Hey everyone, this is not your regular TerraWatch newsletter. It is a one-off deep dive into NASA’s new Landsat RFI and what it could mean for the future of EO. I don't usually send the full deep dives to free subscribers, but this felt too important not to share with all.

Become a premium subscriber to receive exclusive EO insights and analysis!

For over fifty years, Landsat has been the world’s reference dataset for how our planet changes. Now NASA is asking: can that legacy be sustained under a fraction of the cost, and with the private sector in the driver’s seat?

NASA has issued a Request for Information (RFI) for the next phase of the Sustainable Land Imaging (SLI) program, the effort to ensure Landsat continuity beyond Landsat-9. Unlike previous Landsat missions, this is not a build-to-print contract. Instead, NASA is asking whether the private sector can deliver Landsat-class performance, but on a radically smaller budget.

Budgets and the Stakes

The shift is driven by budget reality.

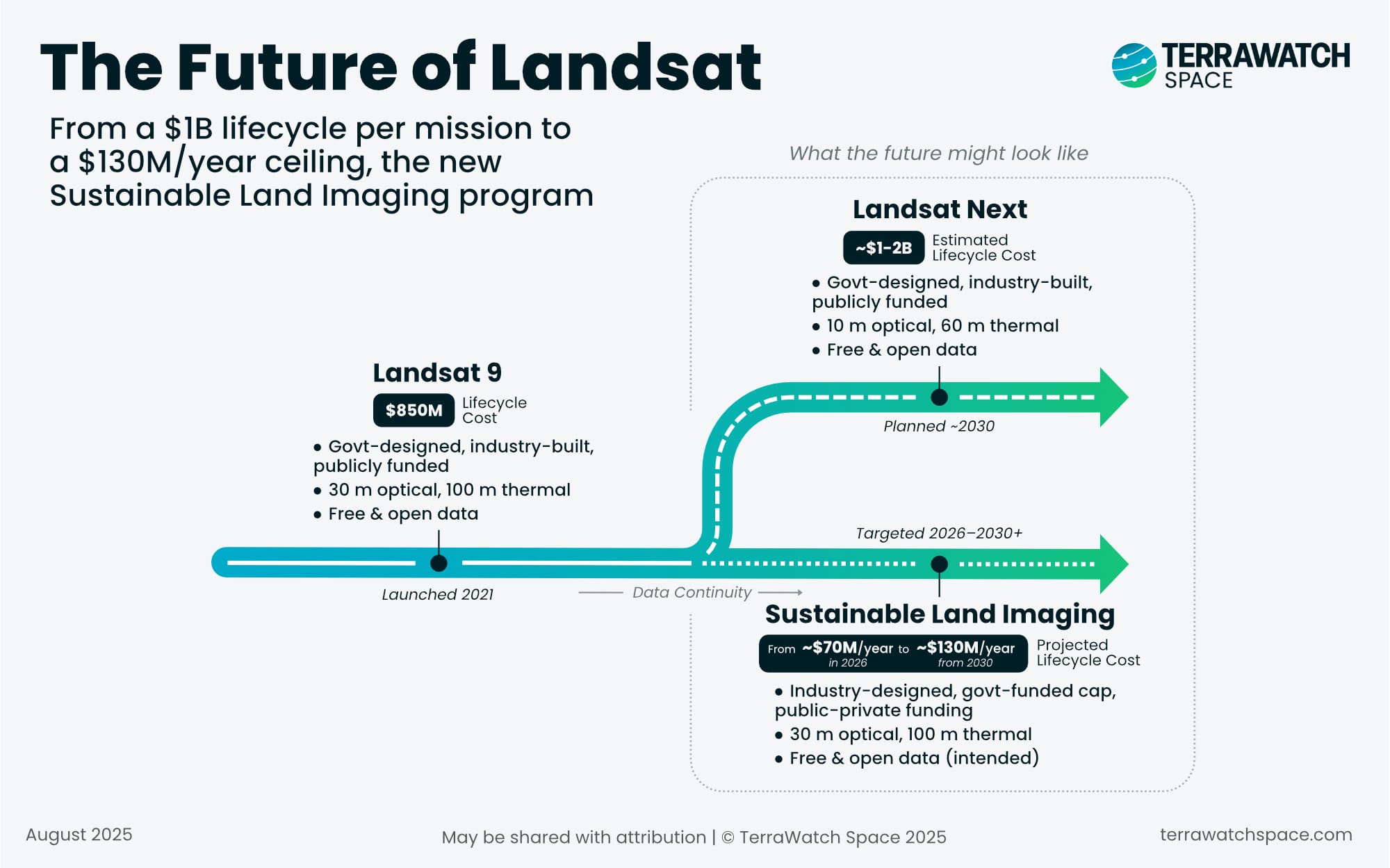

- Historic costs: Landsat-9 cost ~$850M across its lifecycle, and Landsat Next was estimated to be ~$1B-$2B.

- New budget cap: In the RFI, NASA proposes ~$70M/year in FY26, rising to ~$130M/year by FY30, and remaining flat thereafter.

This creates a huge contrast: what used to be a billion-dollar government-led mission is now expected to fit inside a capped ~$130M/year program.

To make this feasible, the RFI explicitly opens the door to new models: fully commercial constellations, hybrid public–private partnerships, hosted payloads, data-as-a-service contracts, and disaggregated systems combining multiple satellites.

Continuity, with Constraints

For over 50 years, Landsat has been the gold standard for open, science-grade imagery used across agriculture, water management, urban planning, climate science, and countless other applications.

The good news is that NASA and USGS are not lowering the bar for what makes Landsat data valuable. They are demanding continuity of:

- 30 m optical resolution

- 100 m thermal resolution

- <5% radiometric uncertainty

- Tight geometric alignment

- Calibration stability across decades

Sounds simple enough. These thresholds underscore the value placed not just on imagery, but on the ability to compare data consistently across decades. But, here’s the catch: several commercial EO satellites beat Landsat on spatial resolution or revisit, but what makes Landsat valuable is its calibration and stability over decades, a very different bar to clear!

Landsat isn’t famous because it is the oldest EO mission. It is famous because a pixel from 1984 still matches a pixel today. That’s calibration chains, ground infrastructure, validation campaigns i.e. decades of investment. Commercial operators generally don’t bother with that, because their customers usually want “better, faster, cheaper,” not necessarily “comparable over 40 years.”

Commercial missions rarely maintain the multi-decade calibration chains that make Landsat data reliable for global change science. Matching those standards would require new investments in ground infrastructure, validation campaigns, and data stewardship, costs that are hard to reconcile with a capped $130M/year budget.

In other words, the challenge is not whether industry can build satellites with higher specifications - they can. The real question is: who is willing to foot the bill for science-grade consistency under a $130M/year ceiling?

A Shift in Risk

For decades, NASA and USGS wrote the specifications for Landsat and the private sector, awarded a firm-fixed price contract, built the hardware (instrument and satellite). This time? The tables are turned: NASA is saying, ‘Here’s the budget, here are the thresholds, you go figure it out.’ That’s a very different kind of risk transfer.

This mirrors broader shifts in defense and space procurement, where agencies increasingly specify outcomes (“deliver 10m imagery every 5 days”) rather than dictating satellite design. The approach opens space for commercial innovation, but also raises questions.

Who ensures data stewardship over decades? Who bears the risk if budgets prove insufficient? And how will open-data policies coexist with private monetisation models?

Open Data and Business Models

Since 2008, Landsat’s open-data policy has been one of the biggest force multipliers in EO history, unlocking billions of dollars in downstream applications and catalysing entire industries. That openness created trust, comparability, and adoption far beyond the initial user base.

Is it really feasible for Landsat data continuity to be delivered under a commercial model, with open data? Companies will want returns on investment - if they are footing part of the bill, do they really have an incentive to keep it all free?

Will the U.S. government guarantee full, open access, effectively subsidising the commercial provider? Or will private operators push toward tiered access, licensing, or usage restrictions?

The answers will shape the market profoundly: maintaining open data sustains Landsat’s role as a public good, while limiting openness risks fragmenting the ecosystem and undermining decades of downstream growth. If openness erodes, the ripple effects could fragment markets and cut off innovation that has always come “for free” from Landsat.

Global & Governance Implications

What happens with Landsat doesn’t stay in the U.S. For decades, Landsat has been the international reference dataset: ESA’s Copernicus program, JAXA’s optical missions, countless regional initiatives as well as a number of private EO firms (like Planet) have all aligned their calibration and validation processes to it. If the U.S. pivots toward a commercial-leaning model, other space agencies will be forced to decide whether to follow suit, double down on public models, or build complementary approaches.

For years, Landsat’s openness has been a U.S. soft power tool in climate diplomacy replacing that with a commercial contract changes the narrative.

And stewardship matters: if private providers supply the data, who guarantees that data quality remains intact for decades? What happens if a company folds, pivots business models, or deprioritised Landsat-class delivery? Without a government “anchor of trust,” there’s a risk of fragmentation i.e. datasets could drift apart and undermine the comparability that makes Landsat uniquely valuable.

Market Spillovers & Technology Experiment

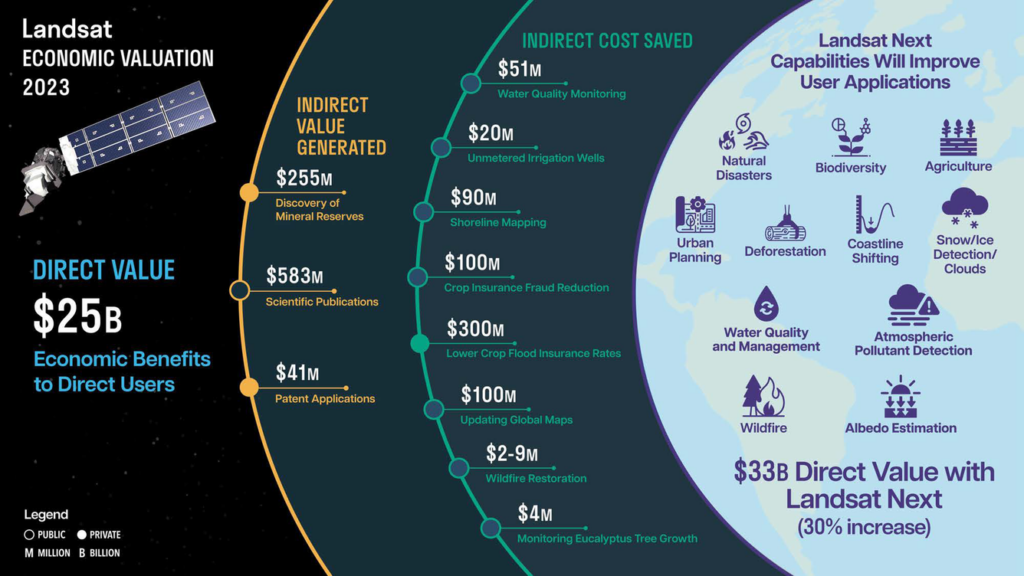

Free Landsat data has been shown to generate billions in economic activity, from precision agriculture to insurance to climate services. I was part of the team that did this study that concluded Landsat generated $25B in economic benefits just within the US in 2023 (a huge underestimation as we point out).

A commercially delivered Landsat could create even more downstream opportunities if openness is preserved. But if access is constrained, market fragmentation could rise, with users forced into multiple incompatible ecosystems.

At the same time, this procurement shift could act as a technology experiment. It might spur innovation in hosted payloads, modular platforms, or AI-driven calibration techniques. And it could set the stage for how other “big science” EO missions are procured in the future.

Who could do it?

The big question is: which commercial players are realistically in a position to deliver Landsat-class continuity under NASA’s new rules?

At ~$70–$130M per year, this isn’t a huge contract by EO standards (compared to the $5B NRO contract split across three companies over 10 years). For many companies, the proposed figures would represent a substantial share of their total revenues. Committing to a science-grade, open-data program at that price could tie up capacity that might otherwise go to higher-margin defense or commercial contracts. That opportunity cost is as big a hurdle as the technical specs.

- Planet: With estimated annual revenues above ~$240M, Planet is one of the few commercial players big enough to absorb a contract of this scale without betting the company. It brings unmatched constellation experience and a track record of data-as-a-service deals. Still, meeting Landsat-class calibration and long-term stability would require new investments.

- EarthDaily Analytics: A private company still in growth mode, EarthDaily has positioned its planned EarthDaily Constellation squarely for science-grade optical imaging. It arguably comes closest to Landsat-like intent, but at its current stage, sustaining such a large, open-data program under tight budgets would be a stretch unless coupled with strong partnerships.

- Hydrosat: Specialising in thermal infrared, with VanZyl-1 launched and additional missions planned, Hydrosat is one of the EO companies in the thermal space. Its resolutions (~70 m) are in the Landsat thermal ballpark. But as a smaller, venture-backed firm with limited current revenues, the economics of sustaining Landsat-class continuity would likely require heavy external support.

- Satellogic: Operates a fleet of ~40 optical satellites with a vertically integrated, low-cost model. Strong on scale and affordability, but less proven on science-grade calibration and long-term stewardship, both critical for a Landsat-class role.

- Maxar, BlackSky, Airbus and others: Maxar’s rich history working with the USG, Airbus' credentials and BlackSky’s growth could appear tempting, but their fleets are built for very-high-resolution, defense-driven markets rather than open, science-grade continuity. They could play a role as contractors or partners in a hybrid/disaggregated architecture, but Landsat-style stewardship is not their core business.

- New entrants / partnerships – Platform operators like Loft Orbital (combined with instrument specialists) or Muon Space (who already develop instruments), could deliver parts of the solution. A consortium approach, with one player providing optical, another thermal, and a prime anchoring calibration and stewardship may prove the most viable model.

In short: no single commercial operator today ticks all the boxes: optical + thermal, Landsat-grade calibration, stewardship, and open access - all within a $130M/year ceiling. Only a handful of companies even have the revenue base to contemplate it, which makes partnerships and hybrid models the most realistic way forward.

Unless the government sweetens the deal with calibration support, infrastructure funding, or long-term guarantees (like the DoD), EO companies may decide that it is simply not worth it. So, there may be no interest in the RFI at all.

Towards a New Normal?

For decades, the Landsat model has been binary: fully public, free and open. Meanwhile, most commercial EO has been the opposite: proprietary, licensed, and closed. NASA’s new RFI could mark the beginning of a middle ground - a “new normal” for how satellite data is procured and shared.

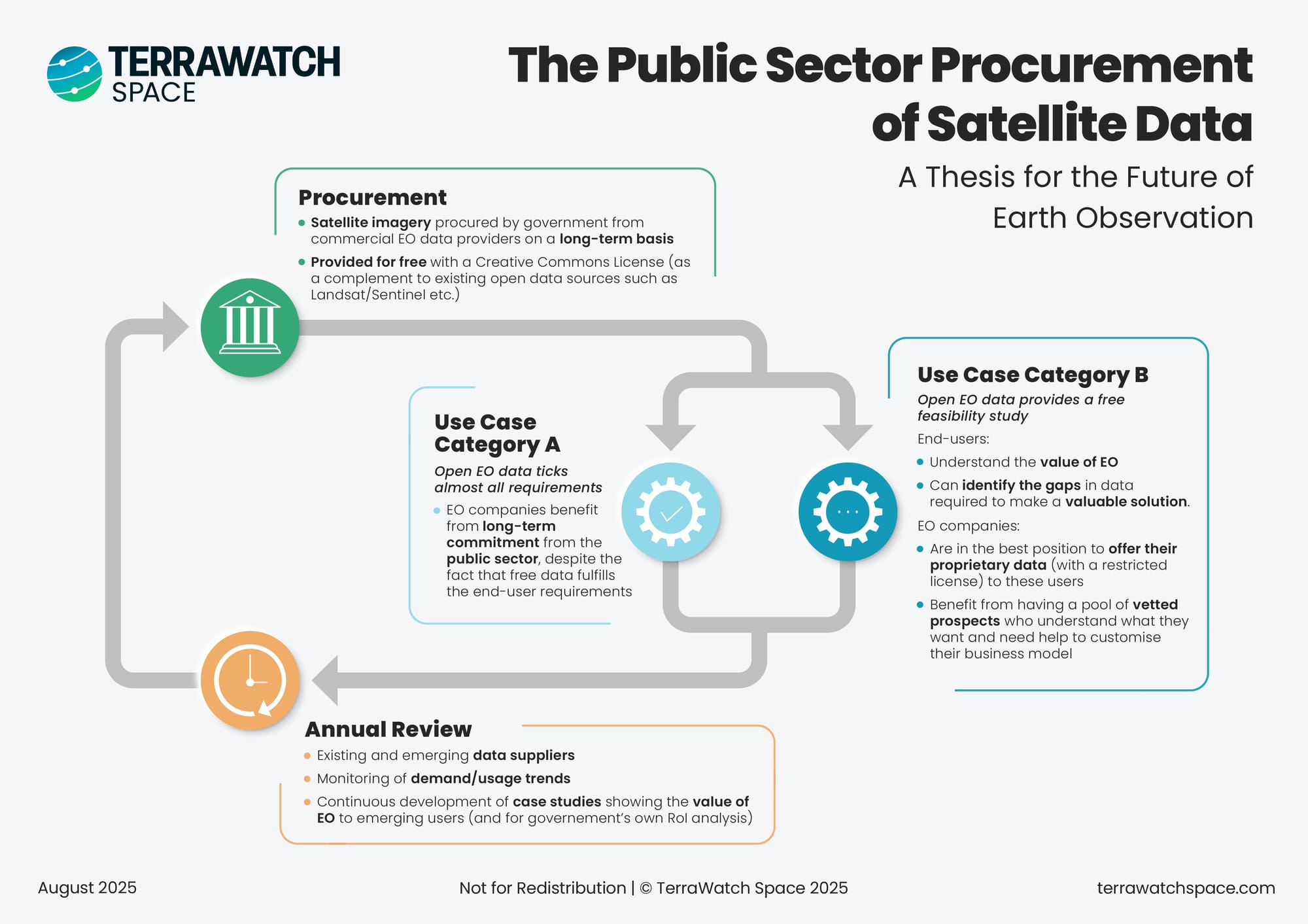

The model could look something like this (see infographic):

- Baseline continuity, procured as a public good – Governments contract long-term access to Landsat-class data, distributed under open licenses. This ensures continuity, comparability, and trust for science and policy.

- Open data as a catalyst – By being widely accessible, open data still ticks a large part of end-user needs (Use Case A). But it also acts as a free feasibility study (Use Case B), helping users understand EO’s value and identify where more advanced, proprietary data might be needed.

- This is where the middle ground comes into focus - exactly what the infographic illustrates.

- Use Case A represents the public good: open data serving essential science and policy needs.

- Use Case B is the catalyst role: open data lowers barriers, helps organisations test EO, and nudges them toward more advanced or proprietary solutions when needed.

- Together, these two use cases show how open access and commercial models can reinforce each other rather than compete.

- This is where the middle ground comes into focus - exactly what the infographic illustrates.

- Commercial opportunity on top – Companies benefit from long-term public contracts for open continuity, while retaining opportunities to upsell proprietary data, higher-resolution products, or analytics to a vetted pool of users who already see the value.

In this framing, open data and commercial models are not in opposition. Instead, open data lowers the barrier to entry, creates demand, and builds trust, while commercial offerings capture value where users need more than the baseline.

This may be the most important long-term implication of the RFI (were it to become an RFP with an eventual contract). The proposed model for Landsat continuity could set a precedent not just for technical delivery, but for a hybrid data economy: one where public investment guarantees trust and openness, and private players build scalable businesses on top.

It is not just about who builds the satellites, it is about whether we finally settle into a middle ground between ‘everything free’ and ‘everything paywalled.’

Where This Leaves Us

If NASA succeeds, it could set a precedent for flagship EO missions worldwide: science-grade, open data, commercially delivered. For the private EO sector, it is both a huge opportunity and a stress test.

The key questions are:

- Can the commercial sector deliver science-grade data at this standard and cost?

- Will open-data policies align with commercial business models?

- How much can hybrid or disaggregated constellations achieve under budget limits?

- And most critically, what happens to the many applications - from agriculture to climate - that depend on the continuity of Landsat data?

If the answer is yes, this could redefine how the world funds and sustains flagship EO missions. If the answer is no, we risk learning the hard way that some kinds of continuity cannot be bought cheaply.

That tension - between ambition and reality, openness and monetisation, domestic politics and global science needs - is what makes the next chapter of Landsat (and EO) worth watching very closely.

Reality Check

Last but not least, it is worth remembering: this is just an RFI. NASA is testing the waters, not issuing a contract. And the politics are far from settled. The White House’s FY26 budget request sets aside ~$70M for Landsat, but Congress has signaled a very different direction: “The committee provides $183M for the Landsat Next Mission and encourages NASA to maintain the current superspectral three-satellite constellation architecture, with a launch target by the end of 2031, to ensure uninterrupted continuity of the Landsat data record.”

So, it is possible the RFI goes nowhere if Congress insists on sticking with the Landsat Next plan, industry proposals may never get beyond the concept stage. In that sense, this whole exercise may be less about immediate procurement and more about signaling: stress-testing whether a commercial model is even plausible.

If you want to receive exclusive insights and analysis on Earth observation, subscribe to TerraWatch Pro for weekly market briefings.

Until next time,

Aravind