Hey! Hope you had a nice, long weekend (Monday was a public holiday in over 50 countries).

Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from last week and some thoughts on the sector that I have come to love.

This is a jam-packed edition, today we are looking at - defence contracts, SAR satellites, global flood forecasting, greenhouse gas emissions reporting, how early warnings save lives and more.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Some funding news from SatelliteVu, SkyFi and Fleet Space…

- UK-based SatelliteVu, which aims to launch an EO satellite constellation to acquire thermal infrared data has raised $15.8M in a Series A-2 round;

- SkyFi, which offers an application for the on-demand acquisition of satellite imagery, has raised $7M in a seed round;

- Fleet Space, which is building a constellation of IoT satellites to connect its proprietary tomographic sensors used for mining exploration applications has raised $33M in a Series C round;

And wins for Umbra, PredaSAR, Northrop Grumman, Jacobs and NUVIEW …

- The US Defense Advanced Research Projects Agency (DARPA) awarded contracts to Umbra to demonstrate the formation flying of SAR satellites and algorithms for processing the imagery collected;

- NUVIEW, which plans to launch a constellation of lidar-equipped satellites won a contract from the U.S. Department of Defense, worth $2.75M.

2. Strategic Stuff: Partnerships and Announcements 📈

Some partnerships …

- Planet is partnering with the UAE Space Agency providing access to its data to build a regional loss and damage solution for climate change resilience; Planet also announced partnerships with AI data analytics providers - synthetic data startup, Synthetaic and South Korean startup SI Analytics;

- Spire is collaborating with BlackSky to build a maritime solution to automatically detect, identify and track vessels in real-time, fusing data from their two sensors - radio frequency (RF) and high-res optical imagery;

- RF monitoring satellite firm Kleos is joining hands with defense corporation General Atomics to derive insights from RF data;

And some announcements …

- EO startup Impact Observatory announced the launch of IO Monitor, a global mapping and monitoring product to classify land use and land cover;

- French startup, GRASP Global, which plans to deploy a constellation of satellites for air quality monitoring launched its platform to provide air quality forecasting;

- SAR satellite company Iceye unveiled a new imaging mode that can distinguish human-made and natural objects and highlight moving vehicles, by having the satellite focus on an area for 25-seconds;

- Google announced the global launch of its AI-driven flood forecasting platform, Flood Hub, which uses satellite data along with other sources;

- Hyperspectral satellite firm Orbital Sidekick and EOS Data Analytics, a Ukraine-based EO company that plans to launch a constellation of optical imaging satellites have received the first images from their recently launched initial satellite(s);

3. Interesting Stuff: More News 🗞️

Some launch-related news …

- The Russian space agency, Roskosmos has launched a radar-observation satellite that will be primarily used by the Russian military;

- Northrop Grumman won a launch contract from the US Space Force to launch a small weather satellite that will demonstrate commercial weather imaging technologies for military use;

- Rocket Lab launched the second and last pair of the NASA TROPICS cubesats that will monitor storms over the tropics;

- South Korea launched a set of technology demonstration satellites including a SAR mission while China launched a Ka-band SAR test satellite;

In other news …

NATO faces hurdles in acquiring commercial satellite imagery, while the US National Geospatial-Intelligence Agency, National Reconnaissance Office and the Department of Homeland Security are all planning new procurement for EO data and services from the commercial sector;

The World Meteorological Organisation (WMO) announced the launch of ‘Global Greenhouse Gas Watch’, an initiative that brings under one roof all space-based and surface-based observing systems for emissions, standardising the models and data assimilation methods;

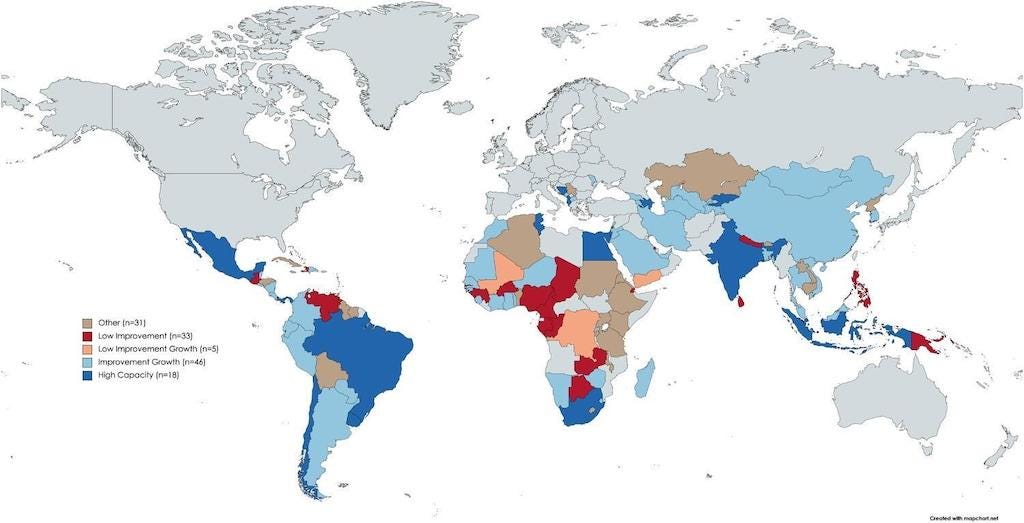

Sticking to greenhouse gas (GHG) emissions, researchers found that of the 133 developing countries studied for progress towards providing regular GHG inventories, over half of them still struggle to report GHG emissions;

Credit: Chisa Umemiya & Molly K. White

4. Click-Worthy Stuff: Check These Out 🔗

- This piece, which provides an overview of the hyperspectral wave in Earth observation, including my thoughts on its potential and adoption challenges;

- This investigative article that shows how satellite data used by the non-profit Global Fishing Watch is used to catch illegal fishing;

- This piece that looks at how China is using a nationwide satellite and automated monitoring system to protect nature;

- This article from the WMO that shows how the economic costs of weather-related disasters have rapidly grown but early warnings have saved lives;

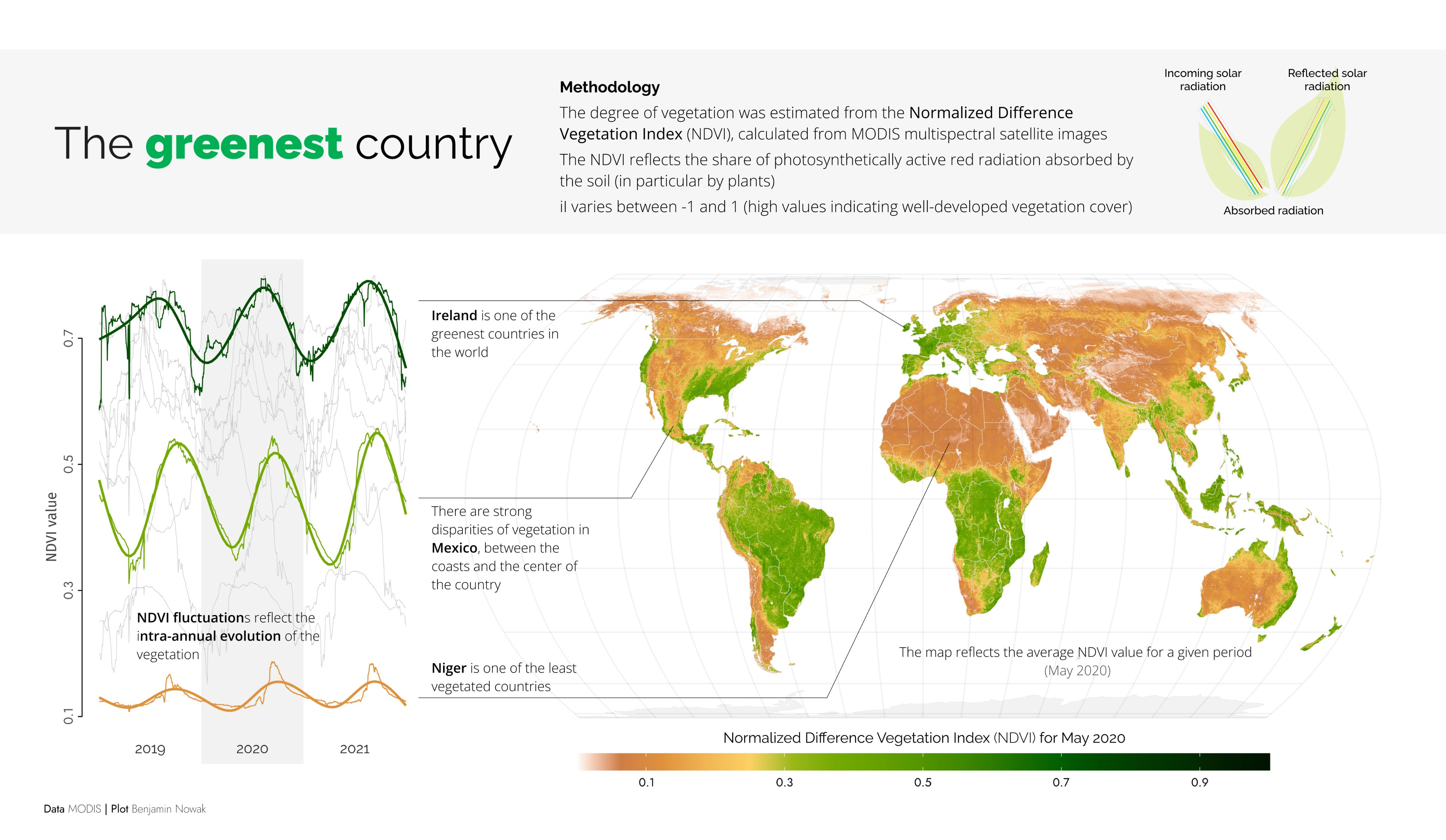

- This visual that puts the infamous NDVI (Normalized Difference Vegetation Index) in perspective on a global scale;

Subscribe for more Earth observation insights!

One Discussion Point

Analysis, thoughts, and insights on developments in EO

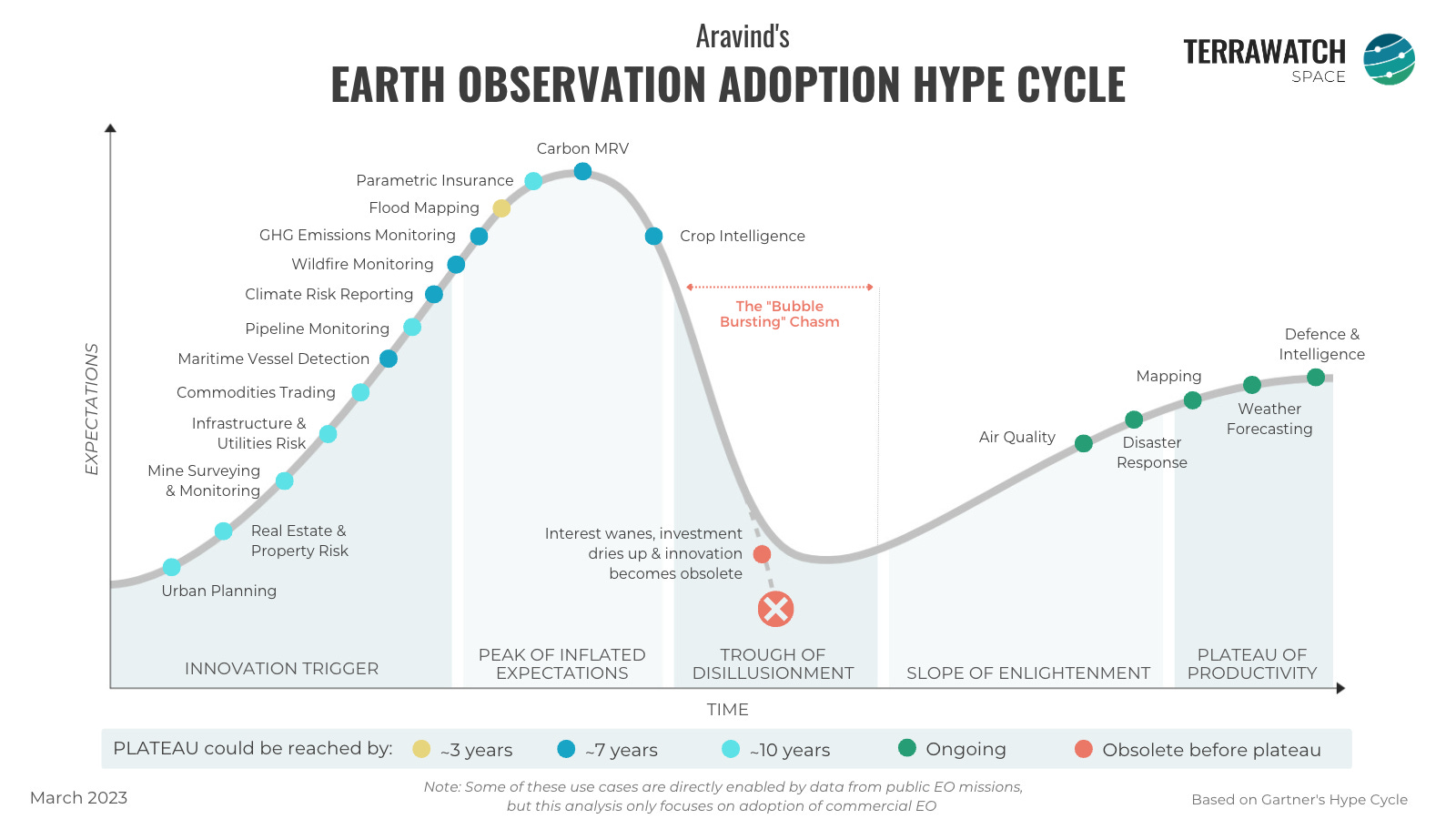

5. Where are we with the adoption of commercial EO data?

While the Gartner Hype Cycle is most suited for analysing technologies, and the Technology Adoption Curve by Geoffrey Moore is most suited for analysing the adoption of technologies, I decided to change things a little bit. I asked myself:

How would some use cases of EO fare if they were analysed through the same framework as the technology itself? More specifically, for which use cases of EO is the use of commercial EO data crucial, making it become mainstream?

I used the two following criteria to analyse and position the selected EO-driven use cases across sectors on the Hype Cycle:

- Hype: The level of buzz that the innovation has already created within the EO sector and the wider space industry —> Not straightforward, but I used proxies such as the amount of media coverage and importance given in conferences and then ranked relatively as Low-Medium-High;

- Adoption: Level of adoption of commercial EO data within the selected use case —> Not straightforward, used a combination of public information about contracts and my experience working with end-users of EO to rank relatively as Low-Medium-High;

Mainstream applications of EO that are, partially, or in most cases, entirely enabled by data from governmental EO satellites including air quality, disaster response, mapping and weather forecasting are likely to benefit from commercial EO data, especially when used complementarily to open data sources. It would be fair to say that these are the low-hanging fruits that commercial EO companies would hope to capture as they move through the technology hype cycle.

Climate change (an umbrella term for several applications in the figure) is accelerating the demand for EO, whether it is to complement data from public EO missions or directly enable use cases that were not possible before. I have written about this subject in detail before, but what I am excited to see is how much commercial EO will play a role in areas where governmental EO missions have been the benchmark (think emissions, weather, climate science, carbon stock takes and the like).

It is important to acknowledge that adoption of EO within some use cases is most likely going to fall into the trough of disillusionment, simply because alternative data sources (remotely sensed or otherwise) solve the problem more effectively and cost-efficiently. Wherever possible, I hope EO takes a seat in the background, and show its value on-demand.

One Podcast Episode

From the TerraWatch Space podcast

6. Translating Climate Science into Quantifiable Climate Risk Analytics

If you have wondered how we can translate all the complex science associated with climate change into useful information for financial institutions, governments, insurance firms etc., then this week’s episode might interest you. I had Dr Claire Burke on the podcast. Dr Burke is the Director of Science at Climate X, a UK-based startup building a global climate risk analytics platform to support organisations in their climate adaptation efforts.

In this episode, we talk about what Climate X does, their tech stack and how they use satellite data, how they convert scientific results into climate risk analytics, the "black-box problem" challenges in educating end-users and more.

Until next time,

Aravind.