Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from last week and some exclusive analysis and insights from TerraWatch.

In this edition: The State of Weather Satellites, Air Pollution in Europe, Methane Emissions from Satellites, Floodplains and more.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- Location platform MapBox has closed $280M in a Series E funding round, led by SoftBank to expand its map offerings for the automotive industry;

- Delos Insurance, which offers wildfire insurance products based on EO has raised $7.3M in a seed extension round;

- Estonian startup KappaZeta, which builds agriculture and forestry solutions based on SAR data has raised €480K;

Contracts

- Spire was awarded a contract, valued at $2.8M over 12 months, by NOAA to provide GNSS-Reflectometry data for measuring ocean surface winds;

Deals

- SynMax, a geospatial intelligence company focused on the energy and maritime sectors, has acquired Gas Vista which offers an energy trade flow analytics & visualisation platform;

Financials

- Satellogic provided financial results for the first half of 2023, in which it reported $3.2M as revenues, a 33% year-over-year growth along with plans to redomicile the company in the US, from the British Virgin Islands.

2. Strategic Stuff: Partnerships and Announcements 📈

Announcements

- Portuguese EO firm GEOSAT has announced that it will be launching 11 high and very high-resolution satellites in 2025 (in Portuguese);

- Spain announced that it will be partnering with ESA to launch the Atlantic Constellation, an EO satellite constellation of 16 satellites, 8 of which will be developed in Spain and the other 8 in Portugal;

- Maxar has reorganised into two separate businesses: Maxar Space Infrastructure and Maxar Intelligence, along with some job cuts;

Partnerships

EO data distributor SkyWatch is teaming up with SatelliteVu to enable access to the latter’s thermal infrared satellite data on its platform;

Pixxel is partnering with geospatial solutions firm Sanborn to provide hyperspectral data from its satellites for developing applications across agriculture, forestry, mining and other verticals;

Earth-i, a UK-based EO startup is joining hands with Planet to build environmental monitoring solutions for the UK’s Rural Payments Agency.

3. Interesting Stuff: More News 🗞️

Flood risk analytics firm Fathom unveiled FABDEM+, a high-resolution, global, digital elevation model;

A Rocket Lab Electron rocket failed during a launch of Capella Space’s SAR satellite, the second of Capella’s new-generation birds;

Indian EO firm SatSure is planning to invest $35M for the launch of four EO satellites by 2025;

Radio frequency monitoring firm HawkEye 360 unveiled RFIQ, a product offering flexible radio frequency data collection options;

The U.S. Space Force, for the second time, has taken ownership of a retired NOAA weather satellite to fill gaps in coverage for the U.S. military (if you are wondering why the Space Force is interested in a retired weather satellite, read my analysis below);

4. Click-Worthy Stuff: Check These Out 🔗

This piece on TerraWatch, which discusses the applications of L-band SAR in the mining sector, through case studies from Israeli startup ASTERRA;

This piece from The Guardian showing how satellite imagery was used to identify and track vessels transporting sanctioned oil around the world;

This article that summarises the findings of a study which analysed EO data to find that between 1992 and 2019 over 600,000 square kilometres of natural floodplains1 were lost globally due to land conversion;

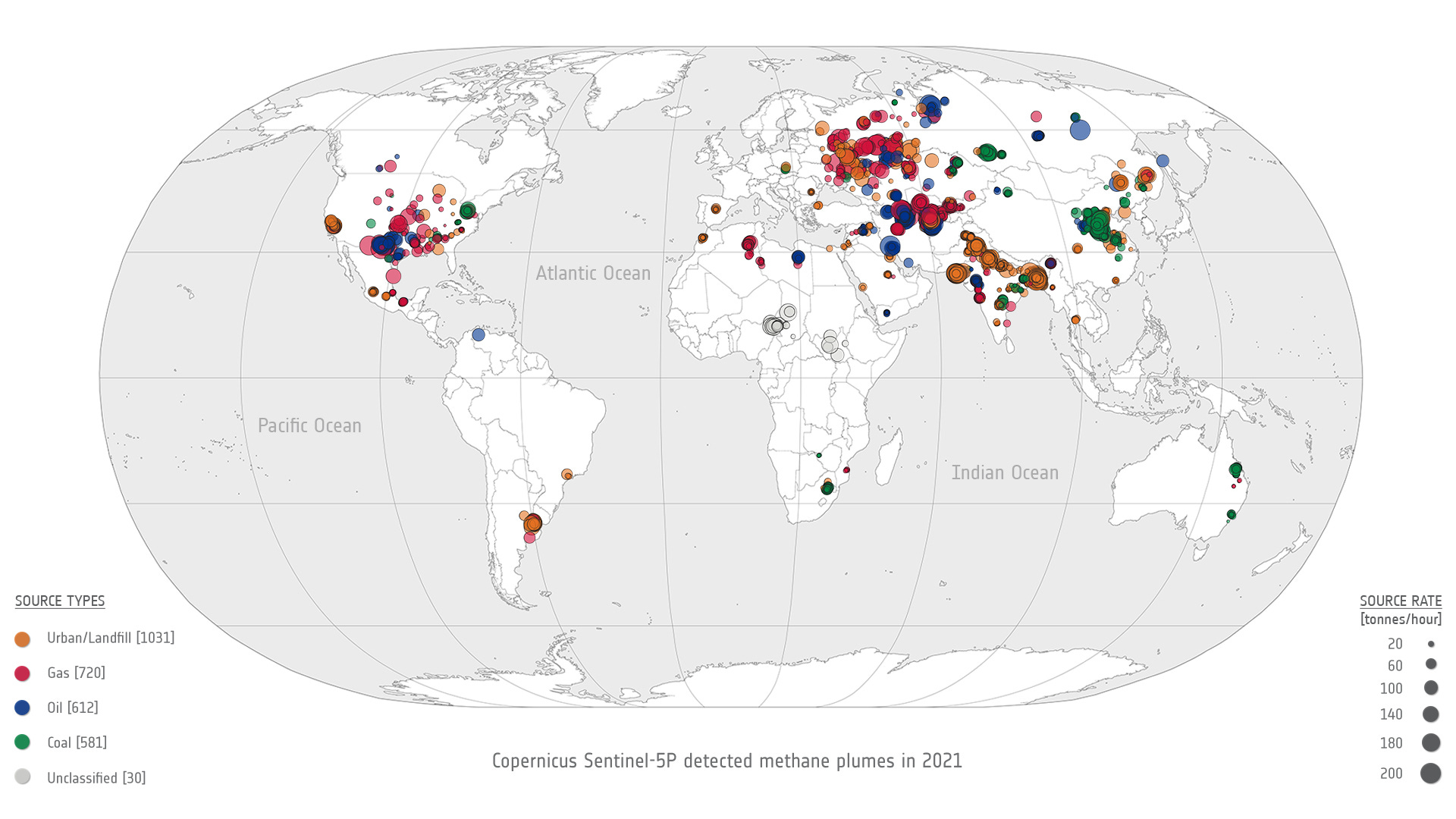

This article from ESA on how the combined capabilities of Sentinel-5P and Sentinel-2 satellites, automatically discover methane super-emitter plumes.

If this was forwarded to you, please subscribe to receive Earth observation insights!

One Discussion Point

Analysis, thoughts, and insights on developments in EO

5. The State of Weather Satellites and Why They Barely Get Any Attention

The news that the US Space Force (USSF), for the second time, has taken ownership of a retired NOAA weather satellite to fill gaps in coverage for the U.S. military should have been a shock for many in the industry. If you are wondering why the USSF had to rely on a decade-old satellite, it is because that is all they can do at this moment to acquire weather data.

The USSF has its own weather programme called the Defense Meteorological Satellite Program, but the decades-old satellites are running out of fuel and are projected to be out of service before 2026. The USSF is currently evaluating concepts for a follow-up programme, called, Electro-Optical/Infrared (EO/IR) Weather Systems, with a couple of demonstrators already launched.

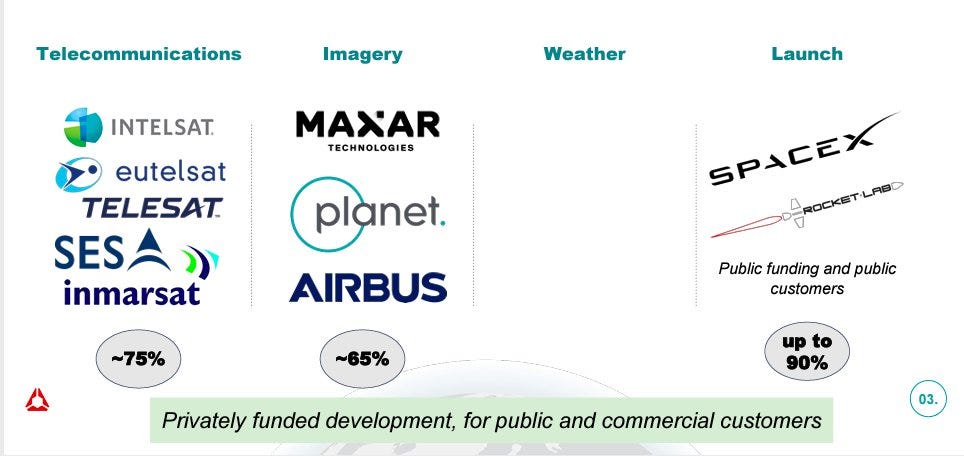

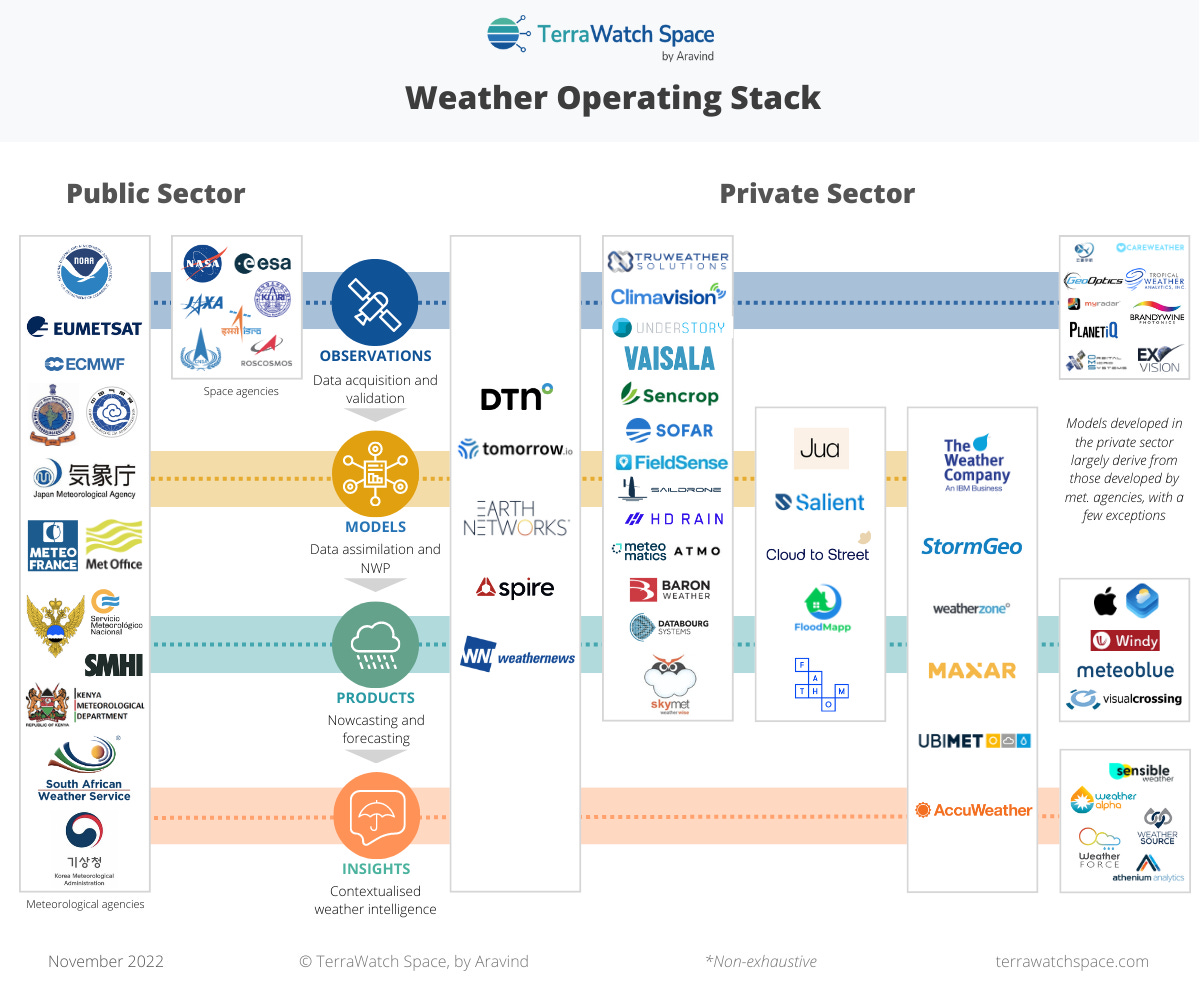

You might ask, but how did we get here? How has there not been a trend similar to the imaging business, in which the private sector has won billion-dollar contracts to supply satellite imagery to the US DoD? Where are the companies supplying weather data?

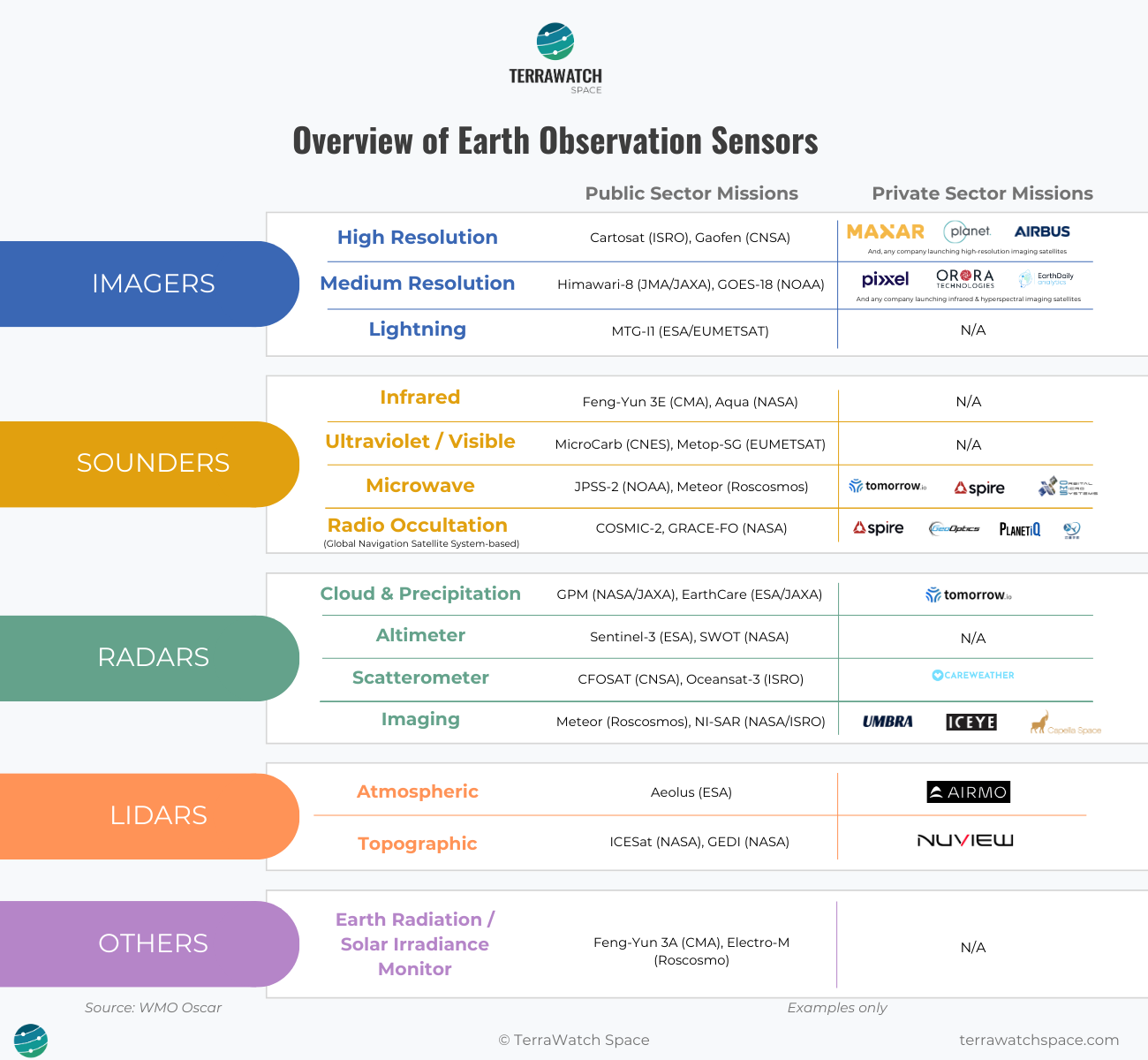

The following figure, from a Spire presentation, is a tad outdated - today, there are a handful of weather satellite companies, but the message it sends is not entirely wrong. The number is nowhere near the number of EO imaging satellite companies.

The Space Force believes that the available offering from the private sector doesn’t fill their needs just yet, and hence, they announced that they will not resort to a model akin to the data buy approach in the imaging business anytime soon. NOAA, the civilian weather agency, on the other hand, believes that “it expected more satellite companies to enter the market, but they have been slow to emerge.”

It might seem like the commercial space industry has effectively ‘failed’ in delivering to the needs of NOAA and the US DoD, with respect to the acquisition of satellite data for weather forecasting. But, there are two important reasons why I think this is the case:

- A lack of understanding of weather from space

I cannot overemphasise this, very few industry professionals and investors actually even properly understand the weather segment. Based on my experiences, not many have insights into the gaps in weather forecasting and climate modelling, the technologies we need to fill those gaps and the challenges of the private weather enterprise.

Weather has been in the realm of governmental agencies, owning the gap analysis, missions and roadmaps, with the private sector mostly just executing. Just like in the early days of EO imaging, weather was restricted to the scientific community. Some of us may have even assumed we are doing alright with the collection of weather data, and the space agencies are taking care of everything - but no, there are plenty of gaps. I believe these gaps will increasingly come to the forefront, as the effects of climate change take centre stage globally.

- The tricky business case for weather from space

Only a handful of weather agencies globally are in a position to buy spaceborne weather data, because they are the only ones who know what to do with it2. So, the private sector is forced to employ a "build it, they will come" approach. And, that is not a good business case to start a company. Also, agencies just don't sign large-sized contracts once data is available, they do many smaller contracts to evaluate the quality of data (and rightly so). Meaning, there is a severe lack of incentives for companies to create business plans to build and launch satellites.

Companies are expected to go all-in and vertically integrate altogether - they need to sell weather data to agencies (DaaS model), but also build enterprise software to sell weather insights to companies across sectors (SaaS model). However, this full-scale vertical integration is tough and expensive to pull off, so very few companies even attempt to enter the satellite weather market.

Therefore, it is no surprise that the list of companies building and launching weather satellites as a business is a pretty short list - Tomorrow.io, Spire, GeoOptics, PlanetIQ, Orbital Micro Systems, MyRadar, Care Weather.

We have a lot of work to do, both in communicating about the importance of weather from space, understanding the gaps in weather data around the world as well as figuring out the business models for satellite-based weather data. After all, the planet is not getting any cooler.

If you want to learn more, check out my deep dive on weather from space.

Scene from Space

One visual leveraging EO

6. Breathing Toxic Air in Europe

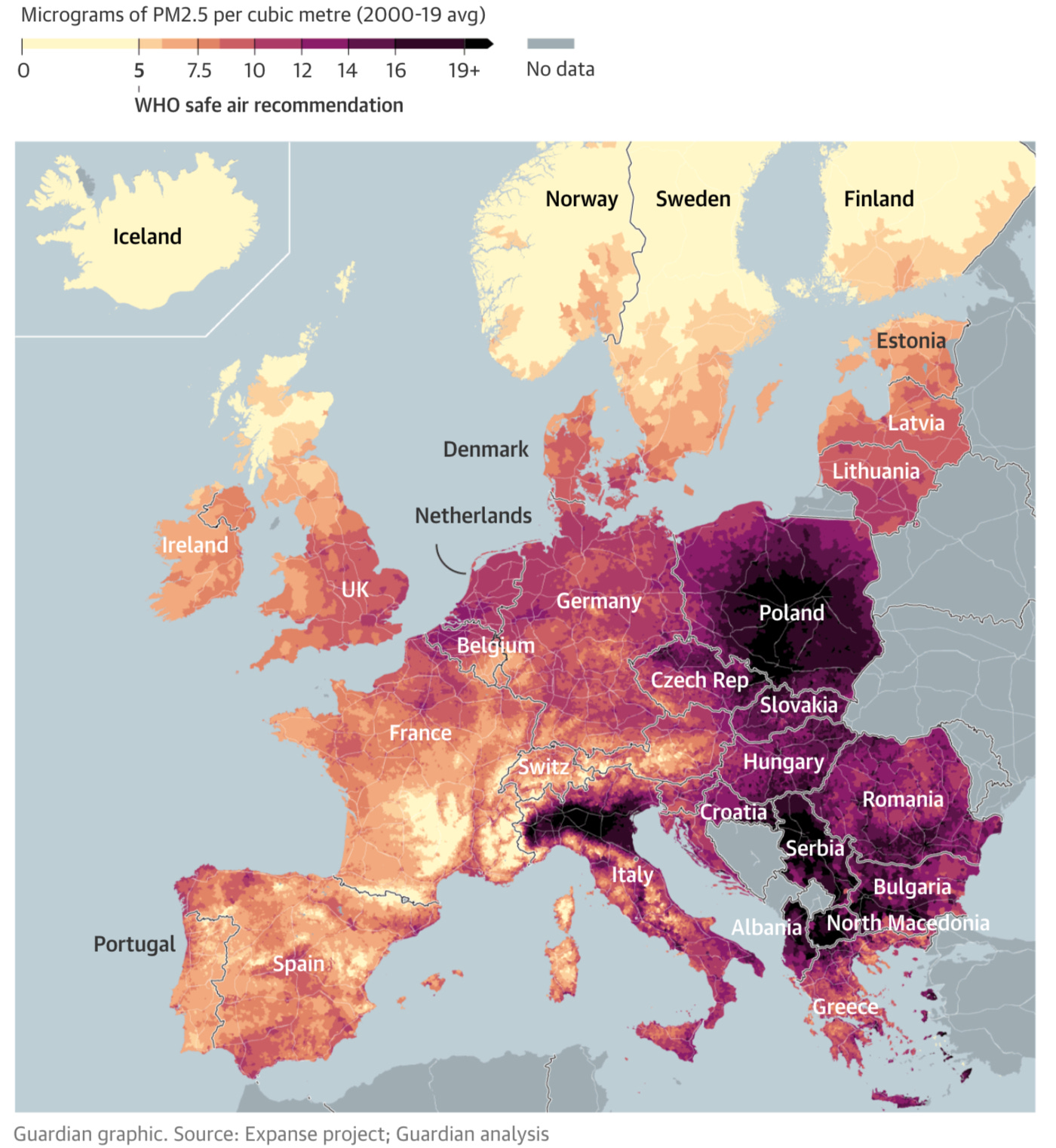

An investigation by The Guardian has found that about 98% of Europeans are breathing highly damaging polluted air, linked to 400,000 deaths a year, with only 2% of the population in the continent living in areas within this limit. The figure below shows the PM 2.5 levels across Europe the results of the analysis, were conducted using data from a combination of sources - from high-resolution satellite data to pollution monitoring stations and information about land use.

Particulate Matter (PM) 2.5 refers to the concentration of tiny airborne particles, mostly produced from the burning of fossil fuels, which can pass through the lungs and into the bloodstream, affecting almost every organ in the body. Looks like it might be a good time to take action on air pollution now!

Until next time,

Aravind

A floodplain is an area bordering a river that naturally provides space for the retention of flood and rainwater. With the loss of floodplains, the size of the country of Madagascar, it should come as no surprise that flood risks are increasing. ↩

There is an added complication due to the open data sharing policy, which might seem ethically right for weather data, but might not be the best thing for running a business. More on that in my deep dive! ↩