Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Contracts

- e-GEOS, a joint venture of the Italian space agency and Italian firm Telespazio, won a five-year contract from the European Environment Agency to detect and measure ground movements using EO;

- Planet signed a seven-figure pilot contract with an international Ministry of Defense customer, in partnership with maritime analytics firm SynMax;

- The US Air Force awarded a $15M SAR satellite system capabilities contract to Capella Space;

M&A

- The two major European satellite manufacturing players Airbus and Thales Alenia Space are in preliminary talks for a merger.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- Reinsurance broker Guy Carpenter is launching a new parametric flood product in partnership with SAR solution provider Iceye, EO-based flood analytics provider Floodbase and computing platform KatRisk;

Announcements

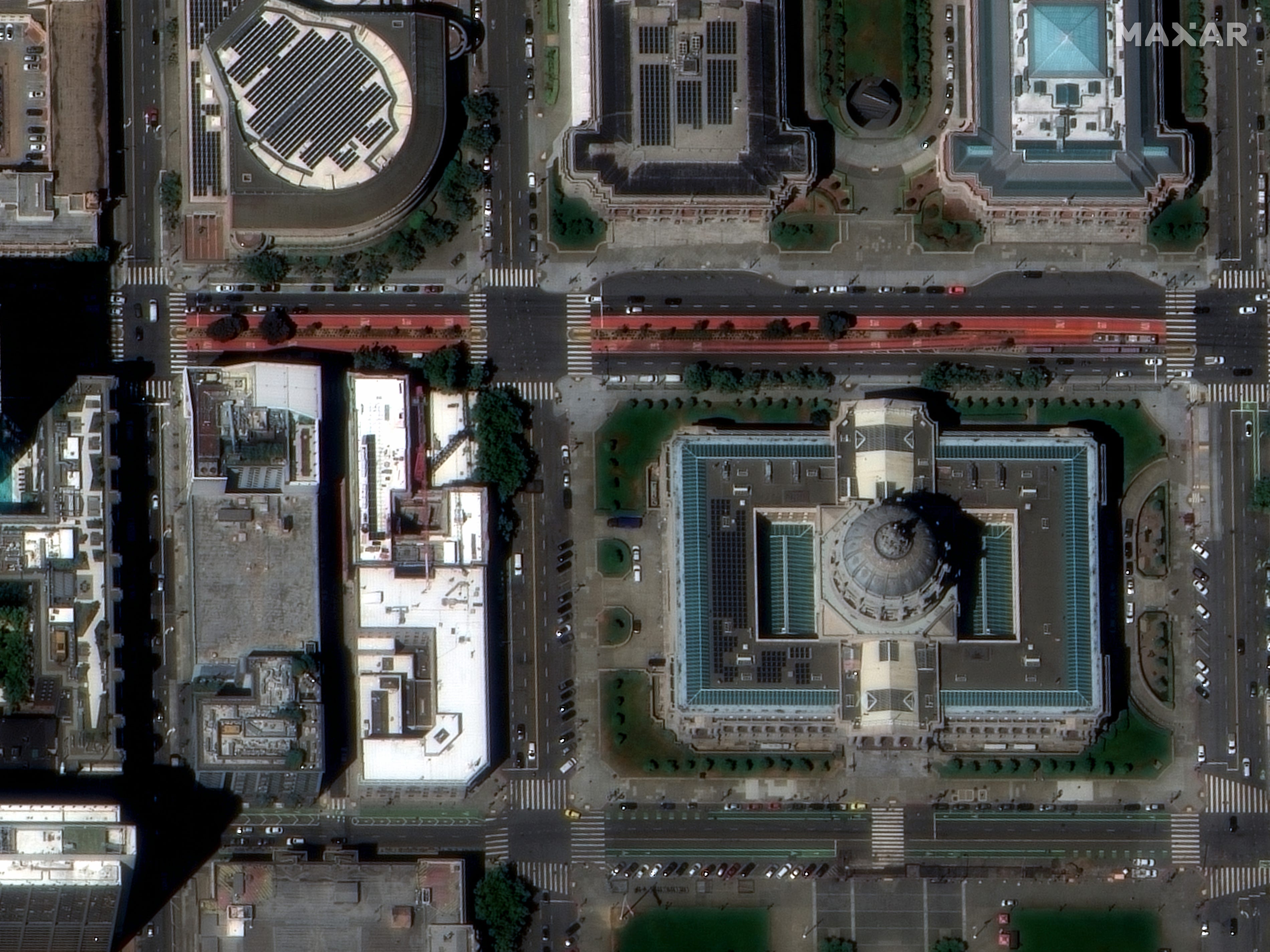

- Maxar unveiled the first images with a spatial resolution of 30 cm from its two next-generation WorldView Legion satellites, which were launched earlier this year, and four more to be launched by the end of 2024.

3. Interesting Stuff: More News 🗞️

- China launched a fifth Gaofen-11 high-resolution satellite to its CHEOS constellation, predominantly aimed at civilian applications;

- South Korea, which recently created its space agency has outlined plans for launching EO satellites with a resolution of 15 centimeters.

4. Click-Worthy Stuff: Check These Out 🔗

This paper that discusses how frequent wildfires are a threat to the stability of the ozone layer;

This article that provides an overview of the plans for the recently created African Space Agency, which mainly includes EO-based applications;

This policy briefing that highlights why the EO sector needs more backing from the government to reach its full potential;

This piece which explains how satellite-based analysis was used to find carbon offsets sold by a firm offers little or no benefit to the climate;

If you want to learn more about EO for carbon monitoring, check out the deep dive from TerraWatch.

Support My Work

If you are getting value out of this weekly newsletter and would like to support my work, you can do so by becoming a paid subscriber. But, I understand this offer may not be interesting or relevant to each of you.

If you want to show your support, you can also make a one-time donation. It is pretty straightforward and you can choose the amount directly. Thank you!

One Discussion Point

Exclusive analysis and insights from TerraWatch

5. The Three Waves of Commercial EO Satellite Companies

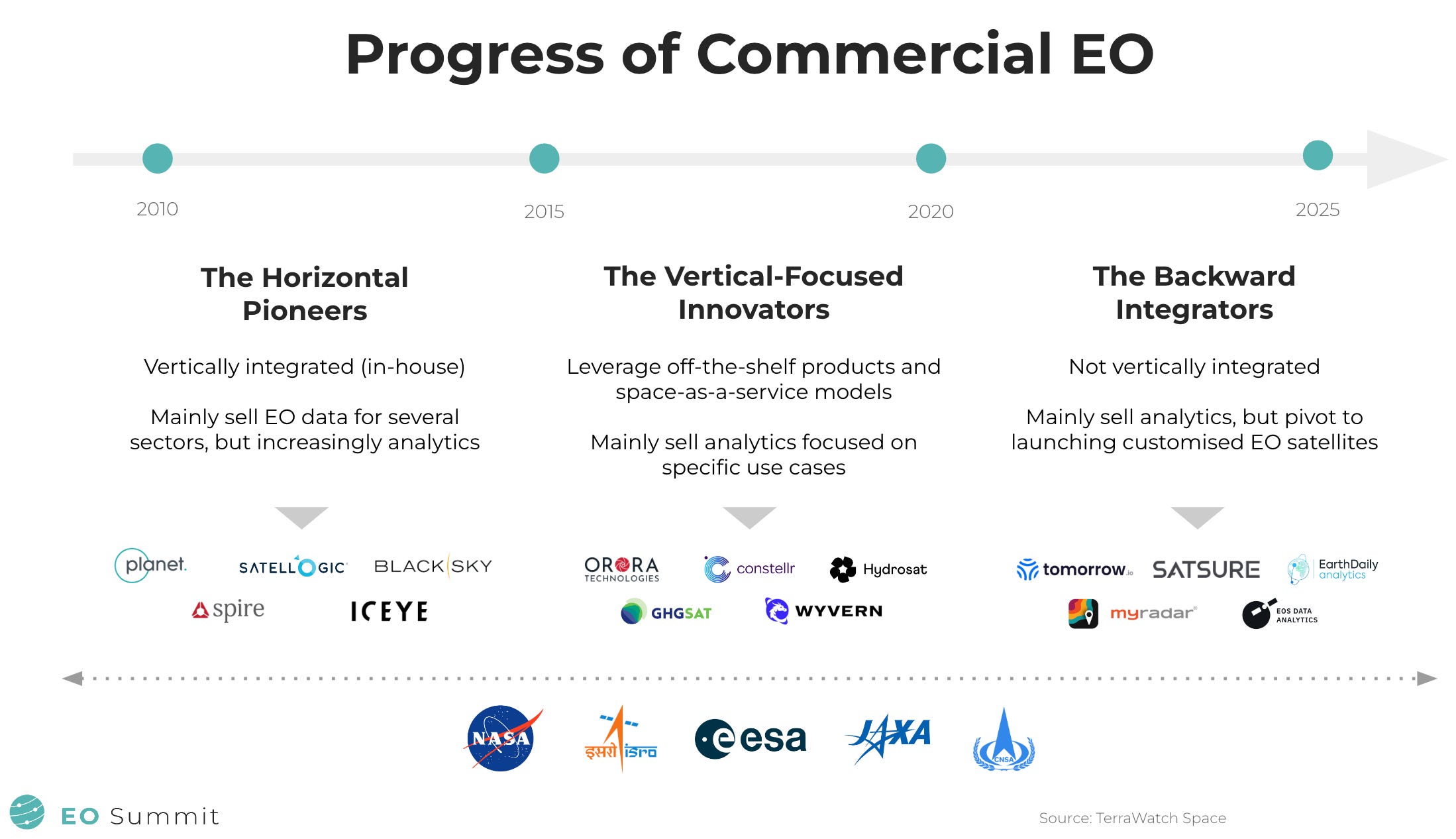

I shared this slide during my opening note at the EO Summit earlier this year, which summarises the evolution of the commercial EO sector over the past decade and a half. While the number of EO satellite companies has risen from a handful in the early 2010s to over three dozen as of today, we can see some common themes and trends in how the industry has evolved. This model is one way to understand how the EO market has unfolded over the years.

Not including the longstanding industry giants such as Maxar and Airbus, I describe the growth of the commercial EO sector, or the so-called NewSpace EO as an evolution that happened in three waves: the horizontal pioneers, the vertical-focused innovators and the backward integrators.

- Horizontal Pioneers from the early 2010s had to be vertically integrated as the NewSpace era had just started and there weren’t many services or components available to buy off-the-shelf. And, since they were mainly pioneers in EO, they had to go with a horizontal approach to selling data to several market verticals. However, gradually they have expanded down the value chain with many of them recently starting to sell analytics.

- The Vertical-Focused Innovators, thanks to the advancements in the satellite and space industries, leveraged the off-the-shelf products and the increasingly available ‘as-a-service’ models. They also had the opportunity to learn from the businesses of the horizontal pioneers that may have led them to build EO satellites to acquire data relevant to specific use cases (vs a purely horizontal approach). Given that many of these companies validated what their customers want and how they want it, they started to directly offer analytics services (vs pure raw data).

- The Backward Integrators, in the meantime, started appearing in the market towards the start of the 2020s, and they came from a completely different angle. Many of these firms were analytics providers actively delivering solutions to their customers, but as a result of their strong understanding of user needs and perhaps, because they found the current crop of EO satellite companies to not answer to their needs, they pivoted to launching their own satellites, almost always with proprietary sensors and satellite architecture, designed specifically to their requirements.

*You might find that there are several anomalies in the market today that do not fit into any of these categories. You might even find that the vertical integration model is slowly coming back, in some companies. This is not a comprehensive market landscape, but simply a framework to understand the evolution of EO.

Scene from Space

One visual leveraging EO

6. Green Spaces and Heatwaves

As a demonstration of why green spaces are important in cities during heatwaves, this visual leveraging data from NASA’s Landsat mission and the ECOSTRESS instrument aboard the ISS shows the difference in temperatures of green spaces and built-up areas in Lahore, Pakistan.

According to a study, built-up areas have replaced more than 200 square kilometres of farmland and other green space around the city since the 1980s. As a result, during a recent heatwave in which air temperatures were above 45°C (with a real feel of 49°C), the urban heat island effect meant that there was a difference of 10 degrees between the built-up areas and green spaces. For more on this, check out the NASA article.

This is a reader-supported publication. To get access to exclusive deep dives, market briefings and the newsletter archive, become a paid subscriber!

Until next time,

Aravind.