Welcome to a new subscriber-exclusive, Pro edition of the TerraWatch newsletter!

If you know someone who would benefit from this, please encourage them to subscribe so they can receive the newsletter directly.

📈 EO Market Signals

💰 Deals & Funding

- Iceye signed a contract worth €158 M with the Finnish Defence Forces for the procurement of SAR satellites. This follows a strong year in which the company has won similar contracts from Netherlands, Poland and Portugal.

- Starboard Maritime Intelligence, an EO-based maritime solution provider raised $13.6M in series A funding to develop its multi-source platform that fuses AIS, satellite imagery and other sensors to detect suspicious activity, highlight risks to subsea infrastructure, and issue real-time alerts

- Planet reported $73.2 M in revenues for Q2 2025 representing a 20% increase compared to last year, along with an adjusted EBITDA of $6.4M (more below).

🎯 Moves & Strategy

- Japan's IHI Corporation is partnering with SatVu to explore adding thermal imaging satellites alongside optical, radar radio frequency and hyperspectral imaging satellites, with plans to launch about 100 satellites by 2030.

- Aechelon Technology, a defense solution provider announced the launch of 'Project Orbion', a live Digital Twin of the Earth, in collaboration with partners such as Niantic Spatial (geospatial modeling and visualization), Iceye (radar imagery) and BlackSky (optical imagery), among others.

- South Korean geospatial solution provider Dabeeo was selected by Korea Asset Management Corporation to develop an AI-based change detection system for national property surveys based on aerial imagery and aimed at improving the efficiency of surveys on state-owned properties.

- With satellites from local EO data provider Satrec Initiative capturing data at 25 cm and those in VLEO planned to reach 10 cm, this opportunity may very well be captured by the commercial EO market, in the future.

- The US Environmental Protection Agency has proposed to end requirements for industrial sites to report their annual greenhouse gas emissions.

But the credibility of EO-based monitoring may become more valuable for states, investors, and international buyers, who still need trusted, independent emissions data. As such, this could tilt EO emissions solutions away from regulatory reporting and more toward market-driven and transparency-oriented use cases.

🛰️ Other Signals

- Maxar executive has reiterated warnings that the proposed budget cuts will threaten the commercial EO sector, even though there is increased demand.

- China launched multiple reconnaissance satellites part of the Yaogan constellation into two different orbits.

- Maxar will provide 3D maps and terrain data for a US Army digital platform designed to give soldiers an immersive view of the battlefield.

🔎 Featured Analysis

Analysing Planet's Revenues: The Declining Share of the Commercial Segment

When Planet went public through a SPAC transaction in 2021, the company promised an explosion in uptake and, therefore, revenues from the commercial sector i.e. non-defense use cases. Planet forecasted that its revenue share from the commercial segment will grow from 54% of total revenue in 2021 to 68% by 2026.

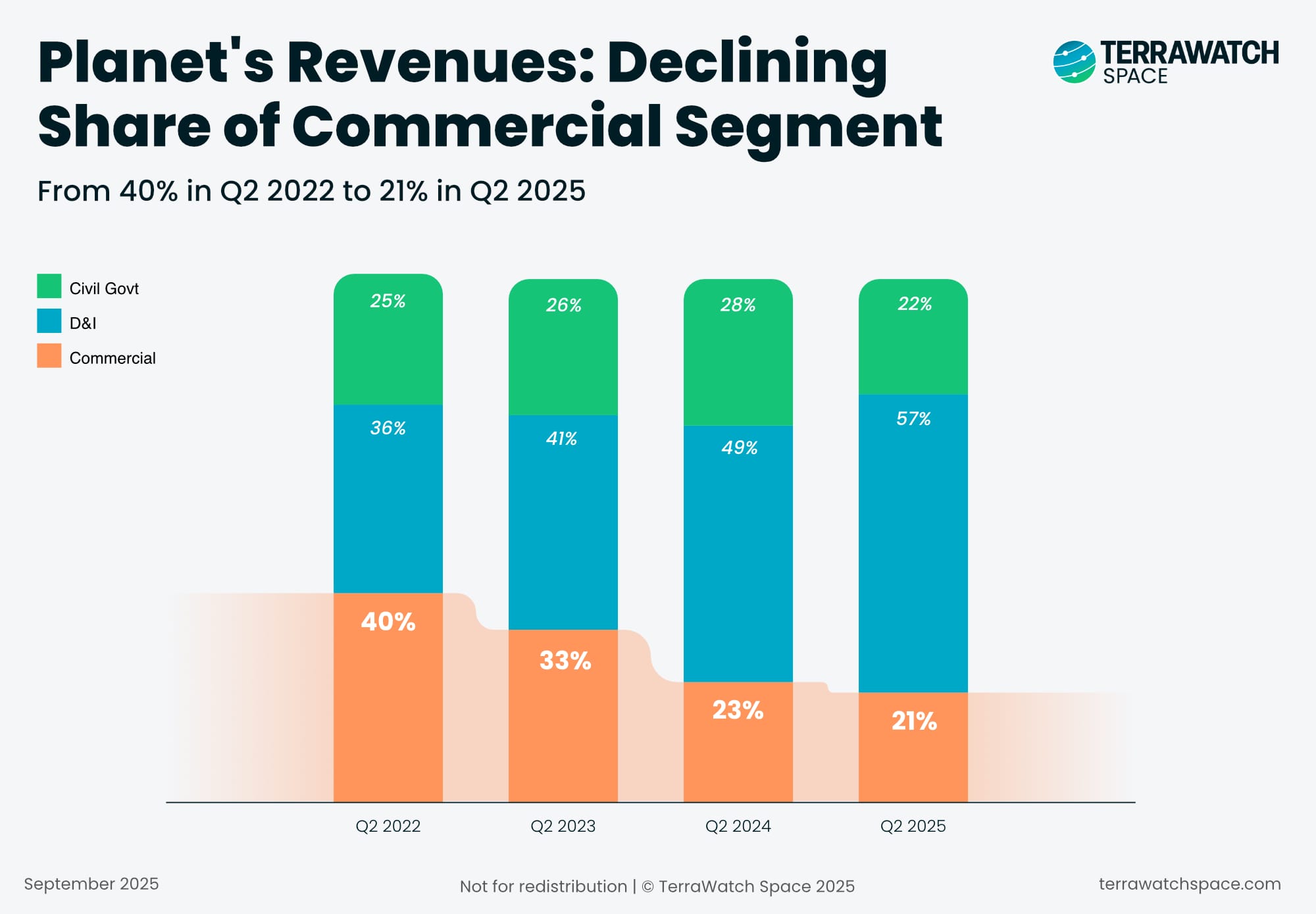

However, the reality has proved to be different: Planet's revenue share for the commercial segment decreased to 33%, according to their Q2 FY 2026 earnings report, down from 40% in Q2 FY 2023 (reported in Sep 2022) to 21% in Q2 FY 2026 (reported in Sep 2025). The visual below shows the share of each segment – note the continuous decline in the commercial segment.

So, why hasn't the EO commercial segment picked up?

Here are some of my thoughts on why Planet’s revenue share from the commercial sector is decreasing while revenues from the government segment continue to grow,

Validated vs. Assumed Needs

There are more validated needs for satellite imagery in the defense and intelligence sector (as a historical user of EO), whereas, for the emerging commercial use cases, these are only assumed needs. As we discuss below, some of the remote sensing needs are satisfied by open data. Affordability and usability, as we discuss below, are crucial factors. In addition, EO has a long sales cycle with the added problem of compounding value over time. So, it’s harder to pick up large contracts in a short time.

Open vs. Commercial EO Data

EO is a relevant tool for many commercial use cases (which are growing as we speak), but open data (Sentinel, Landsat, MODIS, etc.) is fundamentally sufficient for roughly 3/4th of the applications, while commercial satellite data is a real, mandatory value-add for the remaining use cases.

So, while the fundamental assumption of EO being a critical component was not incorrect, the assumption that commercial data (like Planet) is a big part of the addressable market might have been overestimated. Defense does not have this problem, as the likelihood of open data fulfilling the needs of D&I is very low.

Affordability and Usability

While the prices of commercial satellite imagery (including from Planet) have been decreasing in the past few years, they have reduced enough to warrant large-scale adoption in the commercial sector. Defense budgets have, however, been increasing, primarily due to the changing geopolitical situation.

Further, a lot of effort is still needed to make EO data usable for the commercial sector, i.e., converting it to an analysis-ready format or delivering it as analytics. Planet has probably already identified the challenge of usability and invested in developing its capabilities in-house – see the acquisitions of Sinergise (to enable better data dissemination and processing) and VanderSat and Salo Sciences (to enable the delivery of analytics/data products, aka Planetary Variables).

Future of EO

On the D&I front, I am very bullish as the addressable market continues to grow (as evidenced by Planet's contracts with NATO and other international customers). So, unsurprisingly, Planet, like most of the EO sector, will focus on short-term wins in the D&I sector while continuing to invest slowly in the commercial applications, where there is undoubtedly a lot of potential.

💡 TerraWatch Insights

Two Types of Commercial EO Use Cases: Value Drivers vs Operational Enablers

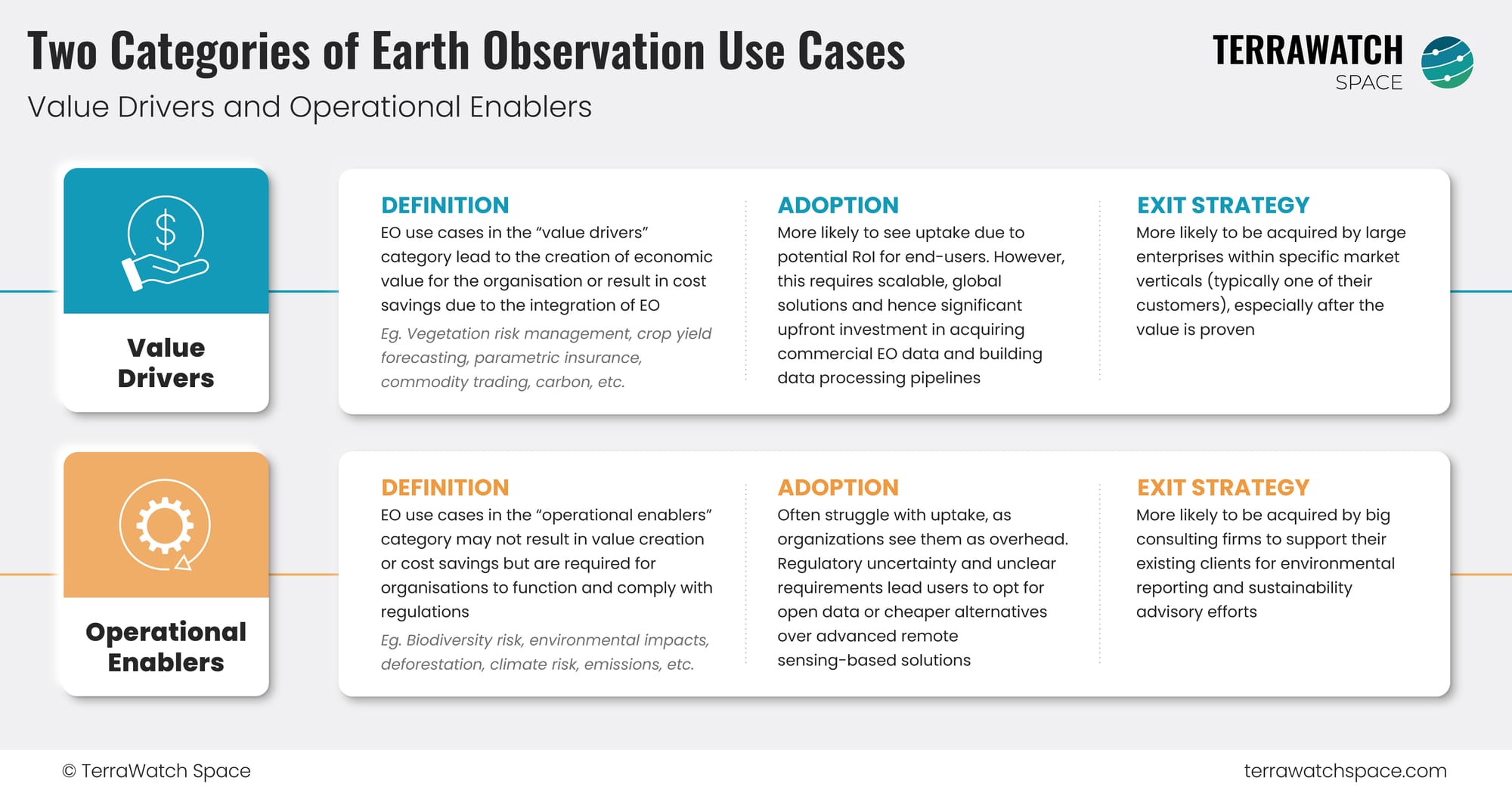

If you are an EO company, an EO-based analytics firm or an investor trying to navigate the EO space, viewing the market through the two categories of EO use cases mentioned in the infographic below could help make sense of things.

Value Drivers unlock economic gains with EO, while Operational Enablers enable regulatory compliance through EO.

Value Drivers

- Deliver clear ROI through cost savings or new value.

- Easier adoption but needs scalable, global solutions.

- Likely exit: acquisition by large enterprises after proving value.

Operational Enablers

- Focused on compliance and environmental reporting.

- Harder adoption, seen as overhead; open data often preferred.

- Likely exit: acquisition by consulting firms for sustainability services.

Until next time,

Aravind.