Welcome to a belated1 edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from last week and some exclusive analysis and insights from TerraWatch.

In this edition: More emissions seen by satellites, finding bitcoin mines from space, strategic dilemmas in the EO market and more.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- German startup LiveEO, which provides EO-based infrastructure and deforestation monitoring solutions raised $10M, and plans to expand into the regulatory compliance market;

- Carbon credit marketplace Pachama added $9M to its Series B funding amid increasing interest in verifying transparency and quality of forest preservation projects;

- EO-driven environmental monitoring firm Upstream Tech has received an undisclosed amount of funding from Engie New Ventures, the corporate investing arm of French energy firm Engie.

Earnings

- Planet reported $55.4M in revenues for Q3, with the total customer count inching towards 1000. The company claims ($) to become EBITDA-positive (aka profitable) by the end of 2024 as the governmental market remains the priority.

Contracts

- The US National Reconnaissance Office has selected five providers of EO data - Airbus US, Albedo Space, Hydrosat, Muon Space and Turion Space - as the agency looks towards integrating a diversity of datasets;

- Thales Alenia Space has signed a multi-mission contract with PT Len Industri to build a constellation of radar and optical satellites, specifically dedicated to the Indonesian Ministry of Defence (MoD);

- Airbus UK has been awarded nearly £95 million and Teledyne e2v £9 million in contracts to build out the next phase of ESA’s TRUTHS mission, focusing on collecting data about the changes in Earth’s climate system;

- Airbus Defence and Space and the Dutch Ministry of Defence have signed a four-year agreement to provide high-resolution satellite imagery base maps via the OneAtlas Basemap.

- Satellogic has signed a multi-million, multi-year contract with Malaysian energy company Uzma, which includes access to satellite imagery from Satellogic’s constellation along with an exclusive satellite launching in 2024;

My take: This is potentially one of the first market validations for the satellite-as-a-service model in the commercial market, and is certainly some much-needed good news for the EO sector.

While the satellite-for-purchase model from Satellogic (and Iceye) is predominantly aimed at governments, large enterprises such as Uzma stand to benefit from proprietary satellites (in addition to data from other satellites) flying over their area of interest. This might not be the first such announcement, and I am confident we will more similar deals done in 2024.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

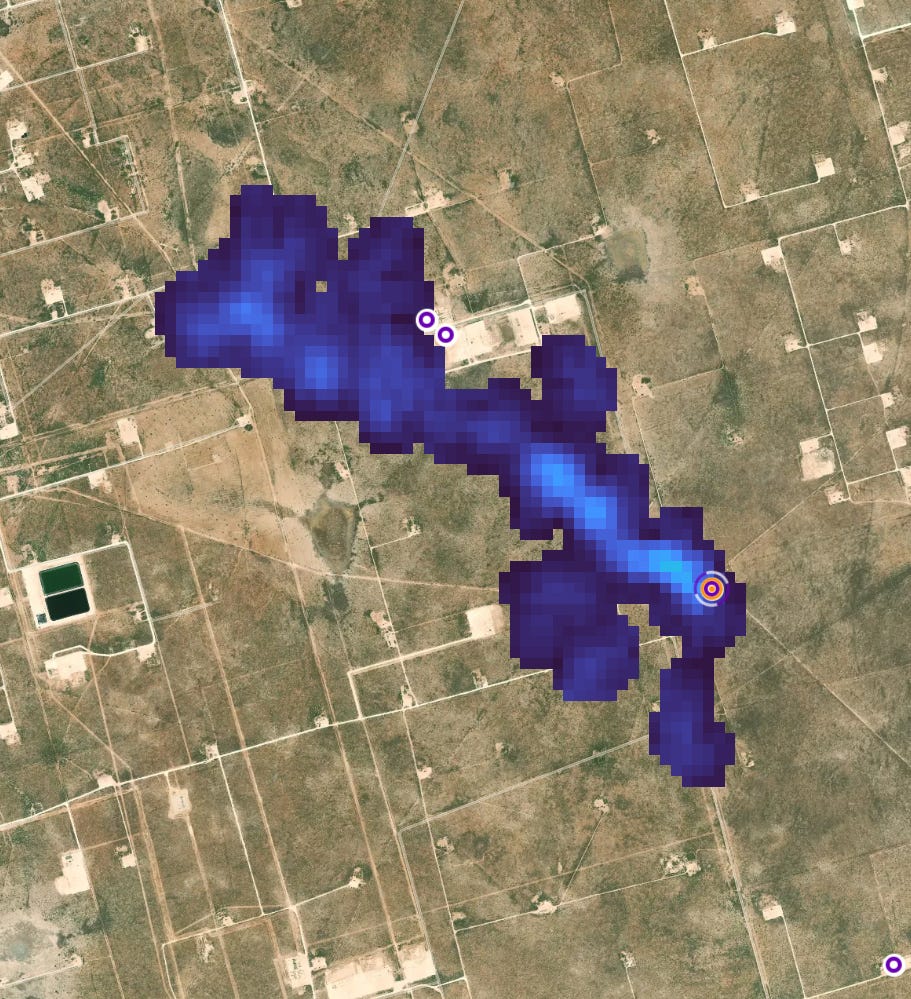

- GHGSat signed strategic partnerships with UAE-based satellite communications company Yahsat and ADNOC (Abu Dhabi National Oil Company) to support the mitigation of methane emissions;

- Weather intelligence firm Tomorrow.io, South African telecommunications provider MTN Group, and Microsoft signed a partnership to provide early warning information to millions across the African continent;

- Floodbase, which offers parametric insurance products leveraging EO is teaming up with insurance brokering firm Oneglobal to develop and distribute parametric flood insurance solutions across Asia;

- Homes.com, a US-based real estate portal is integrating climate risk data provided by the non-profit First Street Foundation to provide property-specific risk assessments;

Announcements

- Aerial imagery provider Nearmap announced that it is acquiring Betterview, a property insurance platform leveraging EO, signalling Nearmap’s intent to double down on the insurance sector;

- NASA, together with its partners, launched the ‘US Greenhouse Gas Center’, a catalogue of greenhouse gas datasets leveraging data from multiple sources;

- PlanetiQ, operator of a weather satellite constellation equipped with GNSS-RO sensors, has announced the launch of its next-generation satellite.

3. Interesting Stuff: More News 🗞️

Indian space development agency, IN-SPACe has launched a scheme to provide funding to startups building solutions leveraging space technologies for the urban development and disaster management domains;

China has successfully launched the MisrSat 2 satellite, an EO mission for Egypt as well as Tianyan 16, a meteorological satellite for Cultivate Space;

Italian rocket maker Avio has lost2 two propellant tanks that were to be used for the final Vega flight in 2024, meaning yet another European EO mission - in this case, ESA’s BIOMASS - will be delayed;

Phillips 66, a US energy company failed to report methane release, acknowledging only after outside researchers noticed it thanks to data acquired from the EMIT sensor on the ISS.

4. Click-Worthy Stuff: Check These Out 🔗

This piece that dives deep into Climate Trace, an independent database of GHG emissions leveraging EO and AI by a coalition of organisations, which found that about 5% of total global emissions were unreported;

Caveat: As we can learn from this insightful X thread, it is important to continuously validate and verify emissions on the database. Using satellites and AI does not make data the objective truth.

This paper that presents an approach using AI to analyse satellite data from Sentinel-2 to quantify economic indicators in least-developed countries such as Nepal, Laos, Myanmar, Bangladesh, Cambodia and North Korea;

This summary of the Global Carbon Budget 2023 providing a comprehensive assessment of the changes to the planet’s carbon cycle.

Want to understand how EO supports the monitoring of carbon dioxide emissions or the understanding of the carbon cycle? Then, check out the exclusive, subscriber-only deep dives from TerraWatch.

Please consider upgrading your subscription to TerraWatch, if you find this valuable.

Spotlight

This edition of the newsletter is brought to you by …

Sen, a British startup, streams high-resolution videos from space to inform, educate, inspire and benefit all humanity with an innovative approach to disseminating satellite data.

The company launched its first satellite last year equipped with four video cameras on board designed to image Earth at different spatial resolutions and is capable of streaming 4K videos. This near real-time dataset about what’s happening on Earth is freely accessible to everyone. Sen plans to have more satellites in space in 2024 with quarterly launches from 2025.

Check out Sen and the live stream from space.

One EO Discussion Point

Exclusive analysis and insights from TerraWatch

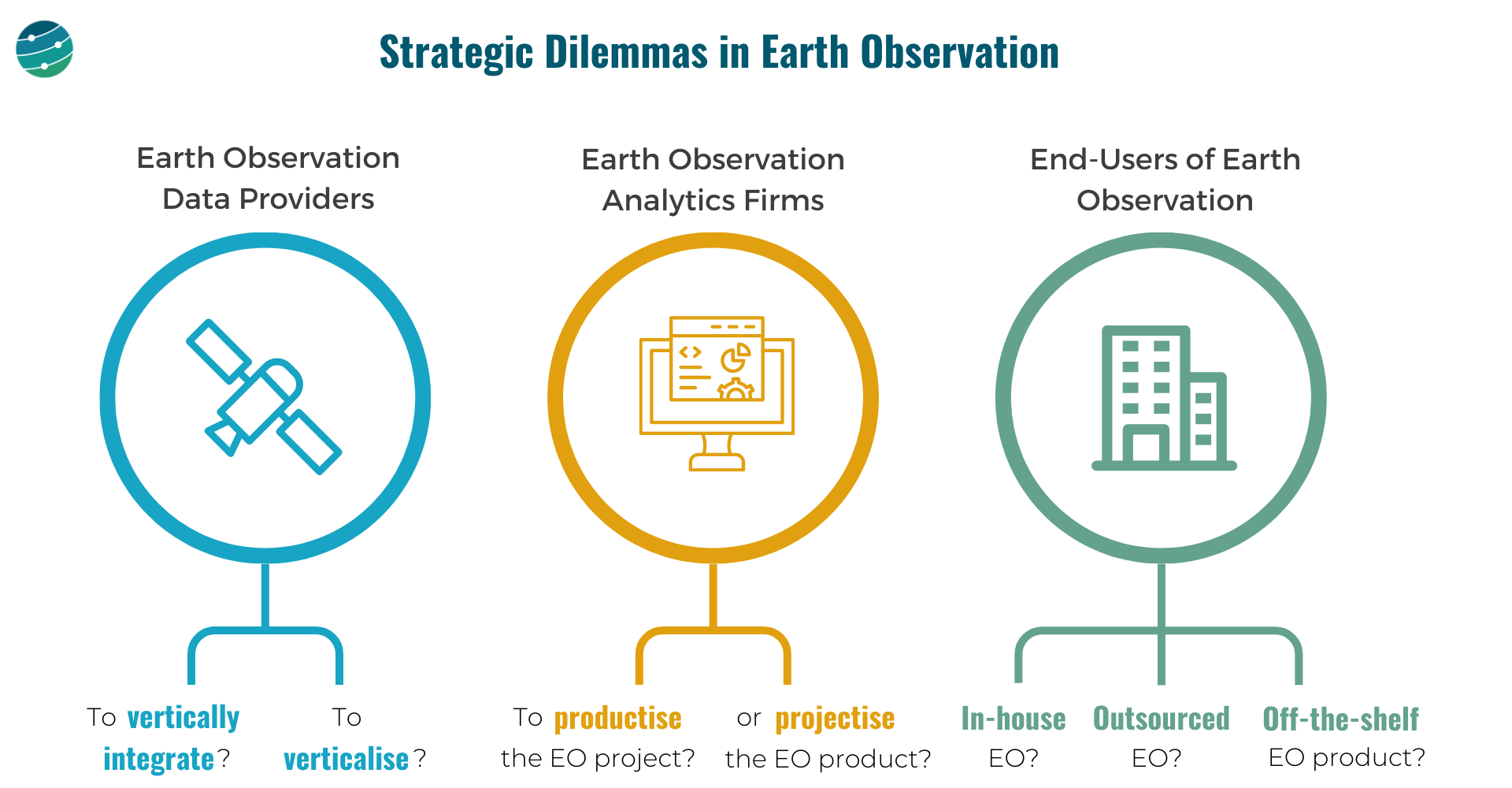

5. Strategic Dilemmas in the Earth Observation Market

Some thoughts on the big strategic dilemmas in EO, based on my experience working in the industry for the past several years. I have categorised them based on the three categories of stakeholders in EO.

- EO Data Providers: To vertically integrate or not? To verticalise or not?

- EO Analytics Firms: To ‘productise’ the project or ‘projectise’ the product?

- End-users of EO: In-house EO vs outsourced EO vs off-the-shelf EO product?

EO Data Providers

These are companies that are in the "Data" layer of the EO value chain. And they, have 2 important choices to make:

- Whether to own as much as possible of the EO value chain or outsource building, launching and operating satellites and just receive the data. And how far down the value chain should they go, just provide data? Or, go one more step further and offer analytics? Where to draw the line?

- Whether to focus the go-to-market efforts on a specific vertical (insurance, agriculture, government etc.) or to remain horizontal and serve as many markets as possible? Companies that verticalise could have an easier route to achieving product-market fit and scalability.

EO Analytics Firms

These are companies that operate in the "Insights" and "Application" layers of the EO value chain. They need to decide:

How to convert the customised EO projects (solve a problem for each customer) into an EO product (that solves that problem scalably for many)

And, when do you say no to more projects and decide to work on a scalable product?

Or, can you pick projects selectively? Assume the current version of your EO product fits only 60% of a large client's requirements, while the other 40% does not fit into your product vision. Do you forego the big client for the product or can you afford to efficiently 'projectize the product'?

End-users of EO

The end-users of EO, who come from several sectors such as agriculture, insurance, finance, infrastructure, mining etc. have some tough choices to make:

Do they go with an in-house EO strategy i.e. build or expand the internal geospatial teams, design their own EO strategy, acquire data from several EO data providers and develop internal solutions with the data?

Or, do they go with an outsourced EO strategy i.e. pick a geospatial consultancy to build custom products as per requirements and abstract themselves from most of the EO choices and challenges, leaving it in the hands of a custom EO solution provider?

Or, can they find off-the-shelf EO-based products for their use case available in the market that fit their needs?

A caveat is although some of these products offer ready-to-integrate analytics, the methodologies used for the work may not be transparent (aka ‘black boxes’).

These are some of the learnings gathered through the past year of work via TerraWatch Space with EO data providers, EO analytics firms and end-users of EO, from around the world. If you are thinking through these strategic questions in your organisation and need some external assessment, I am happy to help.

Scene from Space

One visual leveraging EO

6. Finding Bitcoin Mines in Bhutan

Forbes recently published an investigative article uncovering the secret locations of the world’s largest state-owned bitcoin mines. Bitcoin mining is the process of creating new bitcoins by solving extremely complicated math problems that verify transactions in the currency. When a bitcoin is successfully mined, the miner receives a predetermined amount of bitcoin.

Using satellite imagery from Planet Labs, Satellite Vu and Google Earth sites of what appear to be four bitcoin mines run by the kingdom, that have never been publicly disclosed, were identified. While the country faces an economic and financial crisis, the bitcoin mines in Bhutan are projected to consume more energy than the rest of the nation.

Until next time,

Aravind.

I am currently in Vienna, Austria to participate and speak at the World Space Forum, organised by the United Nations. ↩

A search found that they ended up in a landfill!!! ↩