Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

As mentioned previously, some big changes are coming to the newsletter from August. But, I'd like to get your inputs before I make a final decision. So, please take this 2-minute survey - thank you to those who have already answered!

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- The US National Geospatial-Intelligence Agency awarded contracts to BlackSky, NV5 Geospatial and Ursa Space worth $50M in total;

- Planet was awarded a €240M contract by the German government for dedicated capacity and direct downlink services of data and analytics from its Pelican series of satellites.

Big implications for EO in Europe and for Planet. More below!

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- MapFre, a leading global reinsurer, has signed an agreement with Iceye to license its flood insights solution;

- Indian EO firm SatSure is teaming up with Dhruva Space to offer fully managed EO-as-a-service solution.

🗞️ Interesting Stuff: More News

- EUMETSAT and ESA launched the Meteosat Third Generation Sounder-1 mission, expected to change severe weather and air quality forecasting;

- MethaneSAT, launched in 2024, to monitor large scale methane emissions, has failed in orbit, likely due to power system issue;

- NOAA's 2026 budget proposes to eliminate all funding for climate research, most notably the Office of Oceanic and Atmospheric Research.

🔗 Click-Worthy Stuff: Check These Out

- This article that summarises the current understanding of the various factors involved in the flooding tragedy in Texas that has killed over 80 people;

- This paper providing the methodology and the results of a global flood dataset using Sentinel-1 imagery;

- This article that presents findings from the latest EO-based research showing how the Southern Ocean is getting saltier due to declining sea ice levels.

Reminder: Newsletter Reader Survey

For over two years, I’ve been curating and writing this newsletter every week to make sense of everything happening in the world of EO – from satellite launches to market trends and emerging applications. It’s been a labour of love, and I am grateful it’s become a trusted source for so many across the EO ecosystem and beyond.

Now, I’m rethinking what comes next and I’d love your input.

As I explore changes to the format, frequency, and possibly introducing a low-cost paid tier for deeper weekly briefings, I want to understand how you read:

- Do you find it valuable?

- What do you want more (or less) of?

- Would you be willing to pay for richer, in-depth insights?

Your responses will directly shape how the newsletter evolves, both the free and the paid editions. Please considering taking the 2-minute (anonymous) survey, before Friday, July 11.

Thanks to those who already answered the survey last week!

One Discussion Point

Exclusive analysis and insights from TerraWatch

Planet’s Big Win in Europe and What It Could Mean for European EO

This week, Planet announced a major contract with the German government. Uniquely among recent sovereign EO deals, this isn’t about selling satellites. Instead, it’s for exclusive tasking capacity from existing systems, marking a notable shift in how commercial EO is procured at the government level. Some quick thoughts:

1. Solidifying European Presence

By winning what is possibly the largest commercial EO contract from a European government, Planet has further cemented its position in Europe. While there are always concerns about non-European ownership, Planet’s long-standing presence in Berlin (and past engagements in German institutions) likely helped ease those worries. More broadly, this deal reflects Planet’s clear pivot toward government markets, a segment that already accounts for nearly 75% of its revenue.

2. The VHR Gap in Europe

Despite a growing number of EO companies and suppliers in Europe, Airbus remains the only player offering 30 cm VHR imagery, albeit with only two satellites in orbit. While some access Maxar’s data via EUSI (exclusive reseller in Europe), Planet’s Pelican constellation, expected to scale to 32 satellites, offers both scalability and reliability that others can’t match. For Germany, this contract fills a critical strategic gap in persistent high-resolution monitoring.

3. Implications for Europe’s ERS Programme

Europe’s forthcoming EO initiative, European Resilience from Space is intended to deliver high-res, high-revisit imaging for intelligence and civil security. While program details remain open pending the ESA Ministerial in November, Germany’s deal with Planet signals that commercial capacity can be a credible alternative. This may influence how ERS balances public infrastructure vs. private partnerships, and shape how member states negotiate capability contributions.

TL;DR – Big win for Planet in Europe with a unique capability that could that could shape how Europe thinks about its future EO architecture.

Scene from Space

One visual leveraging EO

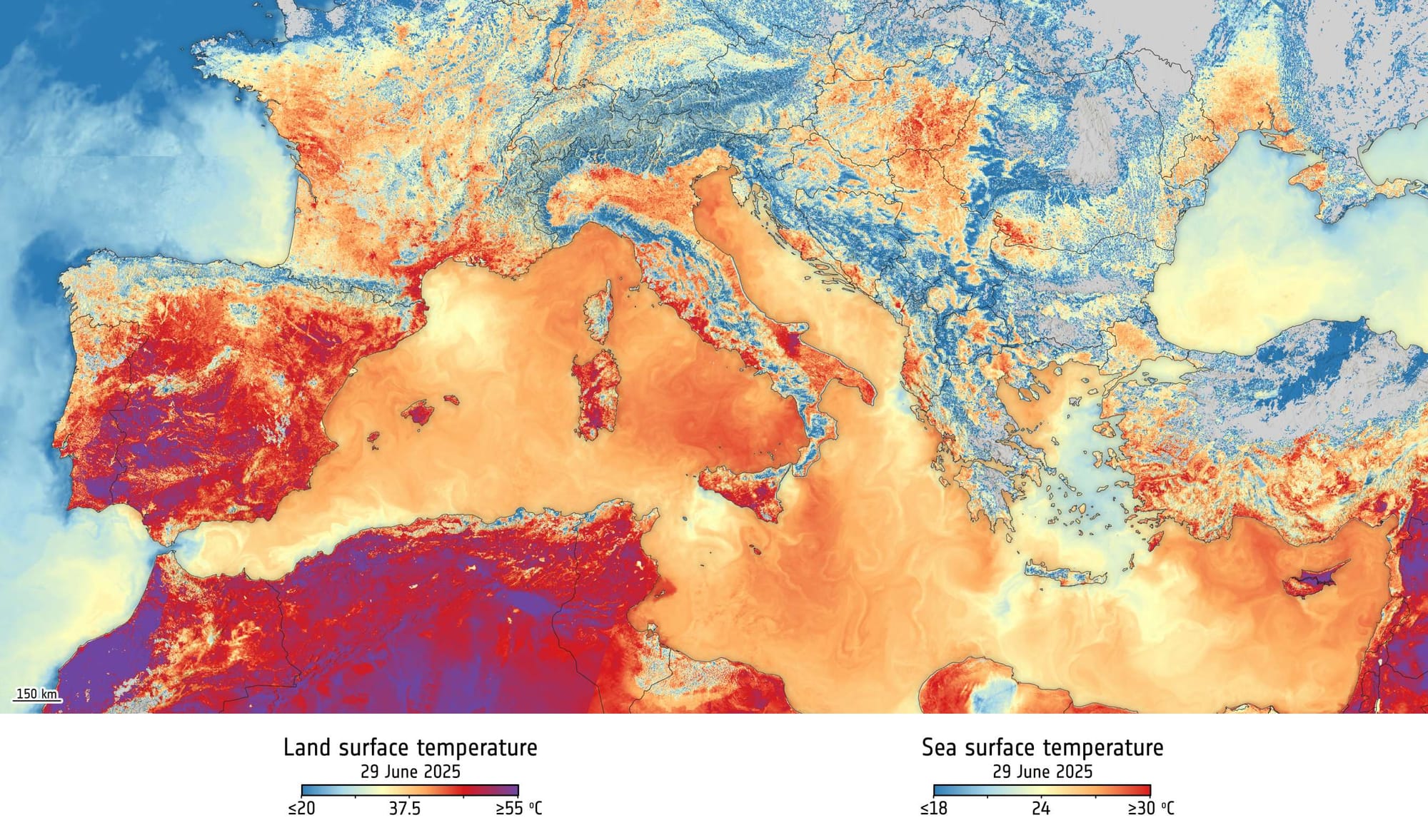

Land and Sea Warming

An intense heatwave swept across Europe and North Africa last week, pushing land surface temperatures (not to be confused with air temperatures) to high levels, at a time when sea surface temperatures in the Mediterranean were also elevated. The image below from ESA, a mosaic from five overlapping Sentinel-3 passes, captures this simultaneous warming of both land and sea.

Until next time,

Aravind.