Happy New Year, everyone. We will be back to our regular, weekly editions of ‘Last Week in Earth Observation’ from next week.

But, it is that time of the year to try to make sense of what happened in EO in 2023 and try to predict what might happen in 2024. So, that’s what I have done.

If this was forwarded to you, please subscribe for more EO insights.

1. Government Contracts Dominance 🏛️

While EO continues to try and become a commercially-driven sector, the reality is that about two-thirds of the EO market is still government-driven.

Looking Back at 2023

On the defence side, contracts from the US National Geospatial-Intelligence Agency and the National Reconnaissance Office continued to dominate the year. On the civilian side, NASA continued to expand its pool of EO data providers within the Commercial Smallsat Data Acquisition Program, NOAA continued to buy data from commercial weather satellite operators and ESA selected NewSpace companies to become Copernicus Contributing Missions.

Outlook for 2024

Government-led contracts to purchase data act as a foundation for EO companies, and are still the most important driver for their survival and financial sustainability. We will continue seeing more contracts awarded by almost all of the agencies above, for acquiring data from multiple sensors as well as some shift towards acquiring services (aka analytics) directly from the market. However, the position of civilian space agencies - as a buyer and a market enabler - will continue to come under scrutiny, as EO budgets stagnate and EO missions get cancelled, leading to more impact assessments and strategic evolution.

2. Sovereign Earth Observation 🚩

The geopolitical situation coupled with the changing climate means that governments are more willing to invest in developing sovereign EO capabilities.

Looking Back at 2023

Italy confirmed plans to launch its multi-sensor EO constellation (IRIDE), while Spain, Portugal and the UK are planning to launch the Atlantic Constellation, and Poland will be launching its constellation, Camila. We also saw the launch of the first EO satellites from Oman, Kuwait, Djibouti, and the state of Andalucia (Spain), among several others. Canada doubled down on its investment in EO by allocating a budget for the evolution of the Radarsat constellation.

Outlook for 2024

I don’t expect the trend of sovereign EO to go away anytime soon, not just because countries want EO data independence, but also due to the increasing availability of off-the-shelf solutions, as countries can choose from 5 options to build and launch an EO satellite - although this does not mean countries will not purchase data from existing data providers.

3. Private Investments in EO 💸

A retrospective analysis of EO investments provides some key insights on where the sector is going. We started doing that last year, and we continue this year1.

Looking Back at 2023

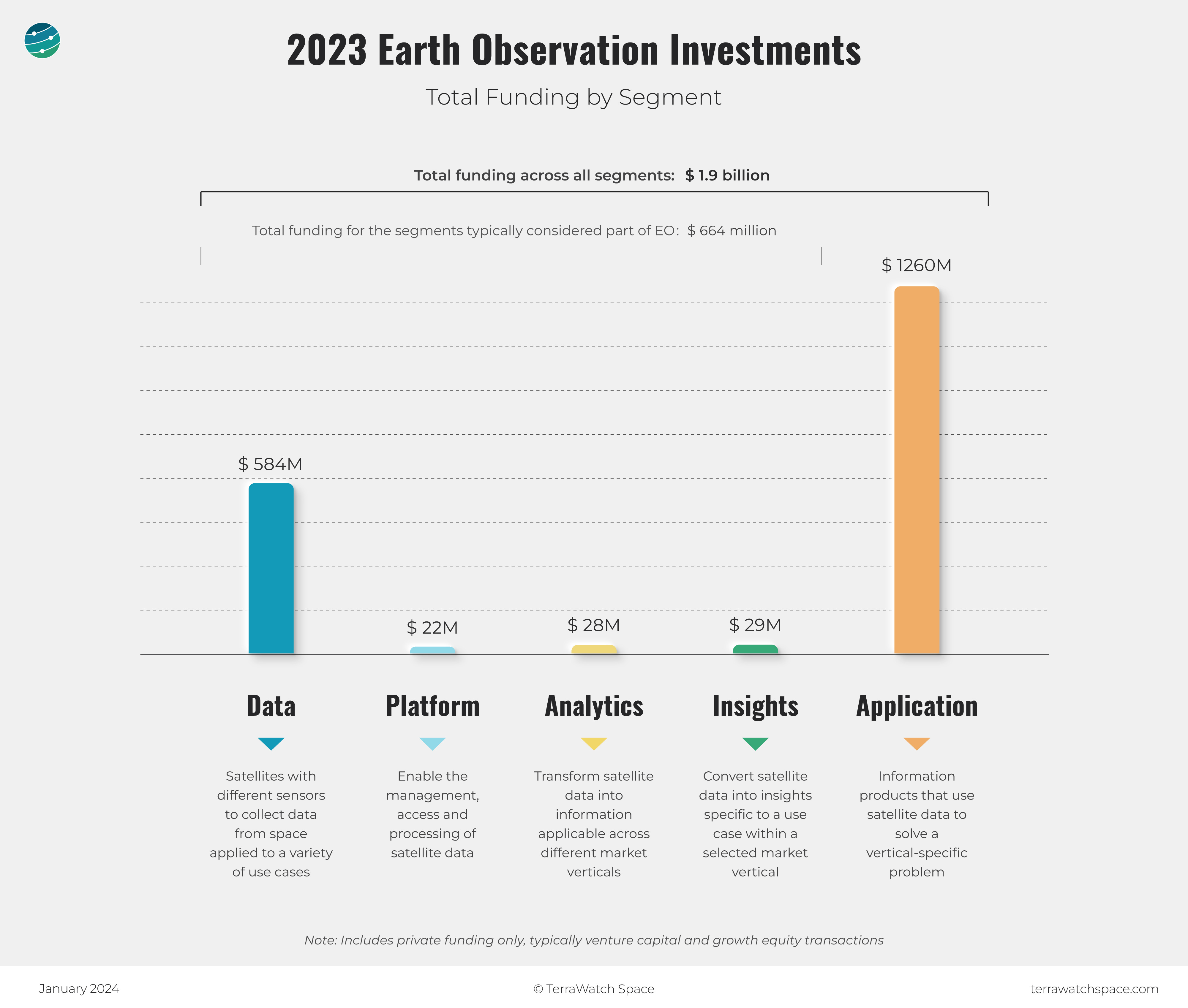

The total investments in EO for 2023 are estimated to be $1.9B, with Data and Application segments contributing to 95 per cent of the overall funding raised. Without the Application segment, which is typically not considered part of the EO sector, the total investment is about $664M, largely dominated by funding from companies in the Data segment.

Key takeaway? Overall funding for satellite EO companies has predictably decreased (vs 2022), but there is a significant increase in the number and funding for downstream application firms that use EO data.

Outlook for 2024

I expect funding for companies in the Data segment to decrease further this year, as investors wait for companies to validate both their technologies and business cases. The Application segment will continue to see more interest and funding, given the plethora of problems EO can contribute to solving. Companies in the Insights layer will look to graduate to the Application layer, as they transition from being EO-first firms to application-first firms and reach product-market fit.

A detailed review of 2023 investments - including analysis by segment, startup stage, market vertical and geography - will be published next week. This will be available exclusively for the paid subscribers of the newsletter.

If you want to receive that and more exclusive biweekly analysis and insights on EO, then become a subscriber, with this 25% discount.

4. Horizontal and Vertical Consolidation ↕️ ↔️

You would have probably heard this many times: consolidation in EO is inevitable. But, to go deeper into this, it is important to realise that consolidation shall be both horizontal and vertical.

Horizontal consolidation, when two similar type of EO businesses get together, on a sensor-level or on a segment-level - for example, an EO sensor company acquiring another due to possible synergies and growth potential, or an EO company going down the value chain through an acquisition.

Vertical consolidation, when a user acquires one of its suppliers to become self-sufficient with that capability - for example, a market leader in a vertical acquiring an EO downstream firm, or when an EO data company acquires an EO downstream firm to double down on a specific vertical.

Looking Back at 2023

On the horizontal consolidation front, we saw HawkEye 360 acquire Maxar’s radio frequency monitoring capabilities (from Aurora Insight), Sidus Space acquire an edge computing startup, General Atomics acquire EO sensor supplier EO Vista and BAE Systems acquire EO instrument manufacturer Ball Aerospace, and probably the biggest of them all, Planet acquiring Sinergise.

On the other hand, vertical consolidation usually does not make much news within the EO sector. In the last year, reinsurance market leader Swiss Re acquired flood risk analytics provider Fathom, energy intelligence solution provider Energy Aspects acquired OilX and EO company Hydrosat acquired irrigation solution provider Irriwatch, among others.

Outlook for 2024

We will see more mergers and acquisitions in 2024, both horizontally as some companies trading in the public markets (Planet, Spire, BlackSky and Satellogic) continue to underperform against expectations, as they inch towards profitability, and vertically as larger market vertical leaders discover the strategic value of EO and what this technology would mean for their business.

5. Regulation-Driven Dynamics: EO for Climate 🌍

This one is quite predictable and frankly, inevitable. As climate and biodiversity crises move up the social, political and economic agendas of nations, so will the importance of EO.

Looking Back at 2023

- Greenhouse gas emission monitoring dominated headlines in 2023, not just around COP, but throughout the year, as EO satellites detected several methane flares, leading to more regulations on GHG reporting,

- Climate risk continued to gain more prominence as countries plan on policies to make asset-level physical risk reporting mandatory, for which continuous monitoring of geophysical variables with EO is a key input,

- Carbon markets were in the news, often for the wrong reasons, but as that plays out, what is undeniable is the role of EO in the functioning of voluntary carbon markets, by being the key technology to measure carbon globally.

Outlook for 2024

Regulation-driven dynamics are bound to continue in 2024, as more countries publish their policies, whether it is for deforestation, emissions or otherwise. While it might be a risky move for EO companies to make regulation their central business case, it provides the much-needed, product-market fit for some EO solutions (which have been searching for that all along).

6. New Satellites and Sensors 🛰️

As always, we had an exciting 2023 and I am confident we will have a more exciting 2024 when it comes to showcasing the capabilities of the Data layer.

Looking Back at 2023

We saw the launch of some important public EO missions such as NASA’s TROPICS and China’s Fengyun 3G for weather data and NASA’s TEMPO for air pollution data. Several private EO missions were launched throughout the year including the firsts from SatelliteVu, Wyvern, Orbital Sidekick, and Tomorrow.io among others.

Outlook for 2024

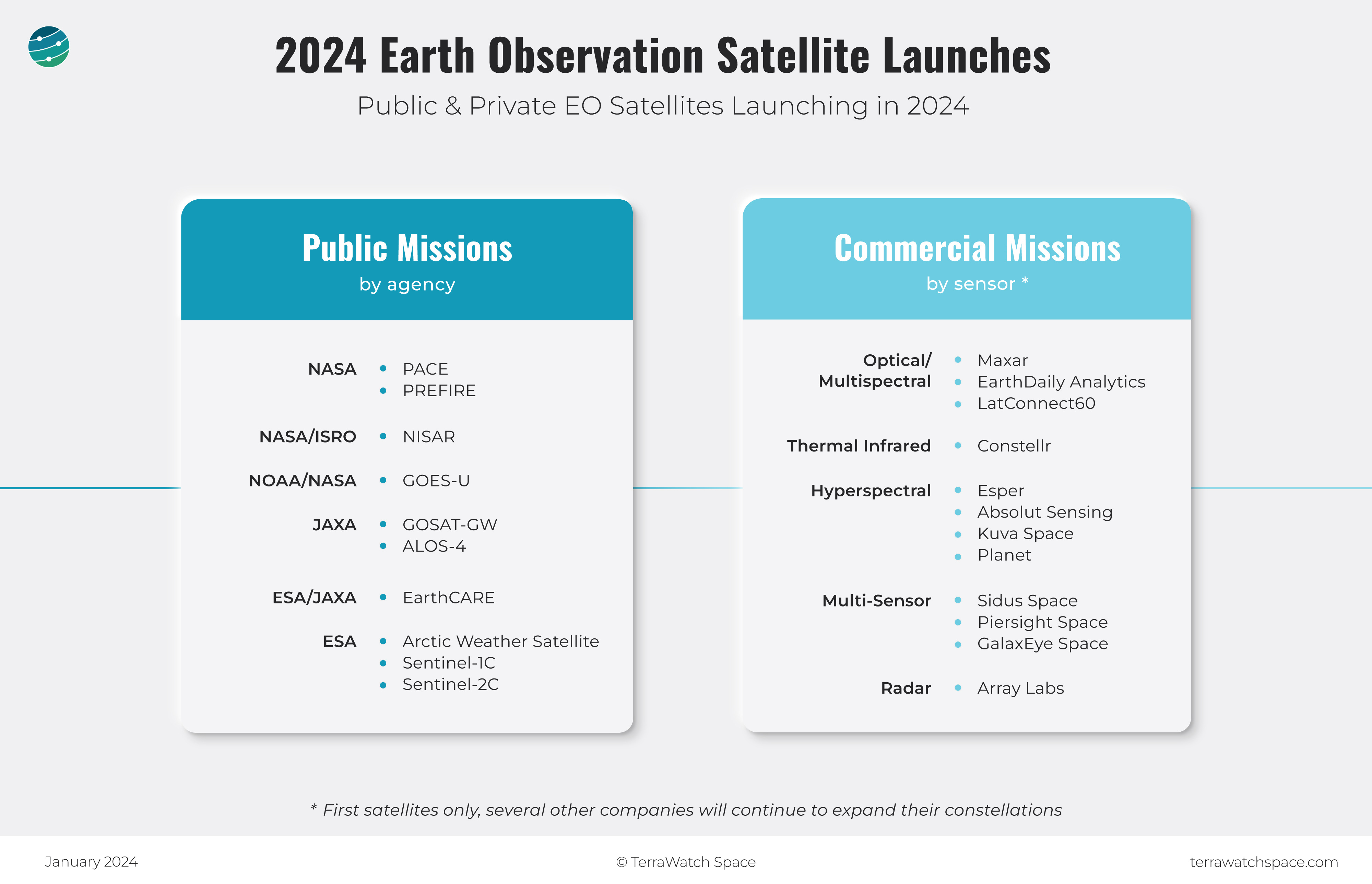

Instead of trying to make a long list of all the exciting missions to look forward to in 2024, we decided to make this a visual. This is the best-case scenario outlook, but the lack of launch options (specifically in Europe) and other space industry dynamics might delay a few missions to next year2.

7. Managing, Distributing and Processing EO Data 🗺️

It is about time we solve the boring problems in EO3 - and that has to mostly do with EO data management, EO data distribution and EO data processing.

Looking Back at 2023

Last year saw SkyFi launch its mobile app to easify the process of acquiring satellite imagery, Danti comes out of stealth with its search engine for geospatial data, Ursa Space, UP42 and SkyWatch continue partnering with more EO data firms, AWS release Sagemaker Geospatial to enable EO data processing and the emergence of several startups and initiatives in the Platform layer.

Outlook for 2024

There is so much to be done in this segment of EO - from validating the feasibility and value of edge computing for EO, making satellite data interoperable to enable data fusion and understanding what analysis-ready data is and what it really means for end-users. I am also excited to see more usable and useful data products (like Planet’s Planetary Variables) come to the market4.

The next deep dive on TerraWatch on the state of EO platforms - including analysis of platform segments and the commercial landscape - will be published end of this month. This will be available exclusively for the paid subscribers of the newsletter.

If you want to receive that and more exclusive biweekly analysis and insights on EO, then become a subscriber, with this 25% discount.

8. Open Source as the Foundation of EO❓

Open source was the backbone of the internet revolution, open source is expected to be the backbone of the AI revolution - so, EO is no different.

Looking Back at 2023

Last year saw a proliferation of open source initiatives including - the release of open footprint datasets from Google and Microsoft, Umbra launching its open data program for high-resolution SAR data, India opening up its EO data archives, Meta’s launch of the Segment Anything Model for object detection, NASA and IBM’s collaboration on creating an open-source geospatial AI foundation model, Google’s open-source AI model for weather forecasting, Overture Maps releasing interoperable and open map data and more.

Outlook for 2024

While the importance and meaning of open source for EO might not be widely discussed, I consider it the foundation for a successful EO sector. Whether it is metadata standards to make EO data more easily searchable, tools to identify and label features on satellite imagery or algorithms to convert EO data into insights, I expect to see more funding for open source efforts in 2024 on both public and philanthropic fronts.

9. Strategic and Purposeful Adoption of EO 📈

I would have liked more than one bullet point for adoption, but on a high level, the use of EO is becoming more strategic and more purposeful than expected. In other words, adoption is not inevitable because data is available, it is a process.

Looking Back at 2023

Based on interactions and work done with end-users, I can pretty confidently say that awareness and adoption of EO are on the rise, especially with a few commercial use cases. The increase in adoption is largely derived from demand from end-users to improve their mapping, monitoring and reporting capabilities, some as a result of mandated regulations, others due to the need to innovate in their businesses. More often than not, EO was in the background than in the foreground, although some users have started to care a little more about the underlying methodology and data, primarily to avoid the black-box problem.

Outlook for 2024

While there will be a part of adoption that will happen inevitably simply because of the value offered by EO (like the $ it saves or the data gap it fills), I expect some adoption for reasons that are beyond the usual benefits offered by EO. This can be through integrating EO into their long-term technology strategy, to derive exclusive insights or to acquire proprietary datasets. This does not mean end-users will launch their own satellites, but this will manifest in the form of strategic investments in EO companies and exclusive partnerships.

10. Awareness and Communication 🗣️

After looking into hardcore market trends, I wanted to end this piece with this subject, which is close to my heart, as I continue working towards EO mainstream.

Looking Back at 2023

This might be just anecdotal evidence, but we certainly started seeing an increasing use of satellite imagery data in mainstream media - whether it is a consequence of the changing geopolitical and environmental situation, or just a correlation with increasing availability and easier accessibility of satellite data. We have also seen more outsiders be exposed to the applications of EO, thanks to the demonstration of its use for some critical environmental and economic use cases, largely derived from open EO data.

Outlook for 2024

What I hope happens this year is we start becoming earnest in our efforts to evangelise the use of EO data, keeping the end-users ‘job to be done’ in mind. As we continue our efforts towards educating the end-users about what EO can do, let’s try and be upfront about a) what it might not be able to do and b) how insights are derived from data.5 I also hope we continue to recognise the concept of the knowledge-action gap - if the information gathered from EO has not resulted in meaningful action, then the value of EO is not fully realised.

The future of EO lies in our ability to look beyond the type of sensor, the name of the provider, or the satellite and look deeper into the problems that can be solved with EO, and the impact that it can have, with an objective, and holistic mindset.

I started TerraWatch to continue working in EO wearing my consulting hat, evangelise the potential of EO by improving its awareness outside the EO bubble and in that process, contribute to making EO mainstream. I wrote about my vision for TerraWatch if you want to learn more about TerraWatch.

Wish you all a fantastic year ahead!

Until next time,

Aravind.

Disclaimers:

Analysis includes funding from venture capital and growth equity rounds and does not include debt funding, government contracts or grants,

Companies in the Insights segment are EO-first companies that build products that use EO data and are in the process of identifying product-market fit within their markets. In contrast, companies in the Application segment are product-first companies that use EO data but are generally considered not part of the EO ecosystem.

Companies in the fringe, which include companies in the space industry supplying components or subsystems, for whom EO is just another market segment are not included in the analysis. ↩

This is as exhaustive a list as we could come up with, but if this is missing any specific EO missions, do let me know. ↩

Boring problems are those that are underrated, underfunded and underappreciated, but unless we find a way to solve them EO will not be mainstream. ↩

A ‘usable, useful EO data product’ is an information product that is derived from EO data, which any user can start using off-the-shelf without really worrying about what the underlying technology is and how it works - one that any software engineer or data scientist can start working with, without knowing or understanding EO. ↩

As much as we focus on the role of commercial EO in offering insights to solve a specific market problem, it is equally, if not more, important to be able to fully understand how the insights were derived - the open vs closed discussions happening on the AI front is no different to the challenges EO faces. ↩