Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- Israeli EO firm ImageSat International signed a $42M contract with an unknown customer for EO services;

- 3D imaging firm Array Labs signed a $1.25M contract with the US Air Force to enhance its 3D radar imaging capabilities.

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- Indian satellite manufacturer XDLINX Space Labs is teaming up with SAR startup Sisir Radar to build India’s first private L-band SAR satellite;

- AI-based weather intelligence firm Zeus AI has partnered with turbulence monitoring startup SkyPath to improve turbulence forecasting.

🗞️ Interesting Stuff: More News

- Chinese satellite manufacturer MinoSpace won a contract to build an EO (optical + SAR) constellation for the Sichuan Province;

- Novi Space plans to launch a 40-satellite EO constellation by 2028 with on-orbit processing capabilities.

Related: The TerraWatch deep-dive on edge computing for EO.

🔗 Click-Worthy Stuff: Check These Out

- This article on the future of AI-based weather forecasting;

- This paper on detecting NO2 and CO2 emission plumes with EnMAP mission.

EO Summit: 1 Week To Go!

Badge printing is underway for ~400 attendees as we get ready to kick off the EO Summit 2025 in New York next week, June 10-11.

After months of working on the agenda, speakers, logistics, and everything in between, seeing these badges come together makes it all feel very real.

What started as an idea to create an application-driven, user-focused EO conference is now coming to life for the second edition, and for the first time in the US. I can’t wait to welcome everyone soon to the conference.

Ticket sales end today (June 2) – register now!

One Discussion Point

Exclusive analysis and insights from TerraWatch

NASA’s FY26 Budget: Cuts, Shifts, and Open Questions for EO

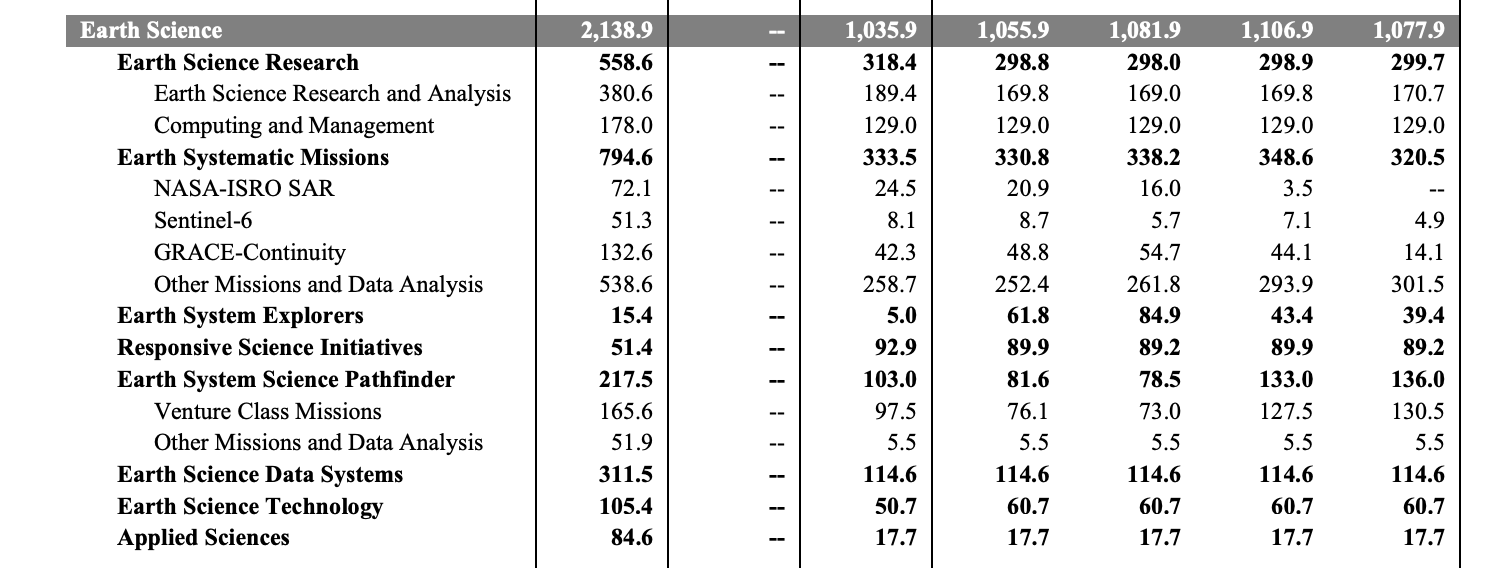

NASA released its FY26 budget request and Earth Science takes a pretty big hit. The request for Earth Science drops to ~$1.03B, down ~52% compared to FY24.

Here’s a quick rundown of what’s happening:

- Landsat Next is getting restructured: the original 3-satellite constellation is cancelled due to cost. NASA will now explore cheaper commercial or hybrid options to keep Landsat continuity going.

- Several Decadal Survey missions are out: AOS-Storm/Sky and SBG-VSWIR/TIR won’t move forward (at least for now) as NASA reshapes its Earth System Observatory plans.

- Long-running missions like Terra, Aqua, Aura, SAGE-III, and DSCOVR are ending after many years in orbit.

- Applied science programs are being cut back - less direct work on areas like wildfire, water, or agriculture, and more focus on building tools, platforms, and models that help end-users adopt NASA’s data.

Overall, this budget reflects a pretty big shift: fewer big new missions, more emphasis on enabling end-users, and some serious trade-offs on what NASA can afford to fund going forward.

The big open questions now:

- How will commercial EO companies respond to these gaps and how does this affect their roadmaps?

- Can international partners step in as Decadal Survey priorities get reshuffled?

- And as NASA shifts toward building tools for end-users, how will that reshape the overall EO ecosystem?

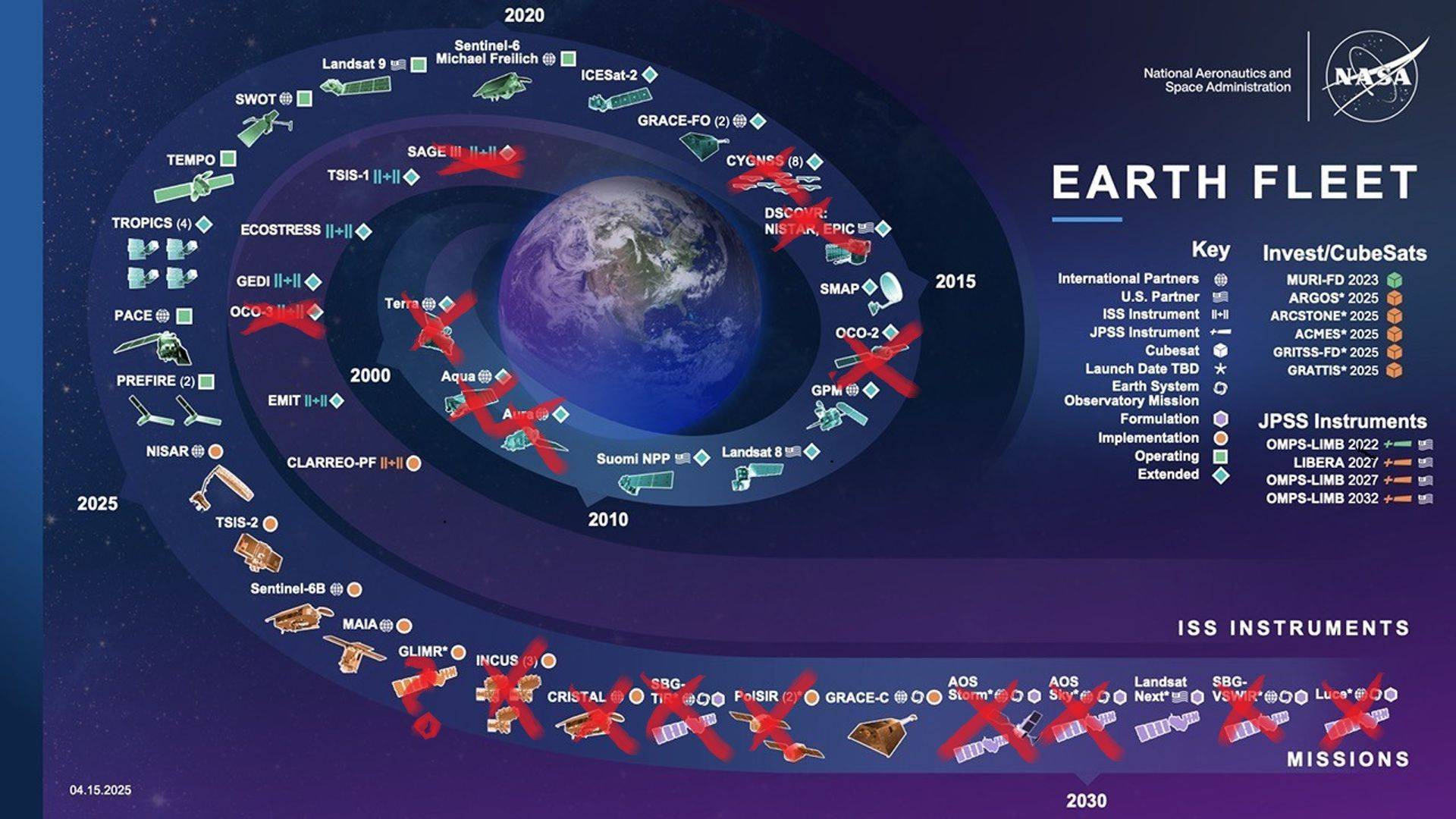

And just to quickly visualize the scale of what’s changing, I found this visual online showing NASA’s updated Earth Fleet chart - the red marks show missions either ending or being terminated.

A Note From the Platinum Sponsor of EO Summit: Pixxel

Seeing the Unseen with Pixxel's Hyperspectral Constellation

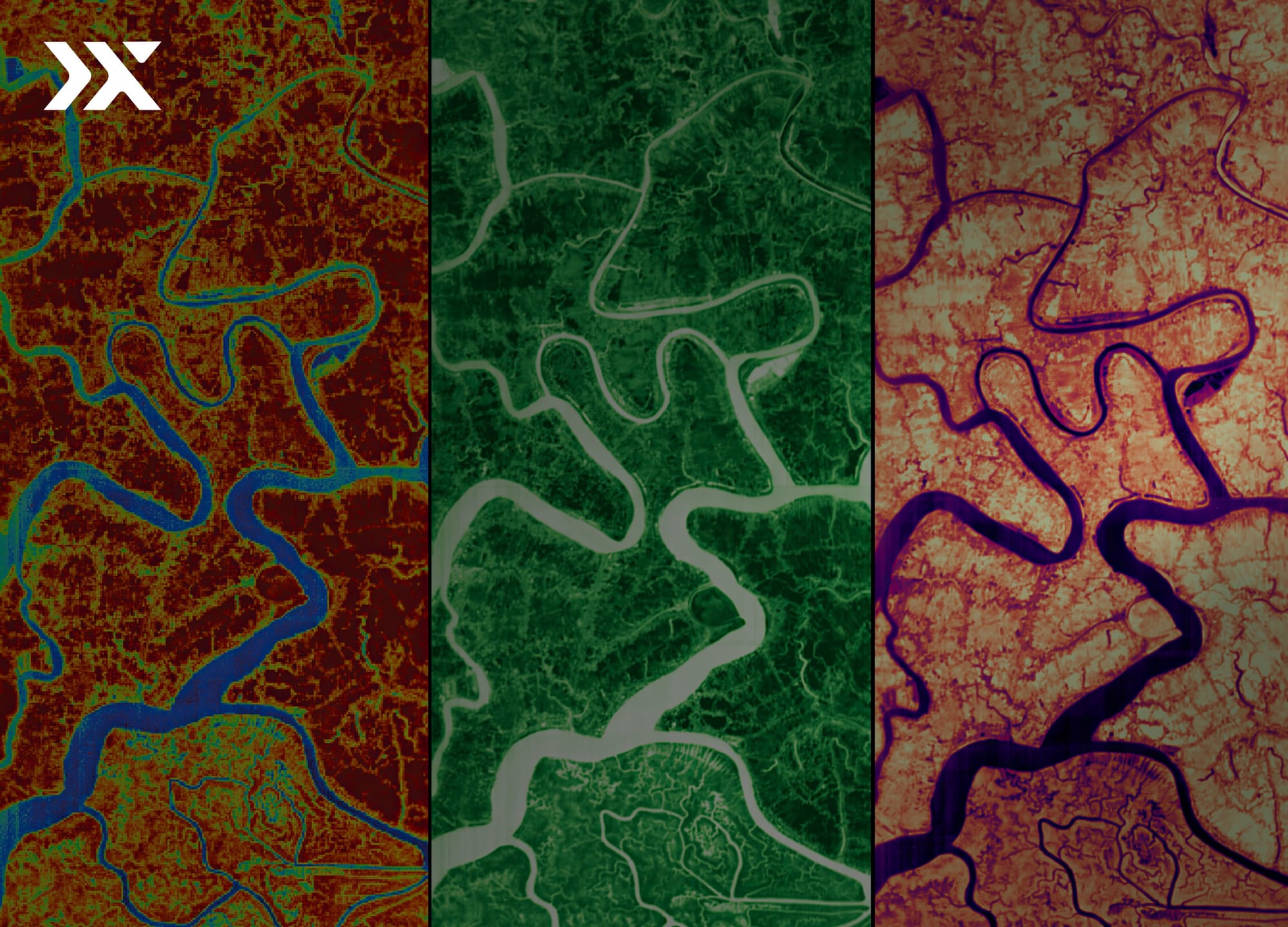

Pixxel is a fully integrated space data company that has launched the world's highest resolution constellation of hyperspectral satellites. The constellation captures collects 135 bands at a 5-meter GSD with a daily revisit — 50x more detail than traditional systems — unlocking a new set of insights across agriculture, climate, energy, environment, and more.

With three satellites already in orbit, Pixxel delivers real-time, actionable intelligence to help industries and governments detect risks early and make informed decisions. Once fully deployed, the constellation will capture imagery across up to 250 bands in both VNIR and SWIR ranges, with a 40 km swath. Furthermore, Pixxel's Earth Observation Studio Aurora streamlines access, exploration and insight generation from hyperspectral and other Earth Observation datasets.

Pixxel also manufactures spacecrafts in its own facilities and its integrated ecosystem of satellites, software, and manufacturing is advancing its mission of building a health monitor for the planet.

Until next time,

Aravind.