Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

As I mentioned last week, some big changes are coming to the newsletter and I'd like your inputs on that – please take this 2-minute survey!

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

- Iceye is exploring an IPO, as it continues to grow and win contracts, from Netherlands and Finland, to supply SAR satellites;

- Maxar and BlackSky won contracts from the National Geospatial-Intelligence Agency as part of the Luno program, valued at $290M overall.

📈 Strategic Stuff: Partnerships and Announcements

- Maxar launched a new monitoring product to provide persistent monitoring service.

🗞️ Interesting Stuff: More News

- A US military weather satellite program that collects vital information for hurricane forecasts will stop distributing data products to users;

- Japan launched the GOSAT-GW satellite aimed at monitoring greenhouse gases and the water cycle.

🔗 Click-Worthy Stuff: Check These Out

- Recaps from ESA's Living Planet Symposium, including partnerships, contracts and new initiatives - Day 1, Day 2, Day 3, Day 4 and Day 5.

Newsletter Reader Survey

For over two years, I’ve been curating and writing this newsletter every week to make sense of everything happening in the world of EO – from satellite launches to market trends and emerging applications. It’s been a labour of love, and I am grateful it’s become a trusted source for so many across the EO ecosystem and beyond.

Now, I’m rethinking what comes next and I’d love your input.

As I explore changes to the format, frequency, and possibly introducing a low-cost paid tier for deeper weekly briefings, I want to understand how you read:

- Do you find it valuable?

- What do you want more (or less) of?

- Would you be willing to pay for richer, in-depth insights?

Your responses will directly shape how the newsletter evolves, both the free and the paid editions. Please considering taking the 2-minute (anonymous) survey!

One Discussion Point

Exclusive analysis and insights from TerraWatch

Assessing Iceye's IPO Ambitions

The trend towards sovereign EO is stronger than ever - in just the last month, Iceye won contracts to deliver at least 10 SAR satellites to three different countries. While the growth trajectory is impressive (with 2025 revenues projected to be €200 million), I’m curious about the long-term outlook.

- Revenue concentration

A large share of Iceye’s growth still comes from government, especially defense contracts. While they do have interesting solutions for the insurance sector, I think it has been somewhat de-prioritised in favour of government opportunities. Will they be able to scale both commercial and government segments in parallel?

- Constellation cadence

Iceye is expected to deliver at least 25 satellites over the next two years. Will they be able to maintain that pace and the quality to keep up with global SAR demand and public market expectations?

- Competitive landscape

Umbra and Synspective (Iceye's main competitors along with a potentially rebooted Capella) continue to invest in their capabilities and develop commercial and technical differentiation. With Umbra in particular pushing hard on pricing and performance, will Iceye continue to hold its edge?

Scene from Space

One visual leveraging EO

Biomass from Space

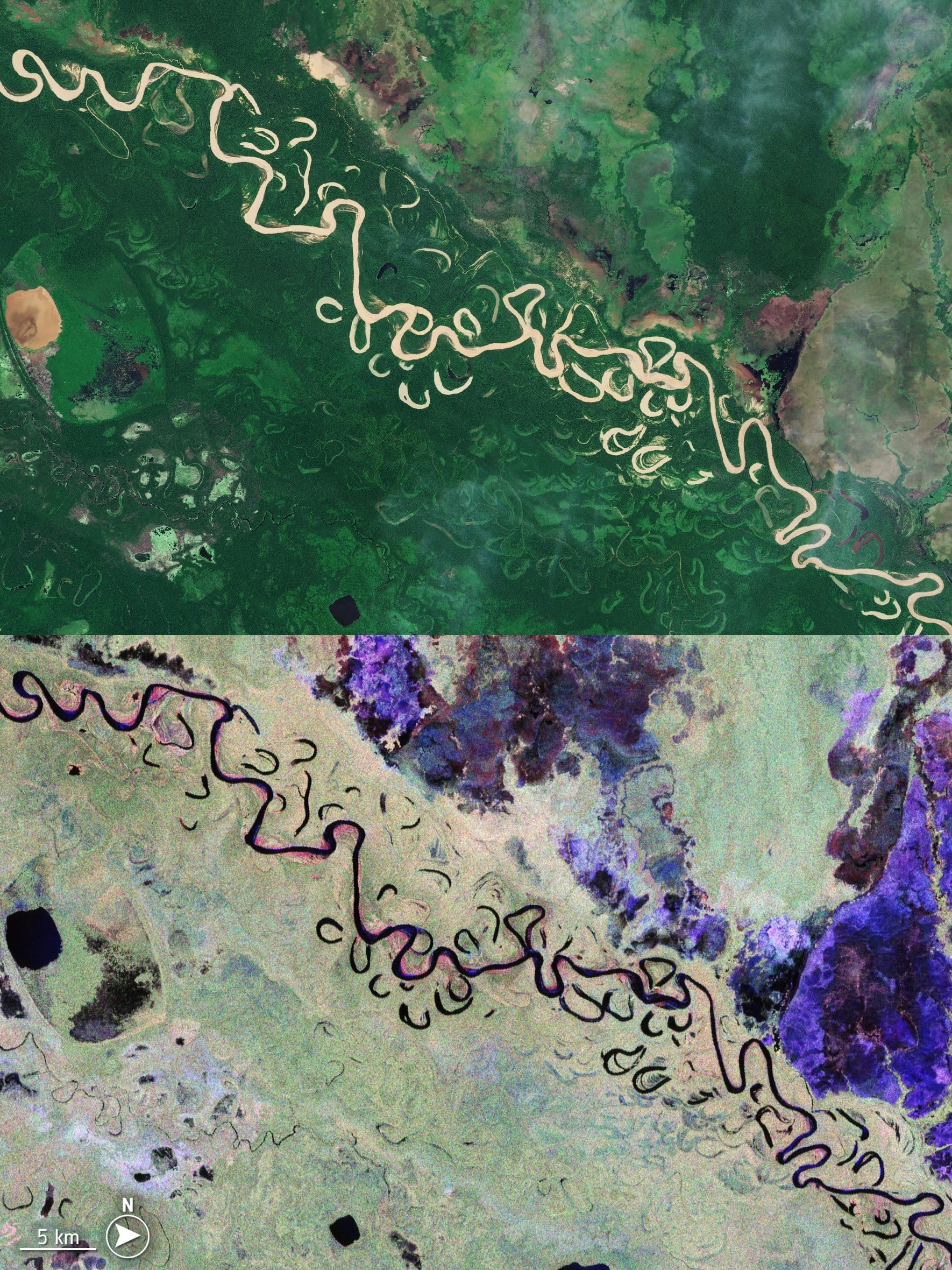

ESA revealed the first images from the Biomass satellite mission, expected to contribute to monitoring the Earth's forests and the global carbon cycle. Biomass is the first satellite to carry a P-band SAR instrument – its signal capable of penetrating forest canopies to measure woody biomass.

The image belows a capture of Bolivia from Biomass satellite and an image of the same area from the Sentinel-2 mission. Although the images appear visually similar, the Biomass image offers significantly more information for quantifying forest carbon stocks.

Green hues indicate forested areas; blue–purple tones suggest grasslands; and the red hues seen around Bolivia’s rivers signify forested wetlands. Each stores different amounts of carbon.

Until next time,

Aravind.