Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- The US Space Force’s Space Development Agency (SDA) awarded a $2M contract to SAR satellite company Umbra to assess how its satellites could integrate into the military’s next-generation satellite network;

- The SDA also selected 19 satellite providers for future space demonstration projects, including EO companies Capella Space, Muon Space, and BlackSky.

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- The Group on Earth Observations announced the launch of the proof-of-concept for the Global Ecosystems Atlas, which aims to map and monitor all the world’s ecosystems.

- The UK Space Agency has assumed the rotating leadership of the Committee on Earth Observation Satellites, with ambitions to improve EO data uptake;

- Data platform Earthmover has announced the release of the Icechunk storage engine, a new open-source library, and specification for the storage of multidimensional arrays on the cloud;

- Planet announced the release of Analysis-Ready PlanetScope, a new product leveraging a proprietary algorithm to create harmonized and spatially consistent data useful for developing machine learning applications.

There has been so much interest and investment in launching new EO satellites in the past 3-5 years. However, there has been relatively limited interest and investment in solving the boring problems of standardization, interoperability, and analysis-ready data in EO. So, the last two nuggets are welcome developments for the sector.

Growth in the EO sector is not inevitable, and it is not going to happen by just launching more satellites. Making satellite data accessible, usable, and reliable is the foundation for incentivizing intermediary users and end users to adopt EO on a large-scale basis.

Partnerships

- EO instrument provider Simera Sense and Belgian research institution VITO are teaming up to work on reducing the latency of translating raw data to analytics-ready data;

- EO platform SkyFi is collaborating with geospatial services firm Makepath to provide custom geospatial services;

- Indonesia is partnering with China to develop a constellation of 19 satellites with optical and radar sensors for military and civilian applications.

🗞️ Interesting Stuff: More News

- The US National Reconnaissance Office (NRO) is preparing an open call to invite EO satellite companies across optical, radar, hyperspectral, and lidar to submit proposals on an ongoing basis;

- SpaceX launched the fourth batch of satellites for NRO’s proliferated constellation, touted to be the largest EO satellite constellation in history;

- China launched a trio of satellites for ground radar equipment calibration and radar cross-section measurements.

🔗 Click-Worthy Stuff: Check These Out

- This paper that provides an overview of usable Landsat and Sentinel-2 data for 1982–2023;

- This article that links to a research paper that shows how wildfires are not only getting bigger but are also spreading faster, using NASA satellite data on 60,000 wildfires in the US between 2001 and 2020;

- This page from Landsat that presents some interesting stats on the Landsat program, the data products, and the applications.

- Every day, about one terabyte (TB) of new Landsat mission data is acquired and downlinked.

EO Summit 2025: Call for Sponsors

If you are an EO company and would like to position yourself in front of end users, investors, and other EO companies, then become a sponsor for EO Summit. You need to be where your customers, partners, and investors are.

We have some attractive sponsorship options available on a first-come, first-served basis. Check out the sponsorship brochure for more information!

Note: Our Platinum and Gold sponsorships are already sold out. Email eosummit@terrawatchspace.com, if you are interested!

One Discussion Point

Exclusive analysis and insights from TerraWatch

5. The State of Weather Satellites (and Why They Barely Get Any Attention)

The US military’s weather satellite program is in flux as the US Space Force is evaluating different options after launching a demonstration satellite earlier this year. Recently, the US Space Force even took ownership of a retired NOAA weather satellite to fill gaps in coverage for the U.S. military. If you are wondering why the Space Force had to rely on a decade-old satellite, it is because that is all they can do now to acquire weather data - the US military still uses weather data from 1960s-era DMSP satellites.

The US military's weather program, the Defense Meteorological Satellite Program, consists of two decades-old satellites that are running out of fuel and are projected to be out of service before 2026. This is why the Space Force and the Air Force are acquiring weather satellites from the private sector (Tomorrow.io and General Atomics) to try and fill the gaps as quickly as possible.

But how did we get here? How has there not been a trend similar to the imaging segment, in which the private sector has won billion-dollar contracts (with more coming soon) to supply satellite imagery to the US DoD? Where are the companies supplying weather data?

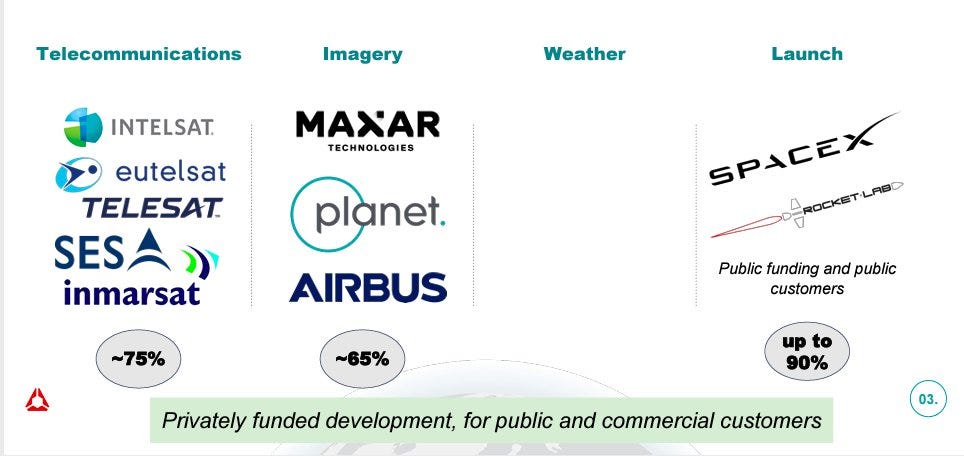

The following figure, from a Spire presentation, is a tad outdated - today, as there are a handful of weather satellite companies, but the message it sends is not entirely wrong. The number of weather satellite companies is nowhere near the number of EO imaging satellite companies.

The Space Force believes that the available offering from the private sector doesn’t fill their needs just yet, and hence, they announced that they will not resort to a model akin to the data buy approach in the imaging business anytime soon. NOAA, the civilian weather agency, on the other hand, believes that “it expected more satellite companies to enter the market, but they have been slow to emerge.”

It might seem like the commercial space industry has effectively ‘failed’ in delivering to the needs of NOAA and the US DoD, with respect to the acquisition of satellite data for weather forecasting. But, there are two important reasons why I think this is the case:

- A lack of understanding of weather from space

I cannot overemphasise this: Very few industry professionals and investors actually understand the weather segment properly. Based on my experiences, not many have insights into the gaps in weather forecasting and climate modelling, the technologies we need to fill those gaps, and the challenges of the private weather enterprise.

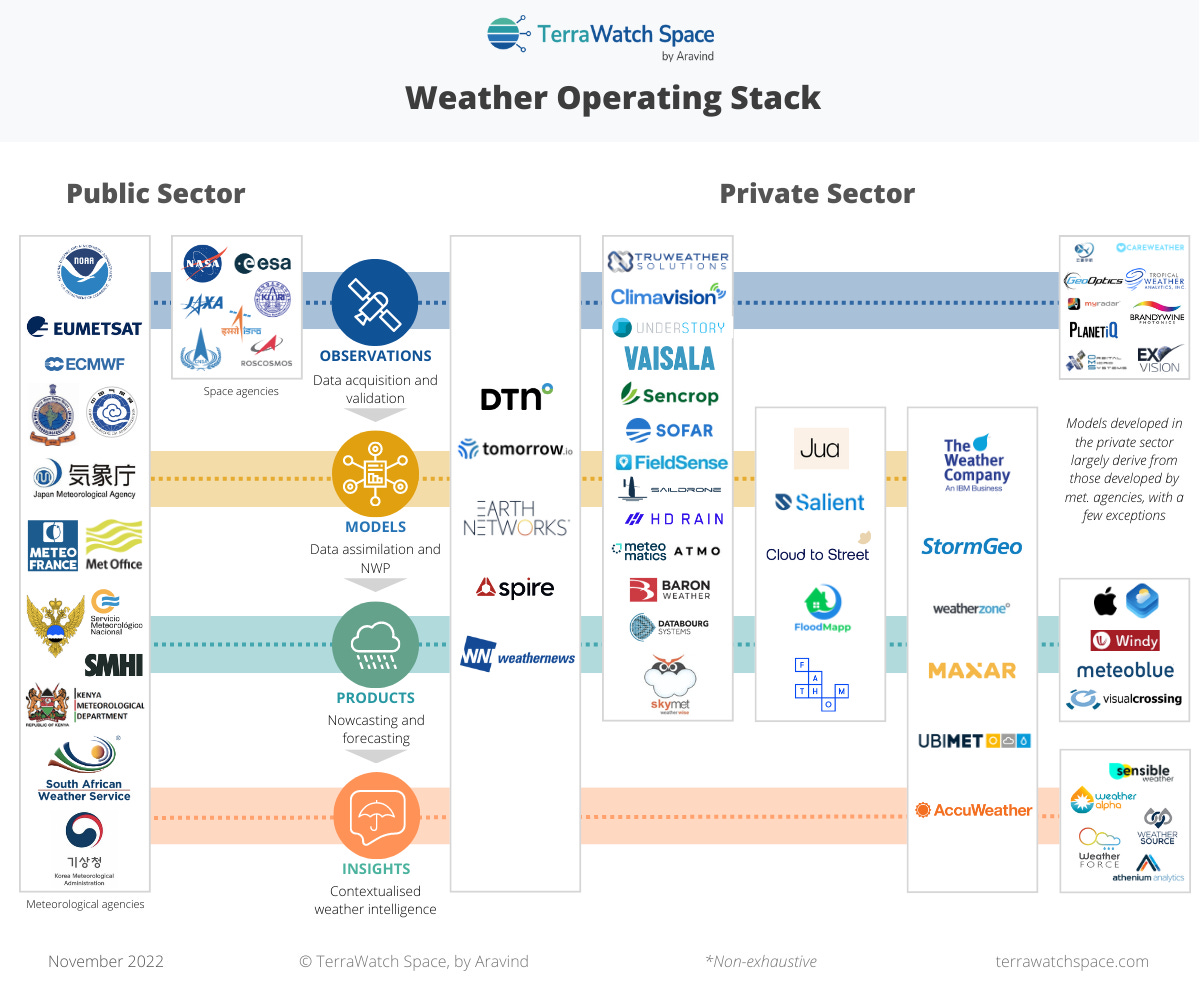

Weather has been in the realm of governmental agencies, owning the gap analysis, missions, and roadmaps, with the private sector mostly just executing. Just like in the early days of EO imaging, weather was restricted to the scientific community. Some of us may even (incorrectly) assume that we are doing fine with the collection of weather data and that he space agencies are taking care of everything - but no, there are plenty of gaps. I believe these gaps will increasingly come to the forefront, especially as the effects of climate change take center stage globally.

- The tricky business case for weather from space

Only a handful of weather agencies globally are in a position to buy spaceborne weather data because they are the only ones who know what to do with it. There is also an added complication due to the open data sharing policy, which might seem ethically right for weather data but might not be the best thing for running a business—more on that in my deep dive.

So, the private sector is forced to employ a "build it, they will come" approach, which is not a good business case for starting a company. Also, agencies don't sign large contracts once data is available; they award smaller contracts to evaluate data quality (and rightly so) before moving to a long-term procurement. This means there is a severe lack of incentives for companies to create business plans to build and launch satellites.

Companies are expected to go all-in to both launch their satellites and also vertically integrate - they need to sell weather data to agencies (Data-as-a-Service model) and build enterprise software to sell weather insights to companies across sectors (Software-as-a-Service model). However, this full-scale vertical integration is expensive and makes weather companies very capital-intensive - so very few companies even attempt to enter the satellite weather market.

Therefore, it is no surprise that the list of companies building and launching weather satellites as a business is a pretty short list - Tomorrow.io, Spire, GeoOptics, PlanetIQ, Orbital Micro Systems, MyRadar and Care Weather (not including the prime contractors such as Lockheed Martin and BAE Systems).

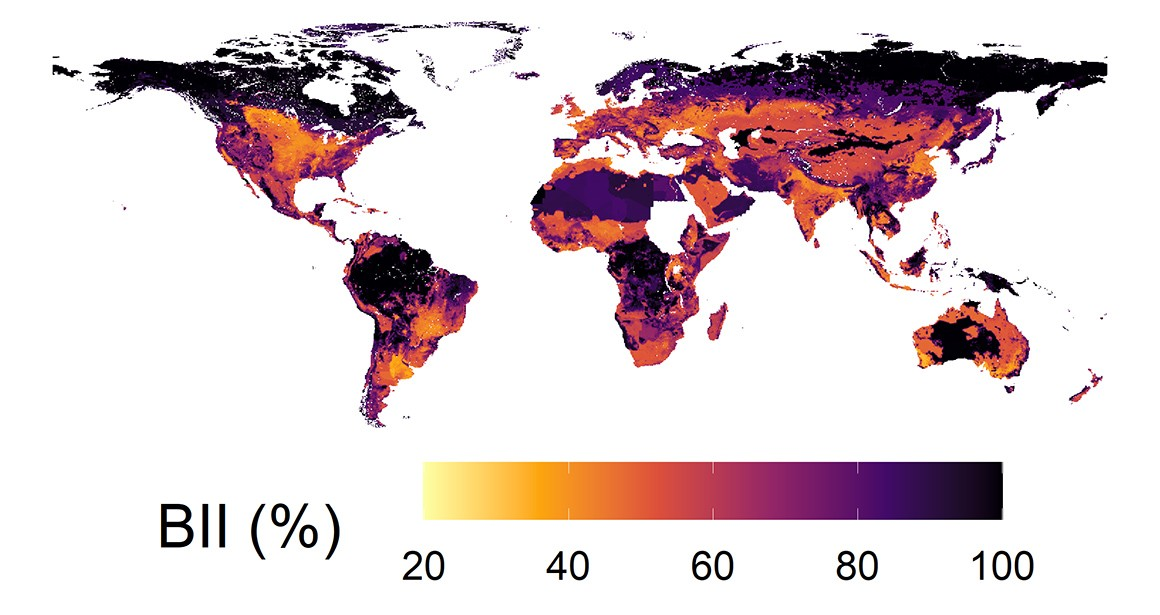

We have a lot of work to do, both in communicating about the importance of weather from space, filling the gaps in weather data around the world (see below), and figuring out the business models for satellite-based weather data. After all, the planet is not getting any cooler.

If you want to learn more, check out my deep dive on weather from space.

Become a premium member to receive exclusive insights on the EO market and read the deep-dives on the state of EO platforms, EO for climate risk, EO for greenhouse gas emission monitoring, EO for carbon monitoring, and more.

Upcoming deep dives include EO for wildfire monitoring (October 30) and EO for nature and biodiversity (November 29).

Scene from Space

One visual leveraging EO

Biodiversity Intactness

A recent analysis by scientists at the Natural History Museum in the UK showed that the current conservation efforts are not adequately protecting the most critical ecosystem services on which six billion people depend. Based on the Biodiversity Intactness Index (BII), which combines satellite imagery, data collected in the field, and algorithmic modelling, the analysis shows that the current efforts to achieve the global objective to conserve 30% of land and waters by 2030 might not be enough.

Until next time,

Aravind.