Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- Urban Sky, a startup that uses stratospheric balloons for imaging, raised $30M in a series B funding round.

M&A

- Infrastructure monitoring firm Fugro acquired EOMAP, an EO-based marine environment monitoring solution provider.

This is yet another example of vertical consolidation in EO i.e. when a market leader in a specific vertical acquires an EO analytics firm to strengthen their offering. There will be more of this in 2025!

Contracts

- Spire and OroraTech won a contract worth $50M from the Canadian Space Agency to build, launch and operate wildfire monitoring satellites;

- Satellogic and its partner Telespazio Brasil announce a multi-year contract for supplying low-latency satellite imagery for the Brazilian Air Force;

- Thales Alenia Space signed a contract with NIBE Space, an Indian space company to supply high-resolution optical satellite as part of its constellation;

- BlackSky won a multi-year contract with geospatial intelligence fusion company EMDYN to deliver EO services to international customers.

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- Hyperspectral imaging firm Wyvern has unveiled an open data program providing free hyperspectral data from its constellation;

- Japan’s SKY Perfect JSAT unveiled that it was the customer for Planet's EO constellation announced last week, for which it invested $230M making steps to expand beyond its satellite communication business;

- European weather forecasting agency ECMWF released its 10-year strategy in which it reinforced its plans to integrate AI weather models anchored on physics-based modelling.

Partnerships

- GHGSat is partnering with Saudi Arabian oil giant Aramco to leverage its satellites for methane emission reduction;

- Aon, Swiss Re, and EO-based flood risk solution Floodbase launched a parametric insurance solution to mitigate hurricane storm surge losses;

- Synspective is partnering with Yokogawa Electric and Insight Terra to monitor ground displacement at mining facilities in Latin America and Africa;

- NOAA is teaming up with weather data infrastructure startup Brightband to make observational data AI-ready

🗞️ Interesting Stuff: More News

- China launched what it called the 'world's first in-orbit AI commercial hyper satellite';

- SpaceX launched the third pair of Maxar’s WorldView Legion imaging satellites;

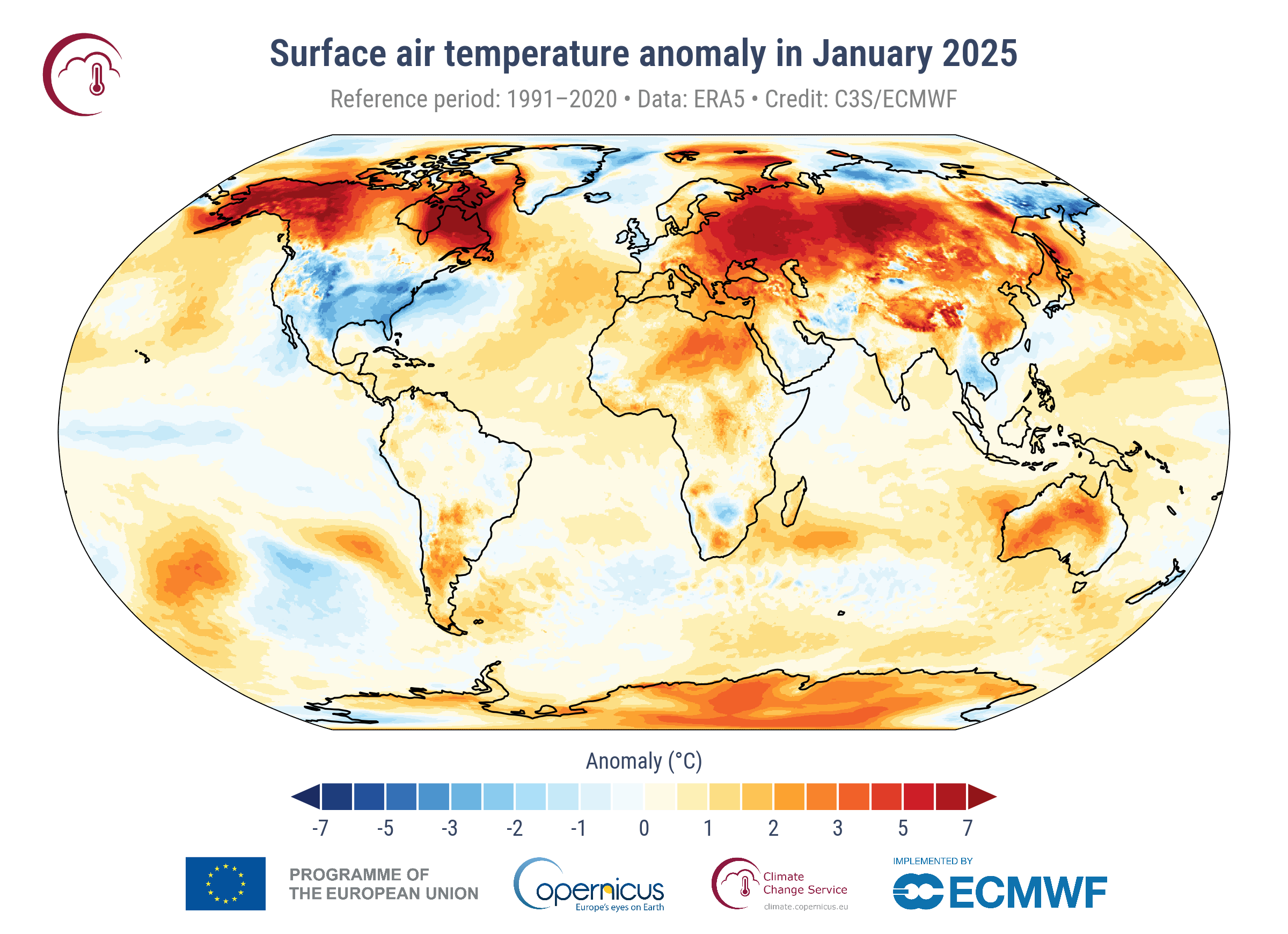

- The Copernicus Climate Change Service reported that January 2025 was the warmest on record globally, despite emerging La Niña conditions;

🔗 Click-Worthy Stuff: Check These Out

- This paper that provides a summary of the role of satellites in disaster response;

- This paper on how explainability can enhance trust in AI solutions for geoscience;

- This article on the Bhuvan portal, India's remote sensing data platform;

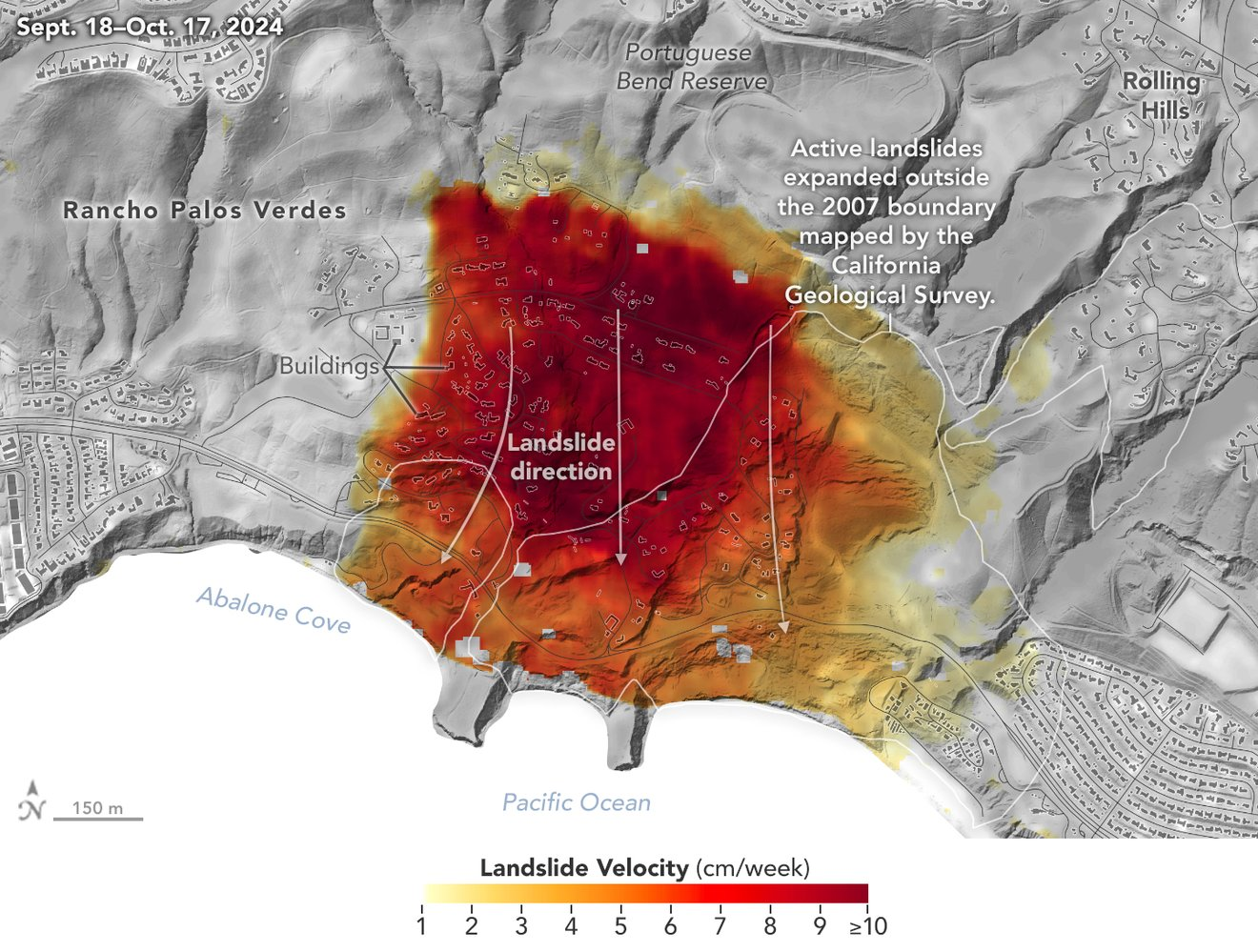

- This article on leveraging SAR for monitoring landslides in California.

EO Summit: Unveiling the Next Round of Sponsors

We have a number of major EO companies signed up as sponsors for EO Summit 2025. I am very thankful for their support and look forward to their participation at the conference.

Some sponsorship slots are still available. For more details, check out the sponsorship brochure or reach out to eosummit@terrawatchspace.com.

Check out the Program Overview to get an idea of the sessions and the topics to be discussed at EO Summit.

Reminder: Early bird tickets are on sale. Grab the last few tickets!

One Discussion Point

Exclusive analysis and insights from TerraWatch

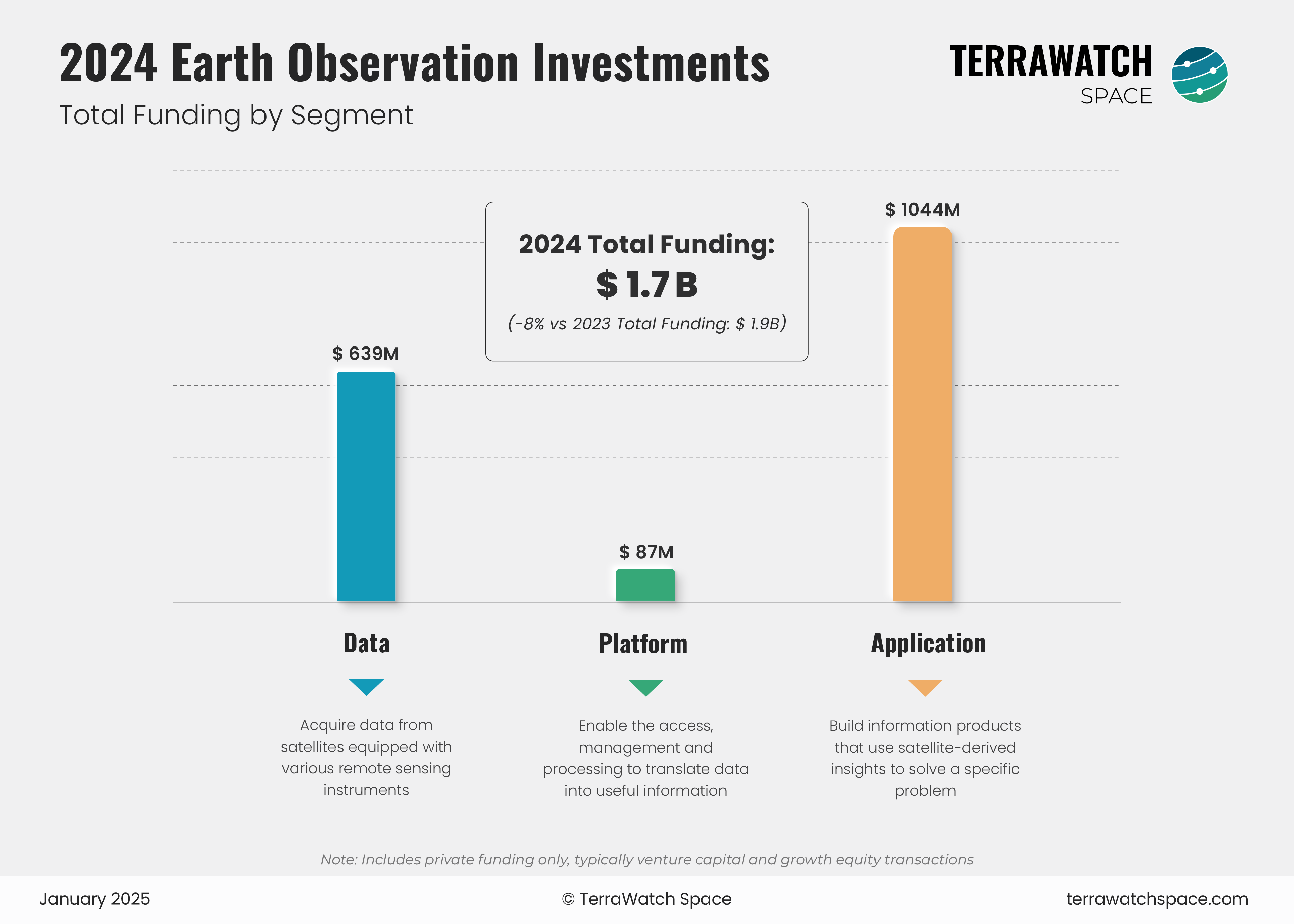

Earth Observation Investments: 2024 Review

ICYMI - Last week I published a deep-dive reviewing the state of EO investments in 2024, along with an outlook for 2025.

Overview of EO Funding in 2024

The total investments in EO for 2024 are estimated to be $1.7B, with the Data and and Application segments contributing to 95 per cent of the overall funding raised, of which downstream firms that leverage satellite data to build vertical-specific solutions received over $1B. The overall figure is a slight decrease, compared to the $1.9B raised in 2023, and the overall deal count last year - however, funding for EO satellite companies (Data segment) grew by about 10% (year-on-year), despite the pessimistic sentiment around EO.

Overview of EO M&A in 2024

2024 saw a few surprising and a few unsurprising deals - primarily horizontal consolidation i.e. when two similar type of EO businesses, on a sensor-level or on a segment-level, join hands. Some examples of transactions included: Safran acquiring Preligens, Privateer acquiring Orbital Insight, EarthDaily acquiring Descartes Labs, New Space Group acquiring EO platform company UP42, maritime intelligence provider Kpler acquire Spire's maritime business along with a few smaller transactions involving NUVIEW, KSAT and Maxar.

Outlook for 2025

I expect funding for companies in the Data segment, especially those focusing on the defense and intelligence sector, to grow as newfound optimism hits the US, with a seemingly, business-friendly administration. The emergence of geospatial foundational models, leveraging open satellite imagery, is expected to open up the traditional Platform segment to wider data platforms (the likes of Databricks and Snowflake). The Application segment will continue to see more interest and funding, however most of these companies will never make it to the EO market maps and the ecosystem.

We will continue to see more acquisitions in 2025 - more specifically vertical consolidation i.e. an enterprise market leader in a specific vertical acquiring an EO downstream firm, as they discover and validate the strategic value of EO for their business or an EO data company acquiring a specialised EO downstream firm, as they reinforce their go-to-market strategies and decide to verticalize in specific industries. As if to validate my thesis further, we have two deals like that already involving Moody's and Fugro.

More analysis and investment figures by year, by region and by growth stage in the full piece. Become a paid subscriber to get full access!

Scene from Space

One visual leveraging EO

Top 10 Persistent Methane Sources

The image below from ESA shows the top 10 persistent methane source regions i.e. natural or anthropogenic sources that emitted methane on a continuous basis over the study period between 2018 and 2021, based on data from the Sentinel-5P mission. Check out the article to learn more about the project.

Until next time,

Aravind.