Hey! Hope you had a nice, long weekend (apart from those who didn’t get a day off on May 1).

Welcome to a new edition of ‘Last Week in Earth Observation’, in which I attempt to curate the major developments in EO from the week that just passed and provide some analysis on the sector that I have come to love.

In this edition, you can read about the thermal infrared satellite companies in the news, some contracts, partnerships and announcements as well as some thoughts on the challenges in the mainstream adoption of EO.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Deals and More 💰

- Planetek Italia, an EO services company won two contracts worth €42M from ESA for the development of downstream services derived from data acquired through the future Italian satellite constellation IRIDE;

- Norwegian ground segment services firm KSAT was selected by the European Maritime Safety Agency to provide SAR monitoring services;

- After reporting the loss of its only EO satellite, Azerbaijan selected Israel Aerospace Industries to build two EO satellites;

- In its financial results for 2022, Satellogic reported that it made $6M in revenue and targets $30M to $50M for 2023;

- CropX, an Israeli agtech startup that offers a farm monitoring solution based on data from in-situ sources and satellites raised $30M in Series C funding;

Some hot (thermal) news …

- Hydrosat, a US-based EO startup raised $20M in private investment and government grants to acquire daily thermal infrared data for plant water stress monitoring among other applications;

- Albedo, another US-based EO startup won a $1.25M grant from the US Space Force - the company is launching a constellation of satellites into very low Earth orbit to collect high-resolution imagery (10 cm) and thermal data;

- Spanish EO company Satlantis has bought a majority stake in SuperSharp, a UK-based startup developing foldable thermal infrared telescopes.

2. Strategic Stuff: Announcements and Partnerships 📈

- The UK Geospatial Commission has launched its commercial EO pilot project, together with Airbus Defence and Space, to provide access and test the use of EO data for up to 35 public sector organisations;

- Airbus will also supply satellite imagery from its Pléiades Neo constellation to Nestlé for its reforestation efforts;

- Space-as-a-service firm Sidus Space signed a partnership agreement with Indian edge-computing startup SkyServe;

- First Street Foundation, a US-based non-profit that produces climate data will deliver climate risk insights to mortgage lending firm Freddie Mac;

- NASA partnered with the US Forest Service to build an inventory of the country’s oldest trees, with ground data complemented by the GEDI mission;

- SAR satellite company Iceye has announced the Beta release of its Wildfire Insights product aimed at the insurance sector;

- BlackSky, through its reseller Telespazio, will provide the Spanish region of Aragon with first-ever high-cadence, low-latency satellite imagery services;

- Maxar expects the first two of its Legion satellites to launch this summer providing high-resolution imagery (30 cm), and plans to add two more to the planned six-satellite constellation.

3. Interesting Stuff: More News 🗞️

- The EU-funded Copernicus Philippines Programme was launched to support the country with natural disaster monitoring and climate change adaptation;

- In total, Italy, through ESA, has ordered 34 EO satellites with optical, SAR and hyperspectral sensors as part of its IRIDE constellation, from a number of local companies, worth €1.1B;

- Researchers concluded that the ongoing drought in the Horn of Africa would not have been possible with human-induced climate change;

- The New Yorker published this interactive piece on the state of methane monitoring and the role of satellites such as MethaneSat;

- Data from ESA’s CryoSat mission was used by scientists to discover that glaciers worldwide have shrunk by a total of 2% in just 10 years.

4. Click-Worthy Stuff: Check These Out 🔗

- The State of Global Climate report from the WMO (+ visualised summary) and the European State of Climate 2022 report (+ tweet summary),

- These workshops on EO data visualisation by Eumetsat;

- These SAR sessions from

L3Harris, now NV5 Geospatial; - This paper that analyses the use of satellite imagery for mining footprints;

- This excellent explainer on the Grace and Grace-FO satellites and how they are useful for monitoring the planet’s water and ice sheets.

Subscribe for more Earth observation insights!

One Discussion Point

Analysis, thoughts, and insights on developments in EO

5. Navigating the Challenges in the Mainstream Adoption of Earth Observation

Last week, I attended the Earth Observation Symposium event organised by the UK Geospatial Commission, which with its commercial EO project, is taking steps towards the mainstream adoption of EO - in their case, by the public sector bodies for everything from emergency response to land use application. I think this is a great move and is expected to help them identify not only the value of EO for these organisations but also to best inform the procurement policy for EO, which in my opinion, is a completely different challenge compared to the former.

Every organisation, public or private, have the same two questions1 when it comes to the topic of the adoption of EO:

- What value does EO bring, compared to existing methods, in order to help me get my job done?

- What is the most efficient and effective way to acquire EO data and services, relative to my budget, on a long-term basis?

Question 1: What value does EO bring, compared to existing methods, in order to help me get my job done?

This is where pilots help. To some extent, a well-strategised pilot that is tracked with relevant business and technical KPIs can support the understanding of the value of EO for the end user. The good news? This is already happening in the sector. There are several pilots in motion by the EO companies and end users are beginning to understand what EO brings and what it does not. They are starting to make sense of the benefits offered by costs (open EO data vs commercial EO), sensors (data and optical vs multispectral vs SAR vs hyperspectral …) and satellite imagery factors (resolution vs revisit vs latency vs quality …). And finally, they might have an idea of the potential return on investment due to EO.

Question 2: What is the most efficient and effective way to acquire EO data and services, relative to my budget, on a long-term basis?

Now, they have done the pilots and want to move on to more long-term, scalable adoption. Here is when the problem starts. If you are an organisation that wants to start using EO within your business workflows, how do you build an optimal EO acquisition strategy that makes sense for you, given your budgetary constraints and other concurrent activities? Every organisation works differently (duh!) and every organisation has a different strategy.

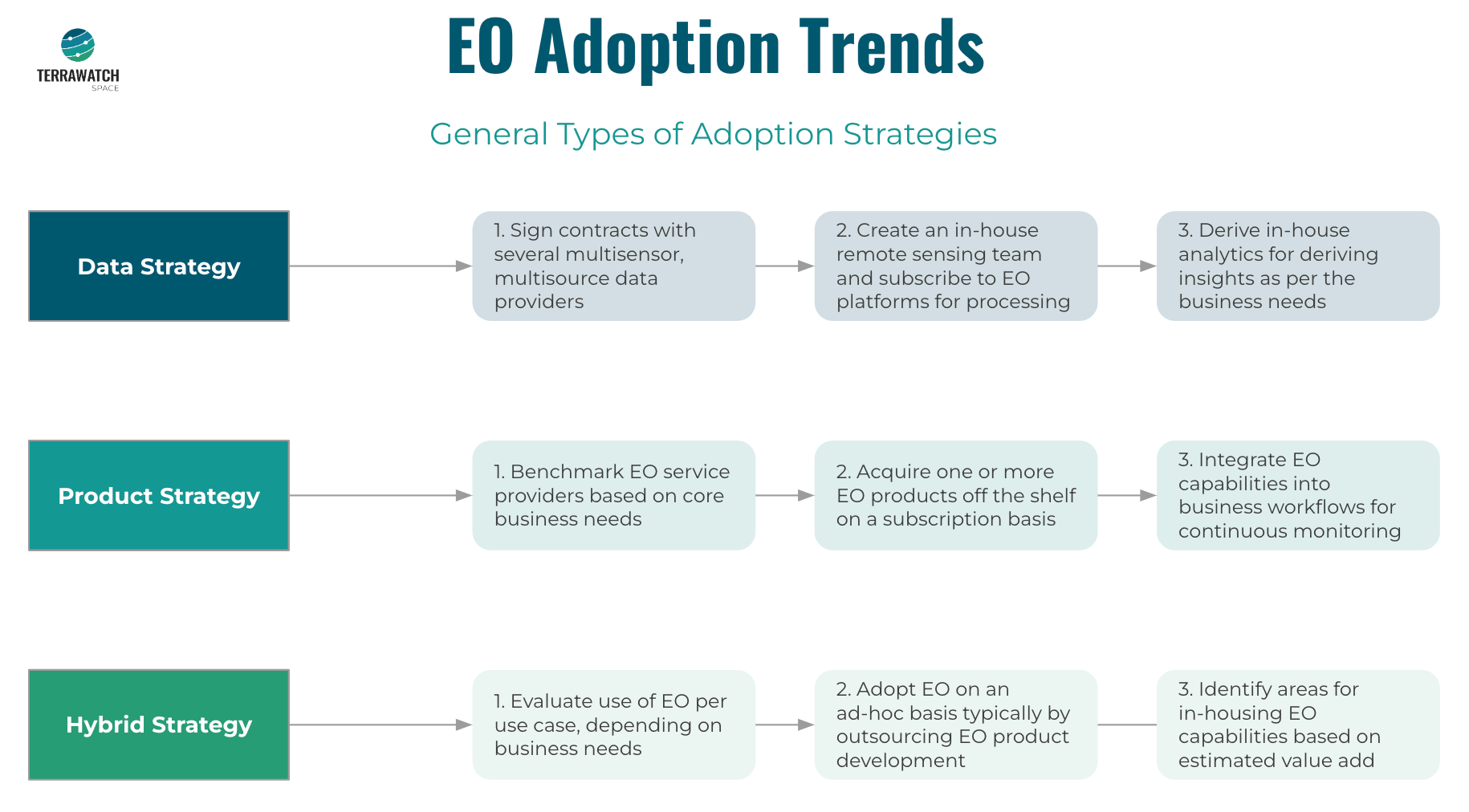

Some organisations have in-house EO teams and can go ahead with a Data Strategy:

Challenge: Many EO companies launching a variety of sensors with a multitude of applications, but also with pricing models and data formats.

Some organisations do not have in-house EO teams and hence have to resort to a Product Strategy:

Challenge: Many EO off-the-shelf products provide direct analytics based on various methodologies that may or may not be ‘black-boxes.’

Some organisations want to pursue a combination of the two strategies - a Hybrid Strategy - on an ad-hoc basis based on their needs:

Challenge: Several emerging EO tools and technologies lead to a dilemma on whether a proper, long-term EO strategy can be developed after all.

These are the kind of questions that I work with for end-user organisations - honestly, there has not been a pattern so far. Every organisation works in fundamentally different ways, has distinct priorities, has unique KPIs, and more interestingly, is in a different stage of the EO adoption cycle. To complicate things, many organisations are also interested in more than one application of EO, meaning every one of those has its own requirements, KPIs and priorities.

And, this has been proven to be true, based on work I have done via TerraWatch with organisations across sectors - in agriculture, insurance, mining, utilities, financial services, non-profits, public services etc. So, what’s the solution? I guess we have not found one yet. If I do, I will be sure to share. And if any EO company cracks it, I will be sure to report it here. Until then, let’s keep truckin’!

Note: I will be sharing more of these thoughts during my presentation at the Geospatial World Forum in Rotterdam on May 5. If you are around, see you then!

PS. There was no new podcast episode last week. Are you sure you checked out every one of the past episodes? Here is your chance!

Until next time,

Aravind

Technically, there is a third one on scalability - the challenges of running EO-based monitoring applications, at scale (spatially and temporally, integrated with the organisation’s existing enterprise software setup). There is a lot to say here, but, I will reserve it for another upcoming newsletter. But here’s a clue! ↩