Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- Planet is expanding its work with Global Fishing Watch, a non-profit focused on maritime monitoring, with a 6-figure deal;

- The US Space Force awarded space engineering firm Optimum Technologies a $4.5M contract to develop an optical imaging payload aimed at detecting anti-satellite weapons.

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- Stratospheric remote sensing data provider Near Space Labs announced the nationwide deployment of its stratospheric robots, which can provide an enhanced 7cm resolution;

- Privateer, which recently acquired EO platform firm Orbital Insight, launched TerraScope Maritime, a multi-source tool to better analyze ocean activity;

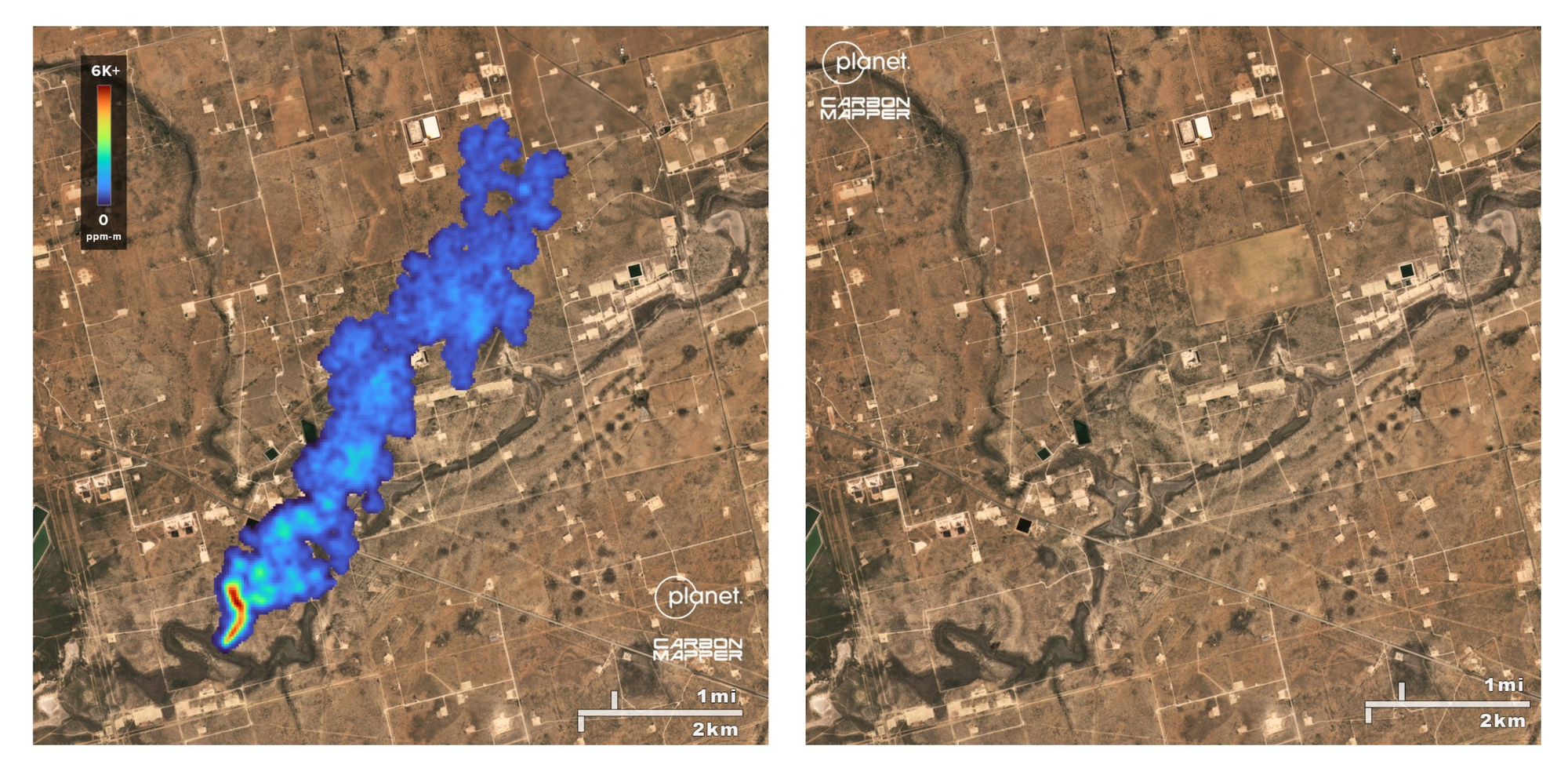

- Carbon Mapper announced that it has achieved its first successful methane mitigation milestone, thanks to data from the Tanager-1 satellite.

Partnerships

- EO instrument supplier Teledyne Space Imaging is collaborating with EO company Satlantis to develop a very high-resolution (<10 cm) sensor;

- Lockheed Martin is teaming up with SAR data firm Iceye to advance AI-enabled targeting for the Finnish military;

- Edge computing solution provider Ubotica and satellite manufacturer Kongsberg NanoAvionics signed a strategic partnership;

- To learn more about edge computing for EO, check out the deep dive.

- Earth Blox, which offers an EO analytics platform, is partnering with Chloris Geospatial, a startup building an EO-based forest carbon estimation tool;

- Ascending Node, a satellite mission management firm, and Pinkmatter, an EO image processing firm, are joining forces to collaborate on data calibration;

🗞️ Interesting Stuff: More News

- China launched Haiyang-4, an EO satellite for measuring global ocean salinity;

- China also launched an EO platform to enable data access and visualization;

- Maxar, which is gearing up for the last launch of its Legion satellites, has confirmed a data breach involving the personal information of its employees;

- Oman launched its first EO satellite on a Chinese launch vehicle, while Bahrain is getting ready to launch its first bird in 2025;

- The Netherlands is set to launch of its first military EO satellite, manufacturerd by local companies, in 2027.

- Hungarian telecom and IT firm 4iG has announced that it will be launching an EO constellation, consisting of six optical and two radar satellites.

My take: We are tracking at least 18 countries that have announced national EO constellations in our EO database. Note that this does not include the 62 companies that are launching their own constellations. It begs the question: "How many is too many?"

Unlike some countries, in which national EO constellations are government initiatives, in this case, a private company is leading the efforts to build this constellation. However, the motivations seem to be the same: sovereign data capabilities with the government as the biggest customer.

As I often say, "we have a tendency to overestimate the potential of EO and underestimate the efforts needed to realise that potential". So, here is hoping all national constellations have an integrated EO awareness and adoption strategy, are actually fit-for-purpose and future-proof and prioritize long-term returns.

I have nothing against countries launching their own EO constellations. The more successful national EO initiatives exist, the more the best practices and case studies are available for other countries to follow.

🔗 Click-Worthy Stuff: Check These Out

- This article that explains the flood forecasting model from Google, now available in over 100 countries;

- This investigative piece that uses optical and radar satellite imagery to identify ships engaging in illicit ship-to-ship transfers of oil;

One Discussion Point

Exclusive analysis and insights from TerraWatch

State of EO Funding: Preliminary Analysis

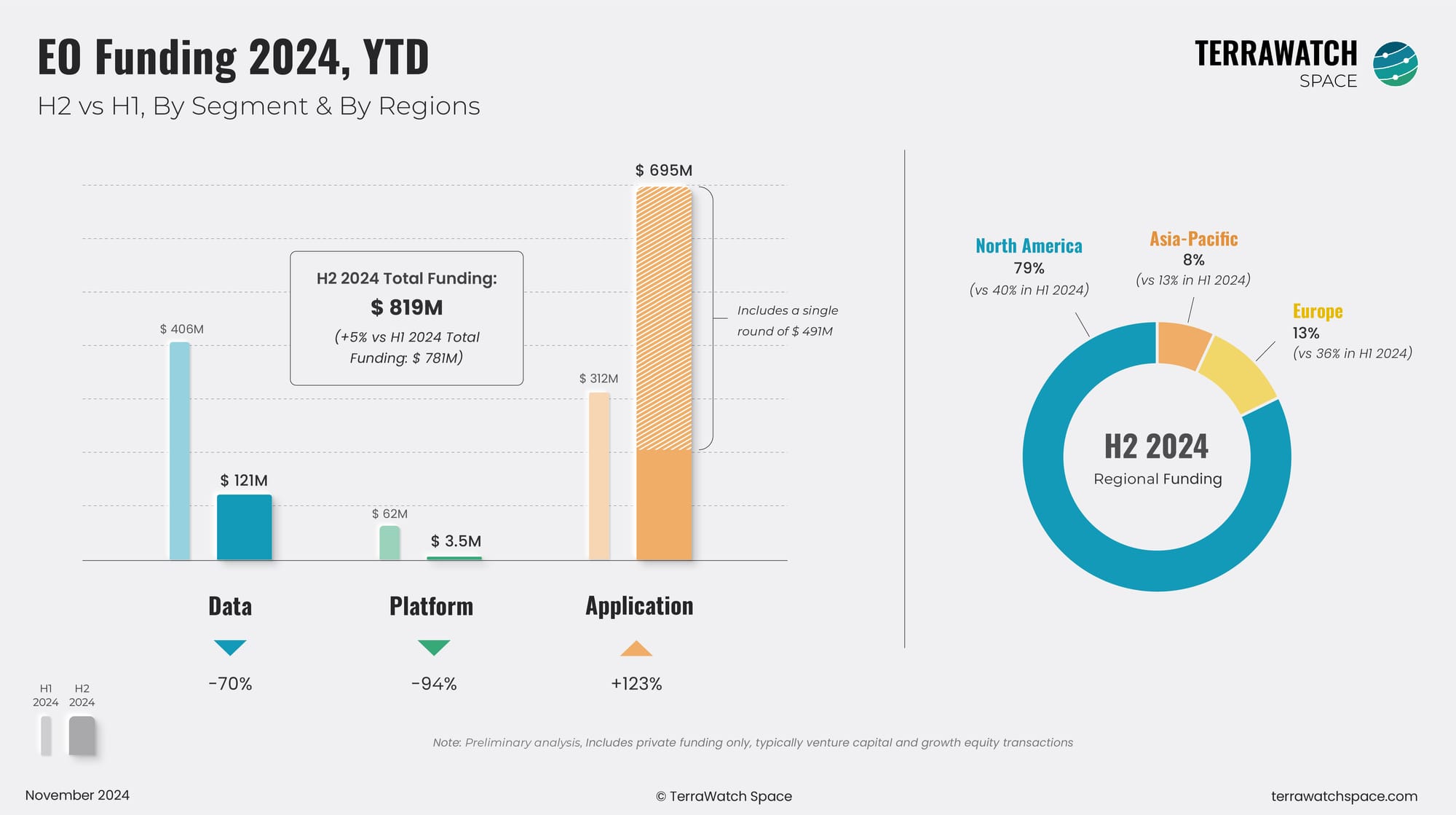

We usually publish our yearly EO funding analysis in the beginning of the year. It is still November, but I was looking at some initial data from the second half of the year. While there is still a good month to go before the end of the year, it might not be too late to look at some initial signals.

Our preliminary analysis shows that investors embraced the 'wait-and-see' approach to funding EO and EO-related startups, continuing to play it safe. We have seen a drop in deal count, with a slight increase in the total funding figure, heavily biased by the $491M round for KoBold Metals.

Interest in the "Data" segment, which includes companies launching satellites, is slowly fading. The "Platform" segment, which has never really been an investor favourite, continues to receive little to no funding. Interestingly, the "Application" segment, which always performs well, also shows signs of 'feeling the pinch', especially when considered without the KoBold round.

With respect to regional distribution, we continue to see North America, specifically the US, lead the way, while it seems like funding for Europe-based EO firms has significantly declined in H2.

We will be publishing an in-depth analysis of EO funding in 2024 in early January (see the last one here). However, you need to be a premium subscriber to read the full piece. We are offering an exclusive 20% off for Black Friday. Subscribe to receive exclusive analysis and insights on EO!

This edition of the newsletter is brought to you by IGARSS 2025

The International Geoscience and Remote Sensing Symposium (IGARSS) is the flagship conference of the IEEE Geoscience and Remote Sensing Society. In August 2025, the 45th IGARSS will be held in vibrant Brisbane, Australia!

With the theme “One Earth”, IGARSS 2025 will focus on addressing global threats to our planet and fostering collaborative solutions through cutting-edge remote sensing technology.

Submissions are now open for this prestigious event. With multiple submission options—including full papers, abstract-only, and published paper—this is your chance to showcase your work, share insights, and connect with global leaders in remote sensing and Earth observation.

Organizations are also invited to sponsor IGARSS 2025. Sponsorship offers a unique opportunity to promote your brand, reach an international audience, and connect with influential stakeholders in technology, academia, and industry.

Scene from Space

One visual leveraging EO

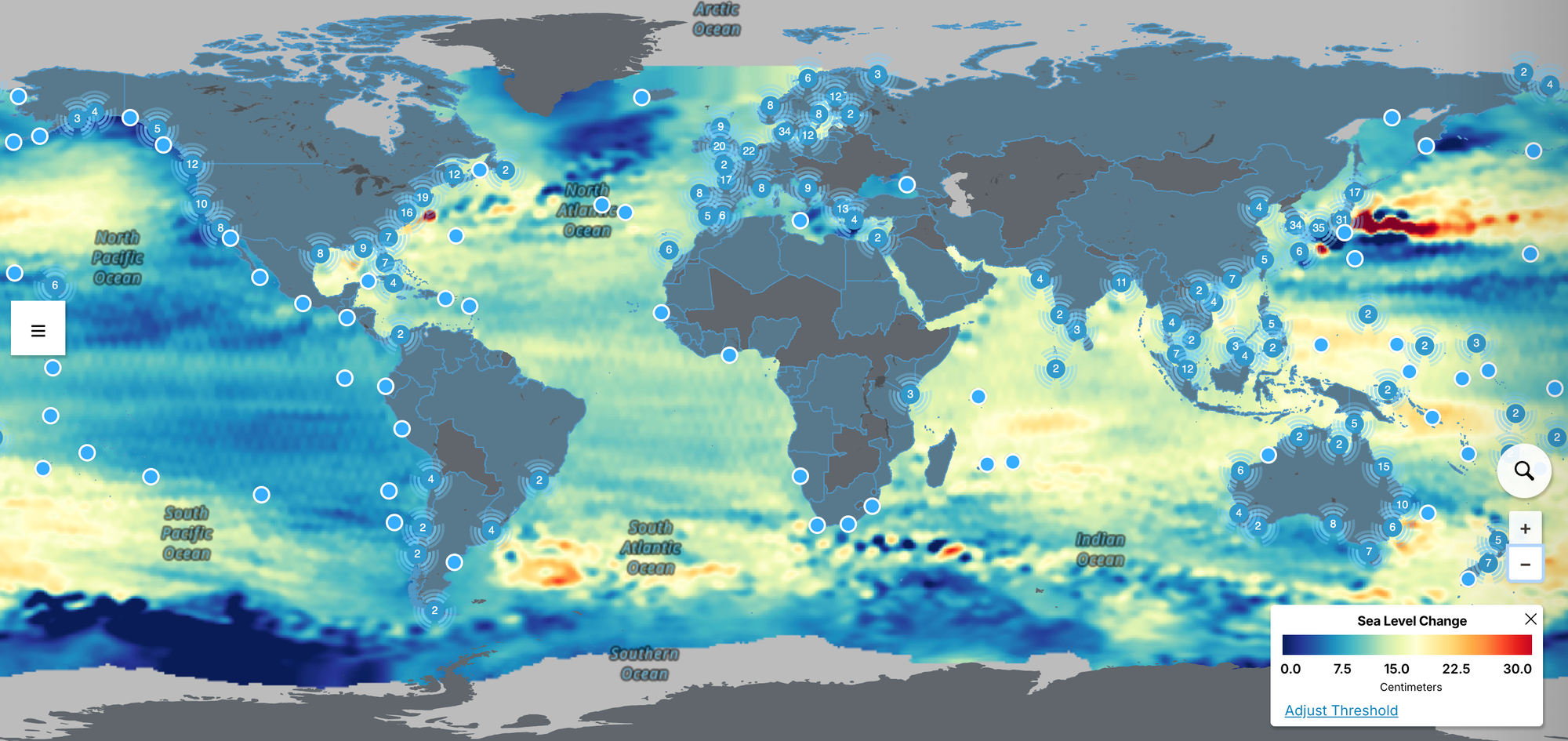

Global Sea Level Rise Projections

Analysis from a NASA-led team has revealed that between 1970 and 2023, 96% of countries with coastlines experienced sea level rise, which is constantly growing - from 0.21 cm per year in 1993 to about 0.45 cm per year in 2023.

The global data and projections until 2150 are available in the sea level section of the Earth Information Center. These projections are based on data from satellites and tidal gauges that measure and model global sea level rise.

Until next time,

Aravind.