Welcome to a new, belated edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

💰 Contractual Stuff: Funding, Contracts and Deals

Funding

- A new hyperspectral EO firm, Matter Intelligence, emerged from stealth with $12 million in seed funding;

- South Korean SAR satellite manufacturer Lumir went public on the KOSDAQ stock exchange and raised $21M, less than the company expected.

Contracts

- French EO platform provider Gisaia won contracts from space agencies in Europe, South America, and Africa;

- Spire, together with OroraTech, was awarded a concept study contract by NASA to develop an early fire detection and wildfire monitoring system for wildfire-prone areas in the US.

- To learn more about EO for wildfire monitoring, check out the deep dive.

📈 Strategic Stuff: Partnerships and Announcements

Announcements

- PCI Geomatics announced that it would offer analysis-ready optical and SAR data, compliant with standards put forward by CEOS, an international organisation that coordinates space-based Earth observations;

- UAE-based high-altitude platform maker Mira Aerospace, part of Space42, announced its plans to acquire real-time data with proprietary EO payloads;

- TelePix, a South Korean satellite firm focusing on edge computing, announced the successful in-space demonstration of its AI onboard processor.

- To learn more about edge computing for EO, check out the deep dive.

Partnerships

- Indian EO firm SatSure is joining hands with mapping and surveying services provider Genesys International to develop integrated geospatial solutions;

- Data compression tech provider Dotphoton is partnering with EO satellite firm Satlantis to provide advanced image acquisition capabilities;

- EO-based environmental analytics startup Upstream Tech and carbon monitoring firm Chloris Geospatial are teaming up to provide forest carbon data on their platform;

- To learn more about EO for carbon monitoring, check out the deep dive.

🗞️ Interesting Stuff: More News

- A Brazilian private satellite, developed by Visiona, a joint venture between local firms Embraer and Telebras, has successfully sent its first images from space;

- Alaska Satellite Facility has released a cloud-based, open-science tool called OpenSARLab to facilitate the access and processing of SAR data.

🔗 Click-Worthy Stuff: Check These Out

- This article that discusses how EO is being used to help spot and clean up the millions of tons of plastic that enter marine and coastal ecosystems;

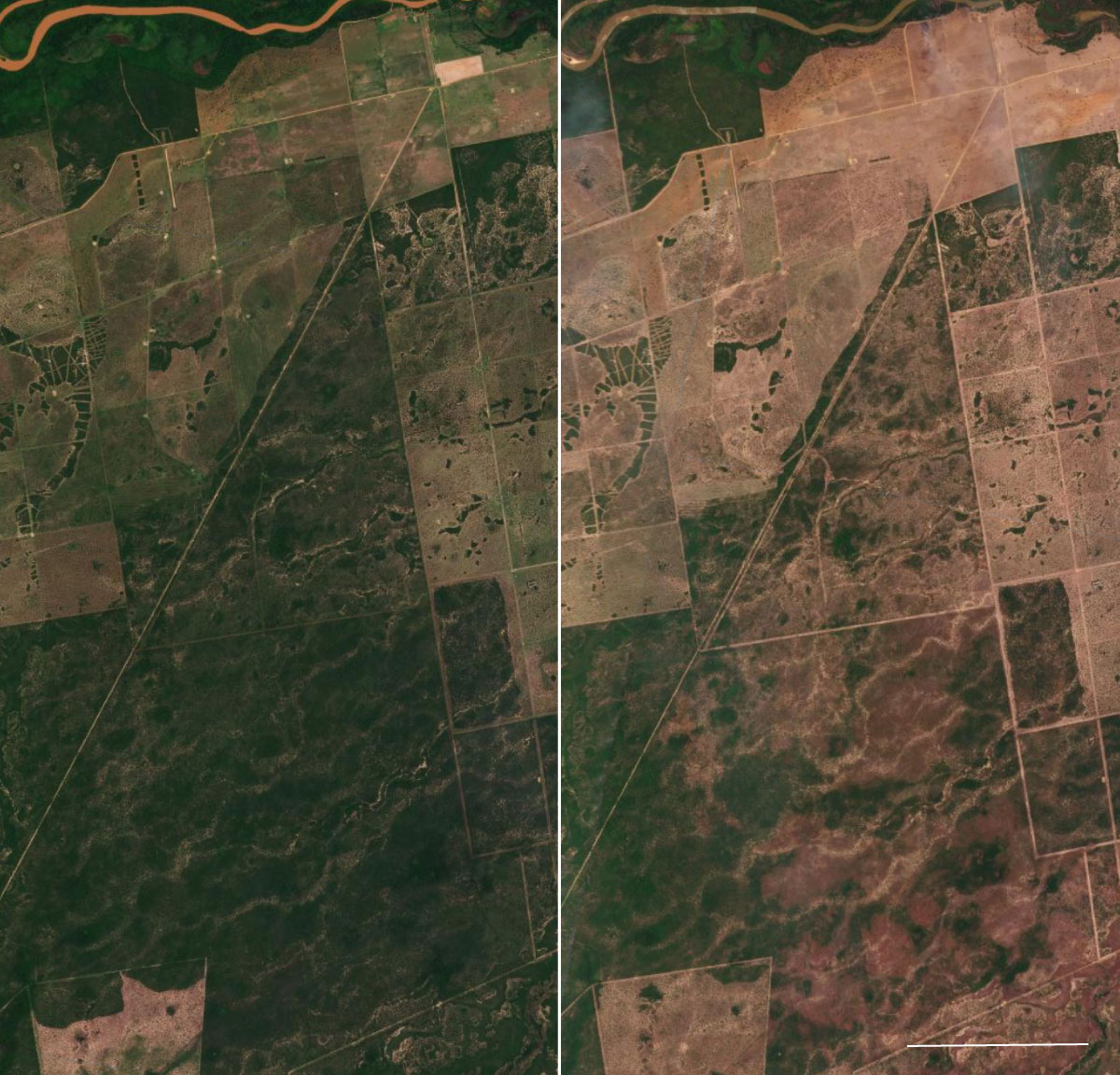

- This piece showing how some ranchers used chemical deforestation techniques to avoid detection by satellite-based monitoring systems, which typically look for abrupt forest disappearances.

- Chemical deforestation is a technique that uses herbicides to cause trees to lose their leaves before drying out and dying slowly. This makes it difficult to differentiate from natural tree death. Drying out forests makes them easier to burn, and the resulting fire destroys evidence that chemicals were ever used.

Did you know?

You can promote your organization and reach thousands of potential customers, partners, and investors by advertising on this newsletter.

If you are in Earth observation and want to improve your brand presence or simply promote a service, this is your opportunity to get in front of a highly engaged audience of over 12,500+ readers.

This newsletter reaches a multidisciplinary audience of Earth observation professionals, remote sensing experts, investors, and enterprises across multiple sectors - perfect for amplifying your brand and expanding your reach.

Reach out to info@terrawatchspace.com for more information!

One Discussion Point

Exclusive analysis and insights from TerraWatch

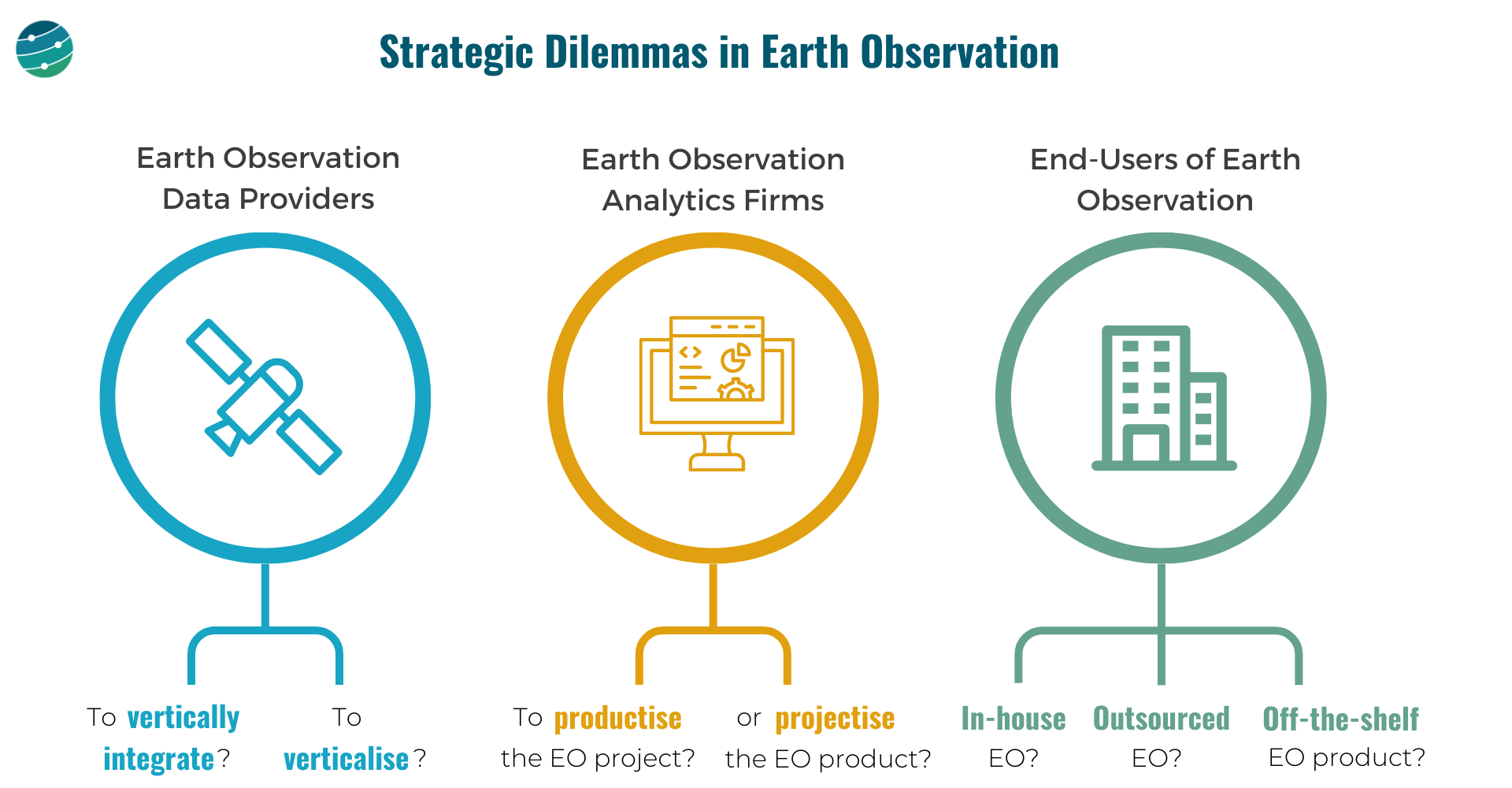

5. Strategic Dilemmas in the Earth Observation Market

Here are some of my thoughts on the big strategic dilemmas in EO, based on my experience working in the industry for the past several years. I have categorised them based on the three categories of stakeholders in EO.

- EO Data Providers: To vertically integrate or not? To verticalise or not?

- EO Analytics Firms: To ‘productise’ the project or ‘projectise’ the product?

- End-users of EO: In-house EO vs outsourced EO vs off-the-shelf EO product?

EO Data Providers

These companies are in the "Data" layer of the EO value chain. And they have two important choices to make:

- Whether to own as much of the EO value chain as possible or outsource building, launching, and operating satellites and just receive the data. And how far down the value chain should they go - just provide data or go one more step further and offer analytics? How do you draw the line?

- Whether to focus the go-to-market efforts on a specific vertical (insurance, agriculture, government etc.) or remain horizontal and serve as many markets as possible? Companies that verticalise could have an easier route to achieving product-market fit and scalability.

EO Analytics Firms

These companies operate in the "Insights" and "Application" layers of the EO value chain. They need to decide:

- How to convert the customized EO projects (solve a problem for each customer) into an EO product (that solves that problem scalably for many)

- And when do you say no to more projects and decide to work on a scalable product?

- Or can you pick projects selectively? Assume the current version of your EO product fits only 60% of a large client's requirements, while the other 40% does not fit into your product vision. Do you forego the big client for the product or can you afford to efficiently 'projectize the product'?

End-users of EO

The end-users of EO, who come from several sectors such as agriculture, insurance, finance, infrastructure, mining, etc. have some tough choices to make:

- Do they go with an in-house EO strategy i.e. build or expand the internal geospatial teams, design their own EO strategy, acquire data from several EO data providers and develop internal solutions with the data?

- Or do they go with an outsourced EO strategy, i.e., pick a geospatial consultancy to build custom products according to requirements and abstract themselves from most of the EO choices and challenges, leaving it in the hands of a custom EO solution provider?

- Or can they find off-the-shelf EO-based products that fit their needs for their use case in the market?

- A caveat is although some of these products offer ready-to-integrate analytics, the methodologies used for the work may not be transparent (aka ‘black boxes’).

These are learnings gathered through over 50 strategic assignments with EO data providers, EO analytics firms, and end-users of EO. If you are thinking through these questions in your organisation and need an external assessment of your strategy, I am happy to help.

Scene from Space

One visual leveraging EO

Record Droughts and Deadly Floods

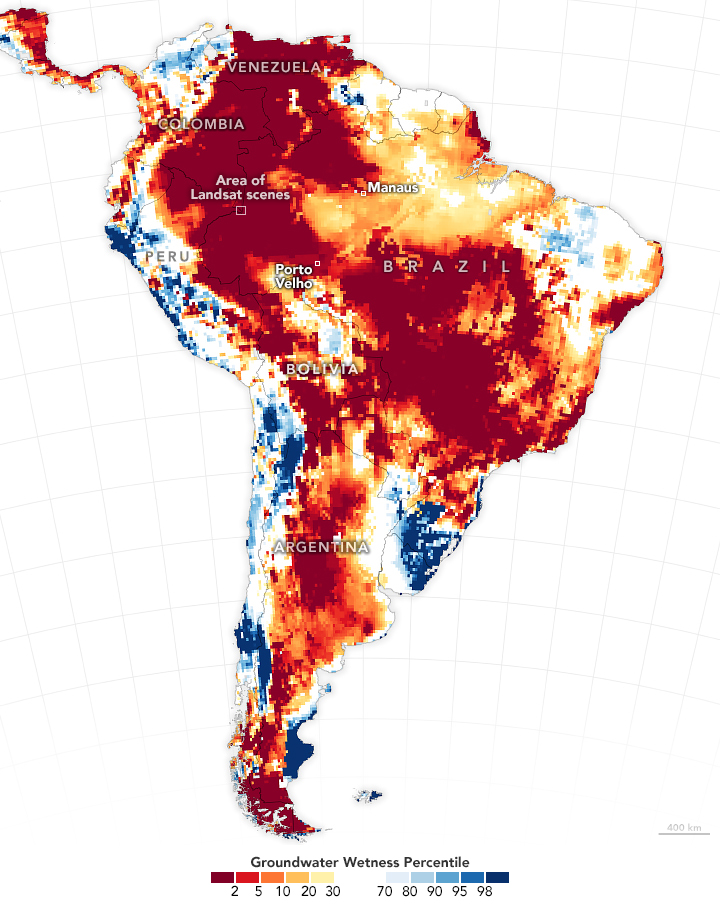

October 2024 saw some river basins, lakes, and reservoirs fall to record-low levels in parts of South America, including Brazil, Bolivia, Colombia, Ecuador, Peru, and Venezuela. The drought contributed to historic wildfires across the continent, with the lack of rainfall and low soil moisture amplifying the fires and causing them to spread faster and farther (even visible from space).

The image below shows shallow groundwater storage in October as measured by NASA's GRACE-FO satellites (possibly my favourite satellite mission of all time)—blue areas have more water than usual, and orange and red areas have less.

How does it work? The GRACE-FO mission detects changes in the Earth's gravity field. Since changes in the amount of water stored in a region can cause changes in the gravity, the satellite is able measure these changes 🤯

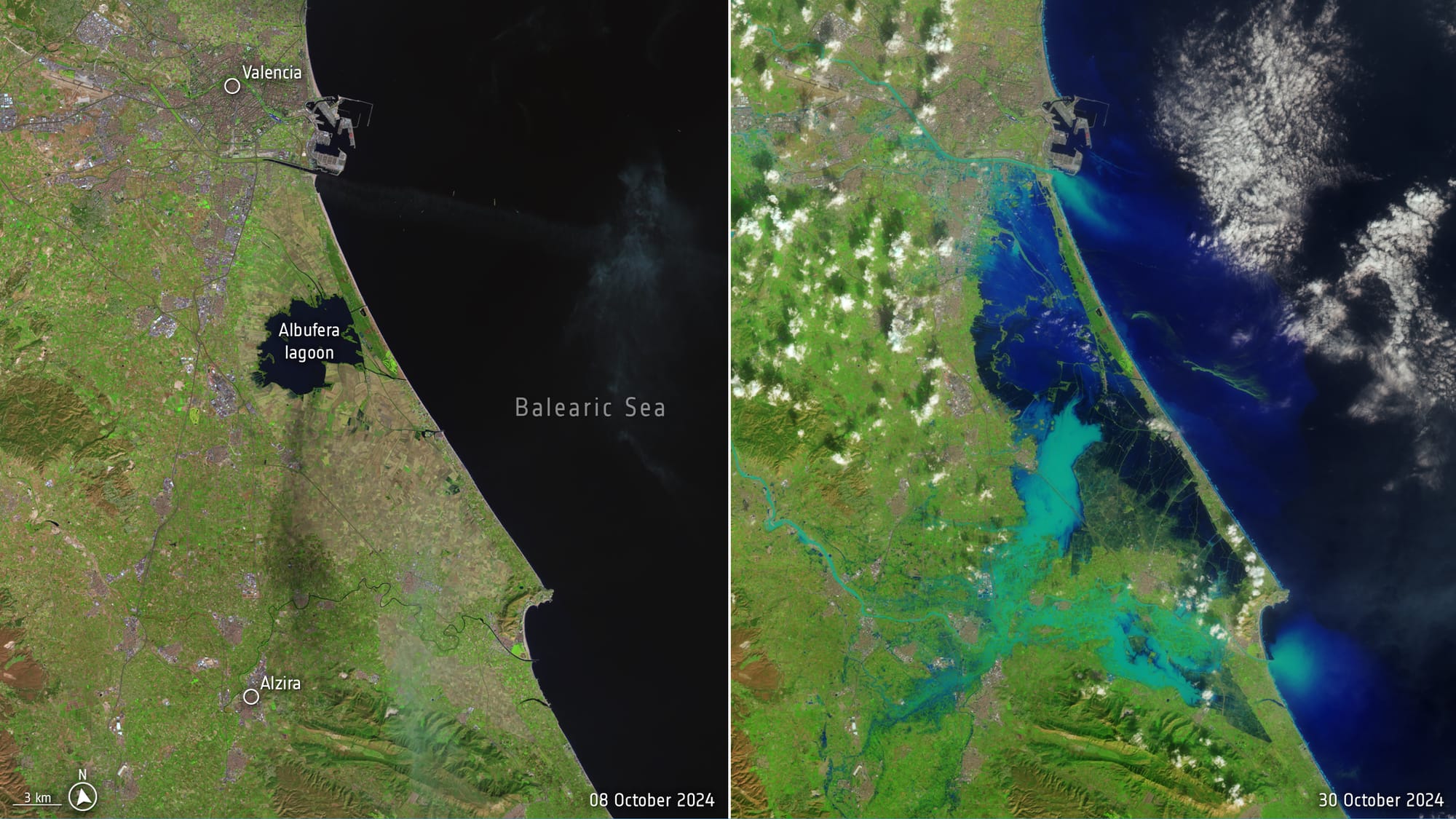

In the meantime, Spain suffered one of its worst flooding events in decades after heavy rains struck the region of Valencia, dropping a year’s worth of rain in just eight hours. This has led to catastrophic floods and over 200 casualties.

The image below, processed by ESA using images from NASA's Landsat mission, shows the level of flooding in the region.

Until next time,

Aravind.