Welcome to another edition of ‘Last Week in Earth Observation’ in 2024, containing a summary of major developments in EO from the last few weeks and some exclusive analysis and insights from TerraWatch.

The newsletter had been on a short hiatus as I was on holiday over the past couple of weeks, but we will be back to a weekly cadence from now on.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- Albedo, which plans to launch a constellation of satellites to very low Earth orbit to collect 10 cm optical imagery and 2 m thermal imagery, raised $35M in a Series A-1 round;

- EO-based infrastructure monitoring firm AiDash has raised $50M in Series C funding including participation from corporate investors such as National Grid, Schneider Electric and Shell;

- Japanese startup Tenchijin which provides EO-based environmental monitoring services has raised $1.7M in a Series A round;

Contracts

- The Canadian Space Agency awarded a $2M grant to greenhouse gas monitoring satellite firm GHGSat to improve methane detection thresholds.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- Parametric insurance data provider Floodbase is partnering with SAR firm Capella Space which will see its data integrated into Floodbase’s solution;

- Synspective is partnering with Uzbekistan’s Center for Space Monitoring and Geoinformation Technologies and Kazakhstan Gharysh Sapary, the national space agency of Kazakhstan to provide InSAR solutions;

- EO platform SkyFi announced that it has integrated data from Planet’s PlanetScope satellites into its marketplace;

- EO data management firms Tilebox and Ellipsis Drive have entered into a partnership to provide end-to-end data management services;

- Polish optical instrument manufacturer Scanway has partnered with South Korean EO firm Nara Space to supply payloads for methane monitoring;

- The Senegalese Space Study Agency and French EO firm Prométhée Earth Intelligence have announced a partnership to evaluate the feasibility of launching a constellation of EO satellites for Senegal;

Announcements

- Weather intelligence firm Tomorrow.io has announced that data from its precipitation radar satellites are comparable in accuracy to ground-based radar networks and NASA’s GPM mission;

- Consulting firm Deloitte launched a geospatial platform for Scenario Planning and Monitoring, powered by Google Earth Engine and Generative AI from Vertex AI.

3. Interesting Stuff: More News 🗞️

- NASA’s PACE mission, which aims to monitor the oceans, clouds and aerosols, is on track for launch on February 6 after resisting several cancellation attempts;

- Chinese automaker Geely, which launched satellites for improving connectivity and navigation for autonomous vehicles, also has plans to include 1.5m resolution imaging sensors;

- China launched five EO satellites including four with optical imaging sensors and one with a phased-array radar instrument;

- NOAA’s GOES weather satellite constellation has shown the potential to also provide valuable data on methane emissions.

4. Click-Worthy Stuff: Check These Out 🔗

- This paper, titled EarthGPT, which proposes a universal multi-modal large language model for EO data processing;

- This article on Cerulean, an open-source ocean pollution monitoring platform from SkyTruth, a nonprofit organization;

- This paper, which proposes a vision for Landsat and Sentinel-2 data products, based on learnings from past EO missions;

This edition of the newsletter is brought to you by …

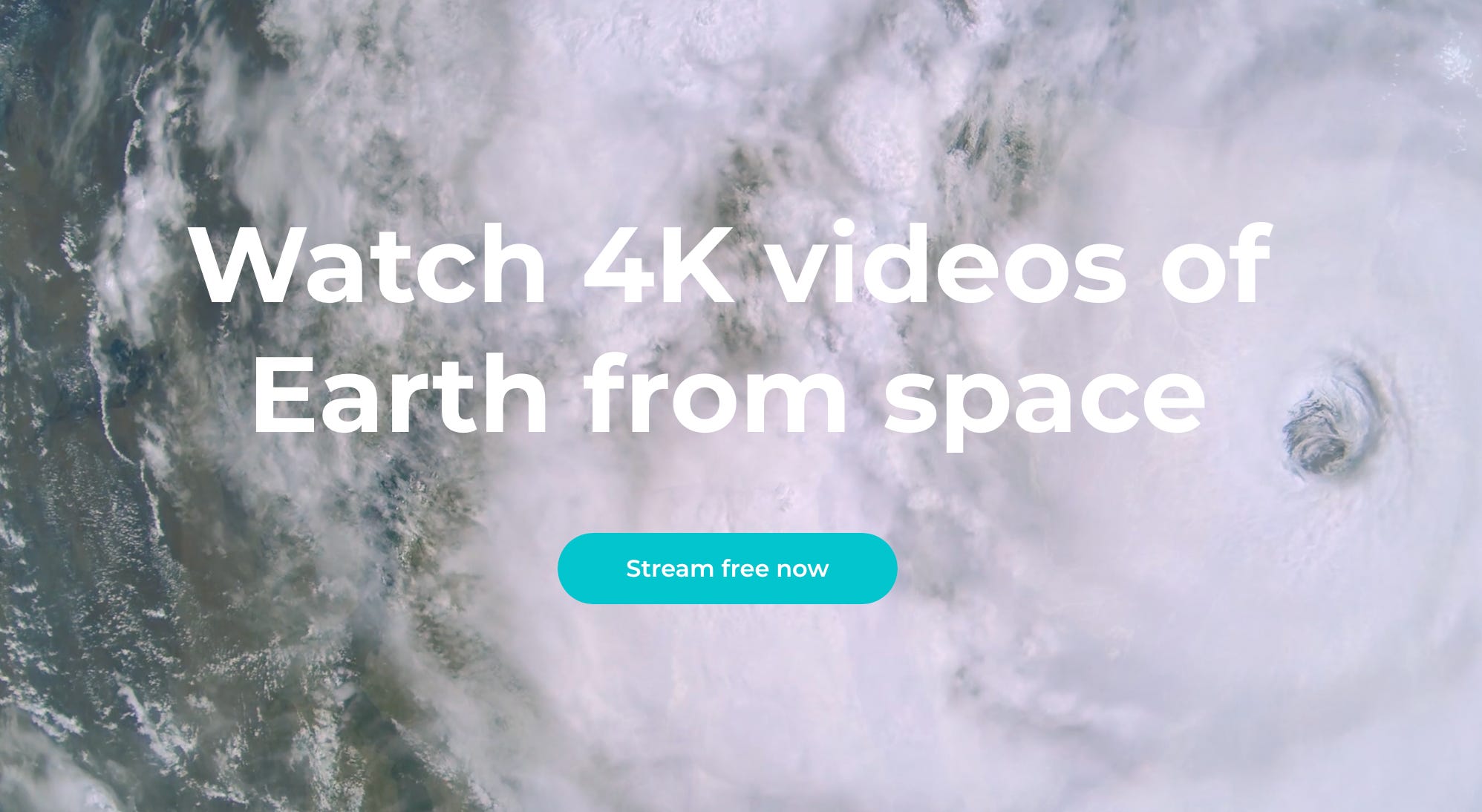

Sen, a British startup, streams high-resolution videos from space to inform, educate, inspire and benefit all humanity with an innovative approach to disseminating satellite data.

The company launched its first satellite last year equipped with four video cameras on board designed to image Earth at different spatial resolutions and is capable of streaming 4K videos. This near real-time dataset about what’s happening on Earth is freely accessible to everyone. Sen’s subscription service includes exclusive video, downloads and location tracking.

Sen plans to launch its next satellite in 2024 with quarterly launches from 2025.

One EO Discussion Point

Exclusive analysis and insights from TerraWatch

5. Analysising EO Investments in 2023

The total investments in EO for 2023 are estimated to be $1.9B, with Data and Application segments contributing to 95 per cent of the overall funding raised. Without the Application segment, which is typically not considered part of the EO sector, the total investment is about $664M, largely dominated by funding from companies in the Data segment.

The overall funding for satellite EO companies has predictably decreased (vs 2022), but there is a significant increase in the number and funding for downstream application firms that use EO data.

The intermediary segments - Platform and Analytics - continue to be overlooked by the venture capital world, receiving less than 3 per cent of overall funding, which can be attributable to two reasons:

Most platforms are essentially marketplaces, which tend to be low-margin businesses, especially at the current levels of scale for EO data. While the Platform segment is undergoing an evolution across data management, distribution and processing categories, the demand for such platforms (whatever they might offer) is not yet fully established.

Some platforms are really custom, project-based consultancies disguised as a scalable, product-based business. While this is a result of a combination of a lack of understanding of the value of EO for several use cases, aka unvalidated demand and unstructured public funding mechanisms that create zombie platforms, one of my many theses is that, we might see the emergence of some vertical-specific platforms that enable some EO tasks for some selected EO applications, not all EO tasks for all EO applications (i.e. platforms good at some things, not all things).

The Insights segment is simply EO companies that desperately try to find product-market fit within a specific vertical, to graduate to becoming an Application company. This segment usually does not get a ton of funding, as the number of EO companies that are not project-driven solution providers or public funding-dependent consultancies is simply too few.

Finally, the Analytics segment, which includes companies that convert satellite data into usable information that can be applied to several use cases, will most likely be disrupted by open-source tools and libraries such as Meta’s Segment Anything Model for object detection and IBM’s open-source geospatial AI foundation model, making this segment not very interesting for private funding. Any company that develops proprietary analytics will use that as a pathway to building an information product applicable to a specific use case (aka the Application segment).

The full piece includes a comprehensive review of Earth observation investments in 2023, including funding by segment, growth stage, and geography. There is also some discussion on why some segments receive more investments than others and an outlook for what to expect in EO investments in 2024.

EO Summit: Updates

This is a new section to provide updates on EO Summit, the conference organised by TerraWatch to bring together users of EO and the EO sector.

A limited number of early-bird tickets for EO Summit are live. Benefit from super low prices of EUR 249 / USD 267 per ticket. Book yours here!

Scene from Space

One visual leveraging EO

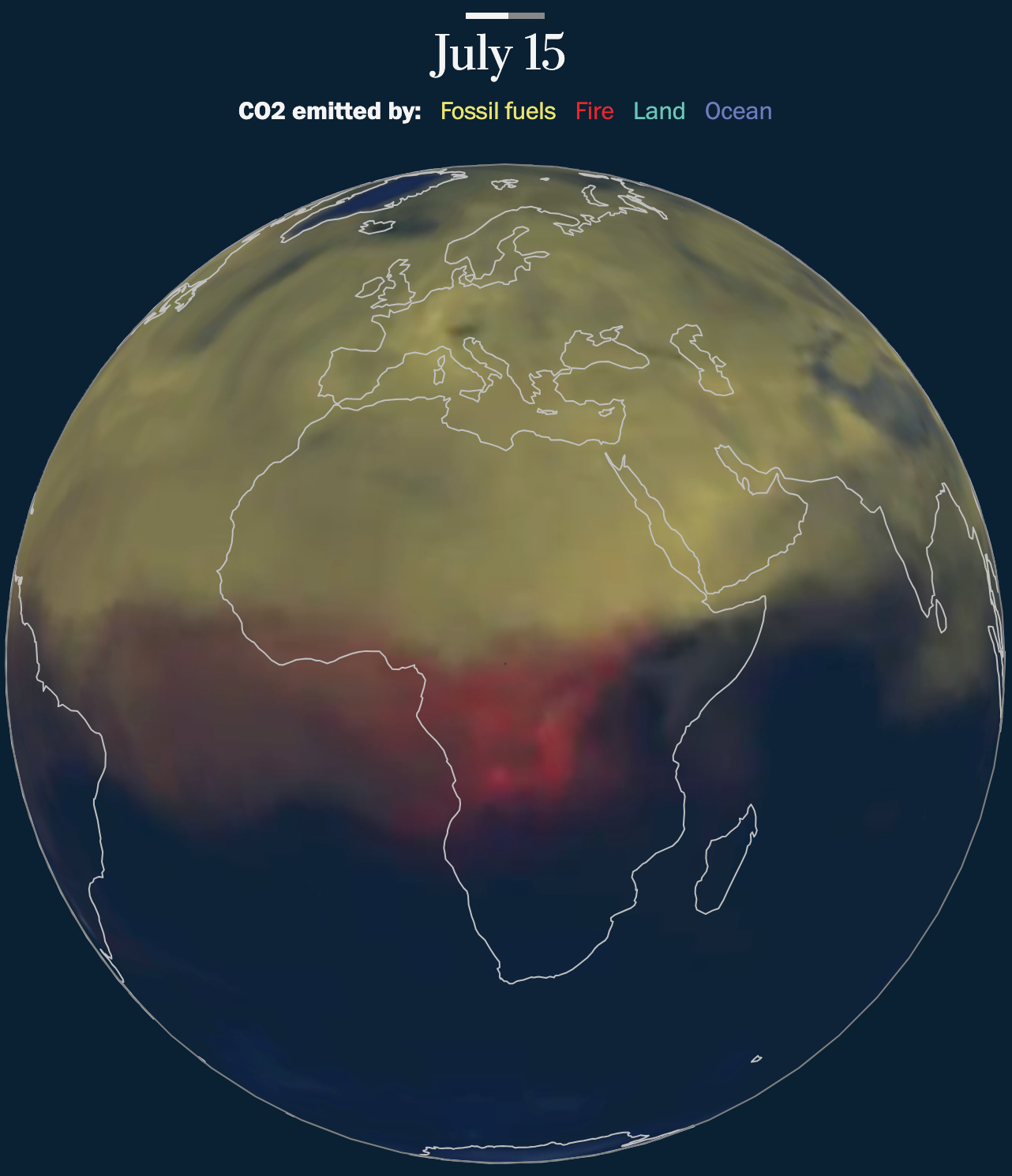

6. Visualising Carbon Dioxide Emissions

This interactive piece from the Washington Post includes visualisations provided by NASA to show the evolution of CO2 emissions on the planet, segmented by sources. Certainly an interesting way to present greenhouse gas emission data collected by satellites (after validating it scientifically).

If you enjoy this newsletter, please subscribe. Already a subscriber? Then, please consider upgrading to support the effort.

Until next time,

Aravind.