Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- Weather intelligence provider Meteomatics raised $22M in a Series C funding round;

- EO-based nature monitoring solution provider Nala Earth raised €3.8M in seed funding.

Contracts

- Planet won a multi-year contract worth $230M from an undisclosed customer in Asia-Pacific to build and deliver a constellation of its high-resolution, Pelican satellites;

The EO market has moved away from data/analytics/insights-as-a-service models. For continued global success, EO companies have had to resort to satellite-as-a-service models (as Satellogic first showed, then followed by Iceye). Anyone who has been paying attention to sovereign EO trends shouldn't be surprised about this deal for Planet.

- French EO solution providers Kayrros, SERTIT and CS Group won governmental grants through the France 2030 initiative;

- Nineteen EO data companies have signed agreements to provide new or enhanced services to the EU's Copernicus programme through the Copernicus Contributing Missions initiative

ESA is setting a precedent for commercial data procurement for civilian applications, especially with acknowledgment of non-European Earth Observation companies (with a European base) now part of the list.

The best solutions leverage as much data as possible from different modalities to solve the intended problem. Being able to integrate almost every available global EO data source means that Copernicus remains the best, comprehensive civilian EO programme in the world.

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- Defense contractor Raytheon, SAR data provider Umbra and radar imaging startup Array Labs have signed a partnership to build 3D mapping products.

🗞️ Interesting Stuff: More News

- Commercial weather satellite companies forecast increased funding under the Trump administration;

- Australia's New South Wales government has selected Airbus and its local reseller Geoimage for statewide digital mosaic maps with satellite imagery;

- Europe’s carbon dioxide monitoring mission, CO2M, will now include a third satellite, improving the revisit rate to 3.5 days to measure global emissions.

🔗 Click-Worthy Stuff: Check These Out

- This paper on mapping the height of trees in the Amazon Forest by fusing Planet data and aerial lidar imagery;

- This consolidated list of EO and remote sensing conferences, workshops and events from TerraWatch (the conference season is about to begin);

- This paper on a SAR-based soil moisture product based on Sentinel-1 data, with 1-km resolution;

- This piece, written by yours truly, on making satellite data mainstream, with a focus on the gaps, challenges, and opportunities in remote sensing.

EO Summit: Early Bird Tickets

🎟️ A limited number of Early Bird tickets for EO Summit 2025 are now on sale!

💰 Buy a full EO Summit conference ticket for only $499 and save $200!

📅 Offer ends on March 10. Hurry up and get your tickets now!

One Discussion Point

Exclusive analysis and insights from TerraWatch

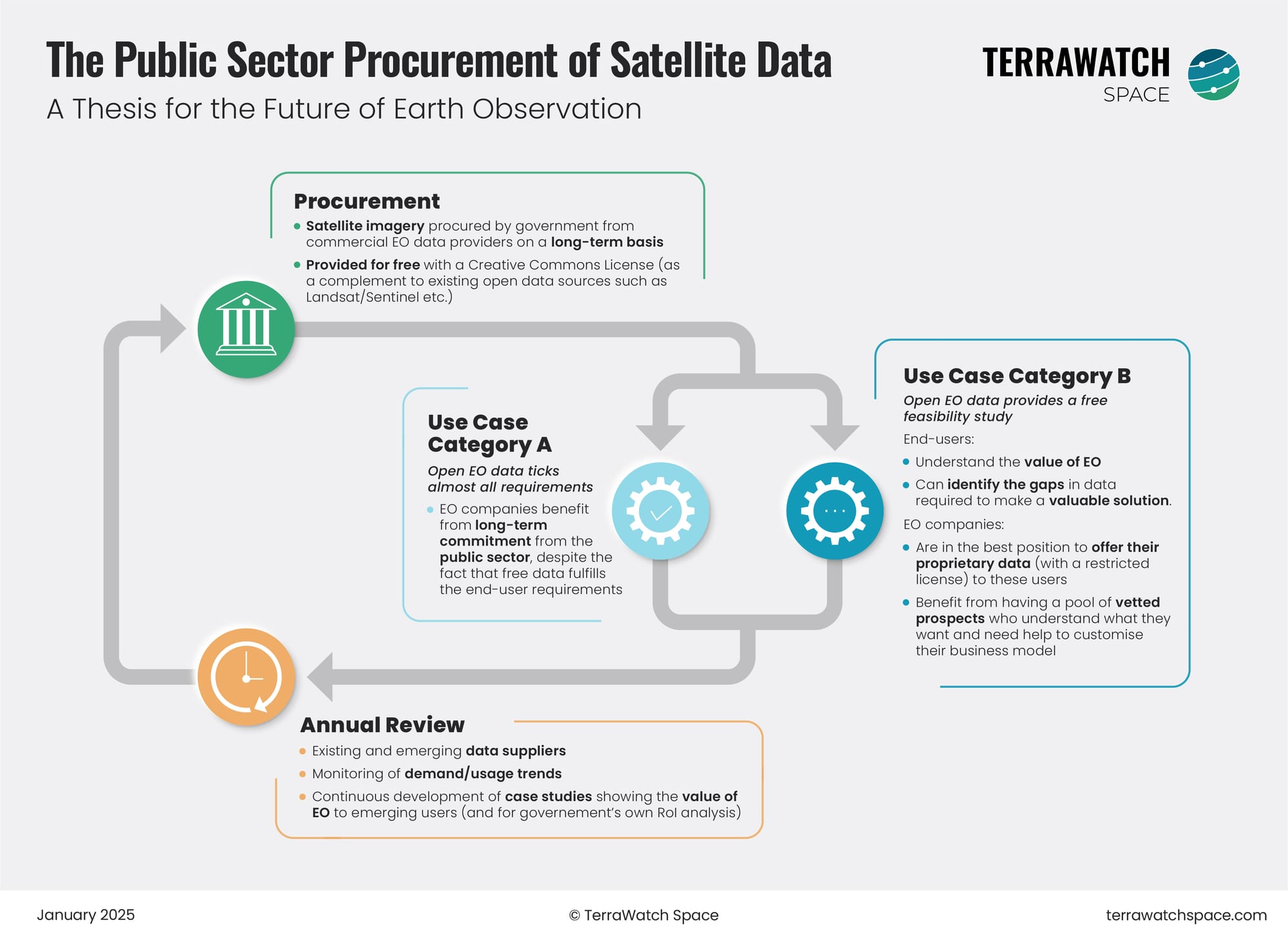

The Future of Public Sector Procurement of EO Data

We have been seeing some developments in EO, over the years, similar to the ESA and NASA contracts, in which the government procures commercial satellite data, mainly for research (i.e. non-commercial) purposes.

I wanted to take a quick second to imagine a future for the EO sector, in which (some) commercial satellite data is available as open data for all uses - similar to Landsat and Sentinel data. My thesis is that this will actually contribute to increased adoption of EO, leading to actual commercial growth of the sector, for civilian and commercial use cases.

Here is a simple explanation of how it could work.

Hypothesis

The public sector procures a defined capacity of satellite imagery from commercial EO data providers on a long-term basis. The government then gives that data away for free with a Creative Commons License, as a complement to existing open data sources such as Landsat/Sentinel etc.

Adoption

- For some use cases, the open EO data would tick almost all requirements, which means the EO companies get nothing from it, but they can afford to do so because there is a longer term commitment from the public sector.

- The combined adoption of commercial satellite imagery and open data creates a need for the data from EO companies to be interoperable and comparable in quality with missions like Landsat and Sentinel.

- For other use cases, the open EO data would act as a free feasibility study. End-users understand the value of EO and can identify the gaps in data required to make a valuable solution.

- EO companies are in the best position to offer their proprietary data (with a restricted license, if needed) to users and can benefit from having a pool of vetted prospects who understand what data they want and why they want it, which helps customize their business model.

Review

In order to keep the policy efficient and the operating model a good investment, the government does a yearly review of existing and emerging EO data providers, monitors the demand trends and continuously develops case studies showing the value of EO to emerging users, which enables higher adoption and contributes to its own return-on-investment analysis.

Am I too optimistic or just naive?

Scene from Space

One visual leveraging EO

Monitoring Wildland Fuel with Satellites

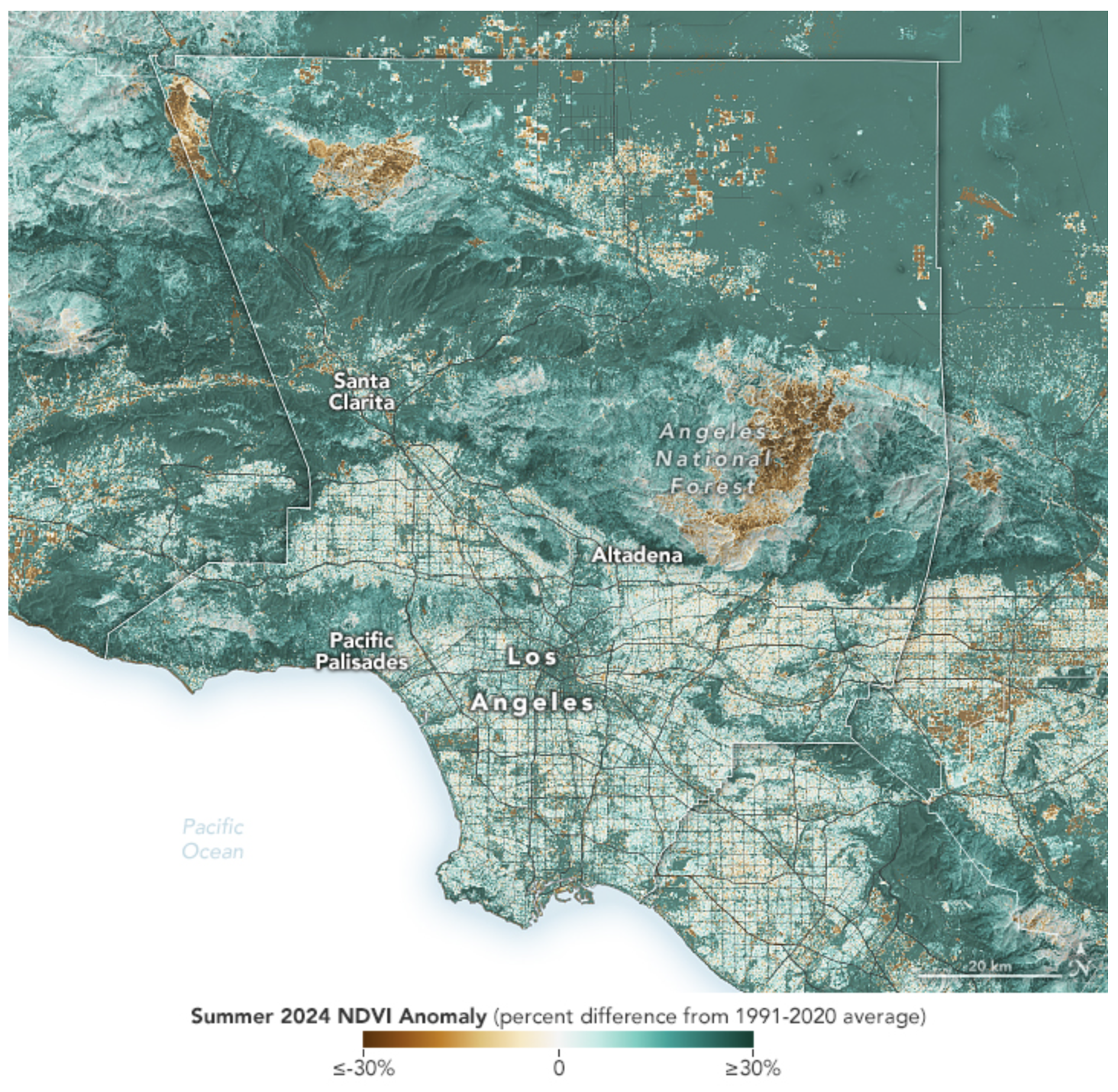

The wildfires in Los Angeles that killed 29 people and caused more than $250B in damages are now fully contained. The fires, propelled by the Santa Ana winds, were enabled by fuel, or in other words, plant material including grasses, shrubs, trees, dead leaves, and fallen pine needles available. Heavy precipitation over the last couple of years in California led to a vegetation build-up, which was followed by warm, dry weather over the past few months (a whiplash), all of which contributed to the fast fires.

The map below shows an index of plant health (NDVI for the geeks) over the summer, indicating that many parts of Los Angeles were 30 percent greener than average.

Until next time,

Aravind.