Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from last week and some exclusive analysis and insights from TerraWatch.

In this edition: Thoughts on the state of the EO market, clouds from space, another EO marketplace, wind risk for real estate and some curated EO jobs.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

- Tilebox, an Austrian startup, building a platform for space data management raised $1.7M in pre-seed funding;

- Indian EO analytics firm, SatSure, which is building a constellation of satellites, made a strategic investment in Astrogate Labs, a startup building laser communications system that enhances downlink speed to 1 Gbps;

- The UK Space Agency announced £15M in funding which will be used to invest in a range of environmental monitoring EO instruments;

- The Government of Western Australia invested AUD 800,000 in LatConnect 60, which is building a constellation of EO satellites;

- Planet has announced a layoff of 117 employees, about 10% of its ~1,000 employees (those impacted, see the last section for some curated jobs).

2. Strategic Stuff: Partnerships and Announcements 📈

- Real-estate broker Redfin will include wind risk data provided by the non-profit firm First Street Foundation, based on current and projected wind exposure from hurricanes, for nearly every U.S. property listed on its website;

- Carbon rating firm BeZero Carbon is partnering with French EO analytics company Kayrros to map the Amazon basin using satellite imagery and geospatial data to rate carbon projects;

- SAR satellites from Capella Space are falling back to Earth much sooner than the three years they were anticipated to operate, due to a combination of issues with the propulsion system and increased solar activity;

- NASA announced the release of the first open-source geospatial AI foundation model for EO data, built using the Harmonized Landsat Sentinel-2 dataset, in partnership with IBM;

- Radiant Earth, PLACE, Spatial Collective, and the Kenyan Space Agency are collaborating on a pilot project to collect and curate labelled high-resolution agricultural data for open access and public benefit in Kenya';

- Privateer Space, a space sustainability startup founded by Apple co-founder Steve Wozniak, unveiled an EO marketplace that will be powered by an edge compute, storage, machine learning, and data transmission module.

My take: Privateer wants to solve two important challenges in EO, with their so-called “marketplace”: affordability and accessibility. By letting customers looking for similar data to “share a ride” on their satellite , it envisions a concept akin to Uber in space, which is innovative. However, I do not quite understand how it addresses the more important problems of suitability (is satellite data even necessary to solve some problems?), usability (if suitable, is data provided in a usable manner to end-users?) and fusability (if usable, how can it be combined with other sources?).

It feels like we have another innovative way to acquire data from satellites, without really knowing who it is for, why it is needed and how it will be used.

3. Interesting Stuff: More News 🗞️

- China launched the FENGYUN-3F weather satellite, becoming the only country in the world to have such satellites in all necessary orbits;

- Australia’s space industry is facing an uncertain future after the recent budget cuts which cancelled the national EO programme;

- India’s IN-SPACe is considering a public-private partnership for building and operating a national EO constellation;

- The US Space Force will receive $40 million for a pilot program to evaluate the use of commercial imaging satellites in support of military operations;

4. Click-Worthy Stuff: Check These Out 🔗

This piece that highlights how the ongoing wildfires are spurring investments in detection systems, enabled by EO

+ This one, if you are keen on learning why this is a big deal for Europe);

This piece that looks into the mystery of the warming oceans, missing ice and bleached corals;

+ This one, if to dig deeper into how marine heatwaves are tracked;

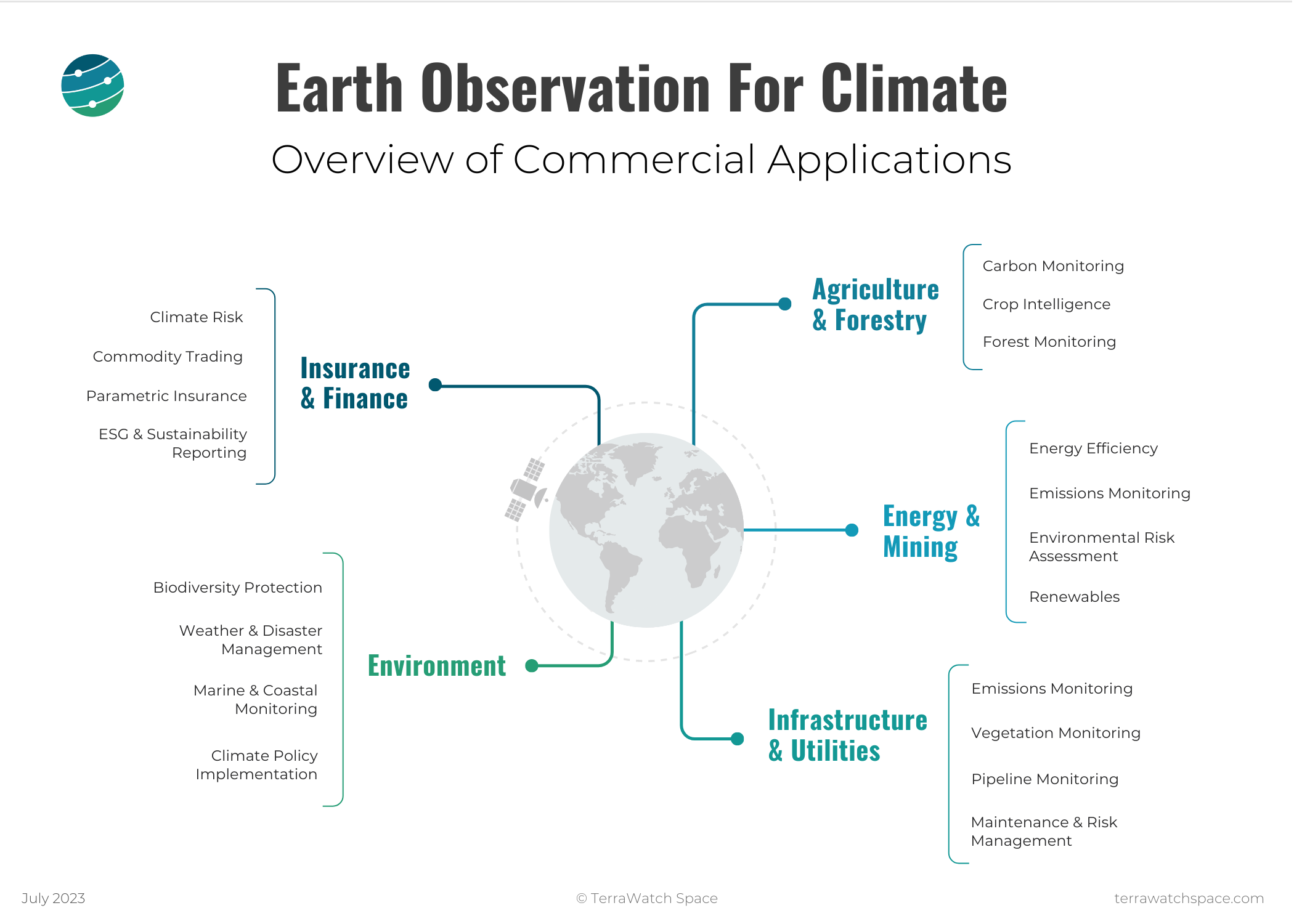

This deep dive, from TerraWatch, that summarised the State of EO for Climate, including the commercial landscape and gave an outlook;

Subscribe to receive Earth observation insights!

One Discussion Point

Analysis, thoughts, and insights on developments in EO

5. Some Thoughts on What’s Happening in the EO Market

Ever since the layoffs from Planet were announced, I have been getting several questions from some of you about the state of the EO industry, and whether we are on track for course correction. I am going to share some of my high-level thoughts here, but do note that the reality is more nuanced than you might like.

Context: Some Facts and Figures

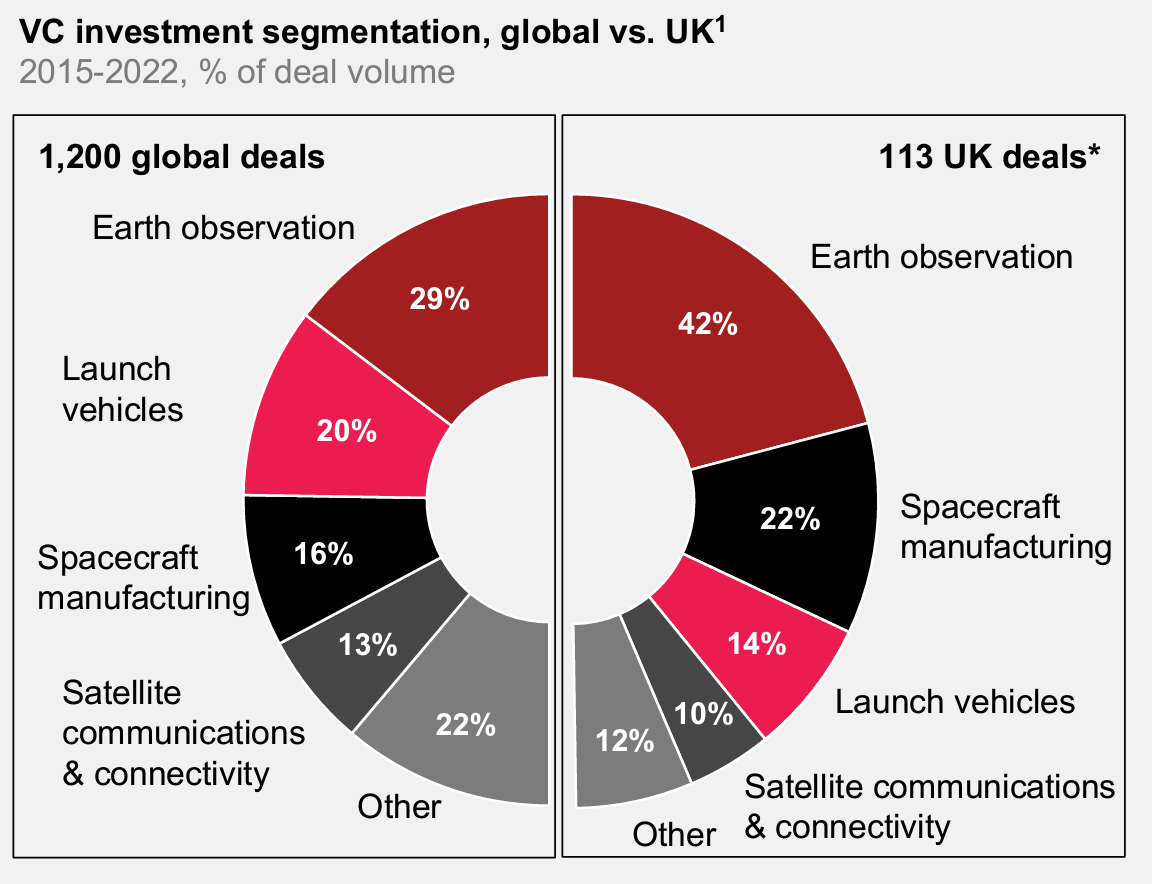

- Total Number of Venture Capital Deals: EO has been the hottest segment in the space industry - since 2015, there have been more VC deals in EO than in any other segment in space tech, which I find to be fascinating as the EO sector really does not receive the coverage that it deserves.

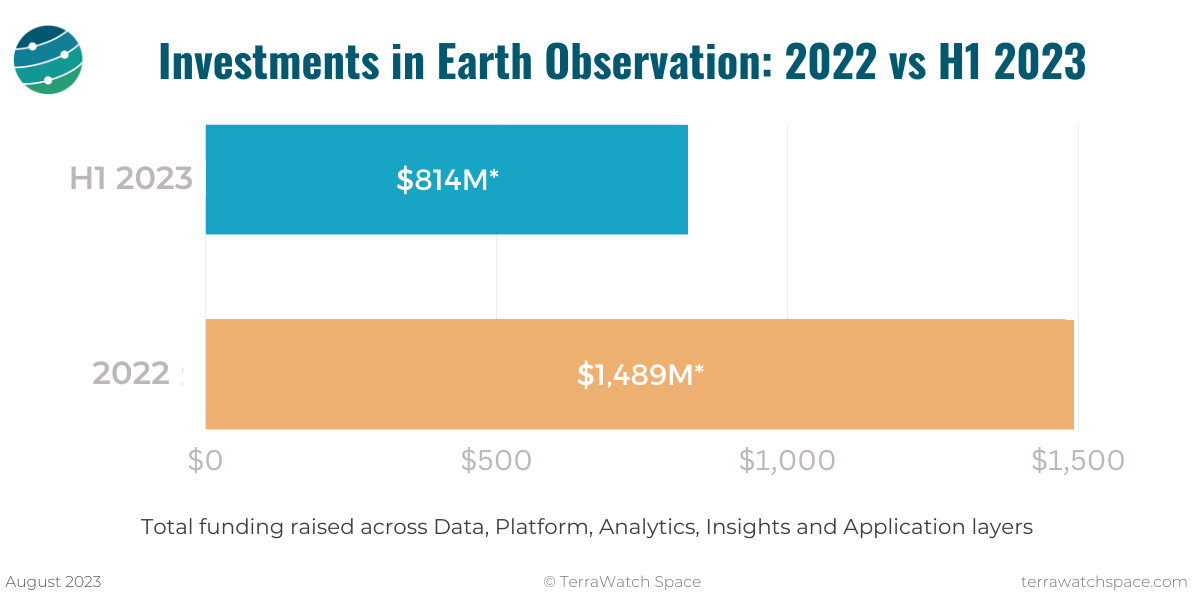

Total Funding Raised: Venture capital funding in EO reached an all-time high in 2022, with about $1.49B invested across the EO value chain, and based on preliminary data from the first half of 2023, we are on track to have similar numbers or more this year2.

- Layoffs: There were at least three publicly announced sets of layoffs, by Satellogic (80 people), Planet (117 people) and Cervest (~15 people in EO). I have also heard rumours and unofficial details about others, but the fact of the matter is hundreds of talented EO professionals have been impacted, just this year.

— — —

The Diversity of Viewpoints

The perspectives on the EO market vary and can be generally categorised into one of these three segments.

The Pessimistic Outlook: There is no market for EO outside of defence

There has been a lot of hype in EO over the past few years, leading to some of the funding raised, but the adoption of commercial EO leading to recurring revenues has not been as rapid as predicted, much of the revenues in EO still come from an on-demand, project basis, which does not help scalability metrics. The EO market has been in the “potential for growth” phase so much so that the overall market forecasts never changed, but the timeline for getting there keeps getting pushed back by a few years.

Folks sharing this perspective point to the continued dependency on the public sector (military & civilian) contracts to spur growth, the lack of understanding of commercial user needs by EO companies and the ‘growth at all costs’ mentality.

The Optimistic Outlook: The best is yet to come for commercial EO applications

Given the increasing amount of EO data acquired and expected to be acquired, it is true that we have only begun to unlock the applications of EO, both for research and commercial use. If you have been a regular reader of this newsletter, you might have come across some fascinating research across sectors - from insurance to shipping, from agriculture to mining. While identifying how many of these applications will turn into actual commercial products with a sustainable market is unclear at this point, it is hard not to be optimistic about the state of EO, especially as it seems like a gold mine.

Folks sharing this perspective point to the expected applications in climate, the unexpected applications we are yet to develop and more importantly, point to the increasing non-defence revenues of companies like Planet.

The Cautiously Optimistic Outlook: The EO sector needs to get its act together

Yes, this is my viewpoint - so this may seem like a rant.

We have made a lot of progress in our ability to launch new instruments and collect more data, but as the analysis, presented here last month shows, I am not sure we are making enough progress towards making all that data accessible, affordable, usable and fusable.

I am excited to see companies that had no plans to enter EO make their moves, but I am worried if they are actually working towards solving the right problems in the industry. I am looking forward to seeing how EO will support the mining sector to identify new minerals, as we transition towards a clean energy economy, but I am wondering if we are taking the adoption of EO for granted.

I do not fully understand why EO companies always tend to pursue a horizontal, multi-vertical strategy as a goal, while that is, in fact, a consequence - some of the ‘successful’ companies in EO (and elsewhere) have started with vertical-focused strategies and then gradually scaled to adjacent verticals. I ask myself if there is really only one EO company that cares about unit economics, that wants to see change happen in the sector.

I am worried about how governments prioritise launching an EO satellite and consider that a measure of success versus having an ecosystem of companies that use Earth observation data to solve problems in a scalable, commercially viable manner. I am concerned about how many of the publicly funded EO projects will cease to exist when funding inevitably stops and then, they do not mature into usable products in the market but end up rotting in the cloud.

In short, we have to get our act together, whether we like it or not, we have a lot riding on us. While we have a set of incredible people working in the sector, we cannot take them for granted and use them in our quest for growth.

Scene from Space

One visual leveraging EO

6. Visualising 23 Years of Clouds on Earth

Clouds are some of the most fascinating phenomena we have on our planet - they may have a warming effect or a cooling effect or a bit of both, depending on where they are located, their type, and when they form. The following visual shows a series of maps showing what fraction of an area was cloudy on average each month, based on data from the famous MODIS instrument from NASA’s Terra satellite. As our climate continues to change, mainly due to anthropogenic activities, the role of clouds in the system is becoming increasingly uncertain.

If you are as interested in clouds as I am, here are three books that I have on my to-read list: Reading the Clouds, The Cloudspotters Guide and A Cloud a Day.

One Curated, Jobs List

For those who were affected by layoffs in EO

I was contacted by a few folks from Planet who were impacted by the recent layoffs. I shared some of these roles with them, but I wanted to make a curated list for the community - broadly categorised into Product, Engineering and business. Again, this is not an exhaustive list, but the ones below were sent to me to share them around.

- OroraTech, Germany - Product, Engineering, Business

- Bayanat, UAE - Product, Business

- Iceye, Finland/Poland - Engineering, Business

- Open Cosmos, UK - Engineering, Business

- Endurosat, Bulgaria - Engineering

- Regrow Ag, US - Product, Engineering, Business (Ag)

- InnerPlant, US - Product, Engineering (Ag)

- Atlas AI, US/Remote - Product, Engineering

- Earth Daily Analytics, Canada - Product, Engineering, Business

- Spire, UK/Luxembourg/USA - Product, Engineering, Business

- GHGSat, Canada/UK - Product, Engineering, Business

- Airmo, Germany - Engineering, Business

- Miscellaneous - Please get in touch with Joseph, Soufiane

- Portals - SpaceTalent, Geospatial Jobs, DahnJ

- Crowdsourced - Several more on LinkedIn and Twitter

Until next time,

Aravind.