Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- Thales Alenia Space was awarded a contract to perform a mission study for SIRIUS mission with a thermal infrared imager to monitor urban heat islands;

- Airbus Defence and Space won a contract to build and deliver two radar satellites for the Spanish Ministry of Defence;

- Saudi's Neo Space Group has completed the acquisition of UP42 from Airbus Defence and Space (more on this below👇);

Funding

- Swiss startup askEarth that aims to build a geospatial agentic AI solution raised $2.85M in seed funding;

- LGND, that aims to build an enterprise-grade ChatGPT for EO, raised $9M in seed funding;

- Chloris Geospatial has raised $8.5M in Series A funding to scale its EO-based forest carbon monitoring solution.

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- Indian EO firm Suhora is partnering with hyperspectral imaging firm Orbital Sidekick expanding its offering to India;

- SAR data provider Synspective is teaming up with Spectee, a provider of AI-powered real-time disaster and crisis management information services;

- Weather intelligence firm Tomorrow .io is partnering with Palantir, integrating the weather solution to Palantir’s enterprise and government focused platform.

- NASA and USGS are partnering to conduct the largest airborne spectroscopic survey in US history to map minerals across the country.

🔗 Click-Worthy Stuff: Check These Out

- This article presenting the environmental and societal impacts of rare earths mining using satellite imagery

- This paper that uses satellite imagery to show how global forest mapping missed 396 million hectares of trees.

One Discussion Point

Exclusive analysis and insights from TerraWatch

Saudi's New Space Group Completes Acquisition of European EO Platform UP42

Neo Space Group (NSG), the Saudi-based, PIF-owned space company (which also acquired geospatial services firm Taqnia) has completed the acquisition of Germany-based UP42, from Airbus Defence and Space.

In Brief: What does this mean?

For NSG, this acquisition allows them to continue becoming more and more fully vertically integrated firm, the only one of its kind in Saudi Arabia - somewhat in competition with UAE's Bayanat, now part of the Space42 group.

For UP42, this transaction, apart from the obvious financial clout, brings independence away from Airbus, both with respect to its product roadmap and potentially the capacity to provide a true independent data marketplace (being owned by Airbus might have impacted its data-agnostic nature in the past).

For Europe, this deal is quite a big blow, especially as it comes only a couple of years after US-based Planet acquired major EO platform provider Sinergise. It is plausible that Airbus, as a result of its dire financial situation, decided to offload UP42 to NSG, while focusing on its core activities. Can Europe afford to continue losing its major EO players?

The Big Picture: EO Platforms

The EO Platform segment received less than 10% of the private funding raised by EO sector in the past 7 years. Yet, this is the segment that has had the most exits in EO, even though some of these ‘exits’ are not your usual kind.

- Descartes Labs acquired by Antarctica Capital (and then EarthDaily Analytics),

- Sinergise (Sentinel Hub) acquired by Planet,

- Astraea acquired by NuView,

- Orbital Insight acquired by Privateer,

- UP42 formed by Airbus and acquired by New Space Group.

My Thesis on the Future of EO Platforms

People have asked me before: "Will there ever be a market for an independent (provider agnostic) EO platform that provides data access, data management, data processing offerings?"

I am not entirely sure platforms that start with a ‘horizontal strategy’ can be the answer to the end users interested in building EO applications. Most of the commercial EO platforms today lack any domain-specific data nor can they provide any expertise through the platforms.

The way forward is most likely to be ‘verticalized platforms' - EO platforms built for a purpose, focused on specific sectors or a set of use cases. Imagine a platform that is purely focused on the agriculture sector, and provides access to all types of data (satellite and non-satellite), tools, libraries and algorithms relevant to the agricultural use cases.

Platforms are fundamental to the growth of EO, especially if we want to unlock its iPhone moment. But unlike Apple (and Android), which laid the path forward for the development of mobile apps that led to the growth of the app economy, we have a pretty crowded ecosystem here, made even more complex with uncoordinated public funding, lack of validated demand and a pretty defence-dependent EO sector.

For a deep-dive on the state of EO platforms, check out the deep dive.

Scene from Space

One visual leveraging EO

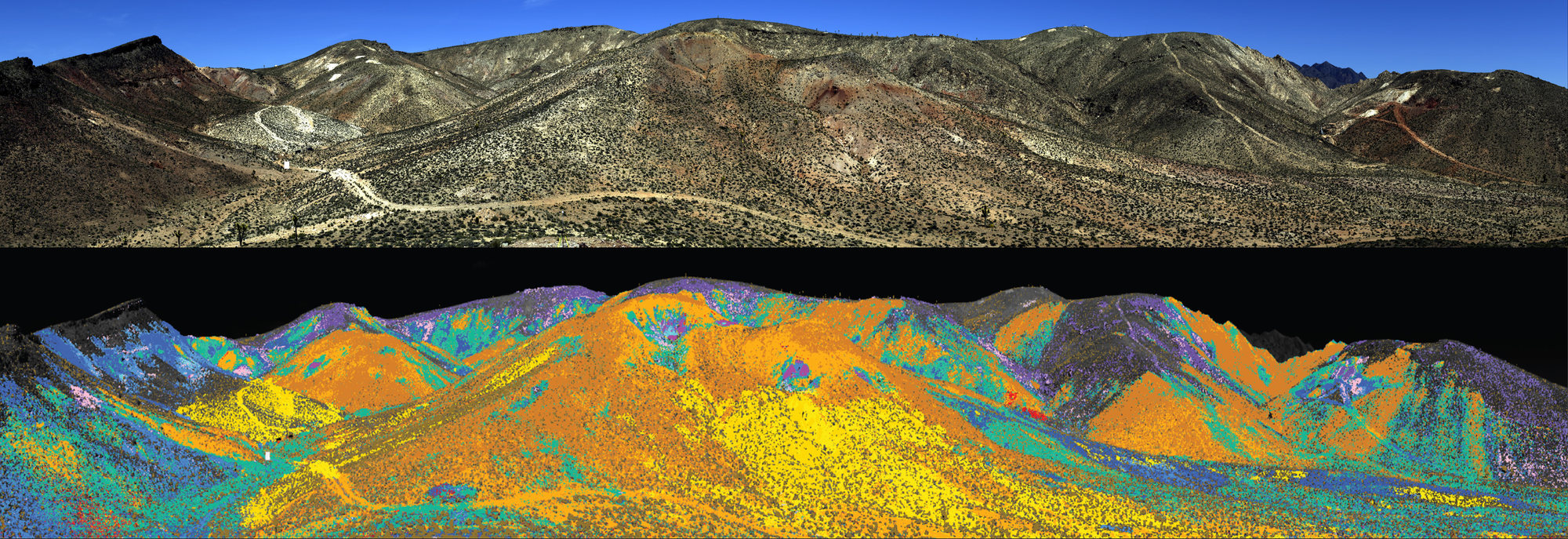

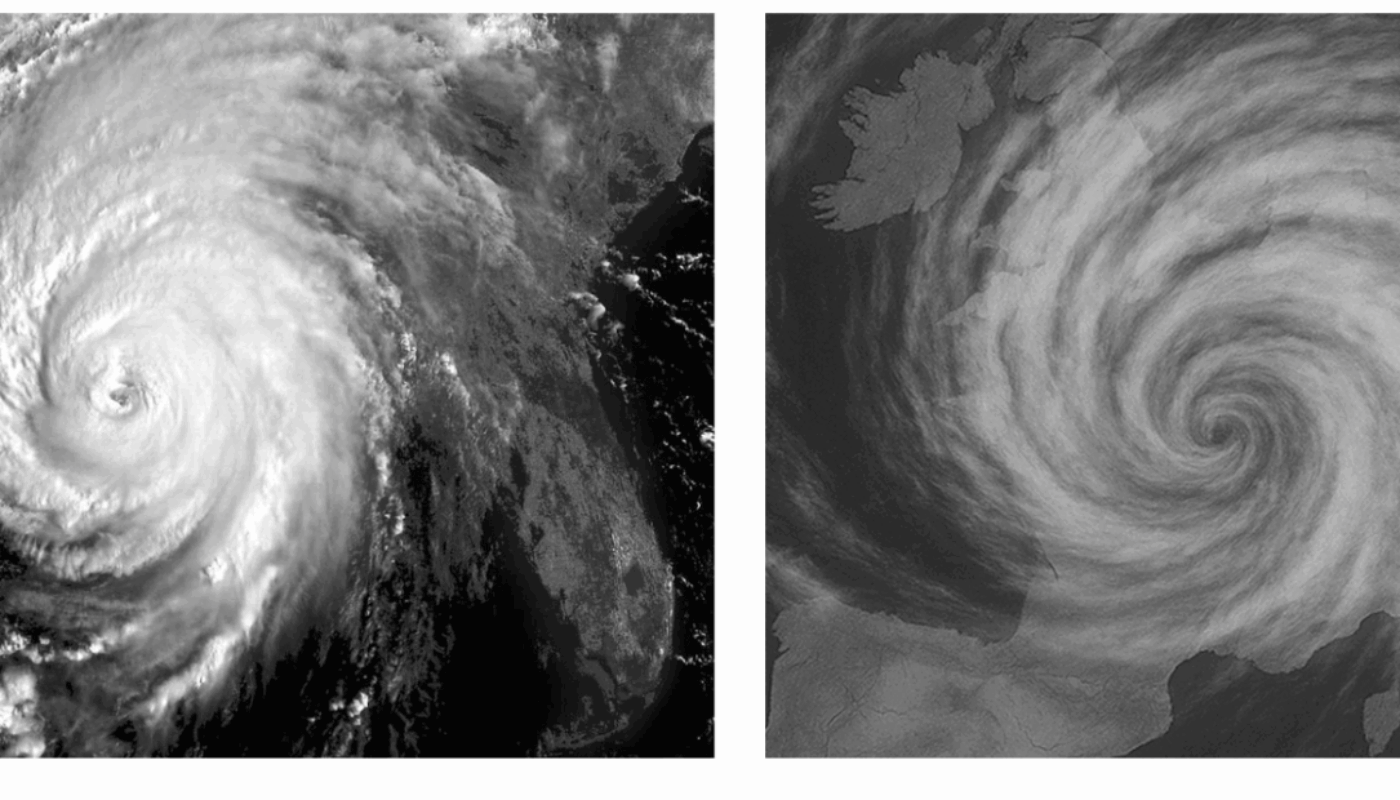

Fake Satellite Images

While AI is becoming a pivotal tool in Earth observation, it also brings challenges while communicating, as this article presents. We are starting to see an influx of AI-generated imagery, including what looks like satellite data. But just because an image looks ‘real’ doesn’t mean it is scientifically accurate.

The example below shows AI-generated infrared imagery of a storm. It may appear convincing, but the storm’s structure and location are physically implausible, because it isn’t based on real atmospheric data.

Until next time,

Aravind.