Note: This is just a blog post and not a paid, strategic assignment. While the latter is what I do for a living, this is just an opinion piece and not intended to be used as a reference.

Although I briefly explain the methodology that I use for the analysis below, I obviously did not put in the work that I would for one of my consulting projects. In fact, I did most of the work for this piece was over two transatlantic flights. Your thoughts and feedbacks are welcome, but please keep the context of this piece in mind.

Context

More than a couple years ago, I published the first edition of the Earth Observation Hype Cycle, in an attempt to provide some analysis on the various trends and technologies within the Earth observation (EO) sector. I had compared, the times we were living back then to an iPhone moment. While we are far from realising that utopian moment that I write about, I believe we are getting close. This decade might really be the do-or-die moment for EO.

Similar to how the iPhone enabled the creation of apps for various use cases, satellite data will enable the creation of different applications. Similar to how the iPhone brought all the innovations into one device, satellites are now on the verge of bringing all the types of data of our planet and our activities on it into one place. Similar to how the multi-billion, multi-vertical app economy was catalysed by the iPhone, we are on the verge of creating multi-billion, multi-vertical applications by data from satellites.

Pre-Read: The Gartner Hype Cycle

I have looked into various frameworks to deal with innovation hypes across sectors. Gartner, one of the popular ones, is probably the best fit simply for the simplicity it offers. Although subject to a lot of criticism over the years, it is a good starting point, especially if you are an outsider looking into a new field (which I presume some of you are).

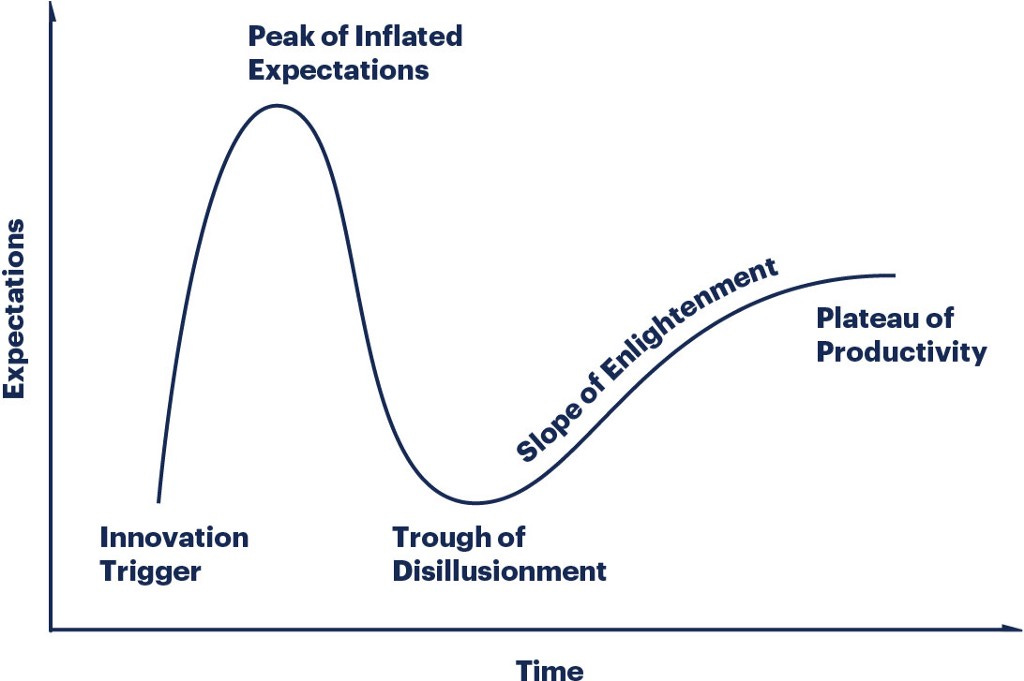

Here is a summary of how to read and understand the “Hype Cycle”, but I would recommend you refer to the official Gartner methodology for a detailed explanation:

Axes

- Time: Each innovation progresses through time, over various phases

- Expectations: A qualitative measure of expectations in the market for a specific innovation, based on commercial interest and investment in the innovation and visibility in the sector

Phases

- Innovation Trigger: A technology/product innovation is announced and starts to generate interest;

- Peak of Inflated Expectations: Expectations reach its maximum and the innovation creates a lot of buzz, sometimes leading to a bubble;

- Trough of Disillusionment: Some innovations don’t show results commercially — interest wanes and investment dries up (i.e. the bubble bursts, for some);

- Slope of Enlightenment: Those innovations that sustained or escaped the decline (with proper technology-product-market fit) start to show results, leading to more understanding of the commercial feasibility of an innovation;

- Plateau of Productivity: Mainstream adoption of innovation happens leading to increased commercial value and the promised J curves start to come true.

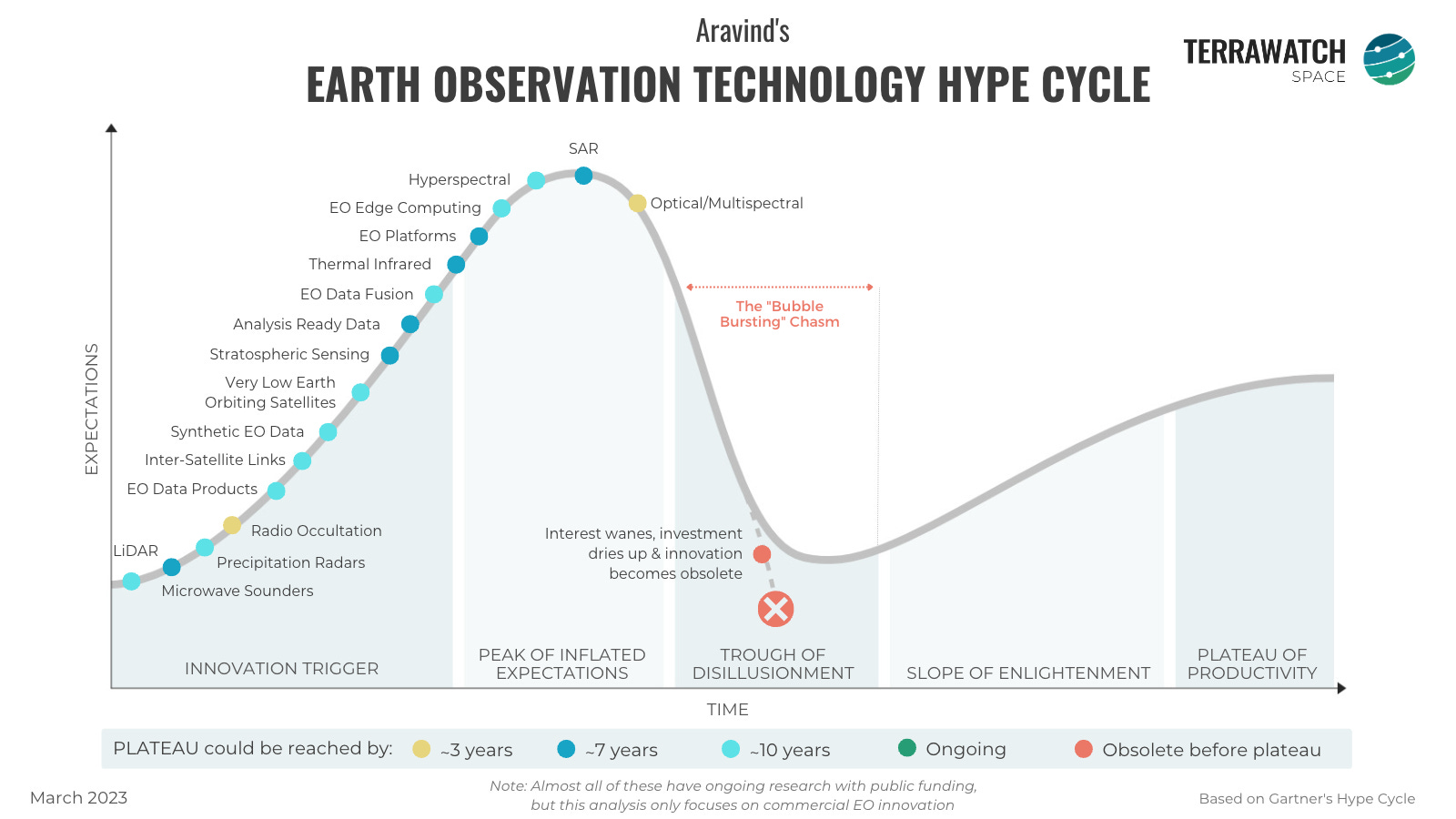

Earth Observation Technology Hype Cycle

I then made a non-exhaustive list of the ongoing innovations in the EO sector to be positioned on the Hype Cycle. I used the following criteria to analyse and position the innovations on the Hype Cycle:

- Investment: Level of funding raised, from private funding - Pretty easy to access this data and rank relatively as Low-Medium-High;

- Adoption: Level of adoption of the innovation by end-users or within the EO value chain - Not straightforward, used a combination of public information about contracts and proxies to rank relatively as Low-Medium-High;

- Hype: Level of buzz that the innovation has already created within the EO sector and the wider space industry - Also not straightforward, but I used proxies such as amount of media coverage and importance given in conferences and then ranked relatively as Low-Medium-High

Some things to keep in mind before getting to the results:

The innovations considered represent satellite-based remote sensing innovations only1.

This analysis only focuses on the commercial EO market and does not, in any way, evaluate ongoing research and development via public funding2.

For the sake of simplicity, the analysis is also looking at the state of EO sector from a commercial lens, not from a defense point of view3.

Being part of the “hype” is not essentially bad, as long as the hype is complemented by actual execution that pushes the adoption forward.

Lastly, yes, analysts get most things wrong4, I try my best not to be.

Highlights

While I have a lot to say about every single one of the innovations on the figure, I will keep this concise and just emphasise some key points.

The Foreground Innovations (EO Sensors)

- Starting with the most obvious one out of them all, “Optical/Multispectral”: While this technology has been around for decades, and you can make an argument that it is actually mainstream (due to its adoption in mapping), I would opine that there is still a long way to do in terms of converting potential to impact and transforming pilots into subscriptions. I have seen more examples of the former than the latter, especially in relation to the other two criteria I use for the analysis (Investment and Hype).

- Two sensors - SAR and Hyperspectral - are close to reaching the peak of expectations (that’s a good thing). We can leverage the buzz created to learn more about the challenges of adoption and see how to best escape the “chasm.” Given where we are in the adoption of EO, and the likelihood of a fused, sensor-agnostic end product there is a very good chance that the sensors feed into each other and stop all of them from falling into the trough (rising tide lifts all boats).

The Background Innovations (Enabling Technologies)

- If I have to name two innovations that will drive the medium-term future of the sector, I would say EO Edge computing and Inter-Satellite Links, simply due to the difference in potential they bring about. I will have deep-dives on each of them over the year, but I am a big fan of Disruptive Innovation. And, I think those two could disrupt status quo in EO, in their best-case scenarios.

- I have been fascinated with EO Synthetic Data for a while, not just for its commercial potential, but for the science. There has been some movement in the market on its adoption within EO (see its use in the Chinese balloon example), and I expect this to grow as the sensors evolve through their hype cycle, due to the complementarity they offer to every sensor.

The Other Innovations (Trends Under the Radar)

There are two areas where I see very little hype today, but expect more in the future. The first one is EO Data Products, or as I call it, "useful, usable data products5” derived from EO. If you buy into my thesis that EO products will be built by tens of thousands of people, but it will be used by hundreds of millions of people, we need more data products. And the first company that started this trend is Planet, with their announcement of Planetary Variables.

The second area is innovations happening within weather. While meteorology is its own industry and requires its own hype cycle, I included three innovations on the list - Radio Occultation, Precipitation Radars and Microwave Sounders. Like many other weather-based remote sensing technologies, these instruments have been in use for decades, but the entry of private sector is going to generate more hype in the next few years.

Bottomline

While I was wondering how to best summarise my thoughts on the state of EO as a conclusion to this analysis, I went back and read my piece from three years back. Judge all you want, but I am just going paste my thoughts from back then, as they resonate as much as they did almost three years ago.

Do I really think all the innovations will make it past the trough of disillusionment? No, but I hope that they do in some form or the other. I am not a pessimist, in fact, I am quite the opposite. I switched careers to get into this industry because I am sincerely passionate and excited about the potential of applications of satellite data. The dreamer inside me believes that Earth observation data will definitely unlock multiple multi-billion-dollar markets across verticals, traversing throughout the value chain with benefits becoming harder to quantify — similar to how data from navigation satellites have become the core of the app economy. Just like how the unicorns of the past decade— Uber, Instacart and Tinder etc. — are not considered space-tech companies (but still heavily rely on space technologies), I believe the unicorns of the next decade will start to rely on Earth observation data based on some of the innovations mentioned above. We just need to make sure we do not slide through the trough and let the bubble burst. I am convinced that we are passing through the iPhone moment for Earth observation.

Subscribe for more Earth observation insights!

Earth Observation Adoption Hype Cycle

While the Gartner Hype Cycle is most suited for analysing technologies, and the Technology Adoption Curve by Geoffrey Moore is most suited for analysing adoption of technologies, I decided to change things a little bit.

How would some major use cases of EO fare if they were analysed through the same framework as the technology? More specifically, which applications of EO, triggered due to the innovations, are likely to become mainstream?

And, that is what I decided to represent through this figure.

Highlights

- Mainstream applications of EO that are, partially, or in most cases, entirely enabled by data from governmental EO satellites including air quality, disaster response, mapping and weather forecasting are likely to benefit from several of the commercial innovations that we discussed previously. It would be fair to say that these are the low-hanging fruits that the successful innovations would hope to capture as they move through the tech hype cycle.

- Climate change (an umbrella term for several applications on the figure) is accelerating the demand for EO, whether it is to complement data from public EO missions or directly enabling use cases that were not possible before. I have written about this subject in detail before, but what I am excited to see is how much commercial EO will play a role in areas where governmental EO missions have been the benchmark (think emissions, weather, climate science, carbon stock takes and the like).

- It is important to acknowledge that adoption of EO within some use cases is most likely going to fall into the trough of disillusionment, simply because alternative data sources (remotely sensed or otherwise) solve the problem more effectively and cost efficiently. Wherever possible, I hope EO takes a seat in the background, and show its value on-demand.

Bottomline

Once again, I am going to use points that I had made three years ago, to convey my thoughts on adoption of EO, as I believe, they are still valid. I invite you to read my thoughts from last time, if you need more context, but I think they are pretty self-explanatory.

- Insights, not pixels

- Solve problems using satellite data, not hoping for satellite data to solve some problems

- Evangelise and democratise

I will end with three points that have become fundamental to my thesis in EO ever since I officially launched TerraWatch Space last year.

- The Importance of Being Impact Driven

It's not about whether we should be selling data, analytics, insights or products. It is not about a specific type of sensor (hyperspectral vs infrared vs SAR vs Lidar), not about a specific medium (satellite vs aerial vs in-situ), not about EO vs weather vs GNSS, and certainly not terminologies such as geospatial or spatial or location intelligence. It is about the impact of EO for the customers, how it helps them get their job done, and in that process help solve larger environmental, societal, and economic challenges of our time.

- The Need for the Advisory Layer in EO

Users just want to get their job done, and perhaps EO can enable that. But, no single entity or organisation is incentivised to be holistic and objective today. Every EO company today is incentivised to push their own technology and products (and rightfully so), but it is my belief that most problems for customers cannot be solved without an objective, holistic view of the entire EO market, which only an advisory layer can solve.

- Let’s Not Forget the Other Two A’s

All of this analysis was about the technology innovations, making them available for use and evaluating their success. In my three A’s framework made up of Availability, Awareness and Adoption, the second and third A’s are more likely to be forgotten. It is perhaps important to remind ourselves that the Availability of a technology will not guarantee Adoption. Just because a sensor is in orbit it will not be used. So, as we focus on the innovations, I hope we spend some time thinking about how to best make users aware of the benefits of the technology (the so what) and think of ways to support its adoption (the how).

Thanks for reading!

Until next time,

Aravind

It is highly likely that across all three criteria other EO mediums such as aircrafts, drones, stratospheric balloons and in-situ sensors will score differently. Therefore, it might actually be wrong to generalise an analysis of an innovation in remote sensing. ↩

One methodology to analyse public investments are socio-economic impact assignments (which I have been a part of in the past). Hype cycles are certainly not a good fit for assessing the scientific research potential of a technology. ↩

Defense has been an early adopter for several innovations in EO, some of which are yet to see adoption levels close to that. Although, some innovations on the list might appear similarly if I included the defense vertical, I have voluntarily left that out. ↩

Remember that even the world’s best technology analysts failed in their predictions of the iPhone in 2007! ↩

A ‘usable, useful data product’ is a product that users can start using off-the-shelf without really worrying about what the underlying technology is and how it works - one any software engineer or data scientist can without understanding EO. ↩