Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- NOAA awarded contracts worth $2.2M and $2M to weather satellite companies Tomorrow.io and Orbital Micro Systems, respectively, to acquire and evaluate microwave sounder data;

- Planet, through a partner, signed a contract with American Crystal Sugar Company to monitor sugar beet crops in the US;

- EO-based oil spill monitoring analytics startup Orbital EOS signed a renewal agreement with Saudi Investment Recycling Company;

M&A

- Taqnia ETS, a Saudi-based geospatial service provider, was acquired by Neo Space Group, a newly formed entity by the Public Investment Fund;

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- EO platform company SkyWatch announced a multi-year partnership with Maxar to distribute its high-resolution satellite imagery through the platform;

Announcements

- SAR solution provider Iceye has announced a new imaging mode called Dwell Precise, offering data at 25 cm resolution;

- Carbon Mapper, a public-private partnership focused on monitoring greenhouse gas emissions, released the first methane and carbon dioxide detections by the Tanager-1 satellite - publicly available on its data portal.

🗞️ Interesting Stuff: More News

- Northwood Space, a startup building phased array ground stations to improve satellite downlink, has successfully demonstrated its technology by connecting with Planet's EO satellite;

- The US Space Force is leveraging data from commercial EO satellites for Hurricane Helene disaster relief;

- NOAA announced a $15.3M project to fund projects aimed at improving climate projections of extreme weather events;

- The UK's National Centre for Earth Observation received funding worth £8.6M to continue EO-focused research;

- The Indian government approved the plan for a military satellite constellation, costing approximately $3.2B, consisting of at least 52 in low-earth and geostationary orbit, of which 31 will be built by the private sector;

🔗 Click-Worthy Stuff: Check These Out

- This paper that discusses the development and implementation of a satellite-based forest inventory in Canada;

- This article that provides some examples of how some EO-based startups supported disaster management efforts following floods in an Indian state;

- This sponsorship brochure for EO Summit 2025, if you are an EO organisation and would like to improve your brand presence and market position;

- This report from the World Meteorological Organization on the state of global water resources.

One Discussion Point

Exclusive analysis and insights from TerraWatch

The Future of EO - in the Foreground, Middle Ground, or Background?

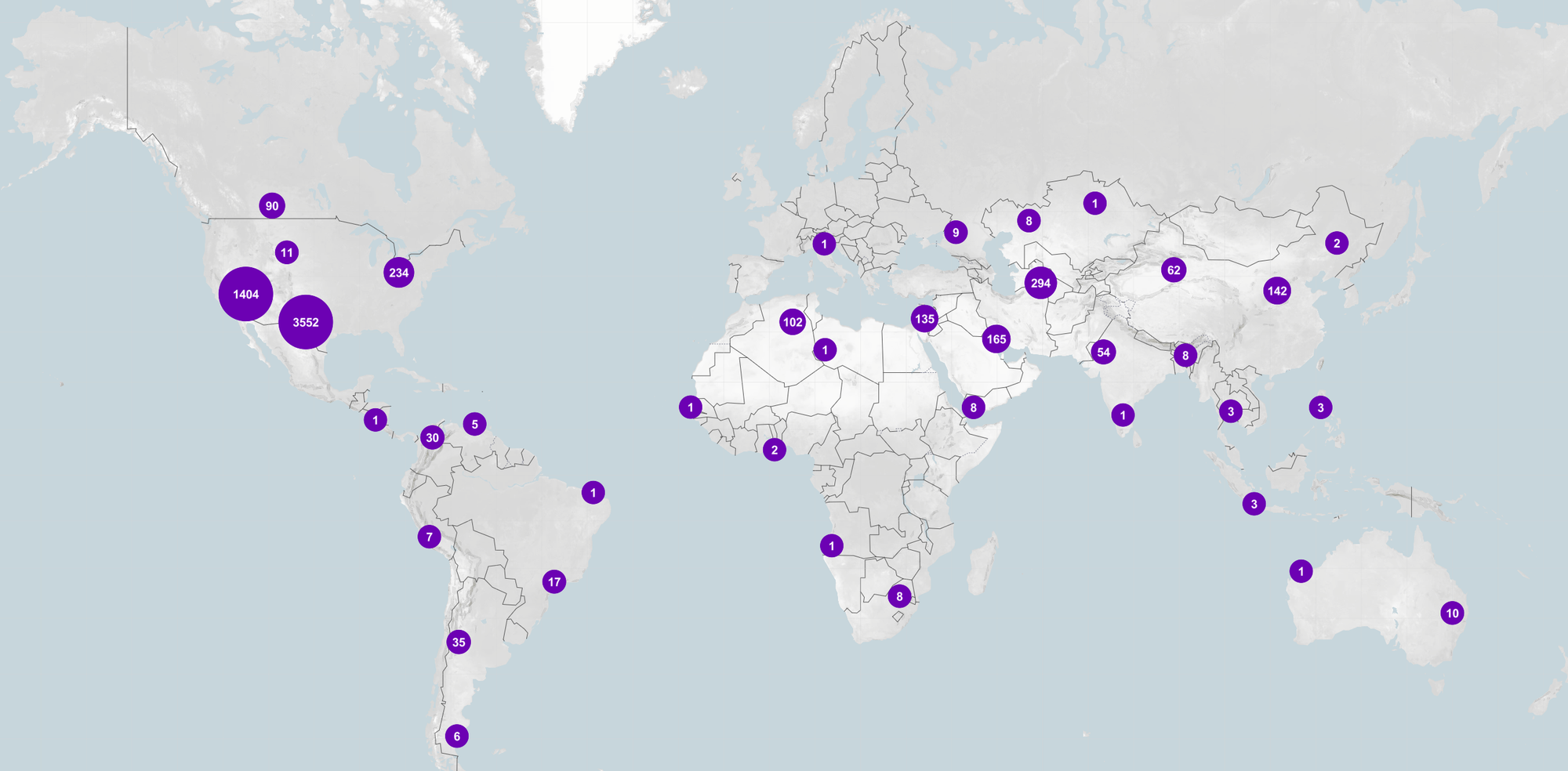

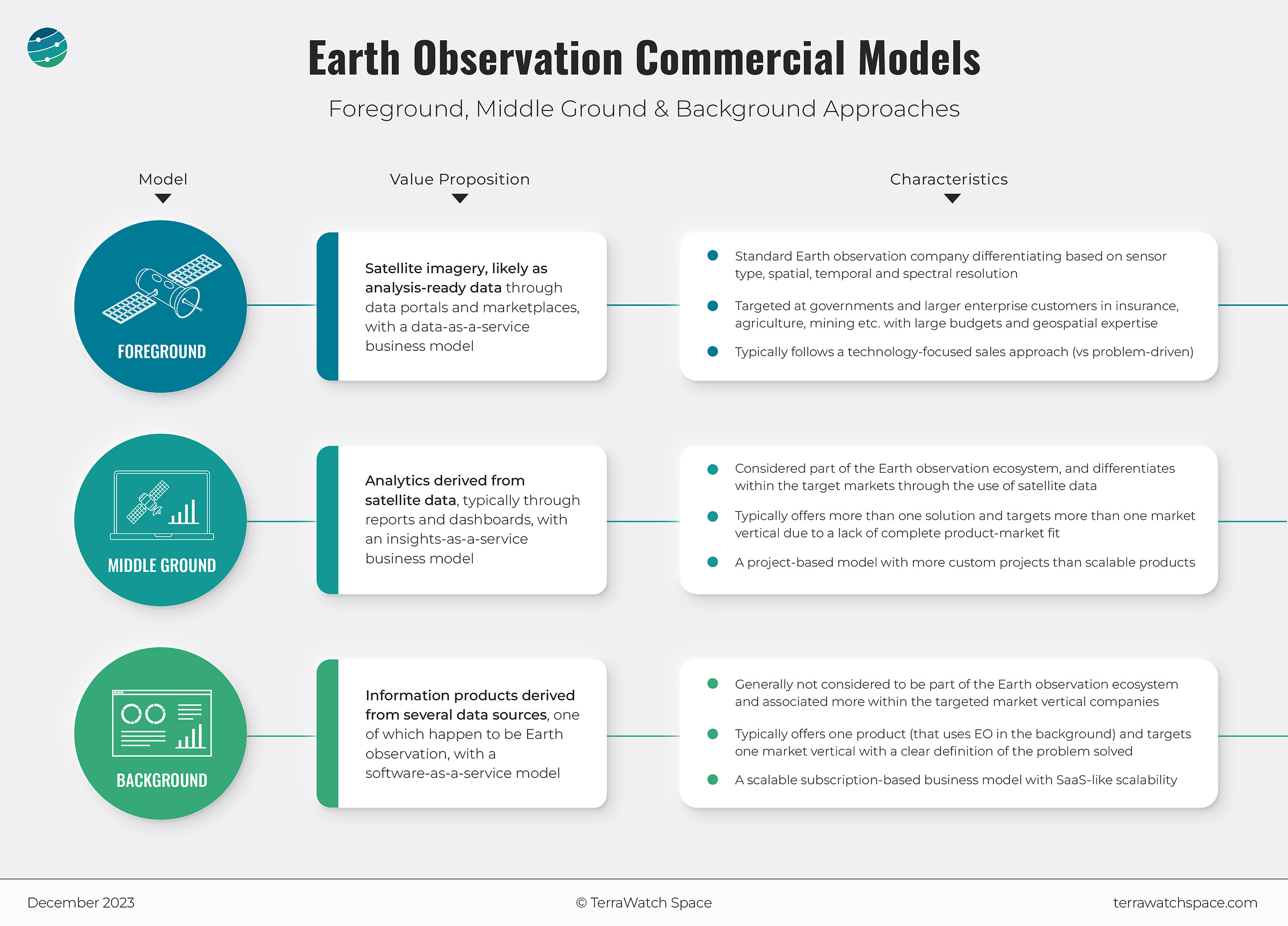

There are different approaches that the EO sector can take to become the multi-billion dollar commercial market that every projection seems to forecast —to be in the foreground, in the background, or to find and settle on a middle ground. The figure below summarises the three models.

The EO in the Foreground Model

Few folks within the larger tech industry (i.e., outside the EO community) understand remote sensing or have used geospatial data. Convincing them to buy more EO data is probably not the path to the multi-billion dollar market. But, apart from some anchor customers who already understand the value of EO data, have strong competencies in processing it, and know how to integrate it into their workflow, I am not particularly bullish on this approach in the short term.

The Middle Ground Model

There is a caveat to growth through the middle-ground approach. The larger enterprises within the specific market verticals (insurance, agriculture, financial services, etc.) might decide to form their own internal EO data processing teams to build their own set of tools that perfectly respond to their needs, thereby eliminating the need for a middle ground approach. I don’t expect this to happen anytime soon as the end-users are probably still in the discovery phase of understanding what the strategic value of EO is for their businesses. Once the product-market fit is established, we might see more consolidation here, with the successful EO downstream companies being acquired by the big corporations of our time.

The EO in the Background Model

I may have changed my mind about quite a few things ever since I started working in EO, but I have always stuck to this fact:

EO data is just another type of data that happen to come from space, yet one that we still use to build (digital) software products.

End-users, whether consumers using a mobile application or employees in a major corporation using an enterprise software application, do not care how they get their answers; they just want to get their “job done.” So, I am betting on this approach in the long term — EO data is just another source of data to build a product, thereby making the product the selling point rather than the underlying technology itself.

Scene from Space

One visual leveraging EO

Hurricane Milton, by Day and by Night

Hurricane Milton made landfall in Florida last week, causing heavy rainfall, damaging winds, and life-threatening storm surges. Several satellites helped monitor Milton's evolution throughout the week. The following animation from NASA shows false-colour images from infrared instruments, monitoring the system's brightness temperature throughout day and night, as measuring the temperature of the storm system is a critical variable to model its evolution.

Until next time,

Aravind.