Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Contracts

- Spire was awarded contracts worth multi-million euros by the European Maritime Safety Agency to provide automatic identification system (AIS) data for global vessel traffic monitoring;

M&A

Nuview, a startup building a constellation of Lidar-equipped satellites, has acquired EO platform provider Astraea enabling the company to leverage Astraea’s distribution and analysis capabilities.

Later this week, paid subscribers will receive a deep dive into the state of EO platforms including analysis of platform segments, the commercial landscape and more. Subscribe now if you want to get your copy!

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- Saudi Arabian energy investment firm Front End Limited Company and EO analytics firm SpaceKnow entered into a joint venture agreement to offer EO-based services within the Gulf region;

- Intent, a software services firm focused on the agriculture sector has partnered with Planet to integrate satellite data into its products & services;

Announcements

- The US National Geospatial-Intelligence Agency has established a new procurement program called Luno, which will leverage commercial EO and EO-based analytics to enhance its global economic monitoring capabilities.

My take: It is good to see government procurement of Earth observation evolve from a standard data-as-a-service model to a more focused, thematic "analysis-as-a-service" model. What would be the implications for the EO sector? I predict 3 things!

1. Emergence of more EO analytics companies

EO has mostly been a solution looking for a problem. The problem-driven, use case-focused Luno program will encourage the inception of new startups because there is a customer with $$$ that (finally) has problems to be solved.

There is now a reason for companies to improve the accuracy of that ship-detection model, develop that global, real-time infrastructure monitoring model and create that mine output tracker. All of these were needed before, but now companies will have an actual anchor customer.

2. Forward vertical consolidation in the EO value chain

While some EO companies position themselves across the data, platform and intelligence segments, some have focused solely on being an EO data provider. The emergence of this reasonably-sized ($290M) program might tempt some EO companies to go down the value chain to take a share of the pie.

And, instead of building those thematic analyses required in-house, why not partner or, more interestingly, acquire a startup that specialises in doing exactly that? This will spur more investment in EO.

3. Standardization of EO downstream business models

Another problem that has riddled the EO sector is the lack of standardized business models. While every EO downstream startup calls itself a SaaS model company, most are really project-based businesses disguised as a product business.

The Luno program which is modelled as a long-term continuous global monitoring tool will mandate companies to think of scalable, repeatable business models which was not required before for short-term projects. This is good news for the adoption of EO for commercial applications.

3. Interesting Stuff: More News 🗞️

- An Indian military reconnaissance satellite, the first to be manufactured by the private sector in collaboration with Satellogic, is shipped for launch;

- ESA has approved the development of two EO satellites - NanoMagSat will measure Earth’s magnetic field and Tango will measure GHG emissions.

- The US announced the Landsat 2030 International Partnership Initiative, which will enhance U.S. and partner governments’ sustainability initiatives.

4. Click-Worthy Stuff: Check These Out 🔗

This video that dives into the reality of using AI to predict the weather;

This article that discusses the ethics of satellite imagery;

While the analysis may appear incomplete and the conclusions somewhat shallow, we need to continue to have a wider discussion involving multidisciplinary experts - not just a bunch of EO folks.

This paper that analyses what happens to deforested land in Africa using EO.

EO Summit: Why EO Summit?

Here is an infographic summarising the concept behind EO Summit and what sets it apart from other conferences in the Earth observation sector: being user-focused and application-driven, which does not happen often.

Early-Bird Tickets

A limited number of early-bird tickets for EO Summit are on sale - only until March 3. Benefit from low prices until then - EUR 249 per ticket.

One EO Discussion Point

Exclusive analysis and insights from TerraWatch

5. Vertical Integration in EO

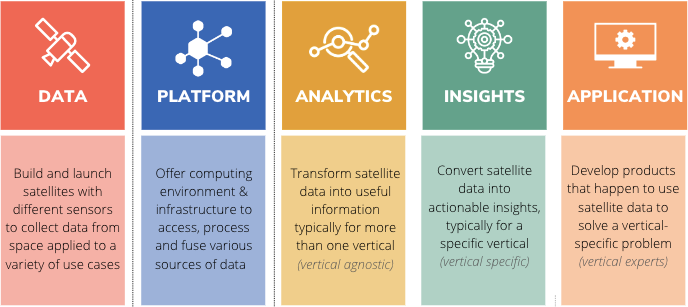

Nuview’s acquisition of EO platform provider Astraea should come as no surprise to anyone tracking the EO sector. While it may be early in Nuview’s evolution when this happened, this makes sense and is the textbook model for expanding in EO, especially if you follow TerraWatch’s EO value chain.

Forward Vertical Integration (left to right)

This is when a company in the Data segment that is focused on launching satellites decides to move forward in the value chain and acquire a company belonging to one of the subsequent segments - either to leverage technical capabilities or to offer analytics products supporting a go-to-market strategy.

Planet’s acquisition of Sinergise made headlines last year, and I wrote about the consequences of that. So, this acquisition of Astraea by Nuview is not the first of its kind and it won’t certainly be the last. Also, it’s not just about EO satellite companies acquiring platform firms to build on top of that, this is also the strategy when Hydrosat (Data) acquires IrriWatch (Insights), an ag-focused EO intelligence firm.

Backward Vertical Integration (right to left)

In the last couple of years, we have seen the emergence of backward vertical integration - EO intelligence companies transitioning to become EO satellite firms. This has been largely because those downstream companies have found a problem for which there is no other solution other than launching satellites themselves. Tomorrow.io, MyRadar, EarthDaily Analytics, SatSure and EOS Data Analytics belong to this new category of companies. With the ongoing wave of satellite-as-a-service models, who’s to say that we will not see more of this kind?

— — —

If you are bored and want to predict the next acquisition (or partnership) in EO, feel free to use this (slightly outdated) infographic from 2022 to take your pick.

Scene from Space

One visual leveraging EO

6. Monitoring the Development of a New Capital City

Indonesia is ambitiously working on moving its current capital, Jakarta to a new one, Nusantara located in Borneo, one of the country's large islands. The motivation came largely from the environmental challenges faced by Jakarta including flooding, air pollution, and water scarcity along with the fact that the city is sinking as we speak - 40 per cent of the city is now below sea level.

Construction of Nusantara began in July 2022 and since then the landscape has been changing, as the two images from NASA below show. While the plan is to keep 75 per cent of the city forested, some researchers worry about the biodiversity and carbon impacts of land use change. At least we will have all our EO satellites monitoring those impacts until the works are complete in 2045.

If this was forwarded, subscribe for free to get your copy every week. Already a free subscriber? Then, become a paid subscriber and get exclusive EO insights.

Until next time,

Aravind.