Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

If this was forwarded to you, please subscribe to receive EO market analysis and insights.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Contracts

- BlackSky won a $3.5M contract from the US Air Force to use satellite imagery and AI to detect and track moving objects from space;

- The US Navy awarded Planet a seven-figure contract for maritime surveillance in the Pacific;

Funding

- Fused, which is developing a serverless platform to make geospatial data usable, came out of stealth and announced its pre-seed raise of $1M;

- Australian EO startup Esper, which aims to build and launch a constellation of low-cost hyperspectral imaging satellites, raised $1M in a pre-seed round;

Earnings

- Publicly trading EO company Spire reported $27.7M in revenues for Q4 2023, totalling $105.7M in yearly revenues.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- French EO analytics firm Kayrros, which specialises in GHG monitoring, is partnering with French bank BNP Paribas to reduce methane emissions;

- EO analytics firm Ursa Space Systems has partnered with MAIAR, a UK-based defence intelligence firm to provide geospatial insights for NATO users;

Announcements

- SAR solutions firm Iceye has announced a new maritime surveillance product that applies computer vision techniques over its proprietary data;

- Planet announced a new data product as part of its Planetary Variables suite called Field Boundaries to detect boundaries of agricultural parcels;

- Umbra has unveiled bistatic SAR data from its tandem pair of satellites with applications in moving target detection, elevation modeling among others.

3. Interesting Stuff: More News 🗞️

US regulators have approved climate disclosure rules that will require large companies to disclose physical climate risks to their assets;

To learn about using EO for monitoring climate risks and the commercial landscape, check out this TerraWatch deep dive.

A recent report from the European Environment Agency has found that the continent is unprepared for rapidly growing climate risks;

ESA launched Major TOM, a community-oriented project to allow researchers to share, use and combine large EO datasets.

4. Click-Worthy Stuff: Check These Out 🔗

This piece that explains why we have many methane-monitoring satellites;

To get an overview of the landscape of GHG monitoring satellites and their applications, check out this TerraWatch deep dive.

This video to help you understand all about synthetic aperture radar.

EO Summit: Why Organise a New EO Conference?

I wrote a blog post explaining why I am organising an EO conference, how it is different from the other events in the EO sector along with the motivation, the vision and the goals for EO Summit. Check it out!

My goal for EO Summit: To organise an Earth observation conference, that I would honestly want to attend myself. I cannot wait to share the exciting line-up of EO user organisations and speakers participating at the event. Stay tuned!

Early-Bird Ticket Sale: Last Few Days

The early-bird tickets are on sale and will be open until March 13. Benefit from the low price, EUR 249 per ticket and reserve your place now!

One EO Discussion Point

Exclusive analysis and insights from TerraWatch

5. NASA & NOAA Budgets - FY 2024: Not Good News for EO

The US federal budget saw some initiatives at NASA and NOAA suffer from budget cuts while others were predominantly allocated flat budgets.

NASA was allocated $24.8B for 2024, 8.5% below its original request and 2% lower, even before adjusting for inflation, from what NASA received in 2023. The share for Earth Science was $2.2B (vs the requested budget of $2.4B), which was the same as what the division received last year. NOAA was allocated a budget of $6.6B in which satellite programs got less than requested, while the overall budget was more than FY2023.

NOAA’s operational weather satellite programs such as GOES (geostationary) and POES (polar) programmes received their full requested budgets. But, follow-on weather satellite programs such as GeoXO and Near Earth Orbit Network got roughly about only 50% of what was requested.

As I think about the future of EO, I continue to think about three fundamental questions - I will write about these topics in the future but for now:

Mission Trade-Offs: EO funding is limited, which is understandable, and it needs to be managed efficiently. Ongoing EO satellite missions will suffer budget cuts, new programmes will be cancelled and older missions will be decommissioned. But at what cost to the economy, society and environment? What are the impacts of not having these satellites in the future?

Working model: What are the future pathways of implementing EO science missions, across the three models below, along with their tradeoffs?

The three models would be - i) NASA-led (NASA leads the design of satellites and outsources the development to the private sector), ii) private-led (private sector leads the design and development of satellites with NASA acting as an anchor customer for data procurement) and a hybrid model where both parties collaborate to work on new missions.

Data Continuity: Which EO satellites, out of the ones launched by space agencies, have the potential to become continuously operational missions, where the private sector can take over to implement this in the long term

While several EO satellites launched by space agencies are scientific missions with science and research as their primary goal (and they have certainly been successful at that) many of them have become fundamental to operational use cases, whether it is for governmental use, like policy monitoring for tracking climate goals or commercial use, in industries like agriculture, utilities and insurance sectors - take, for instance, the uptake of data from SMAP or Sentinel-1/2 by companies.

How do we make sure that we continue to advance EO while making sure that users who have (somewhat serendipitously) become dependent on data from some EO science satellites continue to operate without risk of data discontinuity?

Scene from Space

One visual leveraging EO

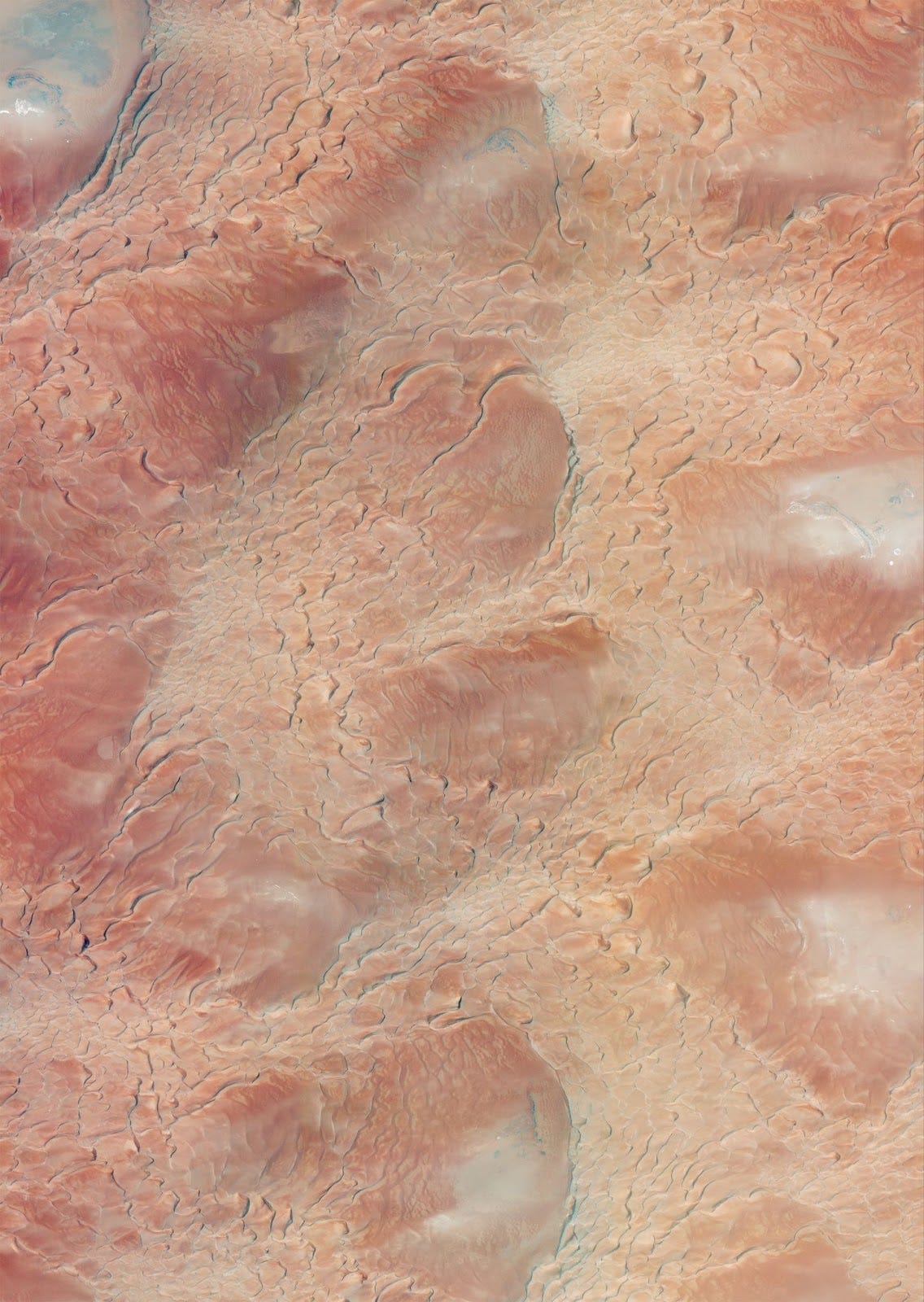

6. Dune from Space

I watched Dune: Part Two last week. Perhaps some of you also did, and I guess you will agree with me when I say it was a cinematic experience. Naturally, I was wondering where the movie was shot and also, on a related note, what dunes look like from space. Thankfully, the editors of the Planet Snapshots newsletter had the same thought.

Wadi Rum in Jordan is one of the many locations where Dune was shot.

And, to satisfy my remote sensing curiosity, this is what dunes look like from space - apparently, there is more than one type of dune. You never stop learning.

Until next time,

Aravind.