Welcome to a very belated edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

It's been a rather hectic week, but I finally found some time to publish this - I hope you all appreciate the effort and find value from the newsletter!

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- California's Air Resources Board awarded a contract worth $95M to Carbon Mapper and its partner Planet to provide methane data from the Tanager satellites;

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- Nvdia's announced that its Earth-2 platform that enable enterprises to build weather forecasting models is used by G42, JBA Risk Management and Spire;

- Related: Spire unveiled medium-range and sub-seasonal weather models;

- Indian edge computing startup SkyServe announced that it is working with NASA’s Jet Propulsion Laboratory to test AI models on a D-Orbit satellite.

For more on edge computing, check out the TerraWatch deep-dive.

Partnerships

- EO-based wildfire monitoring firm OroraTech is integrating its thermal infrared data into Nvdia's Earth-2 platform;

- Hyperspectral imaging firm Wyvern is teaming up with biodiversity monitoring startup Lemu to enhance commercial access to hyperspectral imagery;

🗞️ Interesting Stuff: More News

- Planet reported total revenues for fiscal year 2025 to be $244M and expects revenue growing up to $280M for the following year;

- China launched eight EO commercial satellites that included six with radio occultation sensors and two with multispectral imagers;

- NOAA is is reducing weather balloon launches due to staffing shortages, which can have impacts on accuracy of the forecasts;

- A consortium of organisations including the Alan Turing Institute, Cambridge university, ECMWF and Microsoft have announced a new project that would enable AI-based weather modelling on desktop computers.

This could be a big deal in solving the weather inequality problem in the developing world, particularly in Africa, Asia and Latin America. Being able to run AI-based forecasting models from desktop computers is both cheaper and more energy efficient (compared to status quo that require high performance computing).

Having the capacity to directly ingest observations from satellites and other sources means that everyone in the world will have the means to leverage advancements from the private sector. Further, this could open up the weather market which is currently limited to purchases from weather agencies.

🔗 Click-Worthy Stuff: Check These Out

- This article that shows how NASA uses radars to track water level;

- This deep dive on Norway's importance for satellite infrastructure;

- This article showing the rise of renewable energy globally, thanks to a collaboration between The Nature Conservancy, Planet, and Microsoft;

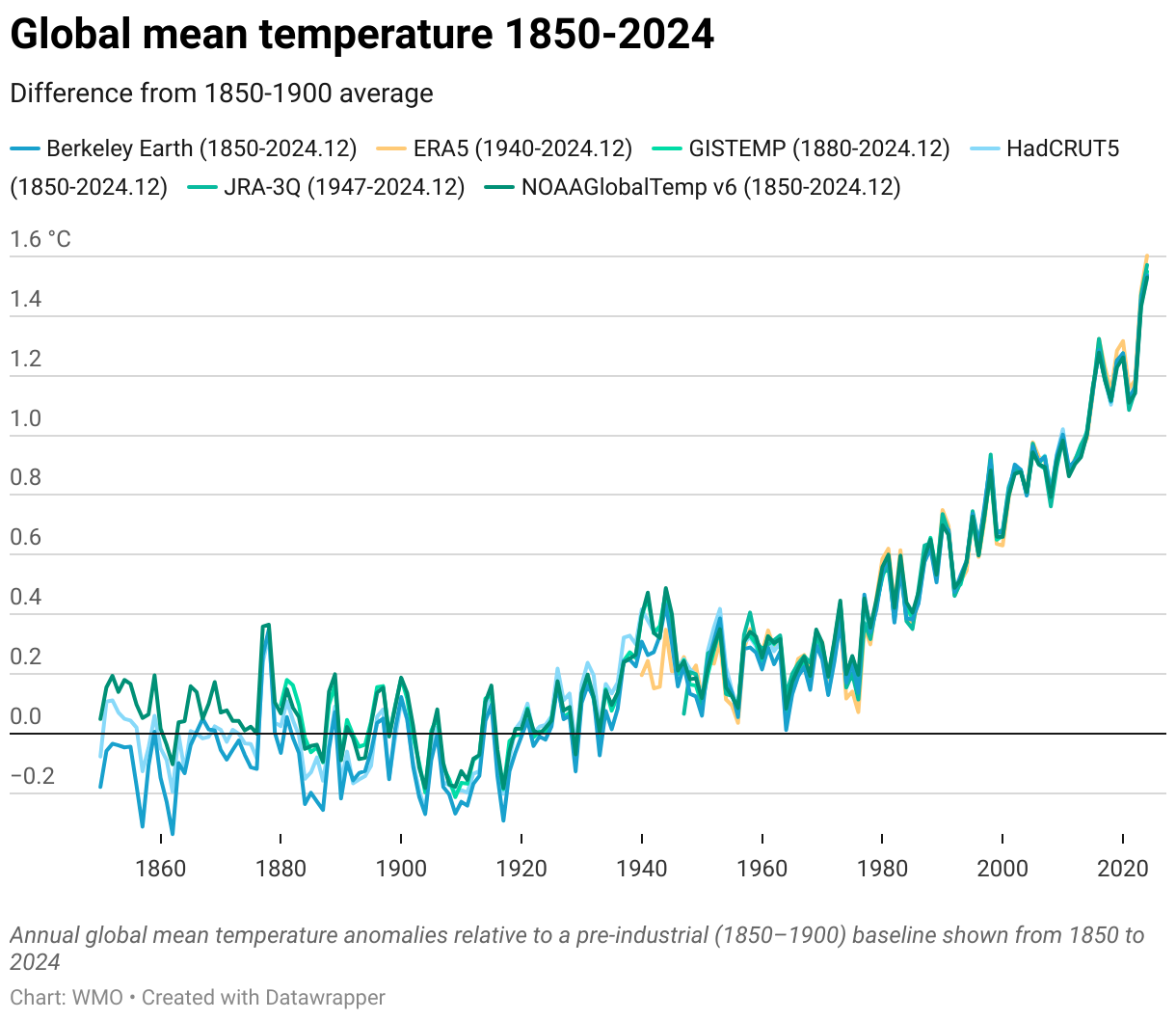

- This report from the WMO on the state of the global climate in 2024 - here is a good visual summary.

EO Summit: First Round of Participating Organizations

Meet the first round of user organizations taking the stage at EO Summit, to present case studies of Earth observation and discuss applications of satellite data across insurance, finance, agriculture, forestry, energy, utilities, climate and environment sectors. More to come soon. Stay tuned!

Tickets are on sale, reserve your place now!

One Discussion Point

Exclusive analysis and insights from TerraWatch

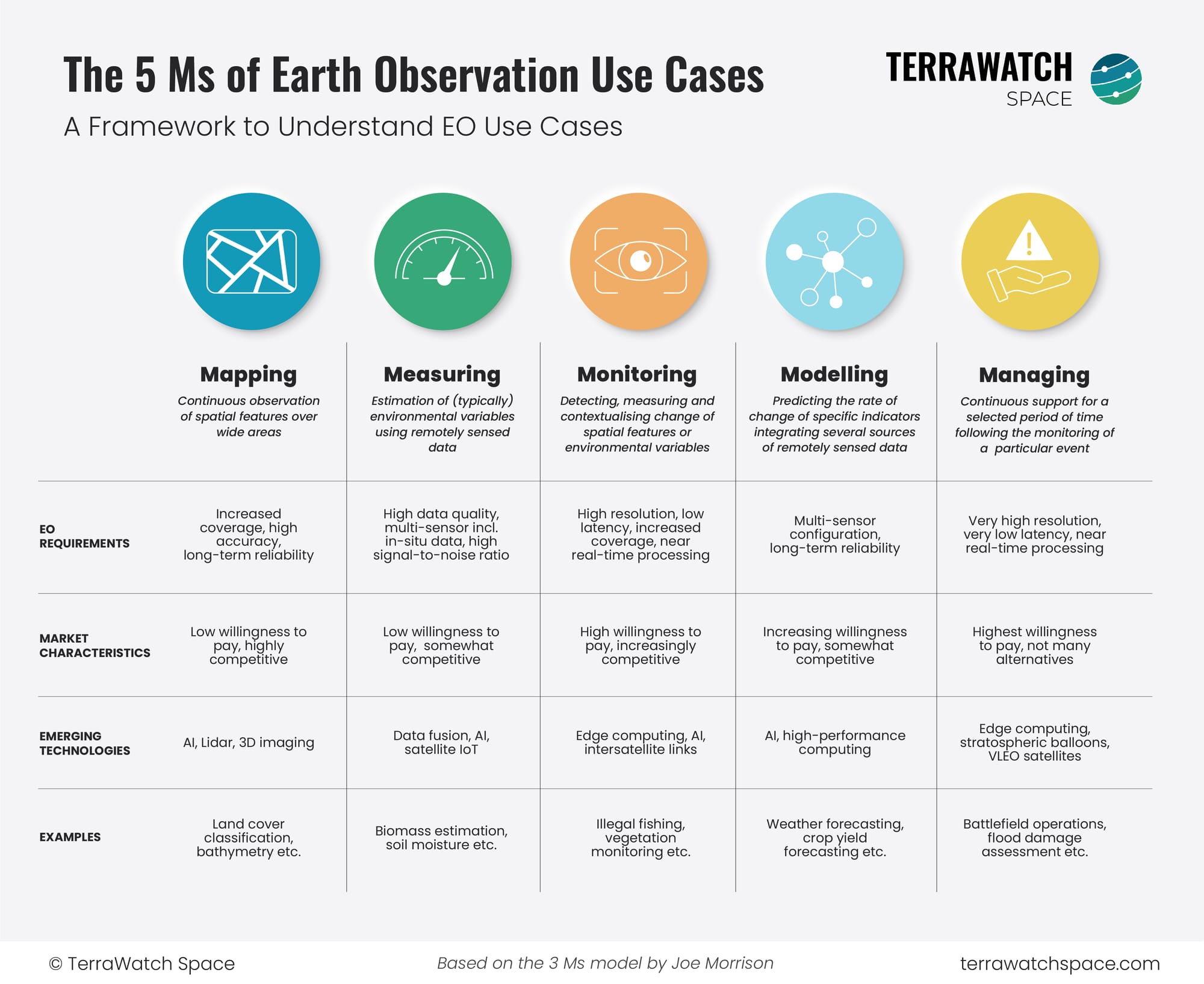

A Framework for Understanding EO Use Cases

When I advise EO startups, develop go-to-market strategies for EO companies, perform commercial due diligence studies for investors or assess the EO strategies for end-users, a set of questions always come up:

"Which EO use cases apply to my situation? What are the enabling technologies for those use cases? Which companies offer these solutions?

So, I wanted to develop a framework that categorises the different EO use cases into different themes, as a function of their technical requirements. Fortunately, my good friend Joe Morrison had already put in some thought into this and developed a 3M framework for classifying EO use cases. This model works well for the EO sector, especially for companies developing satellite constellations.

But, I wanted to create a EO use case classifying model that makes EO use cases easier to understand for those outside the EO bubble (investors, end users etc.), while also providing a structure for those within the EO sector while thinking about market positioning, product roadmap and go-to-market strategies.

So, the following figure is what I have ended up with (as a tribute to Joe, I stuck with the 'M' naming convention). The goal is to make EO use cases more approachable and create a starting point for discussions, especially in my consulting work. But, as I always do, I also wanted to share it with you.

Let me know if you have questions or any feedback!

Scene from Space

One visual leveraging EO

Multisensor First Images from Constellr, Pixxel and Satrec Initiative

You may remember that SpaceX launched over 30 EO payloads as part of the Transporter-13 mission a few days ago. Naturally, it means that it is time for some first images from some of the satellites in orbit.

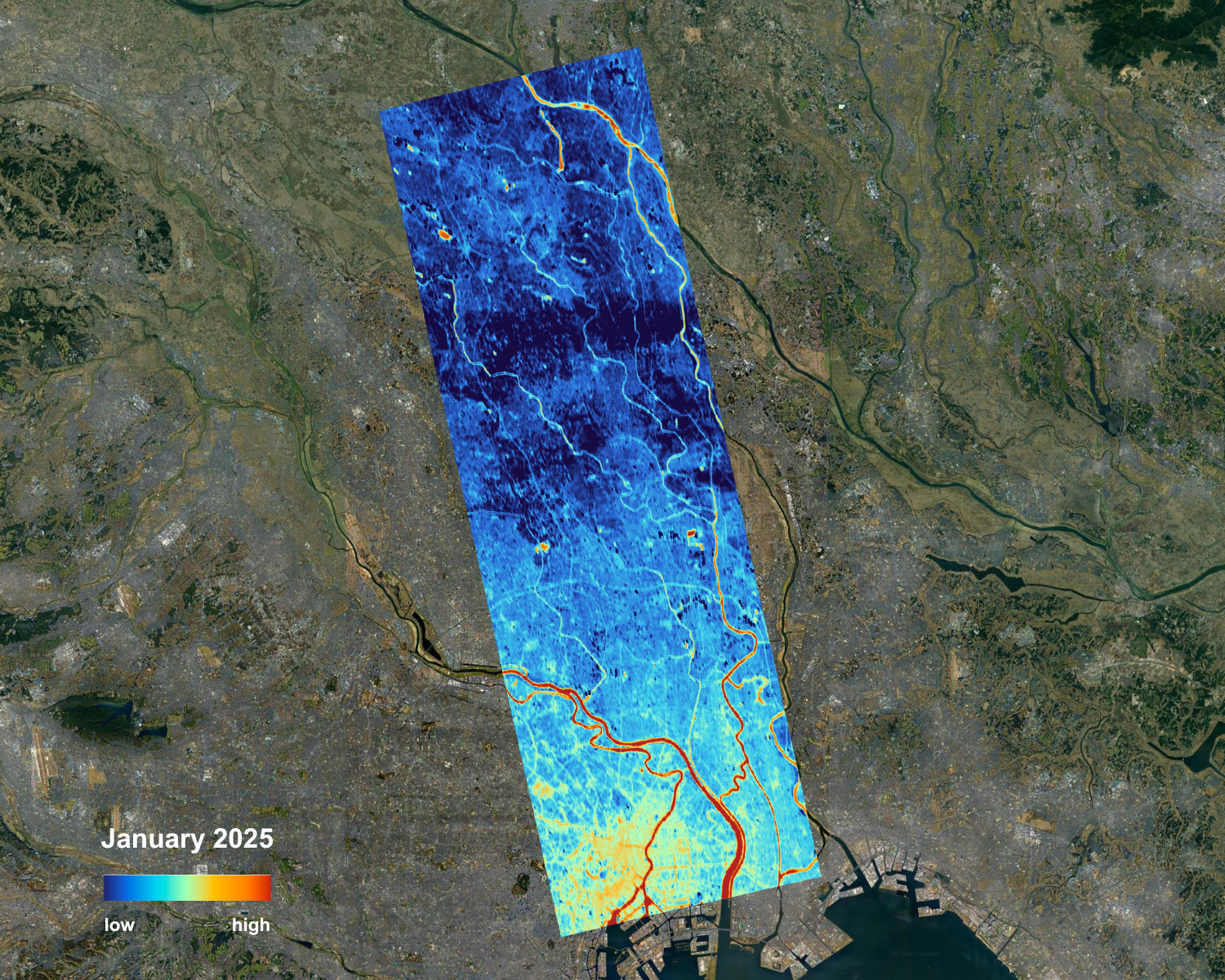

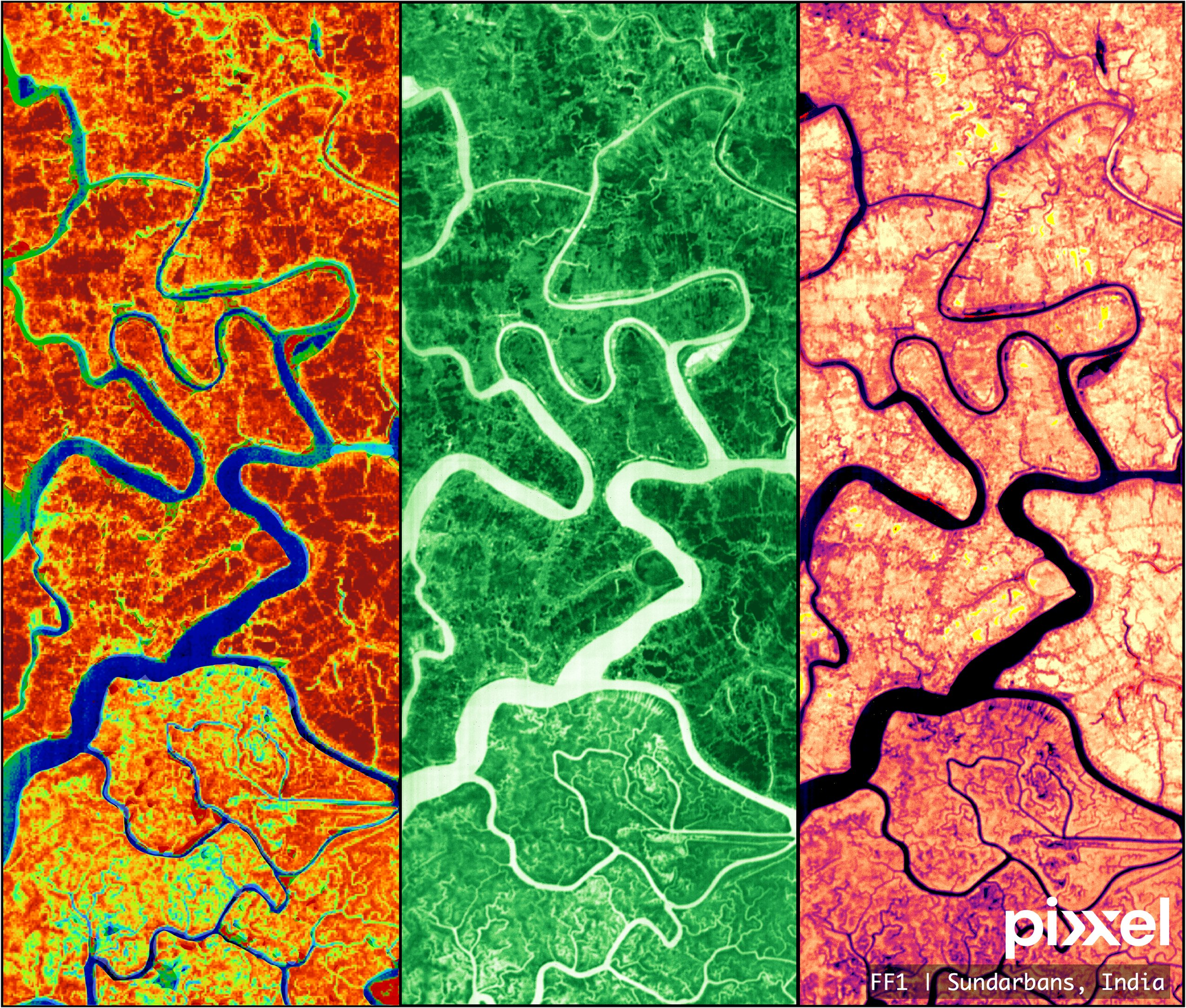

Below are the images from SpaceEye-T satellite from Satrec Initiative acquiring high-resolution imagery at 25 cm, constellr with a 30 m thermal imagery with its long-wave infrared instrument and Pixxel with 5 m hyperspectral imagery across 150 bands.

We will probably see more first images coming from the other birds that launched.

Until next time,

Aravind.