Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- Swiss startup Jua, which aims to build a foundational model for the natural world, using EO data among other sources, has raised $16M in seed funding;

- Synthetaic, which uses AI to rapidly identify images or items in images, has raised $15M in Series B funding;

- Shipping technology firm Signal Ocean has made a strategic investment of $10M in Spire to leverage its data for maritime monitoring solutions;

- Aquaconnect, an aquaculture platform that uses EO and AI to provide insights for the fishing industry, has raised $4M in pre-Series B funding;

Contracts

- EO firm BlackSky has signed a $50M contract to provide EO intelligence and satellites to the Indonesian Indonesian Ministry of Defense, working together with Thales Alenia Space.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- SAR satellite firm Synspective is teaming up with the Ministry of Natural Resources and Environment of Vietnam and Fujitsu Vietnam to help with disaster preparedness and natural resource management among others;

Announcements

- Greece announced plans to invest EUR 60M to develop its national constellation to provide optical, multispectral, and hyperspectral data;

- Planet announced that data from the PlanetScope satellites is now available on Google Cloud Marketplace;

- Satellite manufacturer Thales Alenia Space has launched the ‘All-in-One’ offering, with a combination of optical and radar satellites;

- Finnish hyperspectral EO startup Kuva Space announced plans to establish a US entity targeting government customers.

3. Interesting Stuff: More News 🗞️

Venture-backed space companies face a “year of reckoning”, according to investors in a panel discussion;

My outlook for EO investments in 2024, especially for satellite EO firms was similar, as I expect funding to decrease this year as investors wait for them to validate their technologies and prove their business cases.

Maxar Intelligence has named a new chief technology officer, an executive with experience building digital infrastructure systems at Meta and Apple;

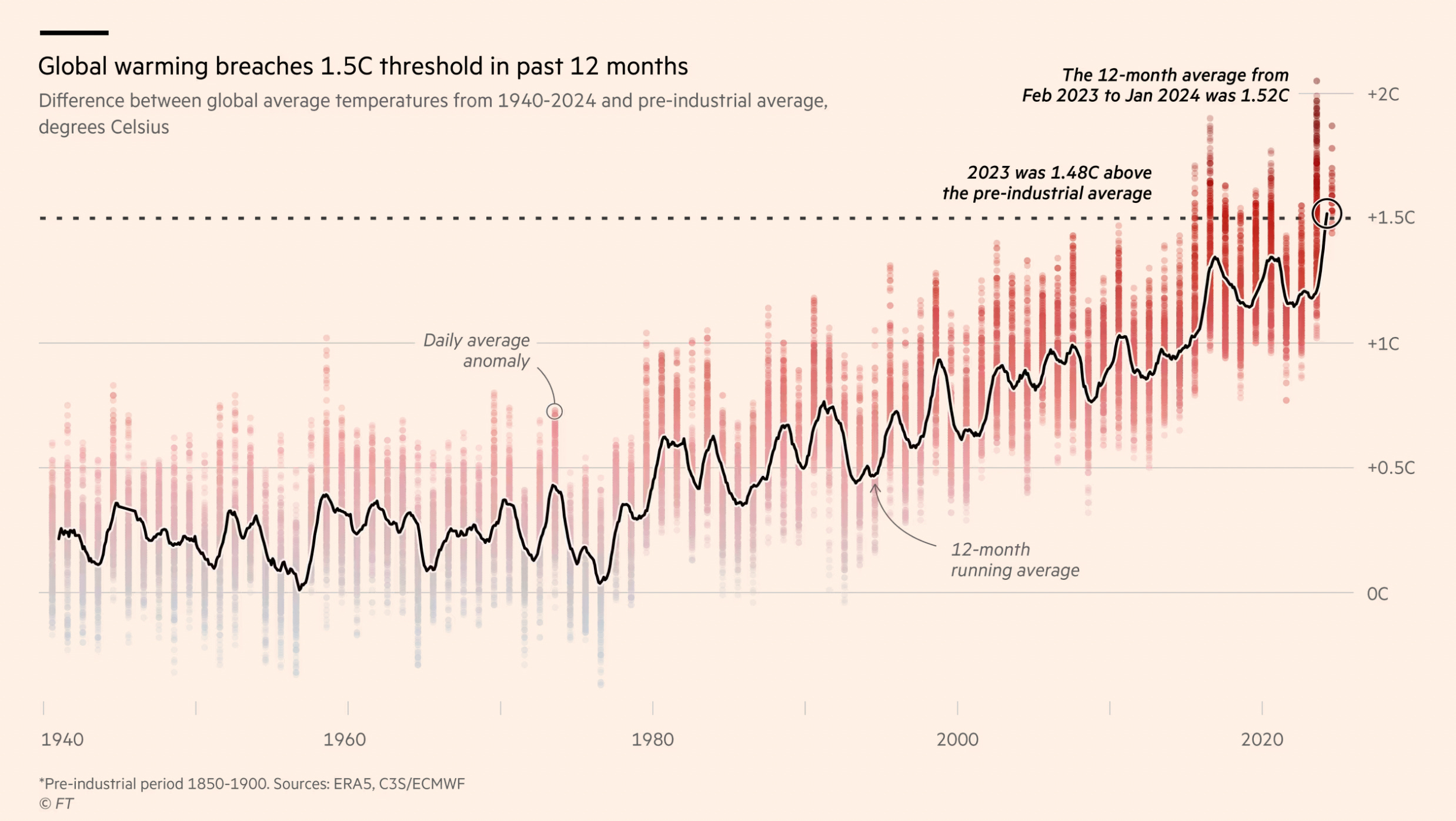

The average global temperature has for the first time breached the critical benchmark of 1.5C above pre-industrial levels over 12 months, according to data from the EU’s Copernicus Climate Change Service.

Credit: FT (via C3S/ECMWF)

4. Click-Worthy Stuff: Check These Out 🔗

This piece that discusses the importance of trustworthy, standardised validation methods for satellite-based observations to be effective;

This paper that argues that satellite data requires a different research discipline altogether from a machine learning context ;

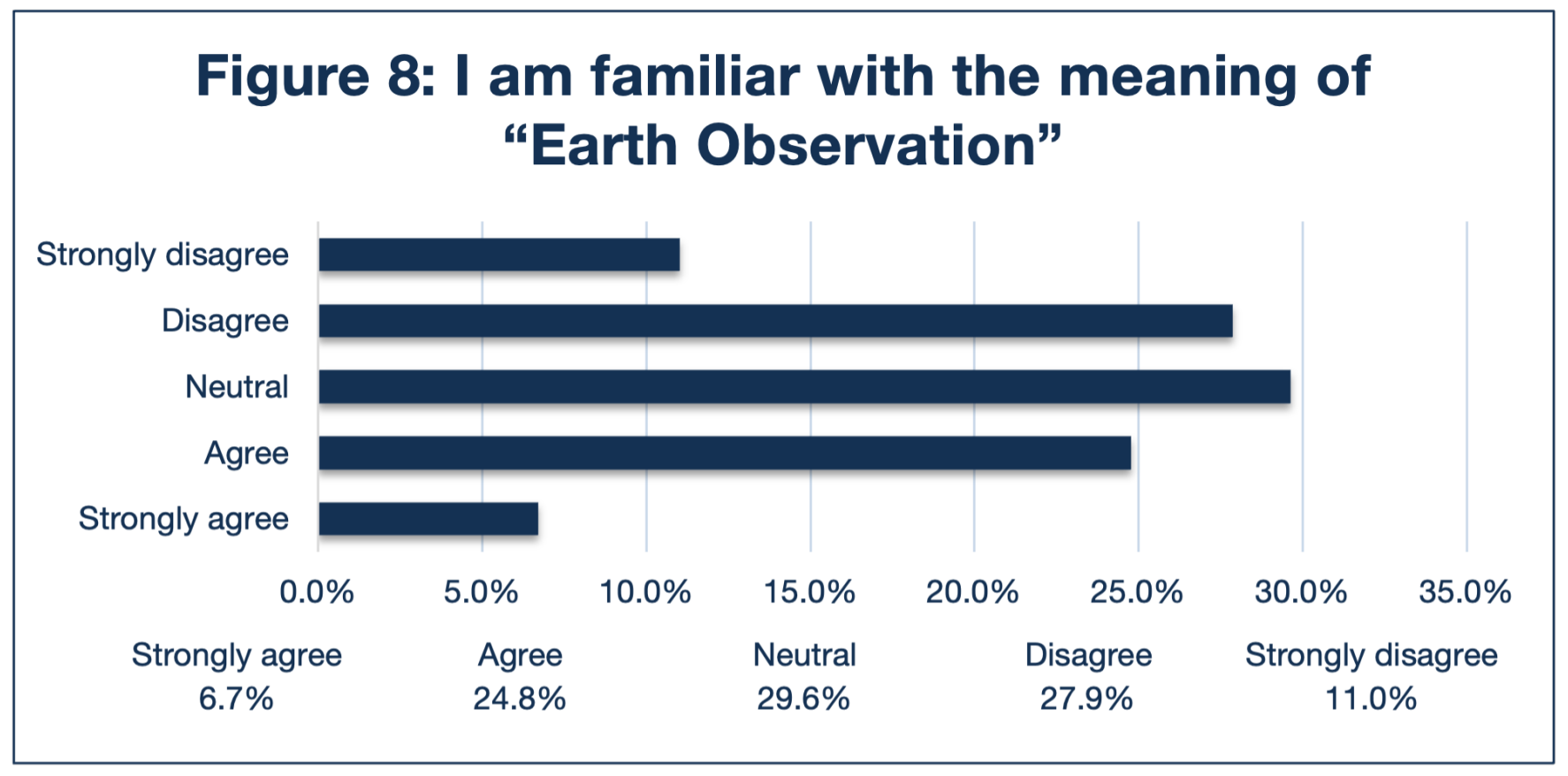

The figure below caught my attention as I was skimming through an interesting report from the Centre for Australian Space Governance, which contains the results of a survey conducted on space activities in Australia.

I founded TerraWatch to demystify EO and I hope to play a part in changing the results of such surveys in the next few years 🛰️ 🌍

EO Summit: Updates

Conference planning is in full swing as sponsors and speakers are being finalised. In the meantime, a limited number of early-bird tickets are on sale. Benefit from low prices of EUR 249 / USD 267 per ticket.

One EO Discussion Point

Exclusive analysis and insights from TerraWatch

5. The Future of National EO Satellite Constellations

Over the past few years, we have seen the rise of national EO satellite constellations, announced by several countries around the world - Italy, Poland, Bulgaria, Greece, Spain, Portugal, Senegal, Oman, and UAE among many others. The geopolitical situation coupled with the changing climate means that governments are more than to invest in developing sovereign EO capabilities.

In 2023: Italy confirmed plans to launch its multi-sensor EO constellation (IRIDE), while Spain, Portugal and the UK are planning to launch the Atlantic Constellation, and Poland will be launching its constellation, Camila. We also saw the launch of the first EO satellites from Oman, Kuwait, Djibouti, and the state of Andalucia (Spain), among several others. Canada doubled down on its investment in EO by allocating a budget for the evolution of the Radarsat constellation.

I don’t expect the trend of sovereign EO to go away anytime soon, not just because countries want EO data independence, but also due to the increasing availability of off-the-shelf solutions, as countries can choose from 5 options to build and launch an EO satellite - although this does not mean countries will not purchase data from existing data providers.

For a lot of them, the primary rationale is economic: investing in developing EO capabilities will lead to the creation of jobs and boost technological know-how. However, while in the short-term, everything looks rosy as many countries announce EO plans, I think some of these national EO constellations may not survive, in the long term. Here are three reasons why:

- Lack of EO Adoption Strategies: Most of these initiatives do not prioritise EO adoption or take steps to support the growth of downstream EO ecosystems. They just wait for magic to happen after the satellites are launched (availability ≠ adoption). So, in reality, governments remain the only customers for the data, which is unsustainable, given the costs involved in being a producer and a consumer.

- Lack of Fit-For-Purpose Innovation: Most of the constellations tend not to be built-for-purpose. In fact, in most cases, the constellations try to do a bit of everything, with a variety of sensors, while not aimed at solving specific, relevant problems. With a rapidly growing, highly innovative global commercial EO sector, these constellations will soon become out-of-date.

- Lack of Long-Term RoI: While these initiatives get approved today because EO satellite constellations are considered national strategic assets, soon there will be a reality check moment when RoI studies are done. National EO constellations do not have a global addressable market, so while for some countries, sovereign capabilities will become the modus operandi (Radarsat in Canada), for others the RoI will be quite limited, given the plethora of alternative options available in the market - EO data, EO data products, EO analytics, EO insights and EO applications.

I certainly do not think that countries actively decide not to have EO adoption strategies - in fact, many of them do. But as often is the case in the EO sector:

There is a tendency to overestimate the potential of EO and underestimate the efforts needed to realise that potential.

My thoughts, originally posted on social media, seemed to have ruffled some feathers - I received some angry messages and at least one veiled threat. I have nothing against any country launching its own EO constellation. The more successful national EO initiatives exist, the more the best practices and case studies are available for other countries to follow.

Scene from Space

One visual leveraging EO

6. Dubai in False Colour

False-colour images allow us to visualise wavelengths that the human eye can not see and are usually a representation of a multispectral image produced using bands other than visible red, green and blue (learn more here).

Here is a false-colour image of Dubai acquired by the Sentinel-2’s near-infrared channel, showing vegetation in bright red and water bodies in different shades of blue. The red dots represent golf courses, gardens, parks and agricultural fields, which use centre-pivot irrigation systems that are easy to spot from their circular shape.

I will be in Dubai (and Abu Dhabi) next week - if you want to meet up and chat all things EO, send me a note on social media or just hit reply.

If you enjoy this newsletter, subscribe for free to get your copy every week. Already a free subscriber? Then, why not become a paid subscriber and get exclusive EO insights?

Until next time,

Aravind.