Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- Australian hyperspectral imaging startup Esper raised $5M in seed funding, to be mainly used for focusing its efforts to verticalize in the mining sector;

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- Danti, an EO search engine allowing users to search satellite imagery using natural language queries unveiled its offering for the government market;

- Spire announced that it has successfully established a two-way optical link between two satellites in orbit, expected to enhance speed and safety for EO data transmissions;

- Inter-satellite links are a necessary component of the future of EO expected to include capabilities for processing data onboard the satellites. For more on this, check out the deep-dive on edge computing for EO.

- Google unveiled AI-powered weather predictions for the energy industry building on its recent gains with the WeatherNext family of models;

- Planet is partnering with Anthropic’s Claude for integrating its satellite imagery into the latter's LLM.

My take: This was no surprise as this is a natural evolution of expanding the input data for LLMs, particularly as they are hitting a 'data wall'. However, being an exclusive EO data provider for one LLM would not be in the interest of an EO company (they would want as many LLMs to use their data that translates to revenues). So, I’m curious to see if this will pique others such as OpenAI, Meta, Mistral, Google, xAI etc. to explore similar partnerships.

Partnerships

- Spire and EarthDaily are teaming up to offer EO-based insights for insurers to assess and manage risk;

My take: I think this is a big deal - if you have been reading my stuff for a while, you know I have been screaming for more purposeful, data-agnostic, provider-agnostic problem-solving initiatives in EO (vs technology-driven, generic announcements). This is a step in the right direction.

- Iceye is partnering with BoxMica and Saab to improve its offerings in the defence and intelligence market.

🗞️ Interesting Stuff: More News

- The recently announced layoffs at NOAA and the potential closures of key weather modeling facilities are raising worries about NOAA's future;

- The US National Geospatial-Intelligence Agency has suspended Ukraine’s access to commercial satellite imagery, particularly from Maxar;

- ECMWF's AI weather model, recently announced as fully operational, is already having a huge impact on the energy sector;

- The US administration may cut NASA’s science budget by 50 percent, potentially affecting a number of EO science projects and initiatives;

- BlackSky announced its total revenues in 2024 to be $102.1M, a slower growth compared to 2023;

🔗 Click-Worthy Stuff: Check These Out

- This piece from Bloomberg that uses satellite imagery to show Gaza’s destruction and the resilience as the war remains unresolved.

EO Summit: Keynote Speaker Announcement

Announcing our first keynote speaker for EO Summit - Jennifer Lacey from the US Geological Survey, who will be discussing the past, present and future of the Landsat missions, the economic value of Landsat and the applications of Landsat across various sectors.

Last day of early bird ticket sale at $499 - buy your tickets now!

One Discussion Point

Exclusive analysis and insights from TerraWatch

State of EO Platforms

There have been a lot of recent developments in the usually quiet corner of the EO sector: Platforms.

EO space situational awareness firm Privateer Space pivoted and bought major EO platform player Orbital Insight, while EO platform Descartes Labs was acquired by vertically integrated EO company EarthDaily. Meanwhile, Planet launched its Insights Platform following the acquisition of Sinergise (Sentinel Hub) and Saudi Arabia's Neo Space Group acquired EO platform company UP42.

We also saw startups like Danti, an EO data search engine, Fused, a serverless EO processing and visualisation platform and Whereobots, a geospatial processing platform raise funding.

However, EO platforms have never really taken off for several reasons that I dig into in the essay. In the latest, deep-dive on TerraWatch, we look at the state of EO platforms, what has happened so far, why platforms have not taken off and where we are going.

In the piece, I classify the EO Platforms segment into five segments (shown below) and try to demystify the term ‘platforms.’ We get deeper into identifying the roles of EO platforms, understanding the current market landscape and assessing which providers are solving problems such as accessibility, usability and usability. I also answer some critical questions for the EO market including:

- Why is Platforms the most overlooked segment in the EO market?

- Who are the major EO platform providers in the market and where are they positioned?

- Why haven't EO platforms taken off and what is the outlook for this segment?

- Will we have a horizontal platform that is data-agnostic, sensor-agnostic and enables the pre-processing, processing & visualisation of EO data?

Scene from Space

One visual leveraging EO

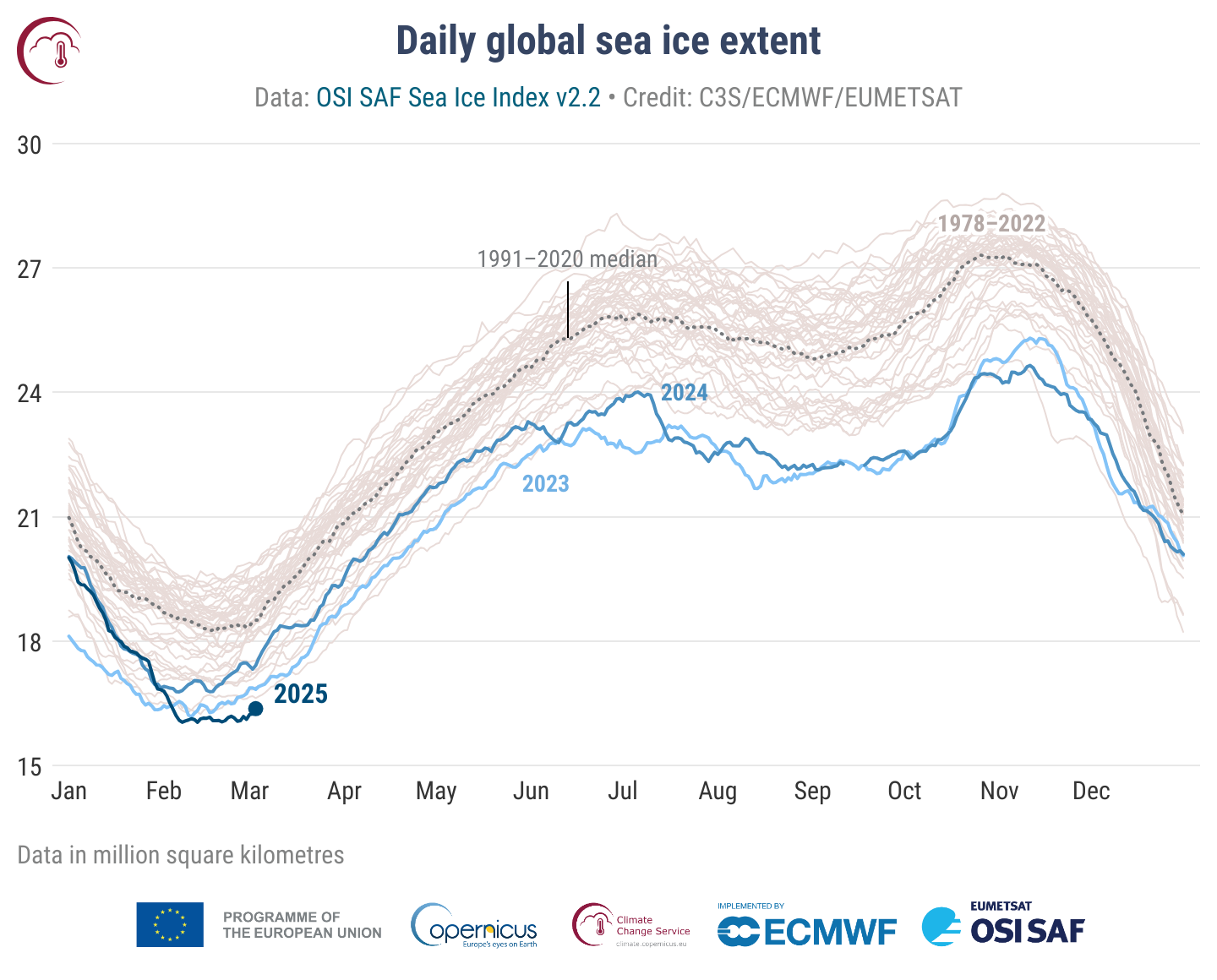

Record low global sea ice level

The EU's Copernicus Climate Change Service reported that the daily global sea ice extent, which combines the sea ice extents in both polar regions, reached a new all-time low in early February. This news comes as February 2025 became the third warmest February globally.

Until next time,

Aravind.