Welcome to this belated edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from last week and some exclusive analysis and insights from TerraWatch.

In this edition: Antarctic sea ice levels, AI for weather forecasting, increasing property insurance rates and my top 3 theses on the EO market

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Contracts

- NASA has extended the Commercial SmallSat Data Acquisition contract with Planet through 2024, valued at $18.5M;

- Planetek Italia won a contract from Saudi Arabia to provide monitoring services based on EO for afforestation initiatives in the Kingdom;

Funding

- Forest monitoring startup Treefera, which uses EO among other sources for its carbon solutions raised $2.2M in seed funding;

- Indian startup PierSight, which plans to launch a constellation of satellites with SAR and AIS sensors, raised $600K in pre-seed funding;

- Insurtech startup Previsico, which offers flood monitoring solutions using satellite data and other sources, raised £2.4M in funding.

2. Strategic Stuff: Partnerships and Announcements 📈

- Outdoor navigation company onX, through a partnership with Planet, has added frequently updated, high-resolution satellite imagery to its apps;

- Indian EO startup GalaxEye Space is collaborating with drone manufacturer ideaForge ink pact to build an Unmanned Aerial Vehicle equipped with a Foliage Penetration Radar to enhance aerial surveillance and mapping;

- The UK Space Agency has announced £65 million of funding over 3 years, for supporting the development of space technologies and applications;

- NOAA is looking for more vendors for commercial radio occultation (RO) data, apart from Spire and PlanetiQ (who are already contracted with NOAA for $60M together over the next five years)

My take: Apart from GeoOptics, I am not entirely sure there are other RO data providers in the market - unless someone emerges out of stealth soon. This is stemming from the lack of growth of the private weather enterprise, particularly in the space sector, a topic I wrote about just last week.

I hope governmental agencies around the world prioritise and encourage the development of a commercial spaceborne weather observation sector, similar to the development of satellite imaging data providers.

3. Interesting Stuff: More News 🗞️

- Several nations including Egypt, Jordan, Mauritania and the Gulf countries are looking to partner with China for its meteorological satellites;

- Analysis of satellite data by EO analytics firm SpaceKnow revealed that the Chinese economy is showing signs of a stronger recovery in September

- Canada will provide the Philippines free access to state-of-the-art satellites that will allow maritime enforcers to surveil, almost in real-time, vessels within the Philippines’ exclusive economic zone

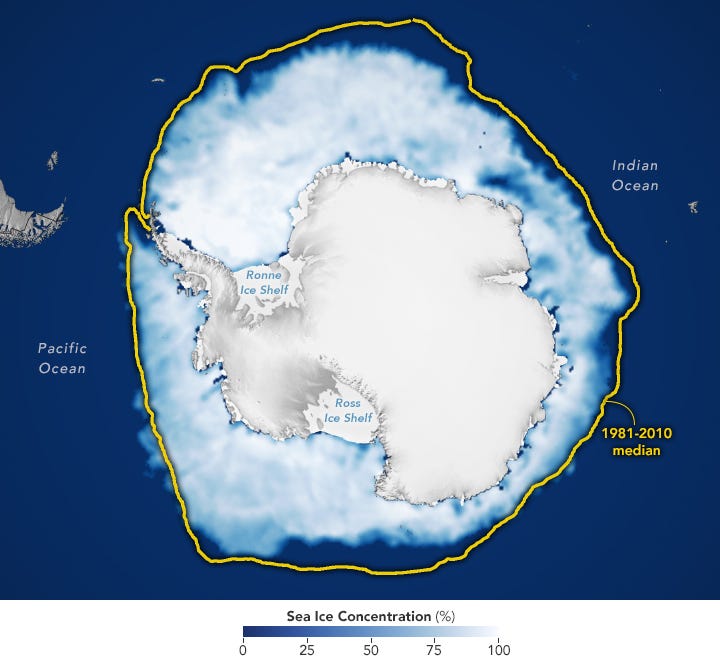

- Satellite data showed that Antarctica has likely broken a new record for the lowest annual maximum amount of sea ice around the continent, beating the previous low by a million square kilometres.

4. Click-Worthy Stuff: Check These Out 🔗

This article that provides a non-hyped, objective analysis of the use and challenges of AI for weather forecasting;

This piece that discusses the need for multimodal solutions - from cameras to satellites to robots, powered by AI - to fight the wildfire crisis;

This inspiring profile of a researcher whose job is to use satellite data to detect, quantify and contextualise some of the most damaging greenhouse emissions around the world (to make the stakeholders to act on them);

The latest edition of the Planet Snapshots newsletter that looks at the future of cities and how they are observed from space (including this image of a new city being constructed outside Cairo, Egypt - I like the viewing angle)

If this was forwarded to you, please subscribe to receive Earth observation insights!

One Discussion Point

Analysis, thoughts, and insights on developments in EO

5. Three Theses (aka Fundamental Beliefs) on EO

Quite a few of you have reached out to ask about my general thoughts on the state of the EO market and what I believe would be the future of EO. As you might expect, I have several thoughts, on how it is evolving and where it might be heading. While it might be hard to give answers that satisfy everyone, I wanted to share these theses on the market with you as a starting discussion point. Feel free to reply with your feedback.

Irrespective of the companies, technologies, policies and overall trends in EO, the following three theses are my core operating tenets that always stay in the back of my mind, whether I analyse the EO market for this newsletter or when I do consulting projects with clients or when I am just simply evangelising about EO.

- In the end, it all boils down to this

The value of Earth observation is usually an actionable alert, a scalable API or an insightful dashboard - that is all end-users want and actually pay for. Everything else (satellites, algorithms, AI etc.) needs to be quietly, but reliably running in the background.

- The future is really quite simple

The future of EO lies in our ability to look beyond the type of sensor, the name of the provider, the kind of satellite and look deeper into the problems that can be solved with EO, and the impact that it can have.

- We just need to be honest with ourselves

We need an independent advisory layer, one that is incentivised to be technologically holistic, commercially agnostic and fundamentally objective, while only focusing on translating the impact of EO for end-users and helping them get their job done.

— — —

Those are the fundamental beliefs and guiding principles for everything I try to do with TerraWatch, as I work with folks across the Venn diagram - those who are building EO (the institutions and the industry), investing in EO (investors and venture capitalists) and adopting EO for solving a problem or getting a job done (any organisation).

Scene from Space

One visual leveraging EO

6. Increasing Property Insurance Rates in the U.S.

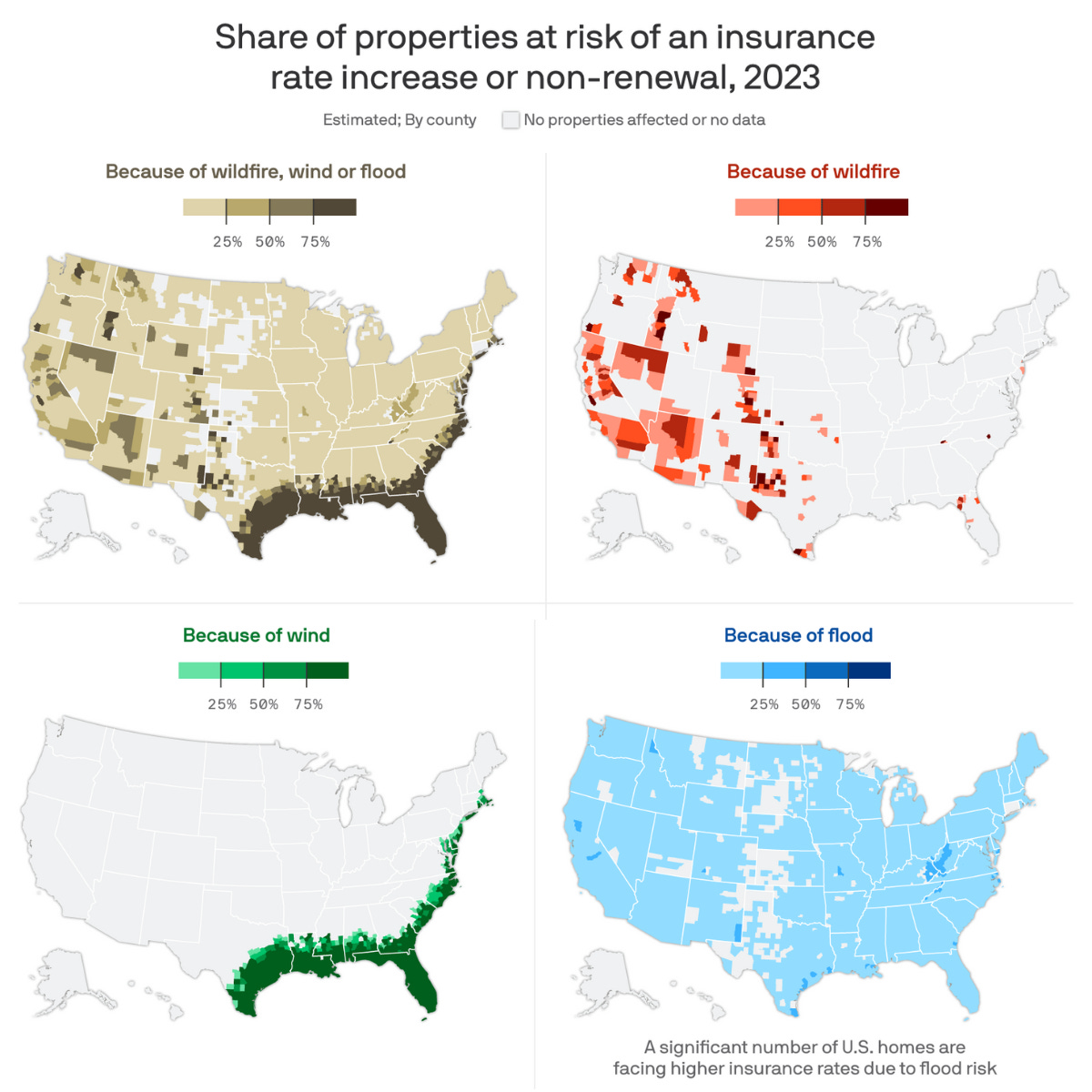

The following figure, based on analysis by the First Street Foundation, shows that millions of homeowners in the US are facing higher insurance rates due to the risk of wildfires, high winds and flooding.

According to their report, about 12 million properties may see premium hikes because of the risk of flooding, nearly 24 million because of potential wind damage, and about 4.4 million because of wildfire risk. Probably why California has started rewriting its state-level insurance rules.

I believe insights from satellite data are going to become a fundamental part of our decisions on where to live, as climate change evolves (and worsens).

Until next time,

Aravind