Welcome to a new, belated edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- Japanese EO satellite firm Axelspace is planning to go public;

Contracts

- Planet signed a seven-figure contract with the German government for a one year term and an option to renew for two more years;

M&A

- Quantum computing firm IonQ is acquiring SAR satellite firm Capella Space with a plan to build space-based quantum network.

My take: It is my job to anticipate market evolution and make predictions, but this was definitely not on my bingo card. This is a very non-traditional exit for an EO satellite firm. Three reasons why I think IonQ could have acquired Capella:

1/ Access to defense customers: Capella has won contracts from the US DoD and the acquisition immediately provided IonQ with customers to sell their IonQ to acquire Capella Space in bid to build ultra-secure quantum network to,

2/ Ownership of the space segment: Capella's vertical integration allows IonQ to integrate quantum payloads and launch as soon as possible so that they can have a first mover advantage, while also allowing them to potentially leverage quantum compute for SAR data processing.

3/ Short-term revenues: IonQ, founded in 2015 and went public in 2021, has seen its revenues double over the last 3 years (to $45M in 2024), so the acquisition of Capella which - according to our estimates - earns between $70-$80M should add to to their growth, at least in the short-term

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- German defense firm Rheinmetall is establishing a joint venture with Iceye in the country, while the latter is also setting up a base in Spain.

- EO platform SkyFi is teaming up with EO-based wildfire monitoring firm OroraTech integrating its thermal data into SkyFi’s platform.

🗞️ Interesting Stuff: More News

- The US has announced that NOAA's extreme weather database, which has tracked cost of disasters since 1980, will be retired;

- Indian media reported that high-resolution satellite imagery orders for Pahalgam, Kashmir surged weeks before the tragic April 22nd attack (following which the alleged firm was removed as an official partner of the EO company).

🔗 Click-Worthy Stuff: Check These Out

- This piece that discusses the role of EO in creating parametric insurance solutions;

- This paper that presents the results of integrating polarimetric radio occultation data for meteorological applications;

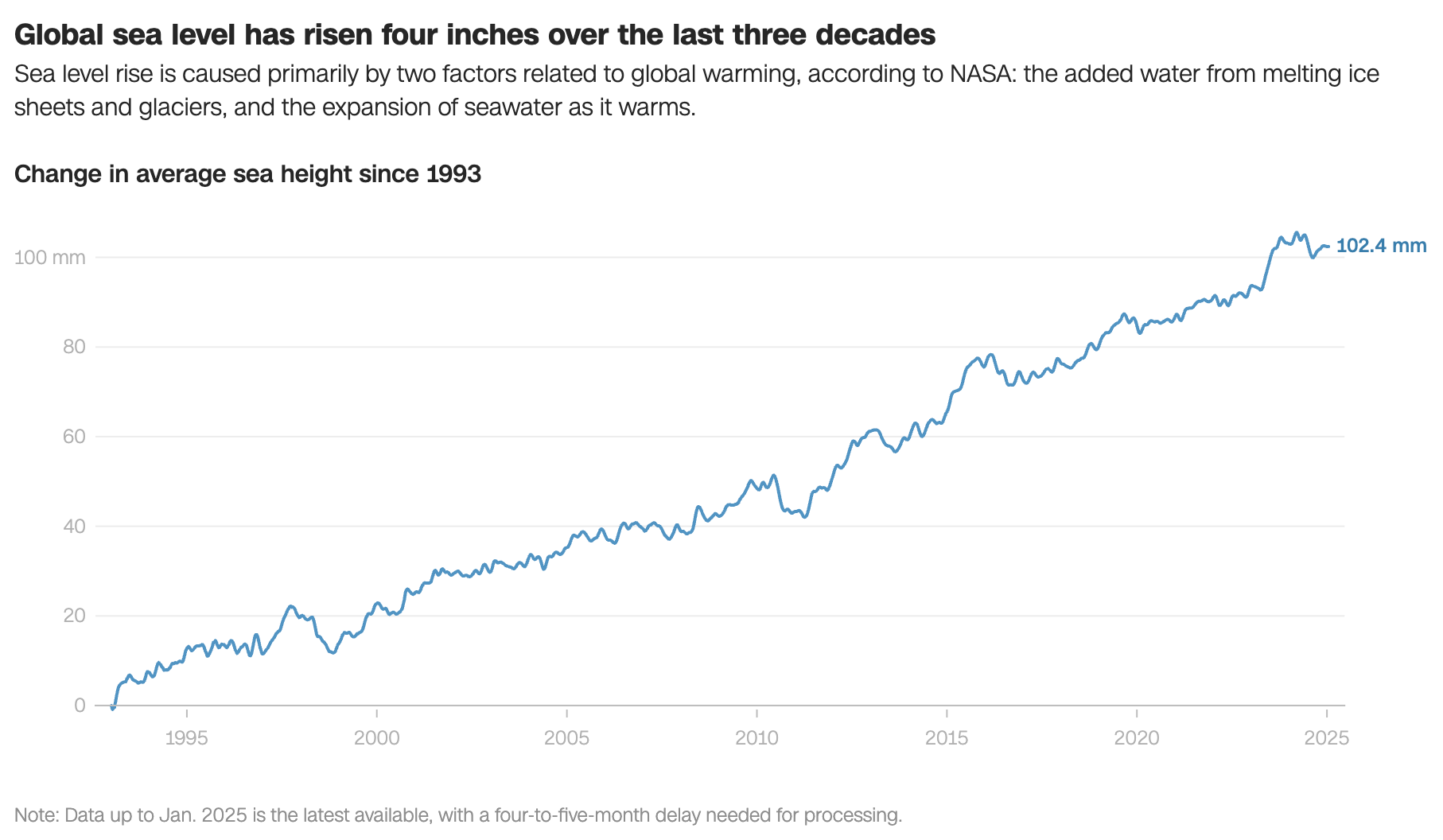

- This article that explains the risks of rising sea levels for coastal cities.

EO Summit: Participating Organizations

EO Summit is a passion project. I wanted to challenge the status quo of conferences in Earth observation and rethink how they are structured —make it user-centric (not provider-centric) and application-based (not technology-based).

We have worked hard to bring together an incredible line-up of speakers from a variety of end-user organizations across insurance, finance, agriculture, forestry, energy, utilities and environment along with technology solution providers across the geospatial and EO landscape.

I set out to build the kind of EO conference that I’d personally be excited to attend, and I can say, objectively, that EO Summit 2025 has turned out to be one. Hope to see some of you in New York in a month!

One Discussion Point

Exclusive analysis and insights from TerraWatch

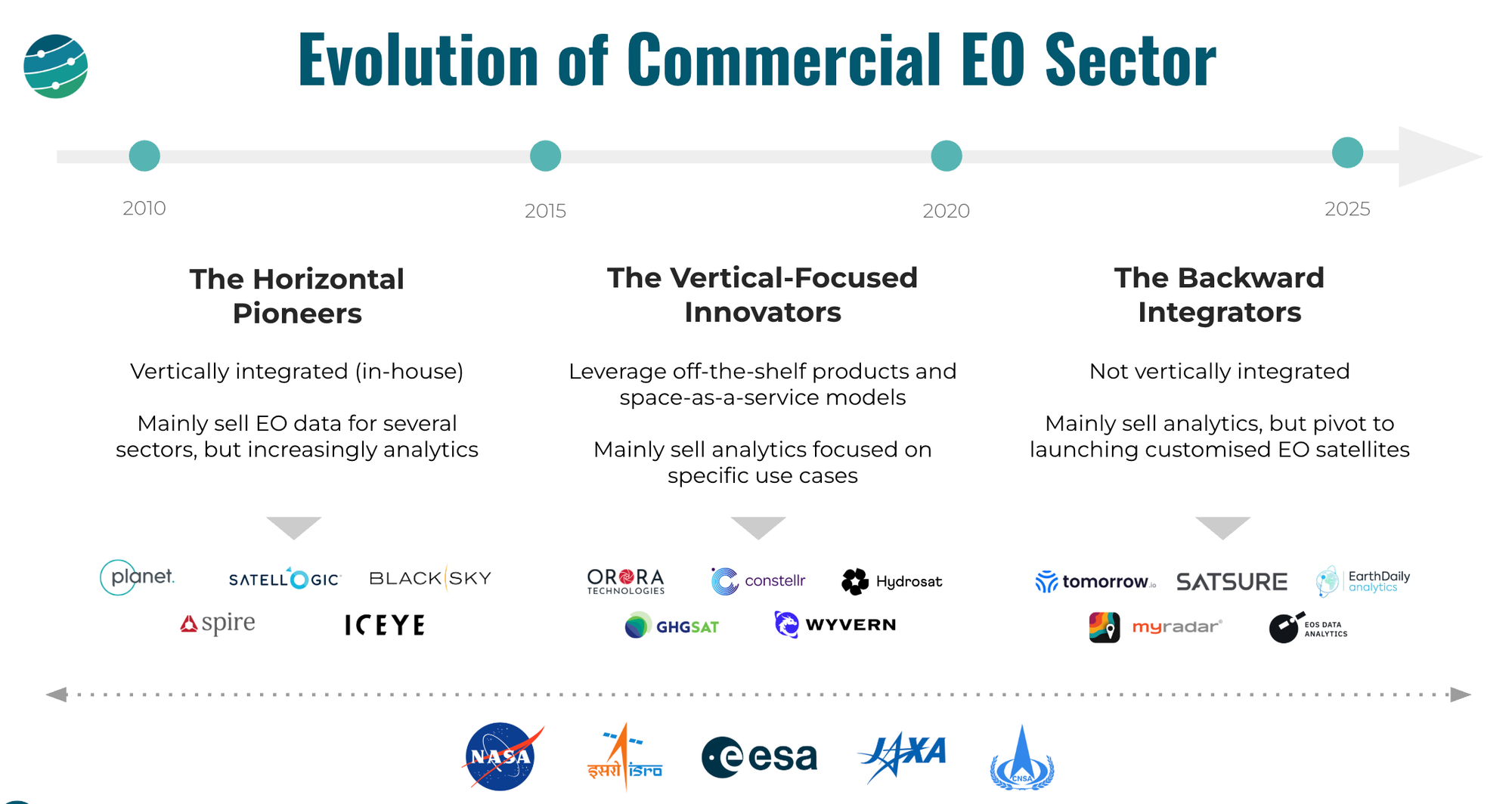

The Three Waves of Commercial EO Satellite Companies

When I give my "State of EO" presentations, I always use this slide to show the evolution of the commercial EO sector over the past decade and a half. While the number of EO satellite companies has risen from a handful in the early 2010s to 76 as of today, we can see some common themes and trends in how the industry has evolved. This visual is one way to understand how the EO market has evolved over the years.

Not including the longstanding industry giants such as Maxar and Airbus, I describe the growth of the commercial EO sector, or the so-called NewSpace EO as an evolution that happened in three waves: the horizontal pioneers, the vertical-focused innovators and the backward integrators.

- Horizontal Pioneers from the early 2010s had to be vertically integrated as the NewSpace era had just started and there weren’t many services or components available to buy off-the-shelf. And, since they were mainly pioneers in EO, they had to go with a horizontal approach to selling data to several market verticals. However, gradually they have expanded down the value chain with many of them recently starting to sell analytics.

- The Vertical-Focused Innovators, thanks to the advancements in the satellite and space industries, leveraged the off-the-shelf products and the increasingly available ‘as-a-service’ models. They also had the opportunity to learn from the businesses of the horizontal pioneers that may have led them to build EO satellites to acquire data relevant to specific use cases (vs a purely horizontal approach). Given that many of these companies validated what their customers want and how they want it, they started to directly offer analytics services (vs pure raw data).

- The Backward Integrators, in the meantime, started appearing in the market towards the start of the 2020s, and they came from a completely different angle. Many of these firms were analytics providers actively delivering solutions to their customers, but as a result of their strong understanding of user needs and perhaps, because they found the current crop of EO satellite companies to not answer to their needs, they pivoted to launching their own satellites, almost always with proprietary sensors and satellite architecture, designed specifically to their requirements.

*You might find that there are several anomalies in the market today that do not fit into any of these categories. You might even find that the vertical integration model is slowly coming back, in some companies. This is not a comprehensive market landscape, but simply a framework to understand the evolution of EO.

AI-Ready Earth Observation

I wrote a white paper in collaboration with EarthDaily on what AI-ready EO is, the differences with status quo, the benefits it could unlock, and the shifts it could bring across the sector.

After speaking with some folks in the EO ecosystem, I was able to validate some key assumptions I had on the path to truly AI-ready data: pre-launch instrument calibration (with continuous validation), automated preprocessing pipelines, interoperability with Sentinel/Landsat and harmonised data acquisitions.

Don't treat this as a technical spec, it’s the beginning of a forward-looking conversation about how we get to AI-ready EO.

Scene from Space

One visual leveraging EO

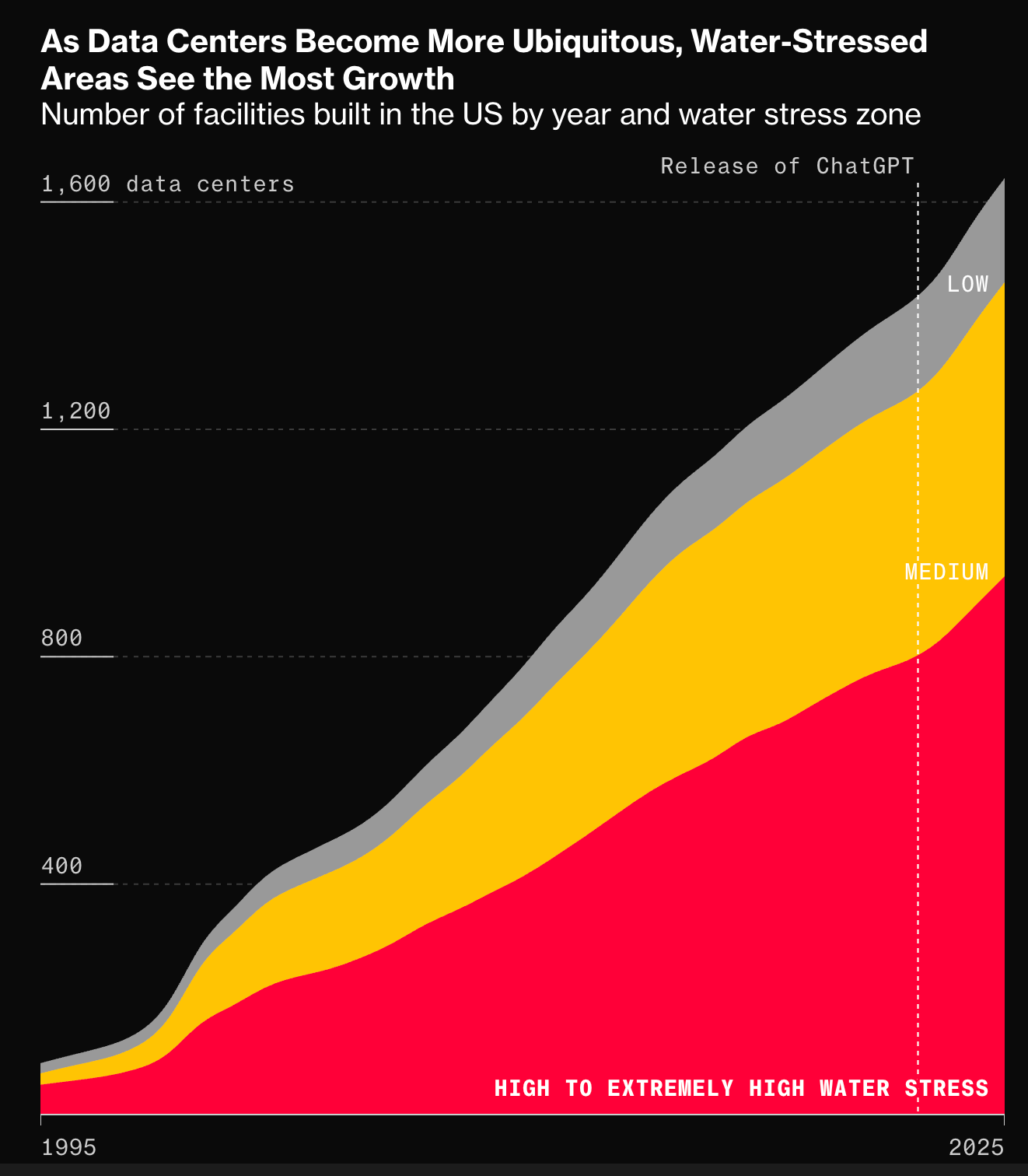

AI, Water Use and EO

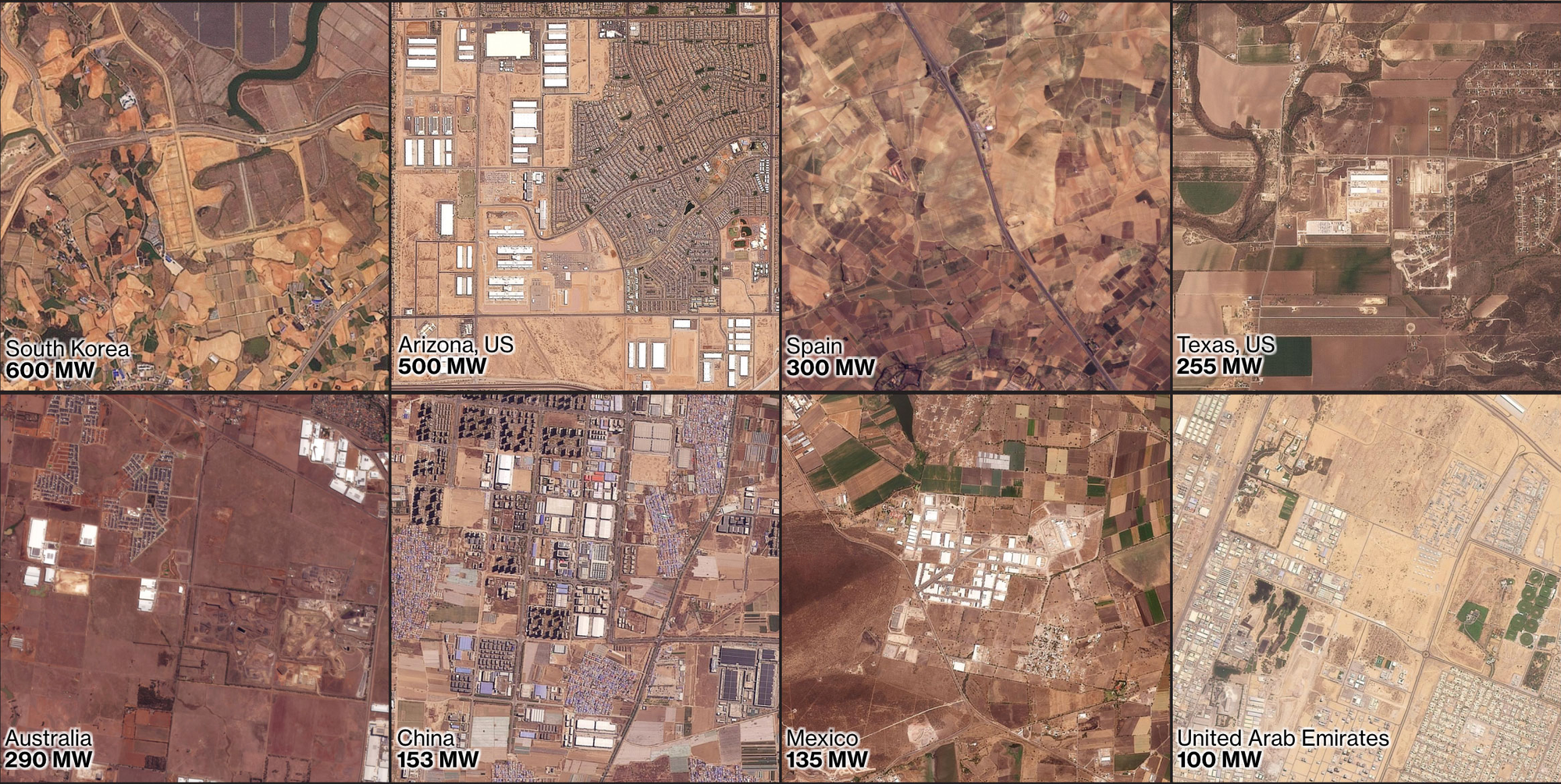

I came across this article that dived deep into how data centers that power AI are using up a large volume of water, and are now increasingly located in areas with high water stress. It came with this graph that shows the explosive growth of data centers in locations with high water risk, based on data that combines satellite data and hydrological models (see WRI's Aqueduct for more info).

It also included these satellite images from Planet showing where data centers are located – it is visually clear how dry these areas are.

Until next time,

Aravind.