Hey! Welcome to a new edition of ‘Last Week in Earth Observation’, in which I attempt to curate the major developments in EO from the week that just passed and provide some thoughts & analysis on some of them.

Along with the usual summary of developments in EO, we are discussing two topics that I love: multimodal EO and EO adoption plus a teaser of job postings!

Four Curated Things

A summary of some of the major developments in EO

1. Financial Stuff: Funding, Contracts and More 💰

- The big one… US’ National Reconnaissance Office awarded six study contracts worth $300,000 each for hyperspectral satellite imagery to BlackSky, HyperSat, Orbital Sidekick, Pixxel, Planet, and Xplore;

- CollectiveCrunch, a Finnish startup building sustainable forestry platform using satellite data among other sources raised €1.4M;

- NASA Administrator Bill Nelson claimed that the proposed spending reductions for US fiscal year 2024 could lead to cancellations of planned EO missions in the Earth System Observatory program.

2. Strategic Stuff: Announcements and Partnerships 📈

- Airbus Intelligence has partnered with TerraNIS to export Farmstar, its precision farming and crop monitoring service, outside of France;

- Sidus Space, a startup offering EO solutions through a space-as-a-service model is partnering with SatLab to integrate its automated identification system technology into the LizzieSat multi-sensor satellite constellation;

- Tomorrow.io announced the launch of ‘Gale,’ the first generative AI product (think ChatGPT) dedicated to weather and climate for businesses and governments to easily identify key trends, risks and opportunities;

- UAE and China have signed an MoU to advance meteorological technologies including satellite-based monitoring and China’s FengYun program;

- Australia’s national science agency, CSIRO, launched AquaWatch Australia, a a 'weather service' for water quality leveraging EO data;

- The European Commission launched the first-ever EU Space Strategy for Security and Defence, which includes a pilot for new EO governmental service as part of the evolution of Copernicus.

3. Interesting Stuff: More News 🗞️

Starting with some good news ..

- ESA’s SMOS, CryoSat and Swarm missions, which monitor soil moisture, ice and magnetic field respectively among other parameters, have been extended at least until the end of 2025;

- NASA’s GEDI mission, which collects LiDAR data from the ISS, was put in hibernation, but will continue to be operational until at least 2030;

- Norway’s International Climate and Forest Initiative (NICFI), which provides open access to high resolution satellite imagery of the world’s rainforests has been extended by a year, until September 2024;

- ESA’s HydroGNSS mission, which planned to measure climate variables like soil moisture using a technique called Global Navigation Satellite System (GNSS) reflectometry, will now be made up of two satellites (instead of one);

- The Surface Water and Ocean Topography mission from NASA and CNES, which suffered a minor setback is now working as expected and downlinked its first images of water on the planet’s surface;

Some launch news…

- China launched four commercial weather satellites with GNSS radio occultation instruments, part of the Tianmu-1 constellation;

- BlackSky launched two high resolution optical imagery satellites with Rocket Lab, marking an end to its Gen-2 version (90 cm), before moving onto its Gen-3 satellites (50 cm) from 2024;

In other news…

- A former NASA scientist and executive has joined the satellite image processing service unit launched by consulting firm, EY;

- A new initiative from the UN, called MARS, will detect at least 40-50 episodes a month and make them public, with data provided by French startup, Kayrros and the Netherlands Institute for Space Research (SRON);

- A SAR satellite from Iceye, purchased with the donations from Ukrainians, has helped detect and destroy thousands of pieces of Russian military equipment in five months of use;

4. Click-Worthy Stuff: Check These Out 🔗

- If you are looking for a good resource that summarises the recent IPCC report, look no further than this piece from CarbonBrief (this is good too);

- This report presenting the importance of geospatial data for finance;

- This brilliantly done, interactive piece that shows how satellite imagery combined with synthetic EO data was used to track the Chinese balloon;

- The Planet Snapshots newsletter full of 10-year timelapses that tell stories.

Subscribe for more Earth observation insights!

Three Discussion Points

Analysis, thoughts and insights on some developments in EO

5. Towards More Multi-Sensor EO Data Providers

This piece from SpaceNews summarises a growing trend in the EO sector, that the companies are “working to expand their offerings beyond optical imagery, looking to capture a broader spectrum of data from space.”

If you are an outsider like me (I try to be even though I have been working in EO for over 6 years), you would think this was obvious as you probably know that no one sensor can solve most of the scientific/commercial problems and satisfy most customer needs. You probably also understand that you need to fuse data from different types of spatial resolutions, sensors and data sources to build a viable, valuable, successful product that “gets the job done”.

But because EO companies tend to operate in a technology-driven model (as opposed to a problem-driven model), operating a constellations of satellites made up of multiple sensors aimed at solving specific problems haven’t been very common in the industry. In fact, if you set aside companies that built primarily for the government and/or the military (the likes of DigitalGlobe (ex-Maxar), Airbus, ImageSat International etc.), this trend of diversifying the sensor portfolio is only slowly starting to catch on. Here are some non-exhaustive examples of this trend from the past couple of years.

- Maxar partnering with Umbra for access to high-resolution SAR imagery and acquiring Aurora Insights for radio frequency signal monitoring;

- Planet diversifying into hyperspectral with Tanager instruments;

- Albedo launching very-high-resolution optical imagery instruments along with thermal infrared sensors;

- Galaxeye Space launching a satellite with SAR and optical sensors;

- Iceye and Satlantis proposing the Tandem4EO constellation to Spain, made up of optical and radar satellites;

- Tomorrow.io launching precipitation radars and microwave sounders;

- ….. and several others.

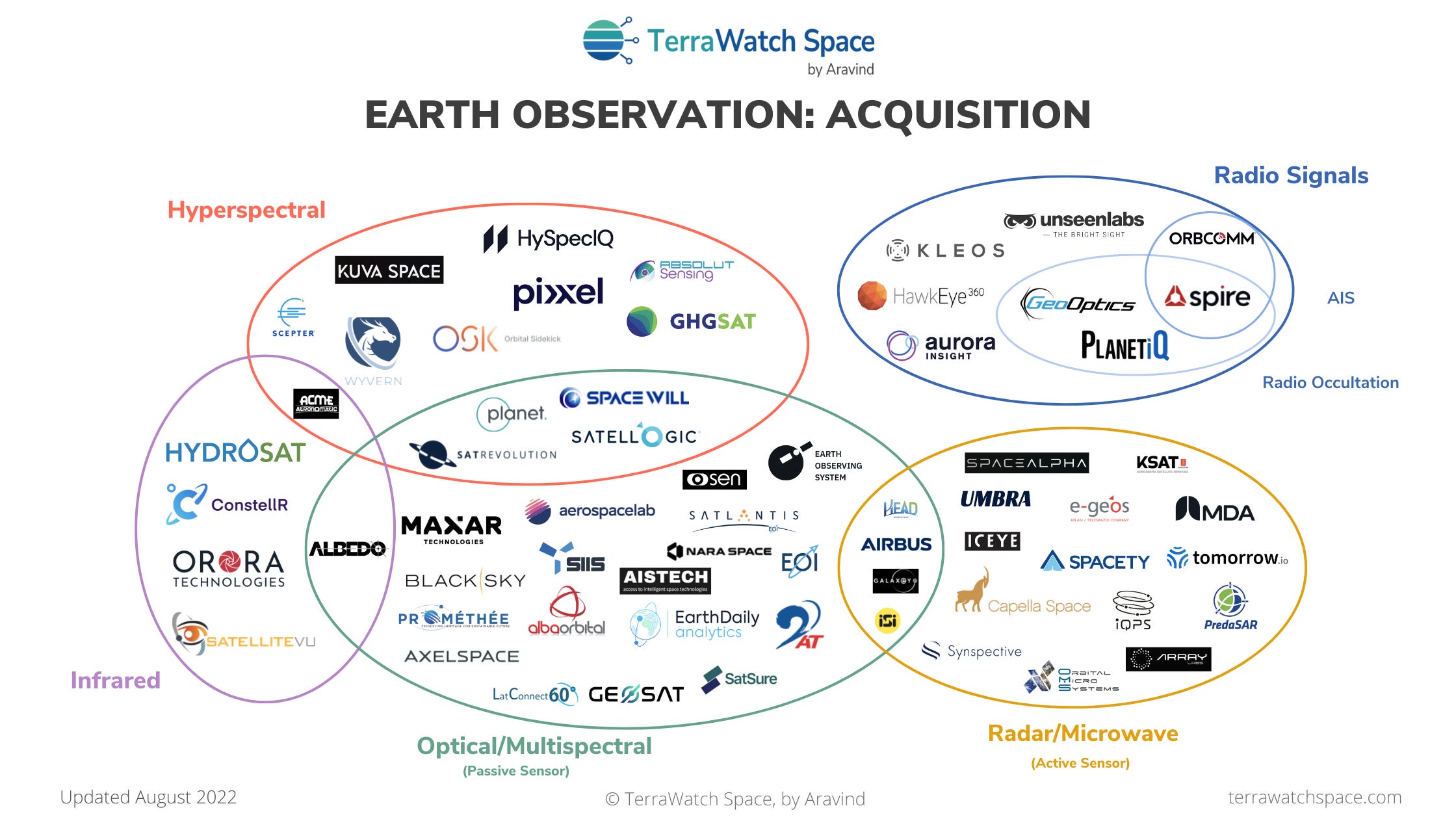

The figure below from the 2022 State of Commercial EO report shows the state of affairs about eight months ago, but things are moving way too fast in the industry to keep up. So, should we expect in EO?

More problem-focused sensor diversification, more sensor-agnostic procurement and more rapid evolution in data fusion techniques.

6. Towards More Strategic (Rather Than Operational) Adoption of EO

The more I talk and work with end-users of EO data (i.e organisations from industries such as financial services, insurance, utilities, mining etc.), the more I am convinced that the adoption of EO will become more strategic than we think.

While there will be a part of adoption that will happen inevitably simply because of the value offered by EO (like the $ it saves due to continuous monitoring it offers or the gaps in data that it is able to fill), I expect some adoption for reasons that are beyond the fundamental benefits and value offered by EO. Companies would be less likely to adopt a technology that every competitor of theirs will have access to - the same data, the same algorithms or the same products. Instead, they would want to develop competitive strengths, derived from EO.

Take the case of Citadel, a multinational hedge fund and financial services company, that has over $62 billion in assets under management. This piece from FT covers the case of how having proprietary access to weather data contributed to the company becoming the most successful hedge fund of all time. In fact, Citadel has a weather team that uses supercomputers to run forecasts and includes specialists in areas such as thunderstorm and tropical cyclone prediction. Instead of relying data that is commoditised and available for everyone to use from the governmental forecasts, the company decided to invest in their own capabilities.

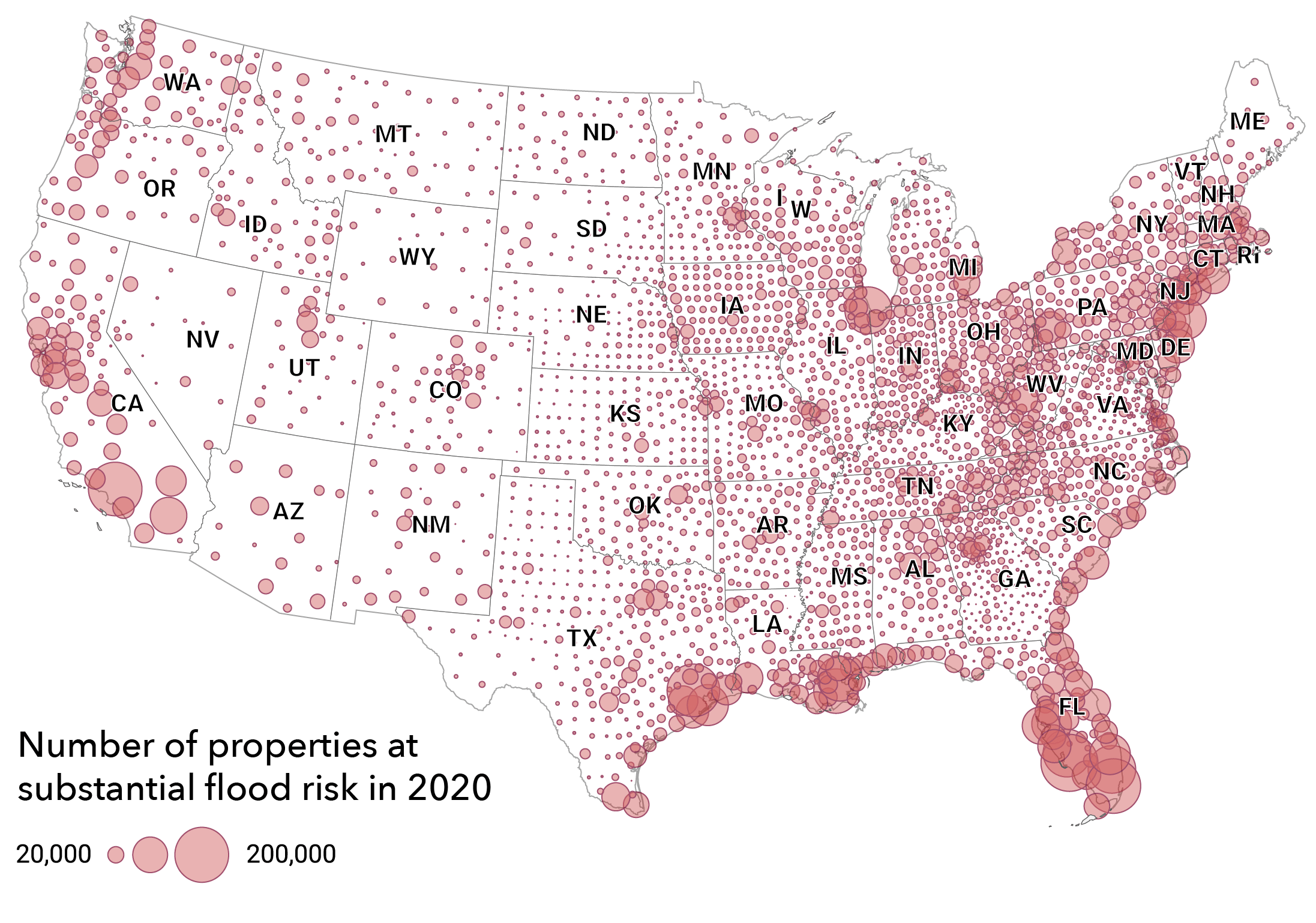

So, what are the parallels with EO? Let’s do a thought experiment. Imagine you are an executive in Fannie Mae, a financial services firm with tens of billions of dollars in revenue, focused on selling mortgage-backed securities. But unfortunately, as a result of climate change, homes in the US that are exposed to flood risk are overvalued by roughly $200 billion. Now, as an executive you have to figure out how the exact climate risk to your company’s balance sheet, so that you can ultimately incorporate that risk into mortgage underwriting. You understand that data from satellites has a lot of value to add. You ask yourself:

Would I rather use data, algorithms and products that everyone has access to and can easily acquire from the market or would I want to build exclusive analytics, hopefully years ahead of your competitors in order to factor climate risk within your underwriting models?

Well, this one is easy, because we know what Fannie Mae is up to - it is working with First Street Foundation and Jupiter Intelligence to build exclusive analytics. Likewise, I would bet that most major enterprises are likely to investigate options to acquire proprietary EO datasets or derive exclusive insights by fusing multiple EO datasets or simply integrate EO into their long-term competitive strategies. I rest my case for more strategic adoption of EO!

Bottomline: Building with the users, for the users corresponding to their strategic needs is more likely to have success than building what we want based on technological possibilities and expecting end-user to adopt the same.

One Podcast Episode

From the TerraWatch Space podcast

7. Measuring and Modelling Flood Risk with EO

We recently had an episode on using satellite data to build flood maps (with Floodbase), but I wanted to deep-dive further on how flood risk is measured and modelled, how this data is used to anticipate flood hazards and the role of satellite data in all of this. So, I had Professor Paul Bates, Chairman and Co-founder of Fathom, a UK-based startup specialising in water risk intelligence on the podcast.

In this episode, Paul and I talk about Fathom and their products, the state of flood modelling today and the role of satellite data, why the quality of data is more important than anything else for this use case, some findings from Fathom's research and more.

One Quick Thing

Hiring for TerraWatch Space

8. Looking For TerraWatchers!

TerraWatch is growing and I am looking for more TerraWatchers (I kinda like how that sounds). I will be posting couple of job postings later this week - will include the links in next week’s edition of this newsletter. If you are curious, here are the (remote) positions that I am going to be hiring for, with a one-liner of their description:

- EO Analyst (Specialist): To support the execution of EO strategic consulting projects, lead research activities for deep-dives on the blog and contribute to this weekly newsletter;

- Operations Associate (Generalist): To manage the implementation of new projects: development of the EO course, growth of the TerraWatch media arm and the organisation of a commercially-focused EO conference;

- Growth Associate (Marketer): To grow the reach and visibility of the blog, the podcast as well as lead all promotional activities of TerraWatch Space on social media (LinkedIn, Twitter) - so far I have done a terrible job!

This is obviously just a teaser, but in case any one of the roles already peaks your interest, just send me a note. But, of course, feel free to wait and check out the full job postings later this week. Thanks a lot!

Until next week,

Aravind.