Welcome to a new, belated edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- Chloris Geospatial, a carbon monitoring, verification and reporting solution provider, raised an undisclosed amount of Seed funding;

Contracts

- Satellite manufacturer Open Cosmos has won a contract to build a constellation of seven EO satellites for the Greek government;

- BAE Systems (formerly Ball Aerospace) was awarded contracts to build all three hyperspectral instruments for NOAA’s GeoXO weather satellite;

- Onboard computing systems maker AICRAFT has announced a contract with European imaging company Scanway Space to deliver a module to be integrated into a space optical payload for detecting methane plumes;

- BlackSky Technology closed a $7 million contract renewal with one of its existing international government customers.

2. Strategic Stuff: Partnerships and Announcements 📈

Announcements

- Canadian space firm MDA unveiled a new vessel detection onboard processing system that will be added to its upcoming CHORUS mission;

- Satellogic has laid off 13% of its workforce as the company continues its efforts to reduce costs and seek new business from the U.S. government;

- EO-based ag insights platform Gro Intelligence is closing down after failing to secure enough capital to stay afloat.

My take: The demise of Gro Intelligence is a warning sign for some EO-based application firms that are struggling to find product-market fit.

The following line about Gro is quite common in the EO sector and should resonate with many companies:

“They were chasing deals for projects that resembled bespoke consultancy work as opposed to something that would generate replicable revenue streams.”

Partnerships

- Japanese EO firm Axelspace is teaming up with Liberatech to supply satellite data for building commodity risk management solutions;

- Hyperspectral data processing platform startup Metaspectral is partnering with Armada, an edge computing startup to run its algorithms on the edge;

- China's Star Vision, an AI satellite company, and Omani startup Lens are collaborating on the development of an advanced digital twin city platform.

3. Interesting Stuff: More News 🗞️

Saudi Arabi’s Public Investment Fund announced the launch of the Neo Space Group to build the national space sector capabilities, including EO;

Satellite system manufacturer Sidus Space announced the successful transmission of data and processing from its LizzieSat-1 satellite;

SpaceX launched ESA’s EarthCARE mission aimed at monitoring the clouds and aerosols;

Read this article if you would like to learn more about the satellite and its scientific significance;

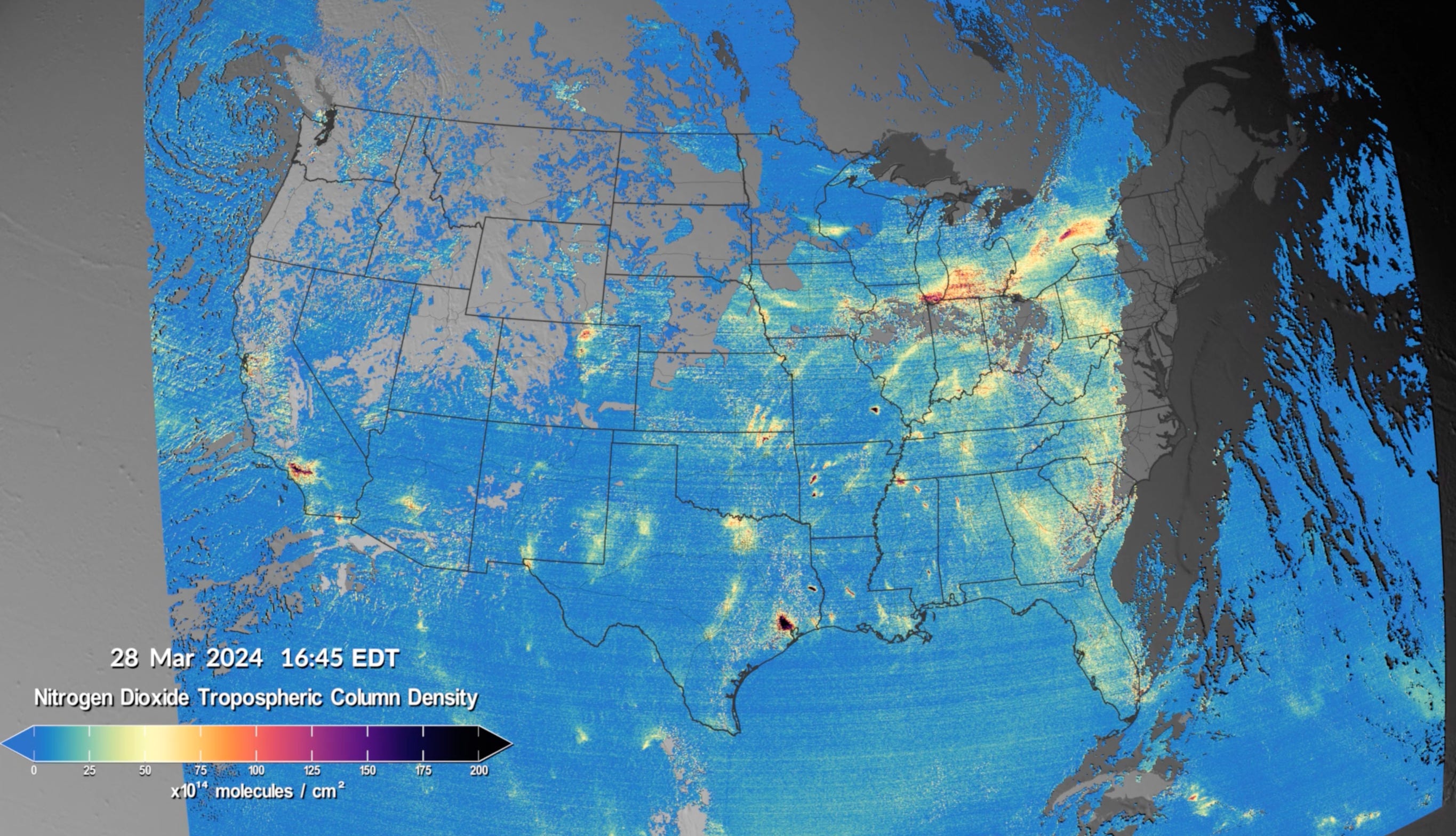

NASA has made new data available from the TEMPO mission capable of providing near real-time air pollution observations at very high resolutions.

4. Click-Worthy Stuff: Check These Out 🔗

- This article that discusses the role of NASA’s GEDI mission, which includes a lidar instrument, in mapping the Amazon rainforest;

- This post and ensuing discussion explaining the decision behind Microsoft’s Planetary Computer Hub which will be retired on the June 6.

EO Summit: Presenting Organisations

Check out the diversity of organisations, including end-user organisations, analytics firms and EO satellite companies that will be presenting at the EO Summit, focusing on insurance, finance, agriculture, forestry, energy, utilities and climate sectors.

The last few tickets are on sale - hurry up!

One Discussion Point

Exclusive analysis and insights from TerraWatch

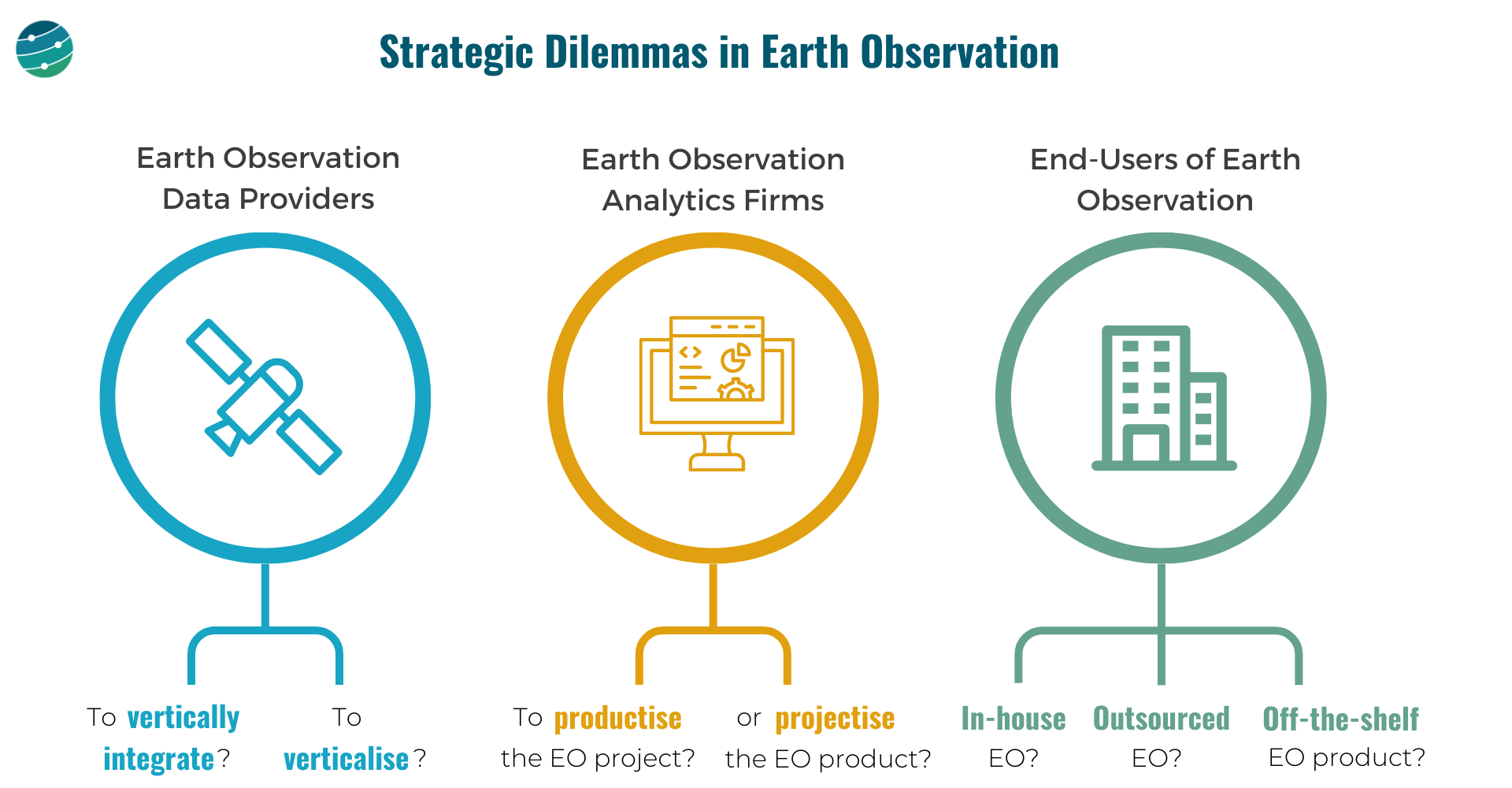

5. Strategic Dilemmas in the Earth Observation Market

Some thoughts on the big strategic dilemmas in EO, based on my experience working in the industry for the past several years. I have categorised them based on the three categories of stakeholders in EO.

- EO Data Providers: To vertically integrate or not? To verticalise or not?

- EO Analytics Firms: To ‘productise’ the project or ‘projectise’ the product?

- End-users of EO: In-house EO vs outsourced EO vs off-the-shelf EO product?

EO Data Providers

These are companies that are in the "Data" layer of the EO value chain. And they, have 2 important choices to make:

- Whether to own as much as possible of the EO value chain or outsource building, launching and operating satellites and just receive the data. And how far down the value chain should they go, just provide data? Or, go one more step further and offer analytics? Where to draw the line?

- Whether to focus the go-to-market efforts on a specific vertical (insurance, agriculture, government etc.) or to remain horizontal and serve as many markets as possible? Companies that verticalise could have an easier route to achieving product-market fit and scalability.

EO Analytics Firms

These are companies that operate in the "Insights" and "Application" layers of the EO value chain. They need to decide:

How to convert the customised EO projects (solve a problem for each customer) into an EO product (that solves that problem scalably for many)

And, when do you say no to more projects and decide to work on a scalable product?

Or, can you pick projects selectively? Assume the current version of your EO product fits only 60% of a large client's requirements, while the other 40% does not fit into your product vision. Do you forego the big client for the product or can you afford to efficiently 'projectize the product'?

End-users of EO

The end-users of EO, who come from several sectors such as agriculture, insurance, finance, infrastructure, mining etc. have some tough choices to make:

Do they go with an in-house EO strategy i.e. build or expand the internal geospatial teams, design their own EO strategy, acquire data from several EO data providers and develop internal solutions with the data?

Or, do they go with an outsourced EO strategy i.e. pick a geospatial consultancy to build custom products as per requirements and abstract themselves from most of the EO choices and challenges, leaving it in the hands of a custom EO solution provider?

Or, can they find off-the-shelf EO-based products for their use case available in the market that fit their needs?

A caveat is although some of these products offer ready-to-integrate analytics, the methodologies used for the work may not be transparent (aka ‘black boxes’).

These are some of the learnings gathered through the past couple of years at TerraWatch Space through strategic assignments with EO data providers, EO analytics firms and end-users of EO, from around the world. If you are thinking through these strategic questions in your organisation and need some external support, send me a note!

A Note From a Gold Sponsor of EO Summit: EarthDaily Analytics

“EarthDaily Analytics is a vertically integrated provider of EO data, analytics, and solutions, launching a new satellite constellation no earlier than Q4 2024.

Utilizing a unique combination of proven space technologies, ground-breaking AI applications, and cutting-edge big data tools, EDA provides value-added, actionable insights to decision-makers and risk managers across the public and private sectors on a global basis - EO Built for AI.

Join us at EO Summit to learn about our company, meet our team and hear from two of our customers - SOYL and ForestRe.”

Scene from Space

One visual leveraging EO

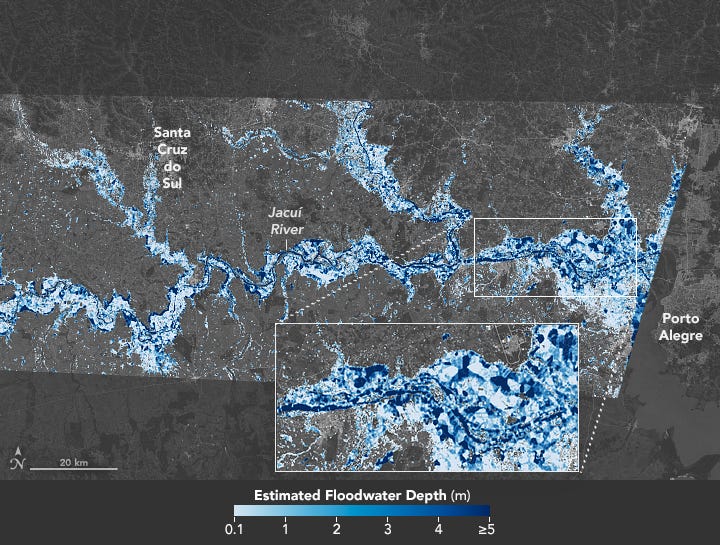

6. Floodwater Depth using Elevation Data

While traditional floodwater extent maps are one way to visualise the level of flooding in affected areas, floodwater depth maps contribute to the analysis of damage and flood risk. The following image from NASA shows the floodwater depth in southern Brazil, where storms and heavy torrential rains caused destructive flooding.

Satellite imagery from the Harmonized Landsat and Sentinel-2 initiative and the ground topography data from the Shuttle Radar Topography Mission were used to create this floodwater depth map.

This is a reader-supported publication. To receive exclusive deep dives and support my work, consider becoming a paid subscriber.

Until next time,

Aravind