Hey everyone! I didn’t get to write much in the last couple of months (I started tweeting a little bit more though). I have promised myself to get back to consistent writing and bimonthly publishing from this month - so, hold me accountable!

Let’s start with looking back at what happened in Earth observation in the first quarter of 2022. I haven’t written about EO for a while, so I thought I will take a deeper look at some of the recent developments in EO - lazily categorised into 8 sections.

PS. You may have probably come across this piece I wrote on the state of EO last year. I hope to publish a follow-up piece, later this year - sometime in June. So, stay tuned!

Sponsored by

3 Emerging Trends

1. To Vertically Integrate (Or Not) 🔼Former EO startups, now publicly-traded companies, Planet, Spire and Satellogic chose to (probably needed to) vertically integrate i.e. build, launch and operate their satellites, but do the emerging EO companies need to do the same? I have pondered about this for a while - so when EarthDaily (ex-Urthecast) announced that Loft Orbital will be building and operating their satellite constellation, with ABB supplying the payload, it took me by surprise. Basically, an EO company decided to essentially “outsource space” to the space infrastructure providers, while focusing on their go-to-market commercial strategy (EarthDaily is a prominent player in the Agriculture market - thanks to their acquisition of GeoSys).

Why? Earth observation is becoming somewhat commoditised - make no mistake, space is still very hard. But, if a company wanted to fill a data gap or solve a problem, which can be done only from space, now is the time. Space-as-a-service models from Loft Orbital, Spire and Xplore have indeed made this very easy, taking the space complexity out of the equation, so that EO companies can actually focus on what they need to be doing i.e. making $$$ by getting the value to the end-users in whatever form they want - data, analytics, insights or applications.

So, will this become the norm in EO? Is there still an argument for vertical integration? I see three reasons why companies will continue to vertically integrate:

- their ability to keep costs low, which is probably Pixxel’s (raised $25M) case;

- retain the option to commercialise its satellite building capabilities, which is probably Aerospace Lab’s (raised $60M) case;

- design considerations involved in developing proprietary technology, which is probably Iceye’s (raised $136M) case.

2. Data Fusion - Finally Taking Off 🔗I have always believed that EO is just another type of data that serves as an input to build products that can help solve important problems - often combined with multiple data sources i.e. combining data from different EO sensors and more importantly, non-EO data. So, needless to say, I was genuinely excited to see a bunch of activity in this area. A few of them that caught my attention below:

- Kleos Space and Satellogic announced a partnership to combine their radio frequency (RF) data and multispectral data, targeting the defence sector.

- Maxar made a strategic investment in Aurora Insight which offers satellite-based RF monitoring for the telecommunications sector.

- Ursa Space raised its series C and wants to enable solutions combining optical, SAR and RF datasets (although SAR is still the main focus).

A good representation of the importance of data fusion is this infographic sourced from an excellent report from SwissRe - pretty important to realise how EO is just one among many components within the solution. There is, of course, a lot of work to be done, before we can get to the best case scenario i.e. work on boring problems - making EO data easy to access, store, process and more importantly interoperable.

3. Verticalisation 🔘I wrote about my thesis on verticalisation in my piece from last year. Verticalisation, as in, companies focusing on developing capabilities to solve a problem within a specific vertical as opposed to offering products for solving problems across industries and use cases.

The most notable development, in this regard, from this quarter was Iceye’s funding announcement, not just the amount (which is incredible for an EO company), but where the investment came from - Tokio Marine, Japan’s largest casualty insurance company. Iceye was slowly, but surely pivoting towards insurance in the last couple of years, but this settles it - Iceye, IMO is now an insurtech company that leverages EO.

Iceye is slowly, but surely becoming an full-blown insurtech company (at least the non-US division).

— Aravind (@aravind_raves) 12:23 PM ∙ Feb 8, 2022

The insurance sector is well-positioned to become the major "anchor customer" for commercial Earth observation data, just like the defence sector has been for the past decade!

Again, this is not new - Planet has been gradually pivoting towards the agriculture market, where they have found a sweet spot for their Dove constellation. Their recent acquisition of VanderSat should enable them to double down on this market.

We are gradually moving away from EO being a technology-driven sector with "SAR market leader, a hyperspectral market leader etc." to use-case driven/vertical market leaders, “EO market leader for crop insurance, EO market leader for parametric insurance etc.”

So, will we continue to see EO companies verticalise? Yes, because it helps them focus on a specific industry and become the market leader within that. But, will all EO companies verticalise? I don’t think so - no brainer, as it helps them show a large TAM to their investors. I do think most EO companies will continue to be horizontal i.e. offer multi-purpose data-as-a-service, or offer products for a number of verticals. But, if you analyse them closely, they will be doubling down on a few core markets.

2 ‘Boring’ Problems

4. Making Earth Observation Data Accessible and Usable 🔍Alright, this is a topic we have been talking about for a while now. So, it was nice to see things moving in the right direction:

- SkyFi raised funds to build a satellite imagery app to “democratize satellite image ordering and delivery” - essentially attempting to give EO an e-commerce user experience (nice!).

- Ursa Space is making data from their virtual constellation of satellites available on AWS Data Exchange - which should certainly help reduce the search costs for some satellite imagery.

- And, in light of the ongoing situation in Ukraine, Astraea and Satellogic partnered to release Ukraine Observer, to distribute satellite imagery to the Ukrainian government, which was nice to see!

We have probably come a long way since I wrote this piece a couple of years ago, comparing the state of EO industry to the state of the video streaming industry. As I continue to track funding across the EO value chain (roughly almost $500M raised by EO companies in Q1 2022), I can’t help but be optimistic about the future of EO - we are not only building and launching more satellites, but we are putting in thoughts into getting all that data into the hands of customers, at the right context, at the right time, in the right format. Are we doing enough? Probably not. But there are a number of ongoing initiatives from the EO community as well as some EO companies themselves that make me hopeful!

5. Working on Synthetic Data For Earth Observation 🖨️I have to admit this is an area that I am not completely familiar with - so I am probably shooting myself in the foot writing about it. Nevertheless, it is one sub-segment of the industry that I am going to be tracking more closely in the future.

But first things first.

What is synthetic data? Information that is artificially manufactured rather than generated by real-world events. Why is it used? To produce training datasets for AI models, instead of just being dependent only on actual data, which may be scarce. And, why is it relevant in EO? As we launch more satellites to acquire more data through different sensors, finding datasets to train the models (for instance, to teach the computer what buildings looks like in a SAR image) might be difficult, especially as we move towards globally scalable EO applications. We currently (mostly) use humans to annotate and label data before providing that as inputs to the computer - so you can imagine how computer-generated datasets might be efficient.

I got to know of two startups this quarter working on developing synthetic data for Earth observation (but not only) - a) Synthetaic, which raised $13M recently to automate the process of rapidly identify and categorising objects in imagery and b) Rendered.ai, which is working on creating a platform for creating synthetic data applicable to all EO sensor types.

This might seem ‘boring’ for some of you (hence the naming of this section!), but as we think about the growth of the EO sector and imagine a world where most backend processes (ordering imagery, delivering to cloud, processing at scale, conversion to insights) are automated, I can start to see the value of synthetic data. More to come!

SpaceDotBiz is the newsletter for how to make money investing in the space industry. We bring you interviews with top space investors and entrepreneurs, as well as key insights into the trends driving space markets. SpaceDotBiz is read by leaders in organizations throughout the space industry, including SpaceX, Space Capital, Blue Origin, the Aerospace Corporation, NASA, Planet, and more. Sign up for free here!

2 Quick Questions

6. Are EO Companies Climate Tech Companies? 🌍As the U.S. Securities and Exchange Commission proposed rules that would require companies to report their greenhouse gas emissions, along with details of how climate change is affecting their businesses, I started pondering if there was any other dominant technology other than EO that would enable the implementation of this regulation. But then, how well understood are the capabilities of EO in the investment community? I have a piece in my backlog that should be published in a couple of weeks looking at the overlapping landscape of EO and climate tech!

In the meantime, Q1 2022 was a good year for companies working in the intersection of climate and EO i.e. any company that is using EO to build products in the climate tech space. From Kayrros (a fascinating startup from 🇫🇷 backed by the European Investment Bank) that is building a platform to assess the climate costs of economic activity to Sylvera (based in 🇬🇧 ) that aims to be the leading carbon offset ratings provider, there is a growing number of companies involved in creating newer markets. And then, there are companies that want to change how things are done traditionally in well-known markets such as insurance - from Descartes Underwriting to Climate X.

So, this brings me to my question - should most, if not all EO companies be considered climate tech companies? Seems like that shift in narrative is happening already. I have observed many EO companies over the years - most which have pivoted completely to labelling themselves climate tech, while a few that have stuck to what they intended to do. There is no right or wrong - you do what you gotta do!

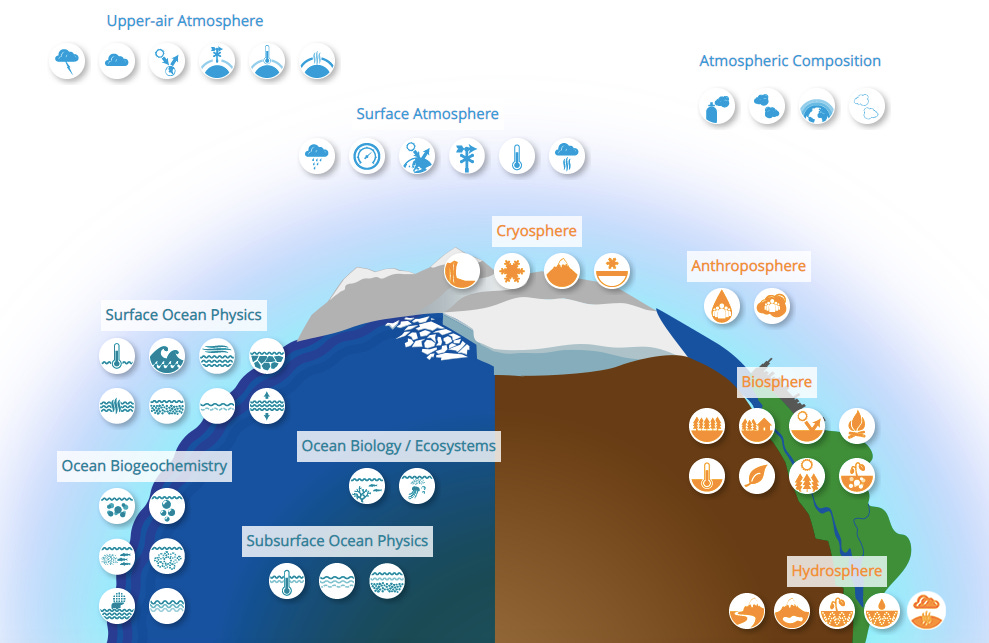

Perhaps there needs to be a framework to identify the real climate tech companies - for instance, through the Global Climate Observing System’s Essential Climate Variables (ECV) approach i.e. whether the technology a company is building is contributing to observing one or more ECVs resulting in improving the understanding of the Earth’s climate. But, clearly this is rather too scientific and limits the translation to a business use cases. More to come on this subject!

7. Will We See Backward Vertical Integration? ⏮️Ok, so this is not really a development as there is no supporting news story to back up what I am about to say. It is more of an educated guess on what might happen as the EO industry continues to grow.

Will we see a market leader in a specific industry taking the decision to invest in EO (through M&A or in-house development activities)? We have seen some early signs:

- Palantir, a leader in the defence sector, building MetaConstellation - essentially a constellation of EO constellations to support their internal product development. Perhaps, their recent partnership with Satellogic and Peter Thiel’s, (one of Palantir’s cofounders) investment into HySpecIQ are stepping stones towards that.

- ExxonMobil’s partnership with Scepter to “deploy advanced satellite technology and proprietary data processing platforms to detect methane emissions at a global scale” - clearly an area where ExxonMobil would be keen on developing in-house capabilities.

- AXA’s spinout AXA Climate that is focused on providing climate-related insurance products primarily based on EO data - I would expect more insurance companies to follow, probably through M&A instead of creating their own in-house remote sensing / data science teams from scratch.

I am also aware of at least two other significantly large companies (billions of $ in revenues), market leaders in their own verticals, that are considering investing into EO - one contemplating launching a constellation of EO satellites (or M&A), while the other building an in-house data science team to leverage on their domain knowledge to build EO-derived software products for their own internal use. With all this going on, I probably expect one big announcement this year that shows how EO is slowly, but surely becoming mainstream within the major industrial sectors of the economy - you would think through the adoption of technology from existing providers in the market, but what stops them from investing in the technology themselves?

1 More Thing From ‘Under the Radar’

8. The Era of Commercial Weather Satellites 🌧Finally, let’s talk about weather - not just because I work in a weather company these days, but also because I strongly believe that the two apparently different sectors -weather and Earth observation - have more similarities than I would have ever imagined. I plan to write about this in detail next month, but couple of interesting developments this quarter from weather involving space that we should be aware of.

First, some context - we have a number of satellites out there monitoring the weather, or should I say different geophysical variables to help us understand and predict the weather on Earth. As you probably see from the image below, most of the satellites are owned and operated by governmental agencies in the USA, Japan, Europe, China, Russia and South Korea. And where’s the private sector? Largely been focused on improving the modelling capabilities based on data already collected from the governmental missions i.e. mostly incremental improvements in our ability to predict the weather better.

But, in the last few years, we have had companies like Spire and GeoOptics starting to offer GNSS radio occultation data and Orbital Micro Systems through microwave radiometers. And, last year, Tomorrow.io announced its plans to launch a constellation of precipitation radars (active sensor). And this month, the company announced an update to its space program plans: the addition of microwave sounders (a passive sensor) to its plans - meaning, for the first time, we will have a combination of passive and active remote sensors in the same weather satellite constellation, launched by a private company. We talked about data fusion in the context of traditional EO previously - this is the same but for weather. This quarter also saw Acme AtronOmatic, a vendor of the popular MyRadar mobile app, announcing their plans to launch a constellation of 250 one-unit cubesats equipped with hyperspectral, thermal and visible cameras (another example of backward vertical integration!)

It is an exciting time to be working in the weather industry because we are going to collect more data about our atmosphere than ever before. And this is all coming together at a time when extreme weather events become more frequent around the world and we need technologies to help us adapt to the changing climate everywhere!

In case, this was forwarded to you:

Thanks for reading! Subscribe for free to receive new posts and support my work.

Thoughts, recommendations or requests? Just hit reply, or reach out on LinkedIn or Twitter. Until, next time!

Cheers,

Aravind