Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- Thermal infrared data-based wildfire monitoring startup OroraTech raised €25M in Series B funding;

- Hyperspectral data provider Wyvern raised $6M in additional funding to expand into the US market;

Contracts

- Thermal infrared solution provider Hydrosat won a $1.9M contract from the US Air Force;

- Satellite manufacturers Thales Alenia Space and Argotec were awarded contracts worth €140M to supply EO SAR and optical satellites for Italy's national EO constellation, Iride;

- Weather firm Weather Stream was awarded a study contract by NASA to develop a radiometer payload for NASA’s AOS mission;

M&A

- EarthDaily Analytics acquired EO platform provider Descartes Labs for an undisclosed amount (more on this below).

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- Spire, together with Canadian startup Mission Control, announced plans to launch a new mission to demonstrate onboard AI data processing;

- AiDash launched a new EO-driven platform aimed at the infrastructure and utilities sector for grid monitoring.

🗞️ Interesting Stuff: More News

- Airbus’ defense and space division announced plans to cut up to 2,500 positions by mid-2026;

- China launched a fifth Gaofen-12 satellite to the CHEOS civilian EO constellation system;

- The EU and ESA have confirmed the funding for the development of all the Copernicus Sentinel Expansion Missions: CO2M, LSTM, CHIME, ROSE-L, CIMR, and CRISTAL;

- Australia's SmartSat Cooperative Research Centre and the Hellenic Space Centre signed a partnership on EO data sharing and EO applications;

- The US Commerce Department eased export controls on the sale of EO satellites (optical and SAR) to Australia, Canada, and the UK.

🔗 Click-Worthy Stuff: Check These Out

- This report from the USGS which quantifies the economic value of the Landsat program, which grew from $3.4B in 2017 to $25.6B in 2023.

Working on this project, which attempted to put a monetary value on satellite imagery, with an honest approach, is perhaps the most interesting and the most important work I have ever done. It was an absolute honour to collaborate with some world-class economists and researchers.

- This resource that demonstrates using satellite data, among other sources, showing how half the world’s population already faces water scarcity;

- The brand-new EO Summit website if you want to learn more about the conference or download the sponsorship brochure.

One Discussion Point

Exclusive analysis and insights from TerraWatch

EarthDaily Analytics' Acquisition of Descartes Labs

The inevitable consolidation of EarthDaily Analytics with Descartes Labs—both belonging to Antarctica Capital's portfolio —has happened. The shake-up of the EO sector is well underway. The next three years will define the future of the commercial EO segment.

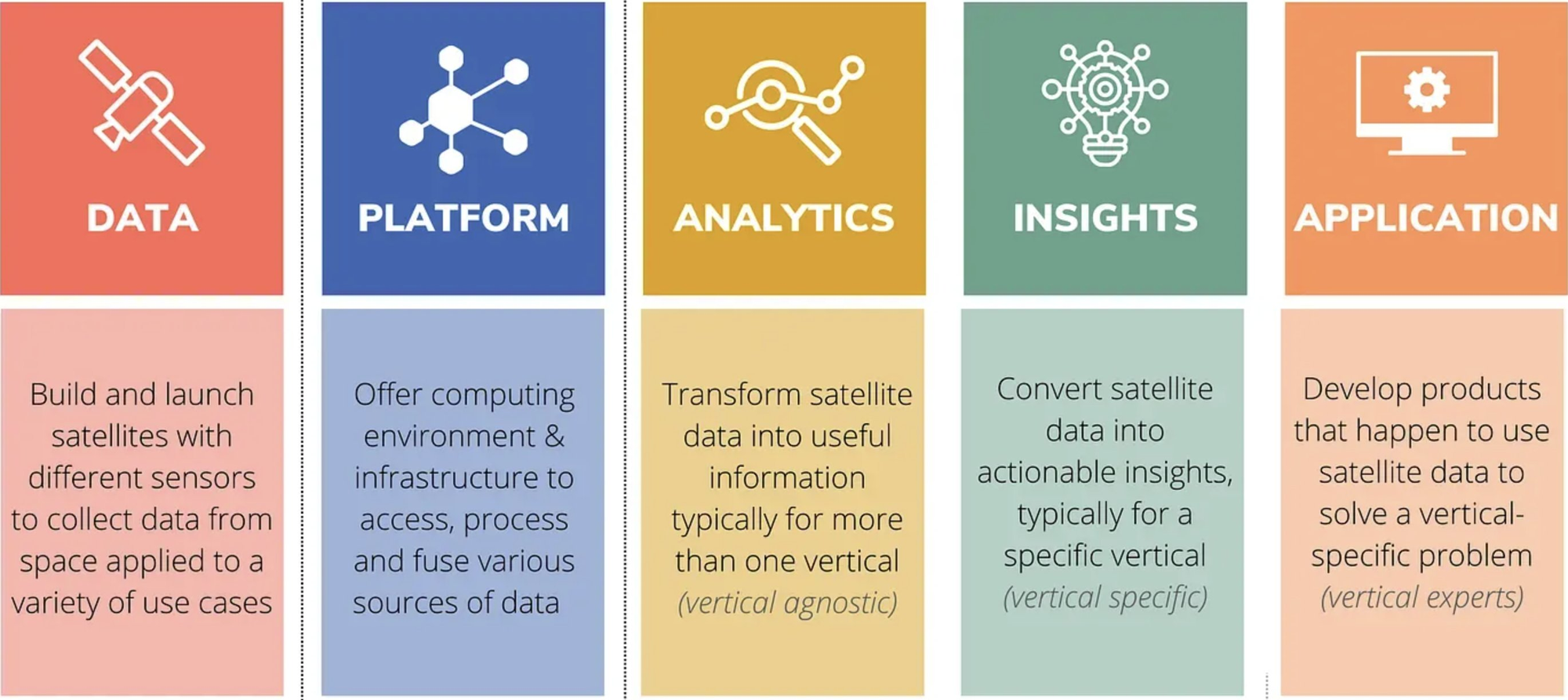

EarthDaily is now a fully vertically integrated player in Earth Observation across Data, Platforms, Analytics, and Insights. For comparison, Planet, Maxar,, and Airbus all operate in some form across those four market segments, potentially making them the big four of EO - not by revenue, but by market positioning.

(The huge caveat in the statement above is that while the other three companies have operational satellites in orbit, EarthDaily will have their first satellites launched in 2025.)

This acquisition was always coming, given the common ownership - so this is not much of news in itself. What is interesting is the evolution of the EO sector and how the major EO companies are extremely complex - both in terms of what they offer and their business models (this is why I have a job!)

- Maxar, which recently created the Maxar Intelligence business unit, offers very high-resolution satellite imagery (including 3D imagery and SAR via Umbra), an EO platform to access data, analytics, and insights on vessel detection, weather information, climate risk, and more.

- Airbus, part of the Airbus Defence and Space unit, also offers very high-resolution satellite imagery (optical and SAR), an EO platform to access data, proprietary and partner-based analytics, and insights on infrastructure changes, land use, vessel and vehicle tracking, and more.

- Planet, which acquired Sinergise last year, offers medium and most recently very high-resolution imagery, along with hyperspectral data, an EO platform to access and process data, and analytics and insights to detect roads and buildings, to measure forest carbon, soil moisture, and more.

- EarthDaily, which was formed following the demise of UrtheCast, plans to offer medium-resolution satellite imagery, proprietary tools to create analysis-ready data, an EO platform (thanks to the acquisition of Descartes Labs), analytics and insights specifically targeted at the agriculture sector.

Does this mean that any aspiring EO company will have to offer data, platform, analytics, and insights in some capacity? What does it say about companies that have made strategic choices to offer only EO data and not enter other market segments? Or are they all wrong, and will all EO companies have to start going down the value chain at some point in their evolution?

Those are some questions that I advise my clients on. If you are an EO company that would like to validate your commercial strategy or if you are a VC or private equity investing in EO companies that would like strategic insights on the EO market, get in touch.

Or, become a premium member to receive exclusive insights on the EO market and read the deep-dives on the state of EO platforms, EO for climate risk, EO for greenhouse gas emission monitoring, EO for carbon monitoring, and more.

Scene from Space

One visual leveraging EO

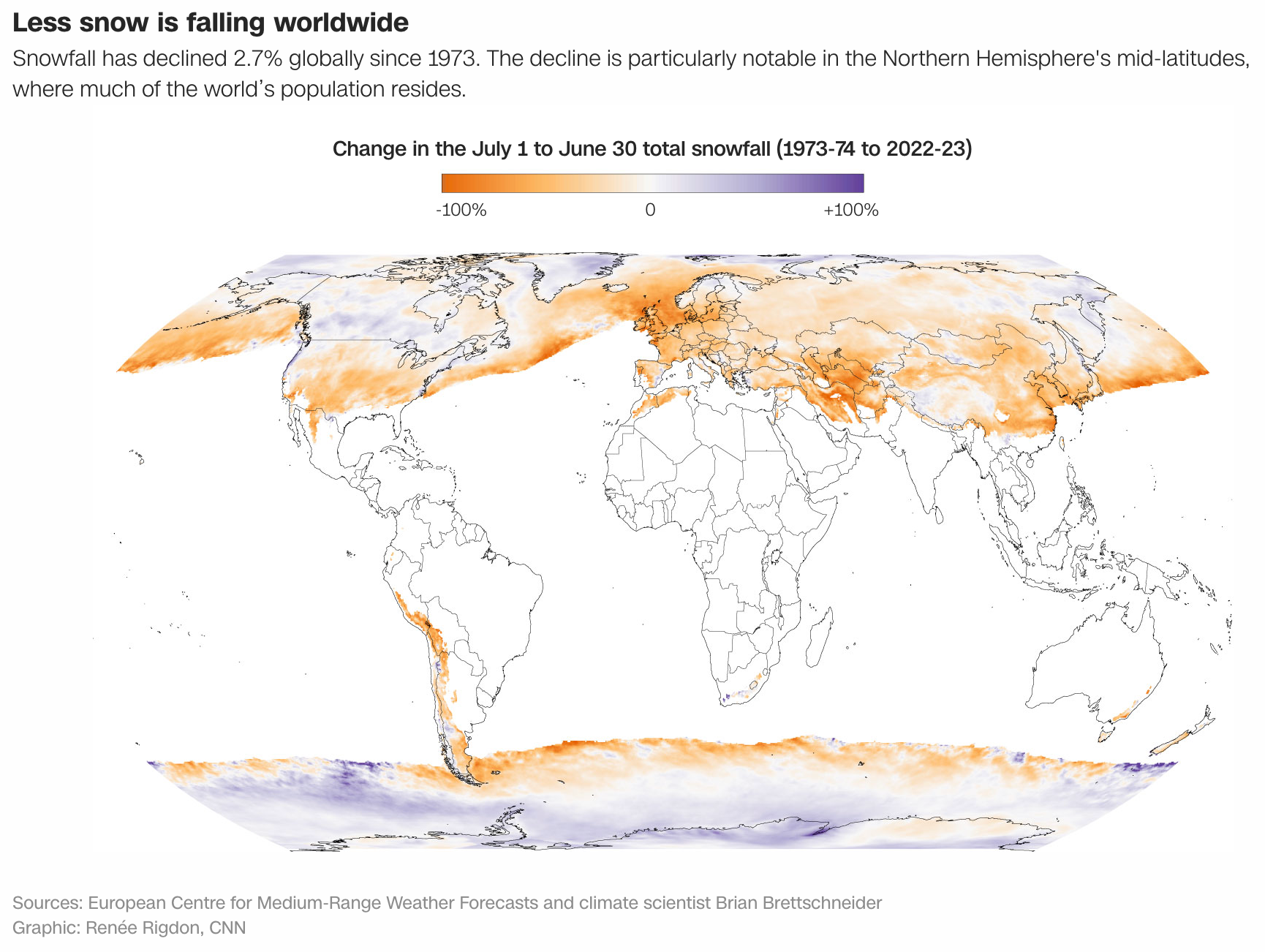

Declining Snowfall

A new analysis published by a NOAA climate scientist shows that snowfall is declining globally as temperatures warm due to human-caused climate change. The rate at which snowfall is declining worldwide (2.7% since 1973) can potentially disrupt the food and water supply for billions of people worldwide.

Until next time,

Aravind.