Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- South Korean EO-based analytics startup Meissa has raised $7.5M in Series C funding round;

Contracts

- The US National Reconnaissance Office has awarded new two-year contracts to three SAR data providers Capella Space, Iceye and Umbra;

- EO satellite manufacturer Muon Space awarded a $2.9 million contract by the US Space Force to evaluate its satellites for acquiring weather data;

- Planet signed a multi-year, seven-figure deal with signed a seven-figure deal with Laconic to provide forest carbon data and also expanded their contract with Colombia’s National Police to monitor and eradicate illicit crop growth;

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- EO-based environmental intelligence firm Kayrros has launched a generative AI tool to allow the public to pinpoint methane-emitting facilities;

- Indian satellite manufacturer Dhruva Space has launched a new EO platform to distribute satellite imagery from EO satellite data providers;

- Google's DeepMind has released a new AI-based weather model that delivers faster and more accurate 15-days forecasts than traditional models.

My take: We are seeing some incredible advances in AI-based weather models, but I think it is crazy to be talking about AI-based models "rivalling" and "replacing" traditional numerical weather prediction models - however more efficient and more accurate, they will still need to be continuously trained and reinforced by physics-based models.

The more important discussion to have is: how the advancements from these AI models will be integrated into the public weather models as a public good (like ECMWF does). We need to be thinking about mechanisms and procurement models to incentivise the private sector to keep improving weather services - currently almost all AI-based weather models are merely research projects, not fully operational services.

The future is about using AI models in combination with traditional weather models with humans in the loop.

Partnerships

- Maxar announced a partnership with TD Synnex, an IT solutions firm;

- EO platform provider Picterra has signed a strategic partnership with Planet to deliver advanced geospatial solutions

🗞️ Interesting Stuff: More News

- Europe launched Sentinel-1C, which will enable increased frequency of radar imagery acquisition, which was impacted with Sentinel-1B's failure in 2022;

- Meteosat-12, Europe's most advanced weather satellite is now fully operational, with data to be integrated into weather forecasts in both Europe and Africa;

- NASA and IBM, have released an expanded version of the open-source Prithvi, a foundation model to support a broader range of EO applications;

- The head of the Iranian Space Research Center has announced the successful production of very-high resolution imagery of 35 to 45 centimeters;

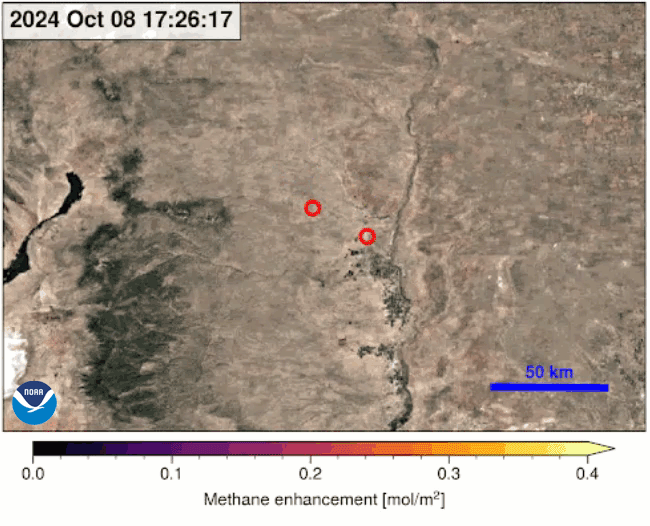

- NOAA’s GOES weather satellites can also provide quicker detection of large methane emissions, as often as every seven seconds.

🔗 Click-Worthy Stuff: Check These Out

- This opinion piece that makes a case for not dismantling NOAA, considered to be part of the federal budget downsizing plans in the US;

- This article that shows how the private military organisation Wagner Group uses Chinese EO data for its operations;

- This piece that shows how satellite imagery was used to estimate the number of casualties in the famine in Sudan;

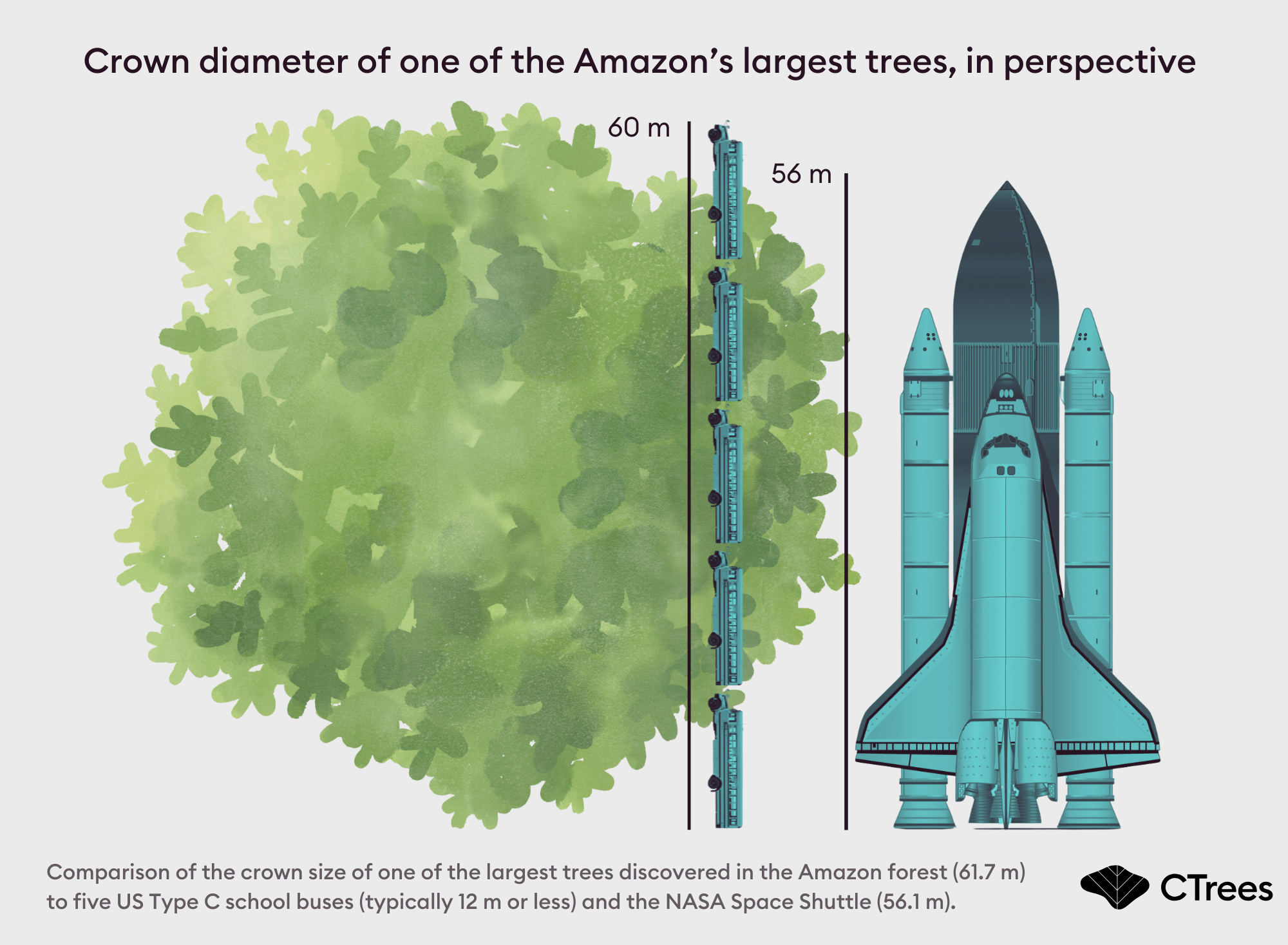

- This interview with a remote sensing scientist exploring how satellite imagery was used to find what could be the largest tree in the Amazon.

One Discussion Point

Exclusive analysis and insights from TerraWatch

Saudi's New Space Group Acquires EO Platform UP42

Neo Space Group (NSG), the Saudi-based, PIF-owned space company (which recently acquired geospatial services firm Taqnia) has entered into an agreement to acquire Germany-based UP42, a fully owned subsidiary of Airbus.

In Brief: What does this mean?

For NSG, this acquisition allows them to continue becoming more and more fully vertically integrated firm, the only one of its kind in Saudi Arabia - somewhat in competition with UAE's Bayanat, now part of the Space42 group.

For UP42, this transaction, apart from the obvious financial clout, brings independence away from Airbus, both with respect to its product roadmap and potentially the capacity to provide a true independent data marketplace (being owned by Airbus might have impacted its data-agnostic nature in the past).

For Europe, this deal is quite a big blow, especially as it comes only a couple of years after US-based Planet acquired major EO platform provider Sinergise. While, it seems like Airbus, as a result of its dire financial situation, could be offloading UP42 to NSG,

The Big Picture: EO Platforms

The EO Platform segment received less than 10% of the private funding raised by EO sector in the past 7 years. Yet, this is the segment that has had the most exits in EO, even though some of these ‘exits’ are not your usual kind.

- Descartes Labs acquired by Antarctica Capital (and then EarthDaily Analytics)-

- Sinergise (Sentinel Hub) acquired by Planet

- Astraea acquired by NuView

- Orbital Insight acquired by Privateer

- UP42 formed by Airbus and acquired by New Space Group

My Thesis on the Future of EO Platforms

People have asked me before: "Will there ever be a market for an independent (provider agnostic) EO platform that provides data access, data management, data processing offerings?"

I am not entirely sure platforms that start with a ‘horizontal strategy’ can be the answer to the end users interested in building EO applications. Most of the commercial EO platforms today lack any domain-specific data nor can they provide any expertise through the platforms.

The way forward is most likely to be ‘verticalized platforms' - EO platforms built for a purpose, focused on specific sectors or a set of use cases. Imagine a platform that is purely focused on the agriculture sector, and provides access to all types of data (satellite and non-satellite), tools, libraries and algorithms relevant to the agricultural use cases.

Platforms are fundamental to the growth of EO, especially if we want to unlock its iPhone moment. But unlike Apple (and Android), which laid the path forward for the development of mobile apps that led to the growth of the app economy, we have a pretty crowded ecosystem here, made even more complex with uncoordinated public funding, lack of validated demand and a pretty defence-dependent EO sector.

For a deep-dive on the state of EO platforms, check out the deep dive.

This edition of the newsletter is brought to you by Geospatial Risk Summit

The Geospatial Risk Summit is a unique two-day event focused on how professionals in finance, insurance, supply chain, healthcare, and energy industries use geospatial data to manage physical and climate-related risks.

Join industry experts and innovators in breaking down silos, exchanging insights, and advancing our understanding of geospatial solutions for managing physical and climate risks.

Don't miss your chance to join the event on January 30, 2025, in New York City!

Technical workshops on January 29th will see top data scientists, analysts, & engineers show off risk analytics applied to real world problems.

Use the code GRS25TerraW when you register to get a 10% discount. TerraWatch Space is one of the sponsors for the Cocktail Reception.

Scene from Space

One visual leveraging EO

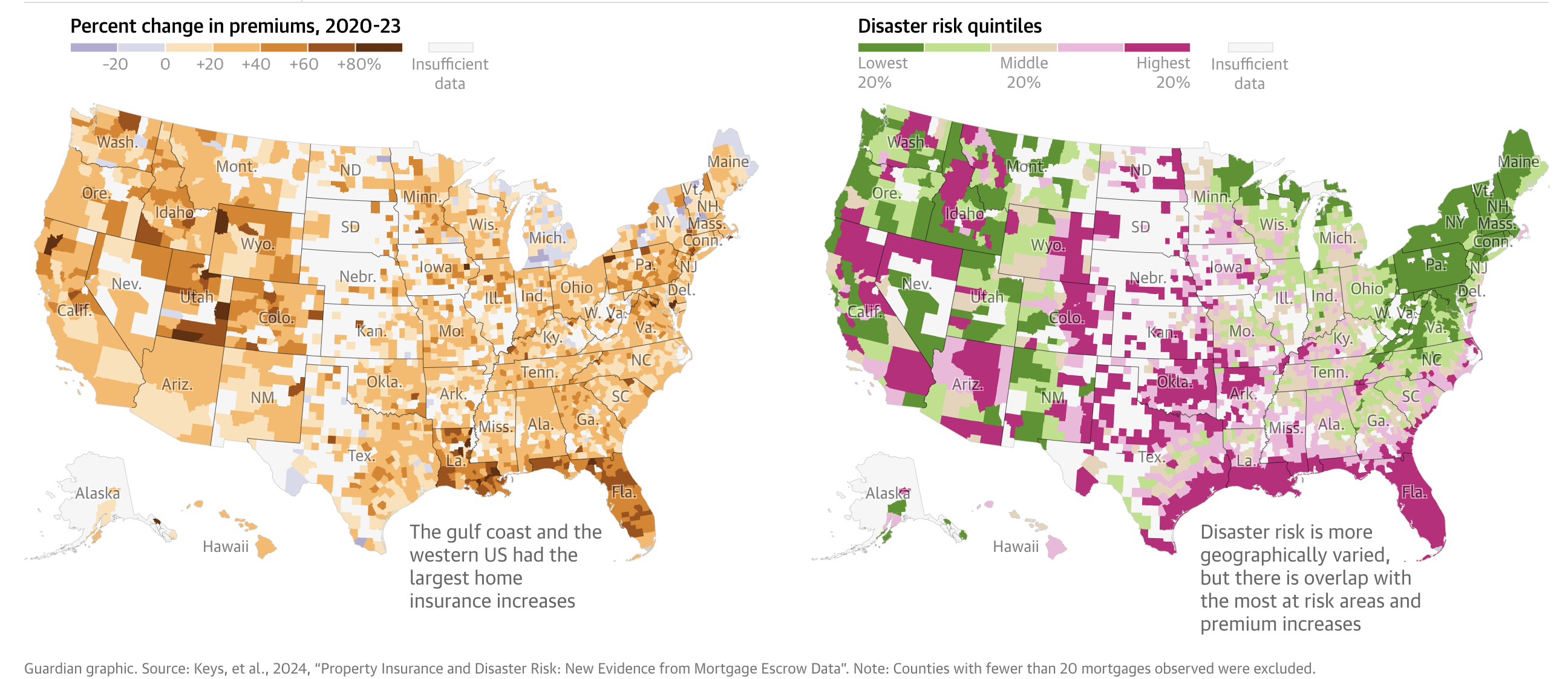

Climate Risk and Insurance Premiums

This visual, from the Guardian, based on a recently study, showing how climate risks are driving up insurance premiums around the US - the top counties saw home premiums increase by 22% in just three years.

Until next time,

Aravind.