To the paid subscribers, thank you for your support. It is a huge source of encouragement and lets me write these briefings and continue to offer the weekly newsletter as a free resource. We have the following deep dives coming up: EO for Wildfire Monitoring (Aug) and EO for Nature and Biodiversity (Oct).

To the free subscribers, this is a short preview of the piece. If you would like to read more, please become a paid subscriber.

Preamble

I decided to start publishing these EO investment deep dives (the first one was back in January) as I did not come across any exclusive analysis focused on investment trends in EO. As I always say, the EO sector does not get the attention and analysis it deserves, especially with an outlook on what is best for the future of EO, from an independent perspective - this briefing and in reality, all of my newsletters, are an attempt to change that.

In this piece, we will look into the investment trends in EO in the first 6 months of 2024 - by segment, growth stage, and geography, as well as some major developments in the period and finally end with some of my thoughts.

A few disclaimers on the methodology for EO investments:

- Only private funding is included i.e. venture capital, debt financing, growth equity rounds, this means government contracts or public grants are not part of the figures.

- Companies in the fringe of the EO sector, such as companies part of the space industry supplying satellite platforms or subsystems are not included in the analysis. Companies that manufacture EO instruments are, however, included in the analysis.

Here is what we have in store for this briefing:

EO Investments in H1 2024

By Segment

EO Investments: H1 2023 vs H1 2024

By Region

By Growth Stage

Major EO Developments in H1 2024

National EO Constellations

M&A Transactions

EO Investments in H1 2024

By Segment

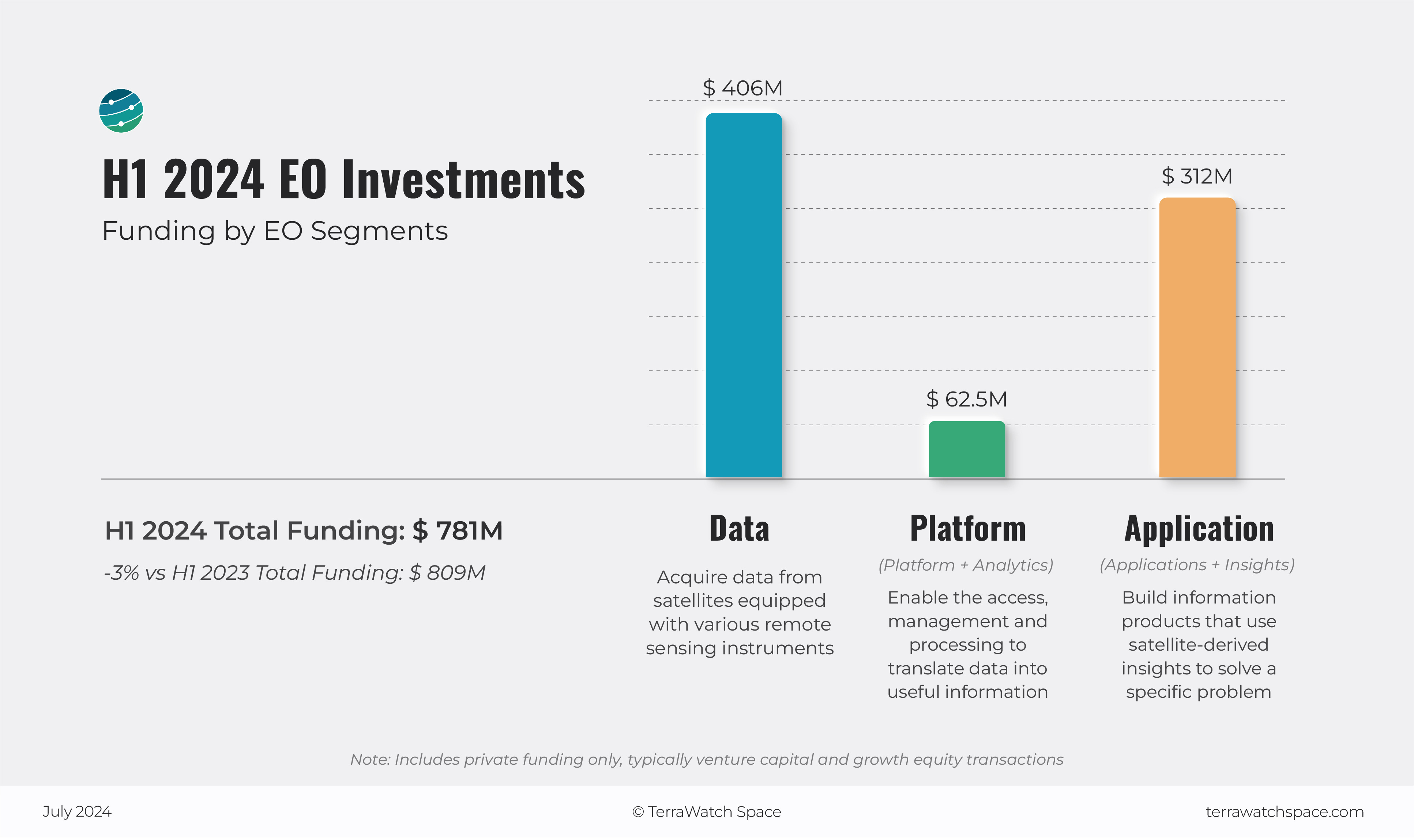

The total investments in EO over H1 2024 are estimated to be $781M, with Data and Application segments contributing to almost all the funding raised.

Companies in the Data segment, which typically include EO satellite companies, had a stronger than expected first half of the year and raised about $406M1, with the largest rounds from: Iceye ($93M), Unseenlabs ($92M), Synspective ($44M), HawkEye 360 ($40M) and Albedo ($35M).

Companies in the Platform segment, which typically include those building EO data marketplaces, EO data management solutions and EO data processing tools, raised $62.5M*, including Danti ($5M) and Fused ($1M). The relative lack of interest in this layer, as I wrote in the EO Platform deep-dive, can be primarily attributed to: a lack of scalable demand for EO data & analytics, unstructured public funding in the past and availability of custom EO solutions.

*Privateer, a startup focused space situational awareness (SSA) acquired Orbital Insight an EO platform provider and raised $56.5M. This is currently attributed as an investment in the EO sector, but it is unclear how much it paid for the deal and whether the company intends to completely pivot away from SSA into EO.

Companies in the Application segment, which typically includes any company that builds products leveraging EO data had a surprisingly sluggish first half of the year, especially compared to the past few years, with a total of $312M in the period. This is also reflected in the weak investment trends in the larger climate tech world. The largest rounds in this category include: Arbol ($60M), AiDash ($58M) and LiveEO ($27M).