Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Quick housekeeping: In case you missed it, we have switched newsletter platforms (from Substack to Ghost). You can see that the homepage for the newsletter looks a lot different (and, I hope, better).

We made this migration to improve your reading experience, especially by making the existing content more accessible. You can now easily access the analysis and insights published by category, including the infographics.

Important: As we have changed newsletter platforms, you might need to add this email address to your contacts to regularly receive the newsletter.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- Singapore-based EO marketplace Eartheye Space raised $1.5M in a pre-seed funding round to expand its online satellite-tasking platform.

- For more on EO platforms, check out the deep dive from TerraWatch.

Contracts

- Israeli EO firm ImageSat International was awarded a $54.5M contract to provide EO analytics services for an International Defense Customer;

- Satellite-based radiofrequency monitoring firm Unseenlabs ordered four new satellites from Danish satellite manufacturer GomSpace;

- Nuview selected Space Flight Laboratory to supply the bus for its first lidar-equipped satellite;

- NOAA awarded GNSS radio occultation data providers Spire and PlanetiQ follow-on contracts worth $3.8M and $6.5M as part of the commercial weather satellite data program;

- NASA has selected eight commercial EO satellite data providers for a total contract worth $476M under the Commercial SmallSat Data Acquisition (CSDA) Program until 2028.

- The selected EO companies - BlackSky, ICEYE, MDA Space, Pixxel, Planet, Satellogic, Teledyne Brown Engineering and Tomorrow.io - join the other eight EO companies that were awarded last year, will provide multispectral, SAR, hyperspectral and weather data to support NASA’s Earth science research and application activities.

My thoughts: The CSDA contracts represent the second largest addressable market in EO, following the NRO/NGA contracts in the defense sector. So, this is quite a big win for the companies and the EO sector. NASA is doing an incredible job supporting EO satellite companies with their business case, while also benefiting from additional data for research. It is crucial for the public sector to not just be a funder of EO projects, but more importantly a consumer of EO data for civilian applications.

M&A

- French defense firm Safran finalised the acquisition of EO-based geospatial intelligence firm Preligens for €220M;

- Infrastructure engineering software firm Bentley Systems acquired Cesium, a geospatial 3D data platform company.

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- The US National Geospatial-Intelligence Agency (NGA) announced that it will launch a $700M AI initiative aimed at labeling satellite imagery and other data over the next five years;

- Climate risk analytics startup Riskthinking.AI has launched a climate risk AI assistant that provides risk assessments of major corporations through an interactive, chat-based interface;

- Google has announced the launch of a new Heat Resilience tool that uses AI and EO data, among other sources, to help cities tackle extreme heat.

Partnerships

- Insurance services firm Aon has expanded its collaboration with SAR solutions firm Iceye to include its Flood Insights and Wildfire Insights products;

- Iceye signed a partnership agreement with Polish imaging instrument supplier Scanway to supply high-resolution optical satellites for the Polish government;

- Australian EO platform startup Arlula is teaming up with hyperspectral data provider Wyvern and will integrate its data to the platform;

🗞️ Interesting Stuff: More News

- The NGA is creating a standardized framework for evaluating the accuracy and trustworthiness of AI models used to analyse satellite imagery;

- SpaceX launched the third batch of satellites it is building for the US National Reconnaissance Office, together with Northrop Grumman, while China launched a group of Yaogan-43 military satellites;

- The Copernicus Programme's Sentinel-2C mission was successfully launched last week amidst calls for the continuation of the Sentinel-2A mission, which, with three Sentinel-2 satellites, will provide a higher revisit rate;

- Follow the discussion and an eventual clarification from an ESA official on my LinkedIn;

🔗 Click-Worthy Stuff: Check These Out

- This pretty comprehensive list of the remote sensing foundational models;

- This introductory course on machine learning for EO;

- The revamped version of the TerraWatch Space official website, that makes it easier for some of you to understand what we do.

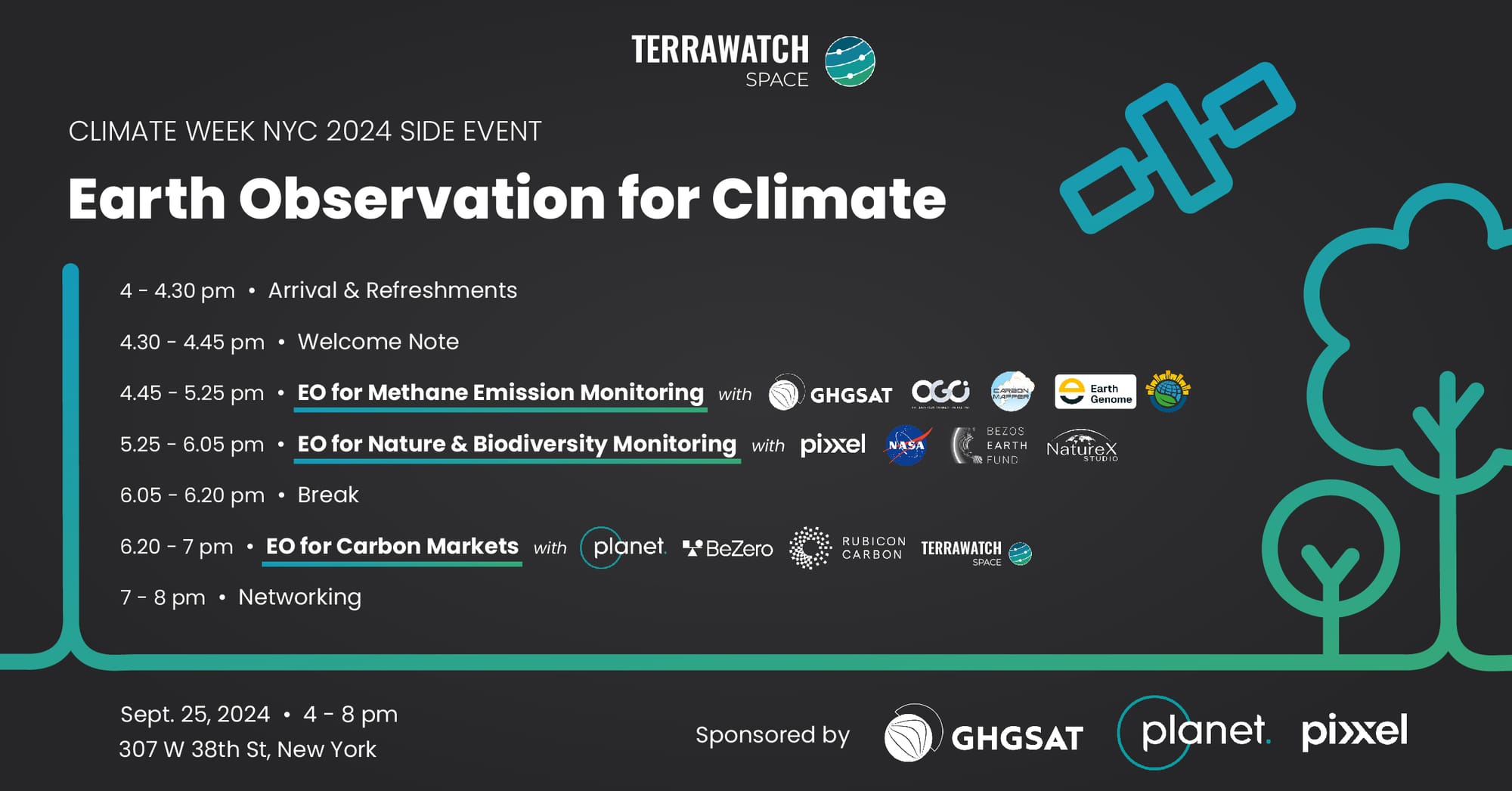

Earth Observation for Climate: Side Event during Climate Week NYC

We are organizing a side event focused on EO during Climate Week NYC on Sep 25. There will be three panel discussions on the use of EO across three use cases: GHG Emission Monitoring, Carbon Markets, and Nature & Biodiversity, with an exciting lineup of panelists.

Only a few more tickets are available! If you are attending Climate Week NYC and want to learn about EO for climate, register your place before we sell out!!

One Discussion Point

Exclusive analysis and insights from TerraWatch

Three Reasons Why EO Might be the Least Suitable Segment in the Space Industry for the Public Markets

I read this recent article on SpaceNews that provided an excellent breakdown of the state of the companies that went public via SPAC transactions in the last few years. As I read through the past financial performance and the outlook for the four EO companies in that list, I couldn't help but wonder whether EO as a market segment might, in retrospect, be the least suitable kind for trading on the public markets.

I lay down three reasons why I think that might be the case, largely derived from the numerous conversations I have had with retail investors and large investment funds, who were attempting hard to demystify the EO market.

1. Complicated Market Positioning

Let's be honest. Even if you regularly track the EO market, you need to spend a lot of time understanding the nuanced differentiation and competitive advantages in the EO market—a simple comparison of spatial resolution numbers won't work. For instance, a 30 cm imaging capability would not simply result in three times the revenues, as 1 m or 30 bands are not necessarily valuable compared to 10 bands.

I believe only a few investors with a nuanced, deeper understanding 'get' the EO market, but most do not. Unfortunately, a crowded landscape with more than five dozen companies targeting the same market with the same messaging does not help. Nor did the pitch decks of the companies that went public, almost all of which showed J-curves, without acknowledging the reality of EO.

- Unrealised Long-Term Commercial Market Potential

While revenues from the defense and intelligence vertical and its overall addressable market have been steadily growing, most other commercial markets (insurance, finance, agriculture, mining, energy, climate, etc.) continue to be in the "has a lot of potential, but got nothing to prove that" bucket.

While I am certainly betting on that potential myself and willing to wait a few years (and help enable that potential to be realised with TerraWatch), I am unsure if public investors will. EO is a long-term focused market with compounding value over time and volatile short-term returns.

- Atypical Business Models

Some companies sell data with a timebound, unlimited-quantity model, some sell analytical products on a subscription basis, a few sell EO satellites directly, and others offer some combination of this.

None of these make it easy to forecast revenues - unlike the satellite communications or the launch segments where scale is somewhat easy to predict, and you can model revenues in a simple spreadsheet. Investors have a lot of trouble understanding the EO market and those who do need to spend a lot of time and effort understanding the above nuances.

My Take? Earth observation is a long-term game. Solving societal, economic, strategic, and environmental challenges, like the EO market, is a long-term endeavour. The short-term winners will eventually face the purge, while the long-termers will create value and make an impact. We are living in a golden era of EO, at a time when EO data is most needed to solve our challenges. While EO might have lost the interest of the public markets, but I am pretty confident we can win it back if we change our old ways.

Scene from Space

One visual leveraging EO

Wildfires in South America

The wildfires that started in Brazil, widely believed to have been caused by human activity, have spread across South America and are now visible even from the Deep Space Climate Observatory spacecraft, which is 1.6 million kilometres away from Earth.

Until next time,

Aravind.