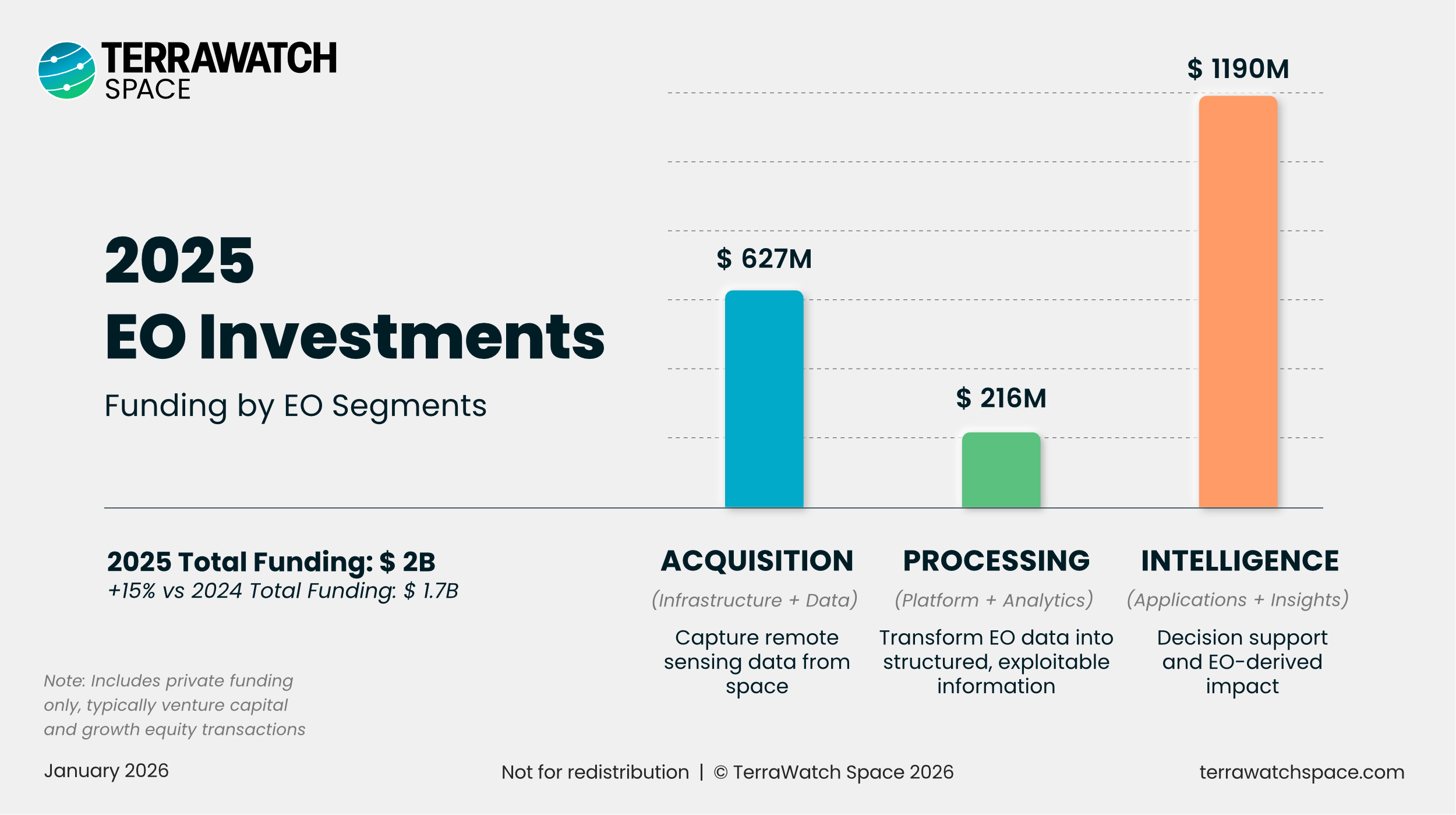

The total EO investments in 2025 reached $2B, the highest annual figure on record, representing a 15% increase from 2024 and even surpassing the 2023 peak. Two segments (Acquisition and Intelligence) accounted for over 90% of all funding, but the other one (Processing) seems to have finally picked up.