Welcome to the new format of the TerraWatch newsletter. A bit later than usual this Monday, but a few quick housekeeping notes before we get into the real content.

📢 Reminder: The TerraWatch Newsletter Is Evolving

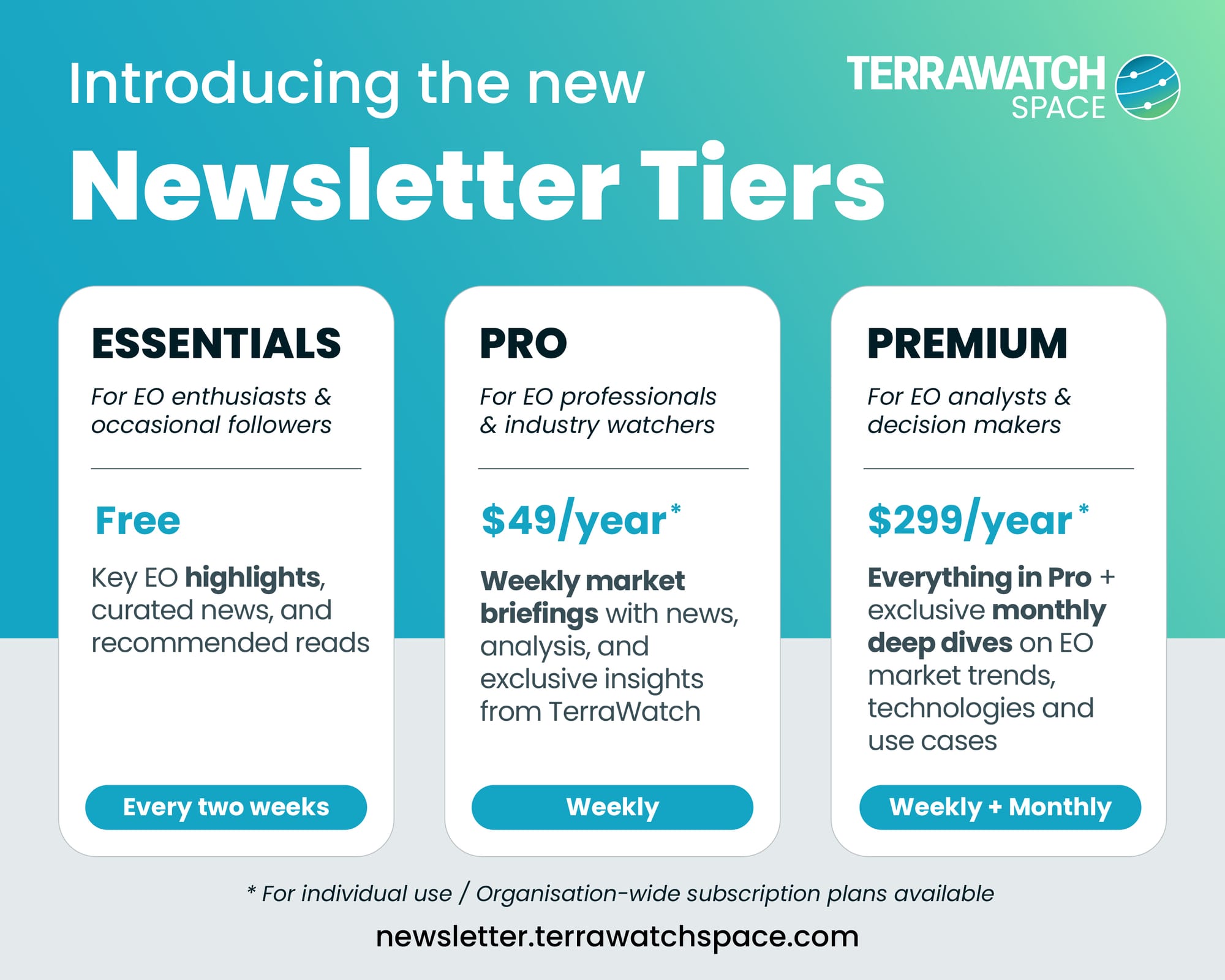

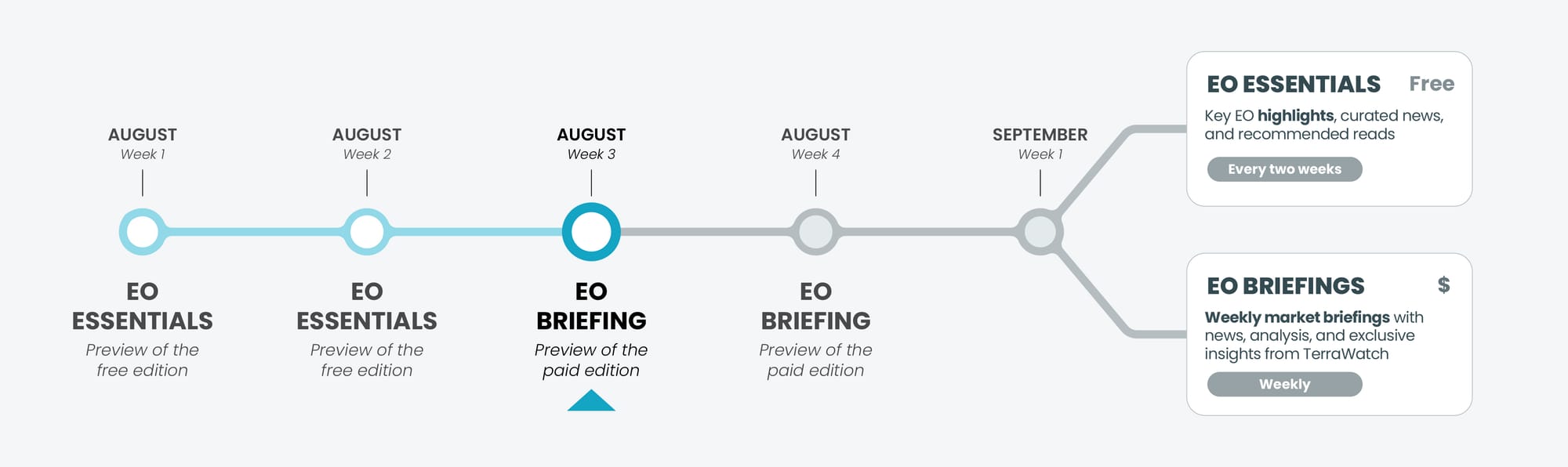

As announced, the TerraWatch newsletter is moving to a new model starting September 1.

To help you get familiar with what’s coming, this month you will be receiving previews of the new formats:

- On Aug 4 and Aug 11, you got previews of the the new format of the free newsletter - Essentials - that will go out every two weeks from September, with shorter, sharper, and focused on key EO highlights.

- This week and the next, you will receive a preview of the new weekly paid newsletter - Pro, showcasing the briefing with deeper analysis and exclusive insights, to help you decide if you want to upgrade.

📈 EO Market Signals

💰 Deals & Funding

- A consortium led by Pixxel with Indian startups SatSure, PierSight and Dhruva Space was selected by India's space promotion agency to build a constellation of 12 satellites under a public–private partnership (more below).

- Indian EO startup Xovian Aerospace raised $2.5M in funding to build and launch a constellation of satellites for radiofrequency (RF) monitoring.

🎯 Moves & Strategy

- Neo Space Group launched Earth Observation Marketplace, Saudi Arabia's first dedicated marketplace for satellite data, following its acquisition of EO platform provider UP42.

- Edge computing firm NOVI announced plans for a multi-sensor, edge-compute based EO satellite constellation.

In an ideal ecosystem, subsystem developers, whether payload makers or edge compute providers, wouldn’t need to build their own constellations. But such is the state of the EO market today: for some, going full-stack may be the only viable go-to-market strategy.

Uncomfortable truth: Not every GPU or inference chip maker is building their own AWS or Azure, but not the case in EO yet.

- NASA’s acting administrator has said that climate and Earth science at the agency will 'move aside' and NASA will focus solely on space exploration.

- KSAT, which operates the largest network of ground stations announced plans to launch a satellite constellation to function like ground stations in space and give customers faster access to their data.

🛰️ Other Signals

- Meta has released DINOv3, its latest self-supervised vision model, for better analysis of EO for tracking forests and climate change.

- Satellite imagery is being used in Senegal to assist with property tax collection, as the most indebted country in Africa aims to increase its tax revenue.

- The 12-meter antenna on NISAR, the recently launched NASA-ISRO mission was successfully deployed.

- Related: This also happens to be the join largest antenna deployment ever for EO missions after ESA's Biomass mission, just a few months ago.

🔎 Featured Analysis

Pixxel-Led Consortium and Their for 0-Rupee Bid

A consortium led by Pixxel, with SatSure, PierSight, and Dhruva Space, has won a Public-Private Partnership contract from IN-SPACe to build and operate a 12-satellite EO constellation, but bidding ₹0 (zero rupees) for the project.

Instead of relying on the government’s ₹350 crore loan, the consortium will invest over ₹1,200 crore (~$150 million) of its own funds over the next 4–5 years. Many of these satellites were already on their roadmaps, making the PPP less about “free money” and more about formalizing a framework for national data sovereignty while leveraging global commercial opportunities.

Breakdown: Pixxel (5 VHR + 2 hyperspectral), SatSure (3 multispectral), PierSight (2 SAR), and Dhruva Space (subsystems & ground)

Why This Matters

This is a bold bet on India’s startups taking on roles historically reserved for state-led programs. If successful, India could leapfrog to one of the most diverse EO capabilities globally while proving a new PPP template: government shapes demand but avoids heavy capex.

At the same time, it brings risks: execution delays, financing pressure, and the challenge of serving both sovereign needs and global commercial markets. National and state governments are the most likely first users, but long-term success depends on building a viable international customer base.

The 0-Rupee Bid

As Pixxel's CEO explained, the “zero bid” wasn’t about undercutting rivals, it was a strategic signal. Pixxel and partners are effectively saying: “We’ll take on the financial risk because demand is inevitable, and we want to control the market.”

In a market where dependency on government contracts is the norm, this is a display of remarkable ambition and audacious confidence. The open question – does this mark the beginning of a sustainable PPP model in EO, or is it a one-off success enabled by a uniquely well-funded group of startups?

You’re reading a Pro preview. From Sep 1, Pro will be for paid subscribers only. Subscribe now to keep getting it every week!

💡 Exclusive Insights from TerraWatch

The Future of Landsat

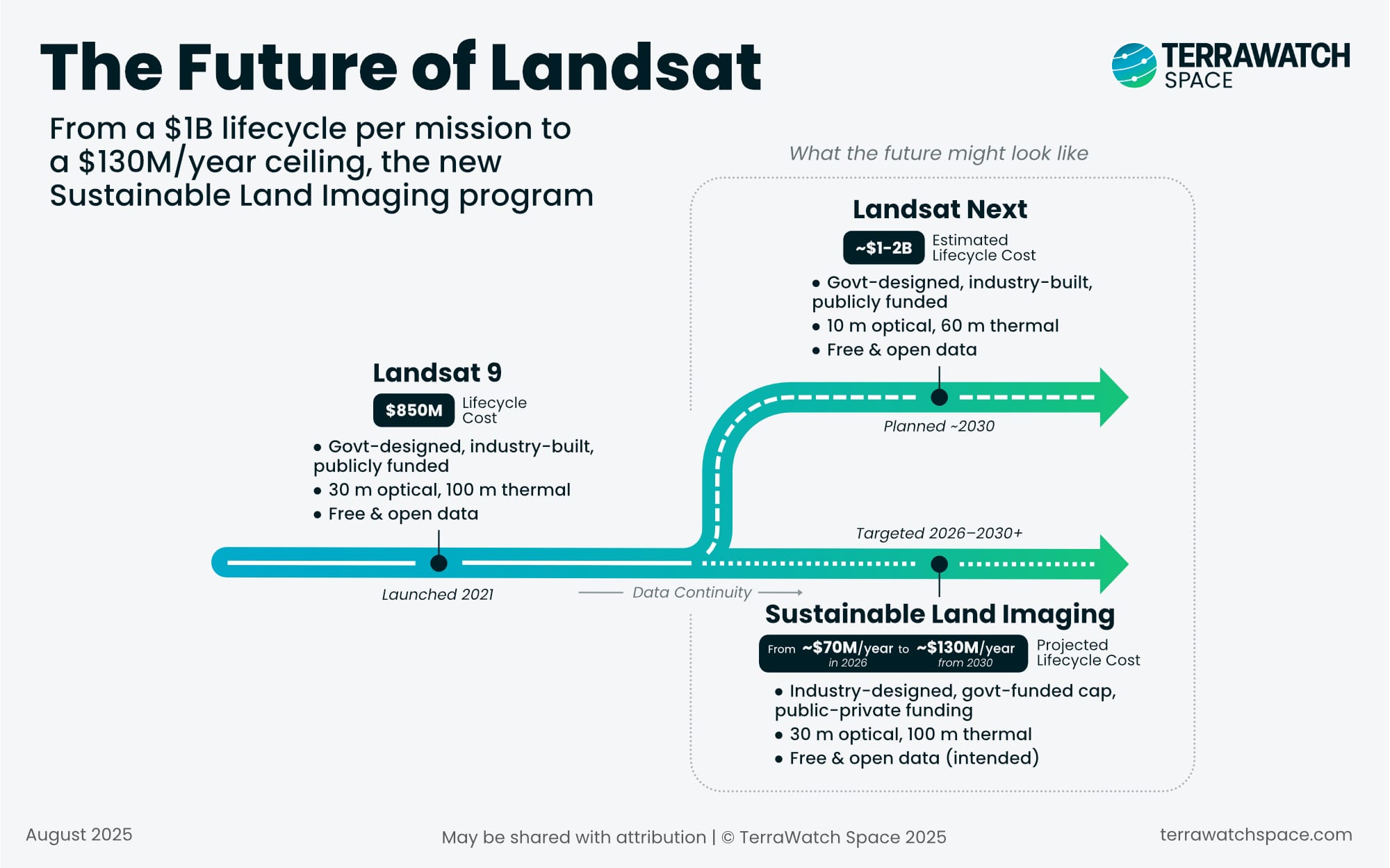

NASA has issued a Request for Information for the next phase of the Sustainable Land Imaging (SLI) program, the effort to ensure Landsat continuity beyond Landsat-9.

What's new? They are interested in getting information about whether the private sector can achieve Landsat-class performance on a radically smaller budget.

Facts & Figures

- Proposed budget: ~$70M/year in FY26, ramping to ~$130M/year by FY30 and flat thereafter

- Historic cost: Landsat-9 cost ~$850M over its lifecycle and Landsat Next was projected at ~$1.2B.

The RFI is open to fully commercial constellations, hybrid public–private models, data-as-a-service contracts and disaggregated constellations combining multiple satellites.

The Significance

Landsat has been the gold standard for open, science-grade optical and thermal imagery since 1972, underpinning everything from agricultural monitoring to water management and climate science.

The good news is the continuity that they are demanding – 30 m optical, 100 m thermal, <5% radiometric uncertainty, tight geometric alignment and calibration stability over decades. So, they would like to keep the trust in the data continuing.

The challenge is that while many commercial EO companies today exceed Landsat’s spatial, spectral and temporal resolution, few offer science-grade radiometry, rigorous calibration and proven stability across decades.

This isn’t just about sharper images; it is about maintaining a calibration chain and stability that makes Landsat data comparable across decades, something commercial missions rarely invest in. Commercial missions generally lack the multi-decade calibration chains of Landsat, but matching that standard would require significant investment in ground infrastructure and validation campaigns.

This raises the stakes significantly – in order to meet these specs under the budget constraint, NASA will have to consider new architectures and business models i.e. from hybrid constellation and hosted payloads to fully commercial “data-as-a-service” models.

Bottom line: Matching Landsat’s trust level and quality is harder than matching/exceeding its resolution.

Why is this different

For Landsat, NASA and USGS traditionally designed the mission and handed industry a build-to-print contract.

In SLI, the RFI sets only the performance thresholds and a strict $130M/year budget cap, leaving it to industry to propose how to meet the requirements. That effectively transfers part of the responsibility (and risk) for continuity from government to industry, pushing contractors and commercial players to innovate on architecture, financing, and delivery.

This mirrors a broader trend in defense procurement, where agencies increasingly specify the outcome (e.g., “10m imagery every 5 days” or “global 6-hour forecasts”) without dictating the system architecture. The shift creates space for commercial players, but it also raises questions about long-term data stewardship, standards, and who ultimately carries the risk when budgets are capped.

Why this matters

If NASA succeeds, this could set a precedent for flagship Earth observation missions worldwide - high-trust, science-grade data, commercially delivered, and openly shared.

It’s both a huge opportunity and a stress test:

- Can the commercial sector deliver at this standard and cost?

- Will open-data policies fit with private monetisation models?

- How much can be achieved with hybrid or disaggregated architectures and what are the tradeoffs?

- How does this impact the various applications of Landsat that have become dependent on its quality, reliability and continuity?

If successful, it could mark the first time a flagship EO mission is sustained under a commercial-leaning model, a precedent that could reshape how countries think about open, science-grade data.

You’re reading a Pro preview. From Sep 1, Pro will be for paid subscribers only. Subscribe now to keep getting it every week!

Until next time,

Aravind.