Hey! Welcome to a new edition of ‘Last Week in Earth Observation’, in which I attempt to curate the major developments in EO from the week that just passed and provide some thoughts & analysis on some of them.

Along with the usual summary of developments in EO, we are looking at: the role of technology consulting firms in the adoption of EO, the passengers in SpaceX’s upcoming rideshare launch, and some worrying climate news.

Four Curated Things

Major developments in EO from the past week

1. Financial Stuff: Funding, Contracts and More 💰

- D-Orbit, the Italian space logistics company signed a contract with ESA worth €26M to supply and operate one SAR satellite as part of the IRIDE constellation program of Italy (Thales Alenia Space was another awardee);

- Spire entered into a long-term agreement with Switzerland-based ch-aviation, an airline insights platform to supply global flight analytics from its constellation of satellites with ADS-B sensors;

- SatelliteVu, the UK-based thermal infrared satellite startup received £300K in public funding from the Energy Entrepreneurs Fund for research on using their datasets for commercial solar farm monitoring;

- vorteX-io, a French startup received (in French) a grant of €2.5M from the European Innovation Council to create the first European flood and drought forecasting service with in-situ monitoring sensors;

- NASA awarded Iceye with a contract to provide high-resolution SAR (1m to 15m) data for evaluation within the Commercial SmallSat Data Acquisition program, which includes Planet, Spire & Maxar as suppliers;

- NOAA has requested $6.8B in funding for FY 2024, an increase of roughly $450M for future weather satellite programs after reduced funding in 2023;

- The US National Reconnaissance Office awarded contract extensions to Aurora Insight (now owned by Maxar), HawkEye360, Kleos Space and Spire to evaluate radio-frequency data from their satellites (it looks like Terran Orbital and Umbra missed out after they were selected last year);

2. Strategic Stuff: Announcements and Partnerships 📈

- Satellogic will be building and launching, what looks like, a hyperspectral sensor to orbit designed in collaboration with agtech firm InnerPlant;

- Planet is partnering with EO platform startup Ursa Space allowing access to its daily imagery on Ursa’s platform and with environmental software startup Upstream Tech offering subscriptions to its basemap product;

- Planet is also collaborating with The Nature Conservancy to build Blue Carbon Explorer, a digital tool to map mangrove and seagrass blue carbon around the world;

- Corteva Agriscience, one of the leading agriculture firms is collaborating with Ukrainian EO company, EOS Data Analytics to research the use of satellite imagery for crop monitoring applications;

- Japanese EO company Axelspace announced partnerships with Space Compass, a venture building space data relay networks and Tokio Marine Holdings, an insurance firm, along with a new round of undisclosed funding;

- Descartes Labs was selected to be one of the technology partners by Comtech, a satellite telecommunications solutions provider.

3. Interesting Stuff: More News 🗞️

- Kenya will launch an EO satellite, designed and developed by SayariLabs, a Kenyan startup, on SpaceX’s upcoming launch;

- Dubai’s Electricity and Water Authority will launch an EO satellite, Dewa Sat-2, with a multispectral sensor after the first mission Dewa Sat-1, which had an IoT sensor, for planning, operation, and maintenance activities;

- The UK Geospatial Commission released a new digital map of underground pipes and cables in the UK;

- Meta released its Segment Anything Model that automatically extracts objects from images, with huge potential for processing satellite data;

- A report from the UN found that more people are being affected by more disasters because decision-makers are failing to invest in risk mitigation;

Some worrying climate news from satellite data…

- Data from NOAA showed that greenhouse gases (carbon dioxide, methane and nitrous oxide) continued to rise rapidly in 2022;

- Data from NOAA also showed that the average ocean surface temperature at the beginning of April rose to unchartered levels potentially risk of extreme weather events due to climate change;

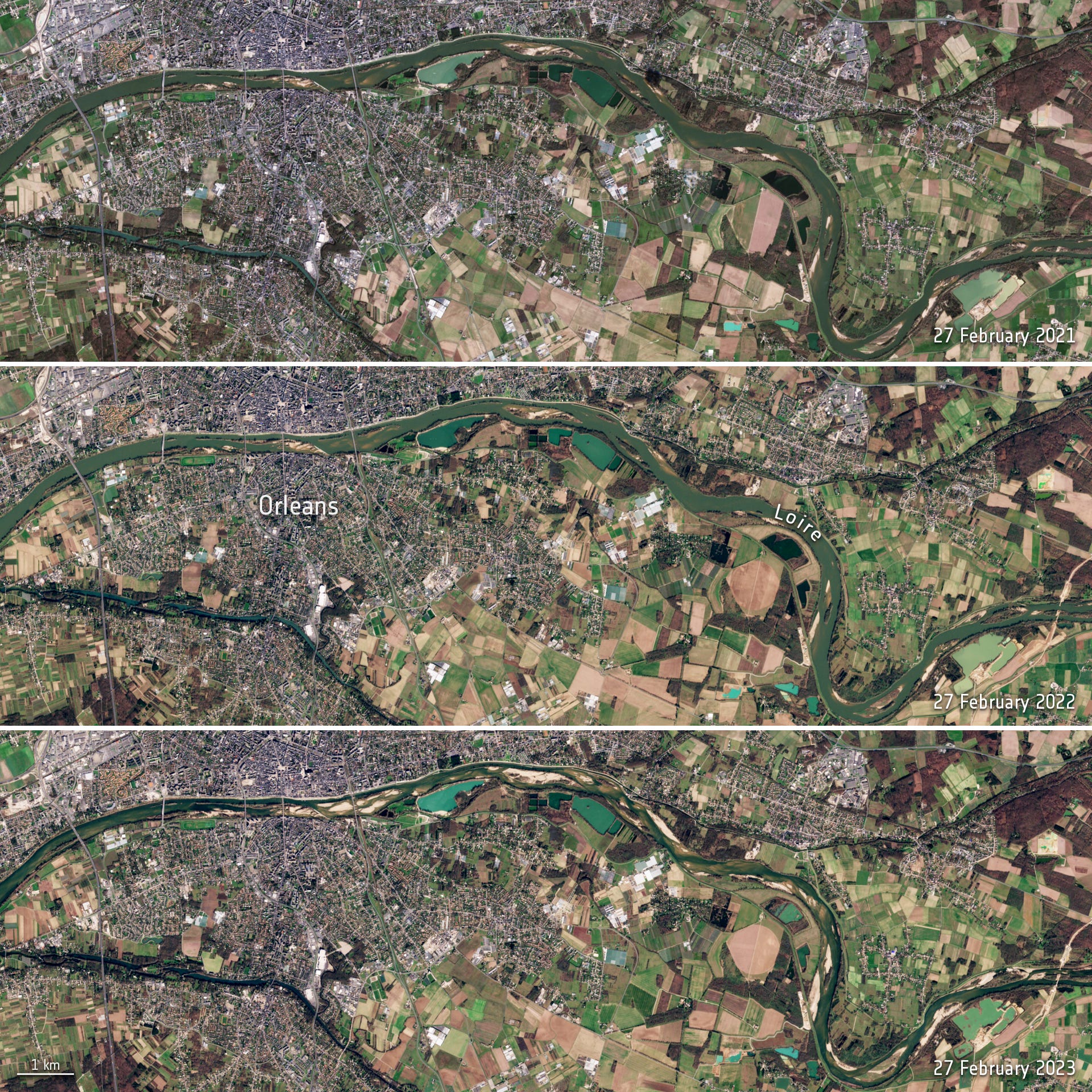

- Data from ESA’s Soil Moisture and Ocean Salinity mission showed low levels of soil moisture across Europe (see an example from France below) raising concerns about water supply, agriculture and energy production.

4. Click-Worthy Stuff: Check These Out 🔗

- An agency-wide Climate Strategy from NASA;

- A dashboard of dashboards with climate-related indicators;

- This piece about Virginia Norwood, who passed away recently, one of the pioneers in spaceborne remote sensing and called the “Mother of Landsat”;

- The NewSpace ecosystem map from Seraphim Space containing some EO companies (see State of EO for a detailed market map of EO);

- This webinar from Airbus Intelligence that I will be moderating.

Subscribe to receive Earth observation insights!

One Discussion Point

Analysis, thoughts, and insights on some developments in EO

5. The Role of Technology Consulting Firms in the Adoption of EO

You might have seen some of the major consulting firms announce the launch of their space practice offerings over the past few weeks and months. Some of them include Deloitte, Accenture, McKinsey, EY, and KPMG among several others - I used to work at PwC's Space Practice myself back in the day. But, what is their strategy when it comes to EO? What do they want their role to be?

If you have read my stuff before, you already know my thesis on the importance of having a customer-focused, intermediary advisory layer in EO, with an objective, independent and holistic mindset.

In their classic thought pieces published recently, both Deloitte and McKinsey highlight the potential of EO as one of the major driving factors for the growth of the space industry, and they are confident they will play a role in that growth. But, how would this play out? Which layer of the EO value chain would they want to position themselves in?

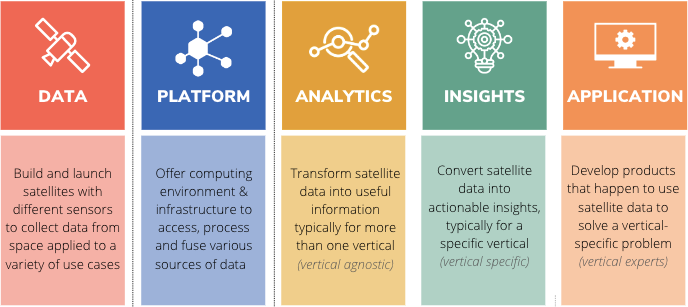

You would think Application because that is typically where technology consulting companies operate, but my thesis is there might be more to it here. But, I would like to posit that the strategies of technology consulting companies across the EO value chain, could play out in one of three ways, using the simple “Build, Buy and Partner” framework.

Build

Some technology consulting firms will want to build their own in-house EO capabilities because they want to add EO to their firm’s DNA and potentially differentiate from their competition. This might make sense as most of these firms have strong data science and in some cases, geospatial capabilities, which would complement EO very well, especially if their goal is to build end-to-end EO-driven solutions for their customers (whose problems they know very well).

This is the default approach that consulting companies operate on, especially on a case-by-case basis, depending on the problem needs - using EO whenever needed but without really having an EO strategy. Some might see enough customer needs and interest to go ahead and create an EO strategy within a specific vertical, which does come with the added risk of becoming siloed. At some point in the building process, they might decide to switch to a Buy strategy, but those who start with a Build model are intent on owning their work.

As you would imagine, a Build strategy can work across the value chain - from launching their own satellites to creating proprietary end-user applications. But focusing on the Analytics, Insights and Applications segments seems to fit this approach well. Some examples of this approach in the market:

- EY investing $3M to build satellite data processing capabilities;

- McKinsey’s ACRE solution, aimed at the agriculture sector.

Buy

The technology consulting firms that do not want to reinvent the wheel in EO go with a Buy strategy, which typically involves acquiring a company and then incorporating its technology into its core offering. Technology licensing would also fall under Buy, especially if you imagine finding a middle ground between Build and Buy.

Firms that see enough customer demand for EO-derived products and those that cannot afford to wait (in the fear of losing out) turn to a Buy model. However, this is only a way of gaining time and postponing the Build model as most products would need to be integrated into the core offering. A Buy approach is more likely to happen on a vertical-specific basis than on a company-wide horizontal basis, although the latter could signify a complete shift in the firm’s strategy.

I expect quite a bit of M&A activity in this space in the next 3-5 years, simply due to the increasing need for the intermediary advisory layer in EO. This model is the most suitable for Analytics, Insights and Applications, especially if they have existing geospatial capabilities, but I will be curious to see the technology consulting firms take a bet on the Platform layer, just because I think they are the best fit for each other. Some examples:

- BCG acquiring environmental software consultancy firm Quantis (not an EO-specific transaction, but the strategy is still the same);

- McKinsey acquiring Iguazio, an machine learning platform startup (also not an EO-specific transaction, but expect something similar in EO!).

Partner

This is the easiest, least risky option of the three because it is also the most obvious way for companies to test the waters for a strategy, particularly for consulting companies that are always eager to partner. Even though this comes with the added threat of wasted time and effort on both sides, consulting firms have a lot to gain from the new revenue streams that EO-related partnerships might open up, while EO companies, which are desperate for customer traction, can start evaluating their product-market fit.

I view corporate investments also as a means of executing an advanced Partner strategy, as a potential stepping stone towards a Buy in the future. While we are yet to see much activity in EO from the large consulting firms, I am quite confident that some of them will want to, or more likely, are already negotiating exclusive partnership arrangements with companies across the value chain: Data, Platform, Analytics, Insights and Applications. Some examples:

- Accenture’s partnership with Planet to build sustainability-related solutions;

- Accenture’s investment in EO startup Pixxel building hyperspectral satellites.

One Podcast Episode

From the TerraWatch Space podcast

6. Earth Observation for Climate Intelligence

In this episode, I am speaking with Dr Benjamin Laken, who is the Chief Science Officer at Cervest, a UK-based startup building a climate intelligence platform to support climate adaptation efforts for enterprises, governments and non-profits.

Climate risk is an important topic and satellite data has a lot to offer for estimating it. Whether it is the climate risk for an individual, an asset, an infrastructure or even an entire city, understanding the probabilities of scenarios is becoming crucial. Cervest is a company that is specifically focused on tracking, quantifying and reporting climate risk, so I thought it would be great to speak to someone who is involved in building this and understand the role of EO.

In this episode, Benjamin and I discuss Cervest and what the company is building, what their tech stack looks like, what type of satellite data they use, the challenges of using EO data, the hardest risk to measure and monitor, what the EO sector can do better, and more.

One Upcoming Launch

SpaceX Transporter-7 on April 11

7. Taking a Look at EO Satellites on SpaceX Transporter-7

The Transporter rideshare missions from SpaceX, which take place roughly once a quarter, are fun to follow because a variety of satellites from several countries get a ride to orbit. This time, the Transporter-7 mission launching on April 11 at 8.48 am GMT, is carrying at least 20 different payloads from at least 10 different countries, with quite many EO sensors.

Here’s a breakdown of the publicly announced1 EO missions on this launch, that I could find, which include some first commercial satellite launches for some companies, constellation updates for others, technology demonstrations etc. 🚀

First Commercial Launches

Tomorrow-R1 (Tomorrow.io) with a precipitation radar to improve global weather forecasting;

Wyvern-1 (Wyvern2) with a hyperspectral instrument for agriculture monitoring applications among others;

2 x GHOSt (Orbital Sidekick) with hyperspectral instruments for oil & gas applications among others;

Constellation Updates

- BRO-9 (Unseenlabs) with radio frequency monitoring sensors for maritime surveillance;

- 3 x LEMUR satellites (Spire) typically with AIS, ADS-B, GNSS radio occultation or radio frequency monitoring instruments;

- GHGSat-C6/C7/C8 (GHGSat) with imaging spectrometers for methane emission monitoring;

Technology Demonstrations

- FACSAT-2 (Colombian Air Force) with an imager with a resolution of 5m;

- NorSat-TD (Norwegian Space Agency) with an Automatic Identification System receiver for maritime surveillance;

- A CubeSat from Saudi Arabia (King Abdullah University of Science and Technology) with a hyperspectral imager;

The mission also includes academic and research missions from universities, a list of which can be found here and here.

Until next week,

Aravind.