Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Important: As we have changed newsletter platforms, you might need to add this email address to your contacts to regularly receive the newsletter.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Contracts

- The National Geospatial-Intelligence Agency selected ten EO firms to compete for up to $290M in contracts to provide commercial satellite imagery and data analytics over the next five years.

- The selected companies include Airbus U.S. Space & Defense, Booz Allen Hamilton, BlackSky, BlueHalo, CACI, Electromagnetic Systems Inc., Maxar Intelligence, NV5 Geospatial, Royce Geospatial Consultants, and Ursa Space Systems.

- Iceye won a contract from the Greek government to provide sovereign SAR satellites in addition to access to Iceye’s existing SAR satellite constellation.

- In total, Greece has awarded contracts worth up to €133M, including the contracts to OroraTech and Open Cosmos, earlier this year.

- Israeli EO firm ImageSat International signed a contract with an undisclosed customer in Asia to supply two RUNNER advanced high-resolution EO satellites.

- Australian mapping agency Geoscience Australia signed a contract with EO-based flood risk analytics firm Fathom to support flood management.

Earnings

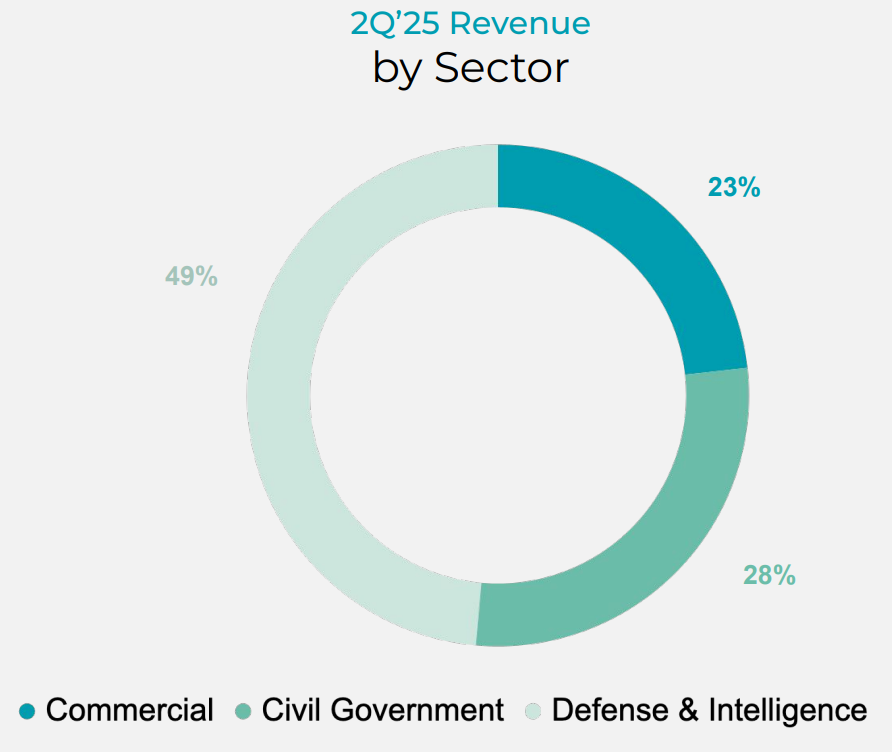

- Planet reported $61.1M in revenues for Q2 2024, representing a 14% increase year-over-year.

- Interestingly, the government segment (including defense and civilian) contributed over three-quarters of Planet's revenues, while the commercial segment was less than a quarter share.

📈 Strategic Stuff: Partnerships and Announcements

Partnerships

- Australian agriculture firm Elders is teaming up with SmartSat, an Australian space consortium, to explore the application of EO in agriculture;

- German defense firm Rheinmetall is partnering with Iceye to integrate SAR capabilities into their next-generation battlefield systems and obtain exclusive rights to distribute SAR satellites to governments.

Announcements

- Techstars, a startup accelerator, announced its fall 2024 cohort, which includes three companies related to EO:

- SkyServe - an Indian startup working on edge computing for EO; Spiral Blue - an Australian startup working on a space-based lidar constellation; and Mithril Technologies - a US-based startup working on a space-based reflector to improve atmospheric monitoring.

- Nibe Limited, an Indian defense firm, has announced plans to build and launch a multi-sensor, all-weather, high-revisit EO sovereign constellation.

🔗 Click-Worthy Stuff: Check It Out

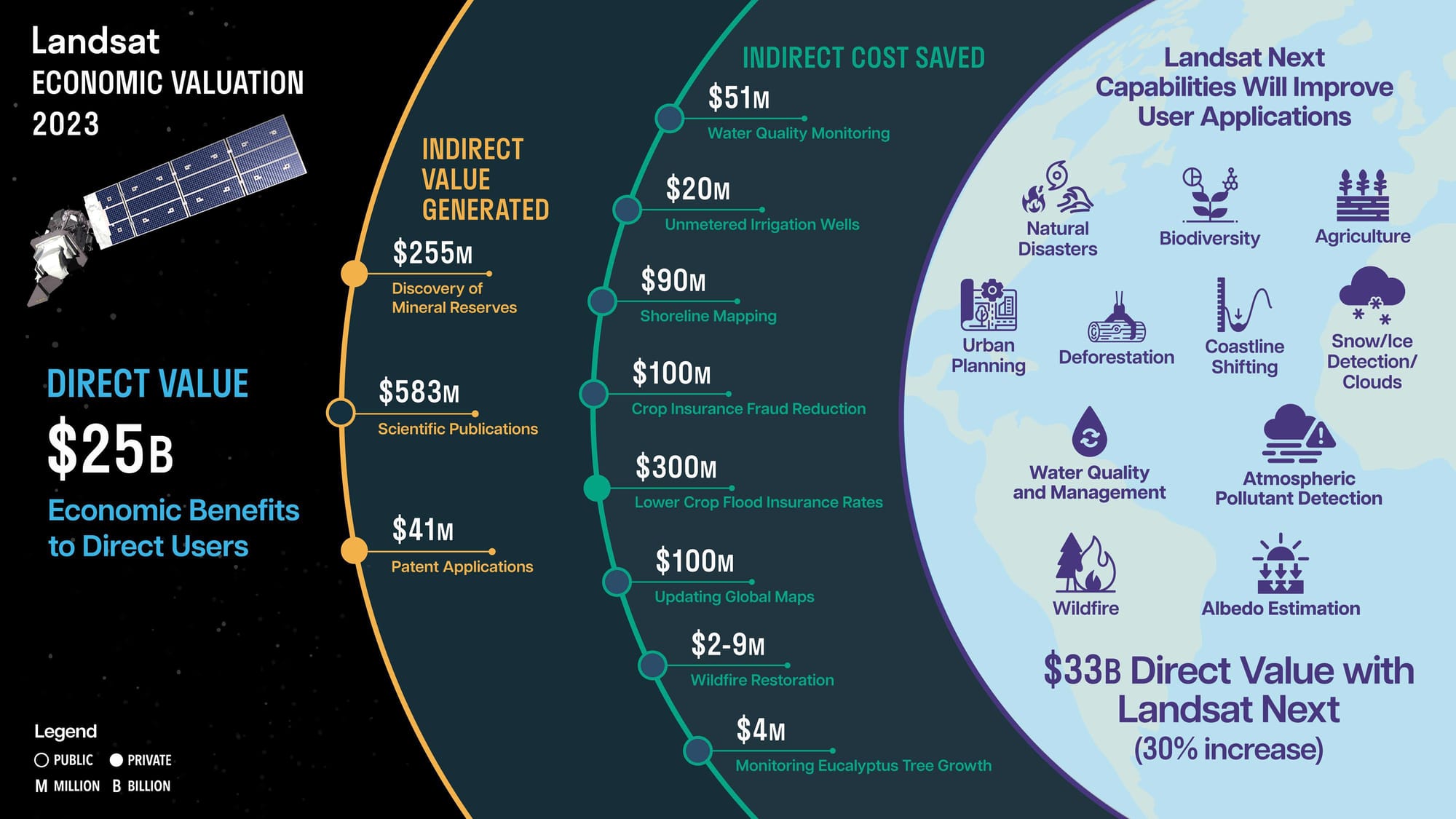

The "Economic Valuation of Landsat and Landsat Next" report, commissioned by the U.S. Geological Survey, has been published. The report details the quantitative and qualitative benefits of the Landsat satellites that have acquired imagery since 1972.

I feel very fortunate to have worked on this project with a brilliant team of economists and researchers from Colorado State University, led by NATECH. Given the significance of this report for the future of Earth observation, I consider it to be the most important and possibly the most impactful work I have done so far in EO.

Key Highlights

- Landsat led to $25B in direct economic value in the US in 2023 from direct users - meaning this figure does not include the value derived from indirect users using Landsat from platforms such as Google, Amazon, Microsoft, Esri, etc. So, this figure is a huge underestimation, and I hope these platforms will publish information on how Landsat is used.

- The value derived from indirect users was classified into two categories: value generated and cost saved. We have gathered and modeled some case studies of how using Landsat resulted in over $2B in new value generated or costs saved. This is by no means exhaustive, but it is a good reminder for everyone using Landsat to reference it and discuss how useful it is for their use case.

- Landsat Next, expected to launch in 2030/2031, will provide even more advanced capabilities, including 10 m resolution, 26 bands, and a 6-day revisit. While it is not easy to predict the economic value for a dataset that does not currently exist, we were able to model and estimate the potential economic benefits across sectors, resulting from the improved dataset to be $33B.

Infographic

We created this infographic to summarise the results of the report, but I encourage anyone interested in EO to read the report, or at least the executive summary, so that you can understand the benefits of an open data program like Landsat and not take the program for granted.

One Discussion Point

Exclusive analysis and insights from TerraWatch

The Three EO User Personas

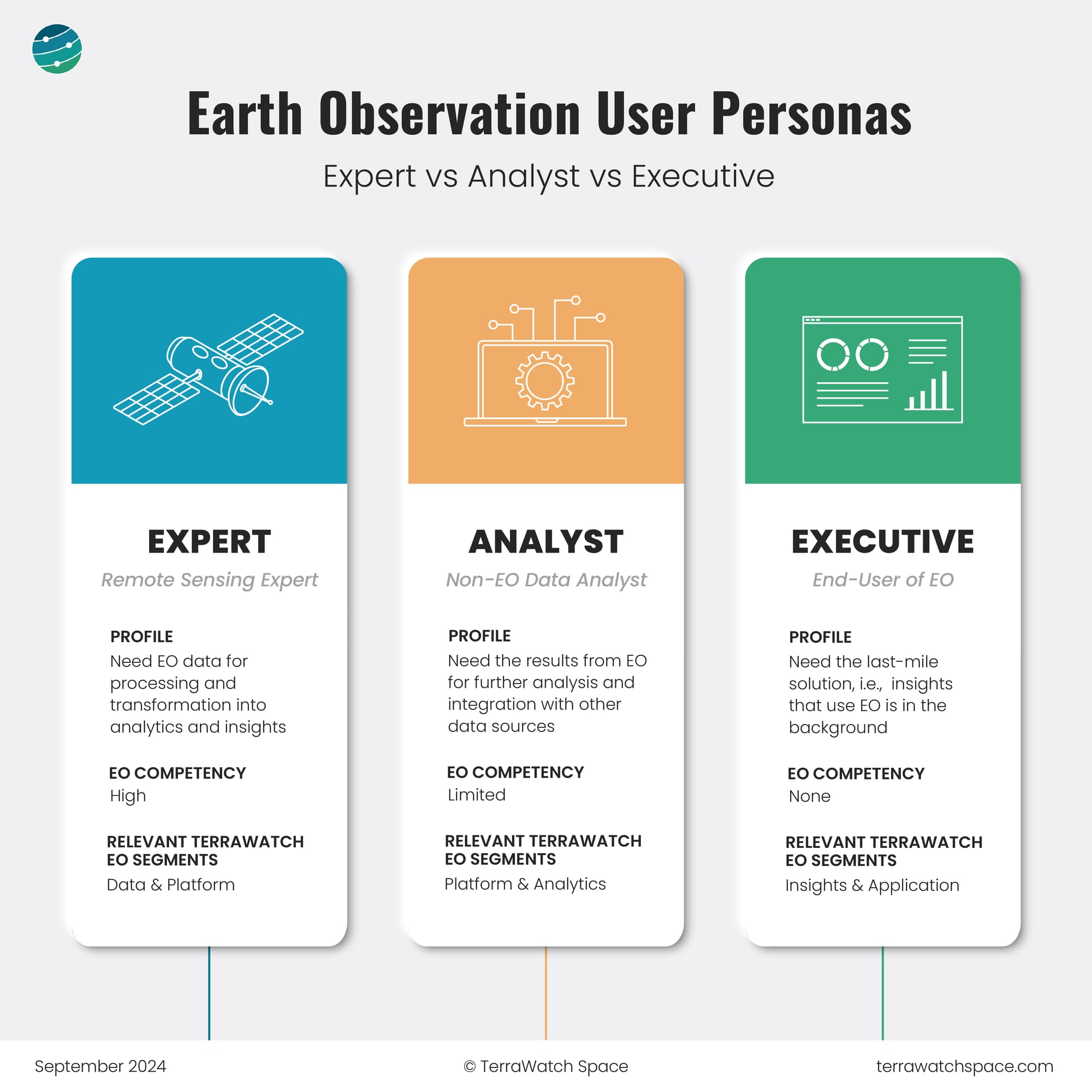

The figure below provides a simplified version of the three EO user personas I use in TerraWatch consulting engagements, especially when drafting go-to-market strategies and building marketing content for EO companies as well as while conducting due diligence assignments for investors and private equity firms.

The aim of the classification (Expert vs. Analyst vs. Executive) is to ensure EO companies (whether they are building satellites, platforms, analytics, or applications) have the correct market positioning, create the right kind of products in the market, and build appropriate marketing content.

Executives do not care about EO and just need the insights, analysts care a little but do not want to work with satellite data and just need the results of EO for further analysis, and experts love to get their hands dirty with satellite imagery and help transform it into analytics and insights.

Scene from Space

One visual leveraging EO

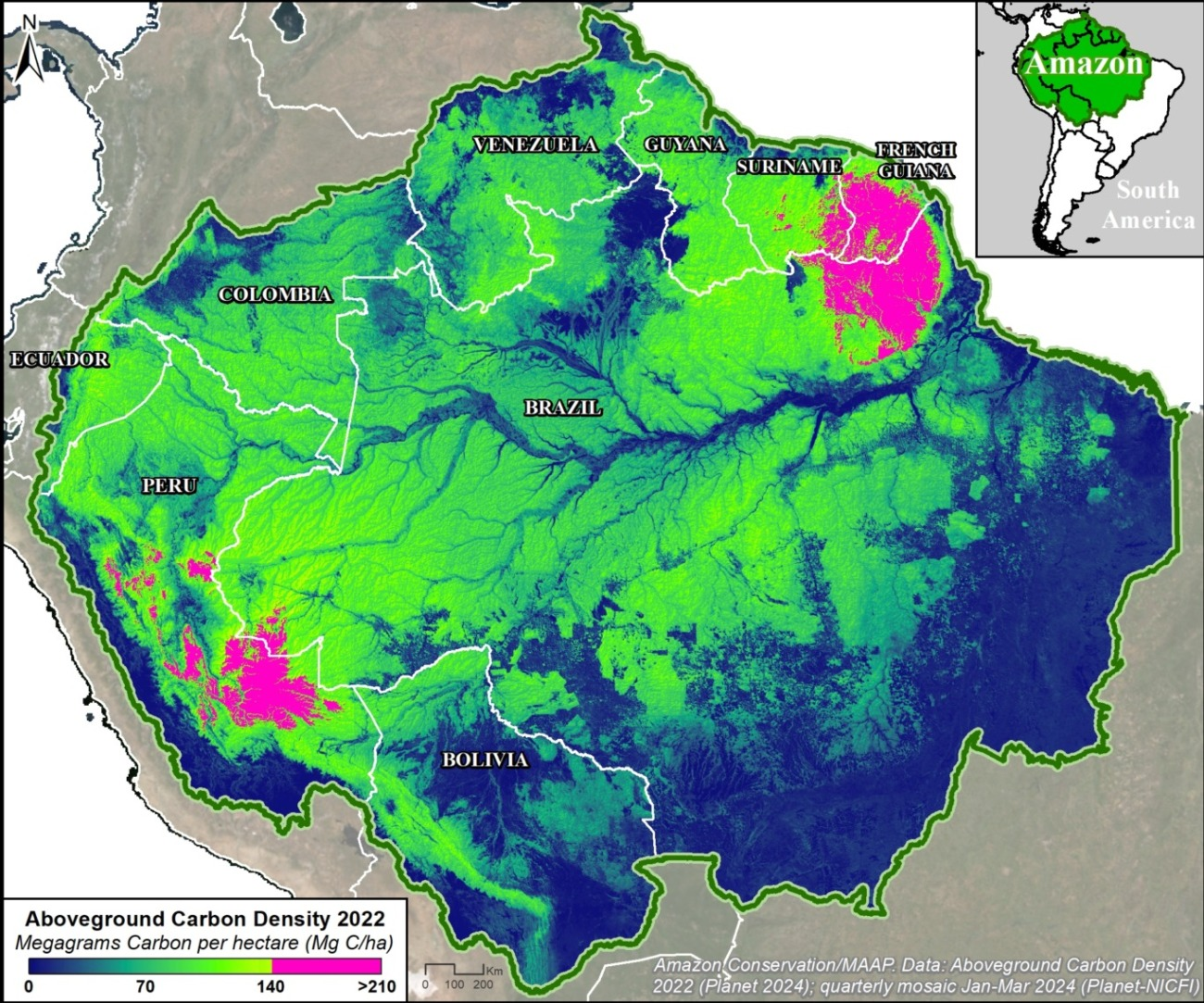

Forest Carbon of the Amazon Rainforest

The aboveground carbon density of the Amazon Rainforest was estimated to be 56.8 billion metric tons, leveraging satellite data from Planet and NASA, among others. This is considered one of the most precise readings ever of forest carbon in the Amazon and provides useful information on where the forest is most intact and which areas most need conservation.

The study concluded that the Amazon Rainforest is still acting as a carbon sink rather than a carbon emitter, which is good news from a climate standpoint. The following figure shows the aboveground carbon density derived from Planet's data.

Until next time,

Aravind.