Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from last week and some exclusive analysis and insights from TerraWatch.

In this edition: Funding rounds, contracts, new EO satellite plans, the state of coral reefs and a snapshot of the heavily fragmented commercial EO landscape.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- HawkEye 360, which operates a constellation of satellites monitoring radio frequency signals, closed an additional $10M within its Series D1 funding;

- EO data management and distribution platform Arlula raised an undisclosed sum as strategic investment from Lockheed Martin Ventures;

- Overstory, which offers EO-based vegetation monitoring products for the utility sector, has closed a $14M Series A funding round;

- Urban Sky, which collects imagery using its proprietary stratospheric balloons has raised $9.75M in Series A funding;

Contracts

- Danti, a startup building a search engine for geospatial data, won a contract worth $1.2M from the US Air Force and also raised additional VC funding;

- BlackSky was also awarded a contract by the US Air Force to evaluate the feasibility of tracking vehicles in real-time with RF and optical imagery;

- Horizon Technologies won a grant worth £1.2M from the UK Space Agency to build and launch an RF monitoring mission by mid-2024;

- Sisir Radar, an Indian startup has won a challenge enabling the company to develop L-and P-band SAR payloads;

- European companies 3IPK and Thales Alenia Space were awarded a contract by ESA to develop a blockchain-based solution for managing traceability and ensuring the integrity of EO data;

- Metaspectral, which offers a platform to analyse hyperspectral imagery has won a grant worth C$690K to evaluate the feasibility of quantifying and monitoring carbon.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- South Korean EO startup SI Analytics has partnered with Maxar and Planet to enhance its offering within the country and in the Asia-Pacific region;

- Azercosmos, the space agency of Azerbaijan has signed a cooperation agreement with Bayanat, the geospatial company from the UAE;

- Indian defence startup Data Patterns has signed a licensing and transfer of technology (ToT) agreement with the Indian space agency for SAR payloads;

Announcements

- The Canadian Space Agency has announced plans to invest over C$1B ($739M) over the next 15 years in the Radarsat mission, which can arguably be considered as part of its climate resilience strategy;

- SAR satellite firm Iceye and market research firm Euroconsult are leading a consortium of European EO companies to conduct a feasibility study for developing an EO service for government-authorized users in the EU;

- Angkasa-X, a Malaysian startup, has announced plans to launch a constellation of six satellites with optical and AIS sensors;

- Investing firm Seraphim has unveiled the startups part of its accelerator programme including 5 from the EO sector: Aquascope, Optimal Cities, SkyFi, Kumi Analytics and Four Point.

3. Interesting Stuff: More News 🗞️

- ESA has approved plans from Poland to build and launch an EO satellite constellation named ‘Camilla’;

- CASSINI Challenges, a space innovation competition from the European Union Agency for the Space Programme has been launched;

- A team from the University of North Carolina won a NASA grant to explore disparities and solutions to urban heat stress in the US, leveraging EO data;

- The co-founder of SAR satellite company Capella Space has stepped down as CEO, while OroraTech, the thermal-infrared satellite startup has appointed a new CEO.

4. Click-Worthy Stuff: Check These Out 🔗

- This report from the World Meteorological Organization, which provides an extensive assessment of global water resources;

- This research paper that shows how to use satellite data to track industrial sources of pollution and aerosol emissions;

- This article that discusses the efficacy of airborne SAR data for detecting polar bears;

- And, this paper that shows results from analysing satellite-derived NDVI (normalized difference vegetation index) over decades to track the impact of land use and climate change.

If this was forwarded to you, please subscribe to receive Earth observation insights!

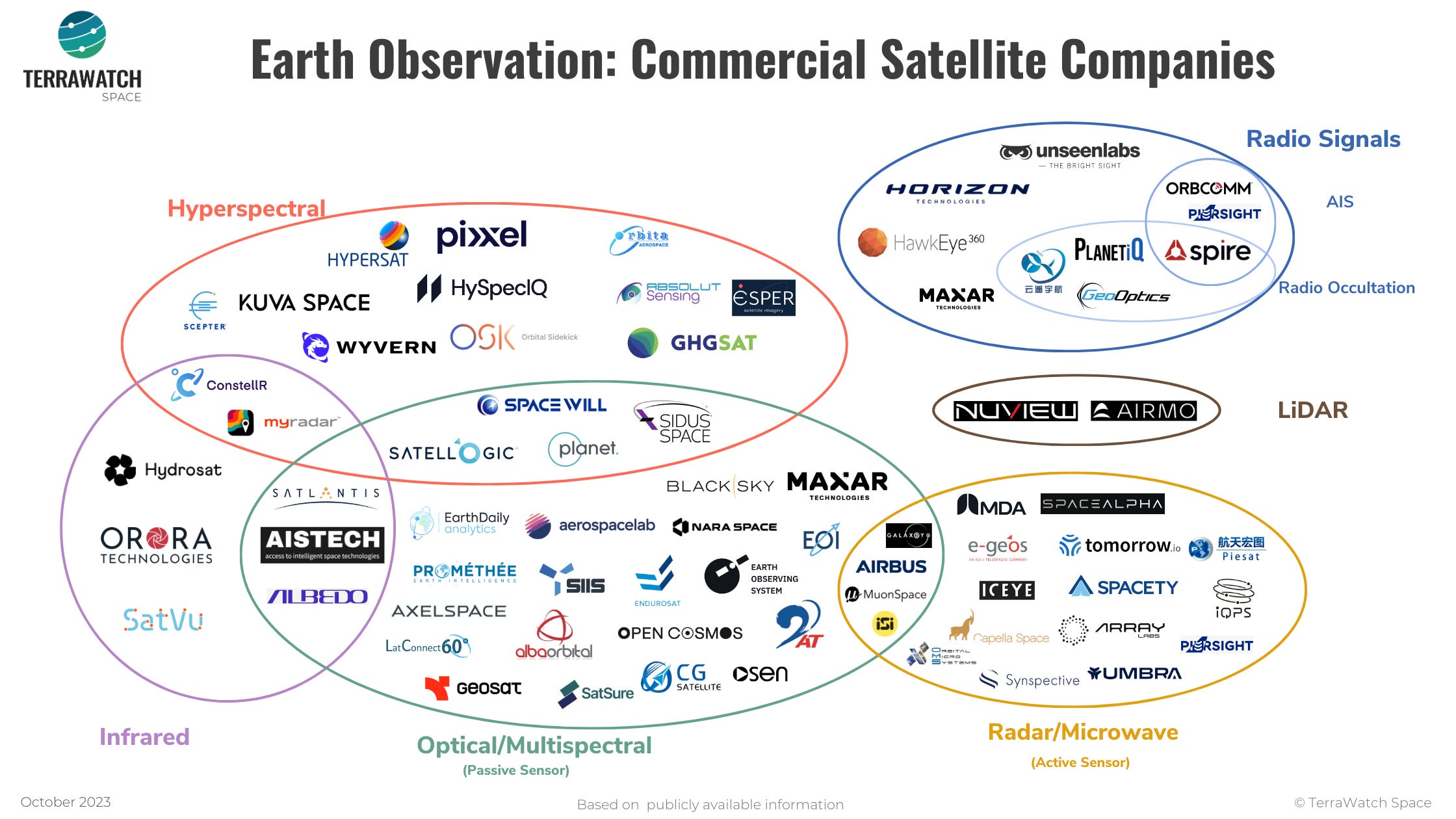

5. From a Technology-Driven, Fragmented EO Sector towards a Problem-Driven Consolidated EO Sector?

If you are an outsider to EO like me (yes, I try to be even though I have been working in EO for over 6 years), you would think this was obvious as you probably know that no one sensor can solve most of the scientific/commercial problems and satisfy most customer needs. You probably also understand that you need to fuse data from different types of spatial resolutions, sensors and data sources to build a viable, valuable, successful product that “gets the job done”, for the end-users, irrespective of market verticals.

But, it is not the case today - EO satellite data companies tend to mainly operate on a technology-driven model (vs a problem-driven model). Operating a constellation of satellites with a multi-sensor configuration for solving specific problems has not been very common in the industry. If you set aside companies that are built primarily for the government and/or the military (the likes of DigitalGlobe (ex-Maxar), Airbus, ImageSat International etc.), this trend of diversifying the sensor portfolio is only slowly starting to catch on. Here are some non-exhaustive examples of this trend from the past few years:

- Maxar partnering with Umbra for access to high-resolution SAR imagery and acquiring Aurora Insights for radio frequency signal monitoring;

- Planet diversifying into hyperspectral with Tanager instruments;

- Albedo launching very-high-resolution optical imagery instruments along with thermal infrared sensors;

- Spire collecting radio occultation (for weather), AIS (for maritime) and ADS-B (for aviation);

- ConstellR acquiring an early-stage hyperspectral satellite startup ScanWorld;

- Galaxeye Space launching a satellite with SAR and optical sensors;

- Iceye and Satlantis proposing the Tandem4EO constellation to Spain made up of optical and radar satellites;

- Bayanat partnering with Iceye, Yahsat and HySpecIQ for creating a geospatial ecosystem in the UAE and the Middle East;

- Tomorrow.io launching precipitation radars and microwave sounders to improve global weather forecasting;

- ….. and many more.

If you feel like things are moving way too fast in the industry to keep up, you aren’t the only one. So, what should we expect in EO?

Here is one of my (many) wishes:

More problem-focused sensor diversification, more sensor-agnostic data procurement and more rapid evolution in data fusion techniques.

Scene from Space

One visual leveraging EO

6. Hot Summer for the Coral Reefs in Florida

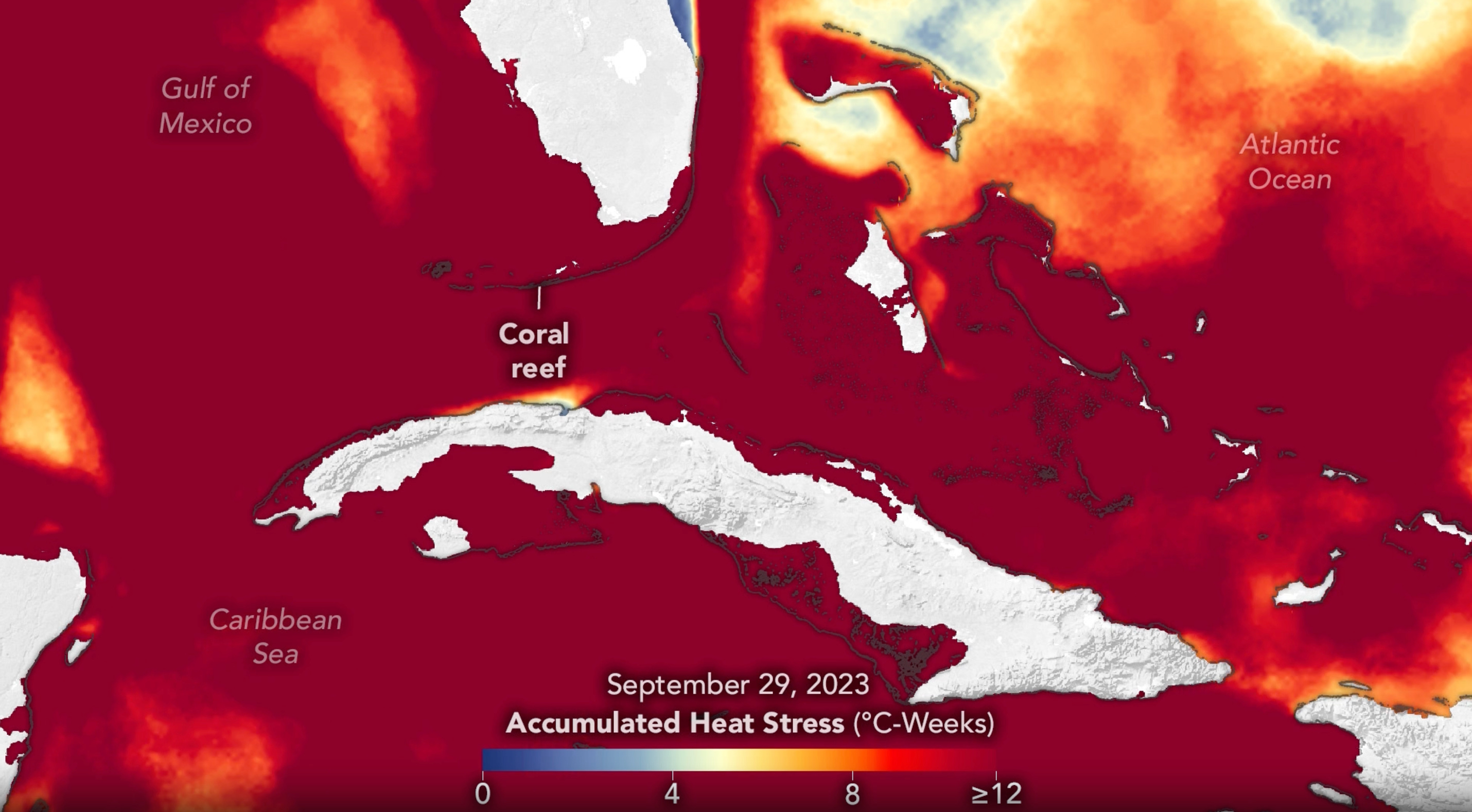

I have not yet seen Florida's coral reefs with my own eyes, but based on what we can see from this satellite image, they seem beautiful.

For several months this year, the global sea surface temperatures (SST) reached record-high levels, fueled by decades of human-caused climate warming, compounded by the El Niño phenomenon. Some areas—including the seas around Florida, Cuba, and the Bahamas—saw particularly high temperatures, with implications for the health of coral reefs.

The stress caused by the record SSTs on corals can be seen from satellites - the following image shows the heat stress in “degree heating weeks” (°C-weeks)—a measure that provides an estimate of the severity and duration of thermal stress. At values of 8, which is most of the area below, coral bleaching and widespread mortality are supposed to likely, according to NOAA’s Coral Reef Watch.

Until next time,

Aravind.