Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

Quick housekeeping: The weekly newsletter will on hiatus for the next two weeks - so there will be no new editions on August 12 and August 19. We will be back on August 26.

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- Indian EO startup GalaxEye Space, which is building a multi-sensor (optical/SAR) satellite constellation, has raised $6.5M in series A funding;

Contracts

- The US Air Force has awarded SAR data provider Capella Space a $14.9M contract for radar imaging services;

- SynMax, a maritime intelligence provider has won a pilot project from the US National Geospatial-Intelligence Agency to to detect, track, and analyze maritime activities in near real-time.

2. Strategic Stuff: Partnerships and Announcements 📈

Partnerships

- SkyFi has integrated high-resolution satellite imagery from Planet SkySat into its platform;

Announcements

- GHGSat has won NASA approval for integrating its methane emission data into the Commercial SmallSat Data Acquisition program;

- SAR data provider Umbra announced its new Mission Solutions offering enabling customers to buy satellites (in addition to imagery);

- EO edge computing solution provider Ubotica demonstrated the near real-time onboard processing and analytics downlink workflow.

3. Interesting Stuff: More News 🗞️

- NOAA is testing next-generation wildfire detection and warning tools using imagery captured by geostationary weather satellites;

- The methane emissions of the US Oil & Gas sector are over four times higher than the agency estimates, which will improve with more EO satellites;

- ESA and the UK Space Agency have announced a new funding call for UK-based entities developing innovative and commercially viable EO projects;

- The extent of the landslides in the southern Indian state of Kerala, which have killed over 300 people, can be seen on satellite images.

4. Click-Worthy Stuff: Check These Out 🔗

- This paper on evaluating and benchmarking foundation models for EO;

- This piece on the evolution from procuring EO data to EO analytics by the US DoD, along with new very high-resolution imagery that makes it possible.

This is a reader-supported publication. To access exclusive deep dives, market briefings and the newsletter archive, become a paid subscriber. If you want to show your support, you can also make a one-time donation here.

One Discussion Point

Exclusive analysis and insights from TerraWatch

5. State of EO Investments: H1 2024

Last week, a deep dive on EO investments in H1 2024 was published for the paid subscribers of this newsletter. This is a short preview. Become a paid subscriber to get full access.

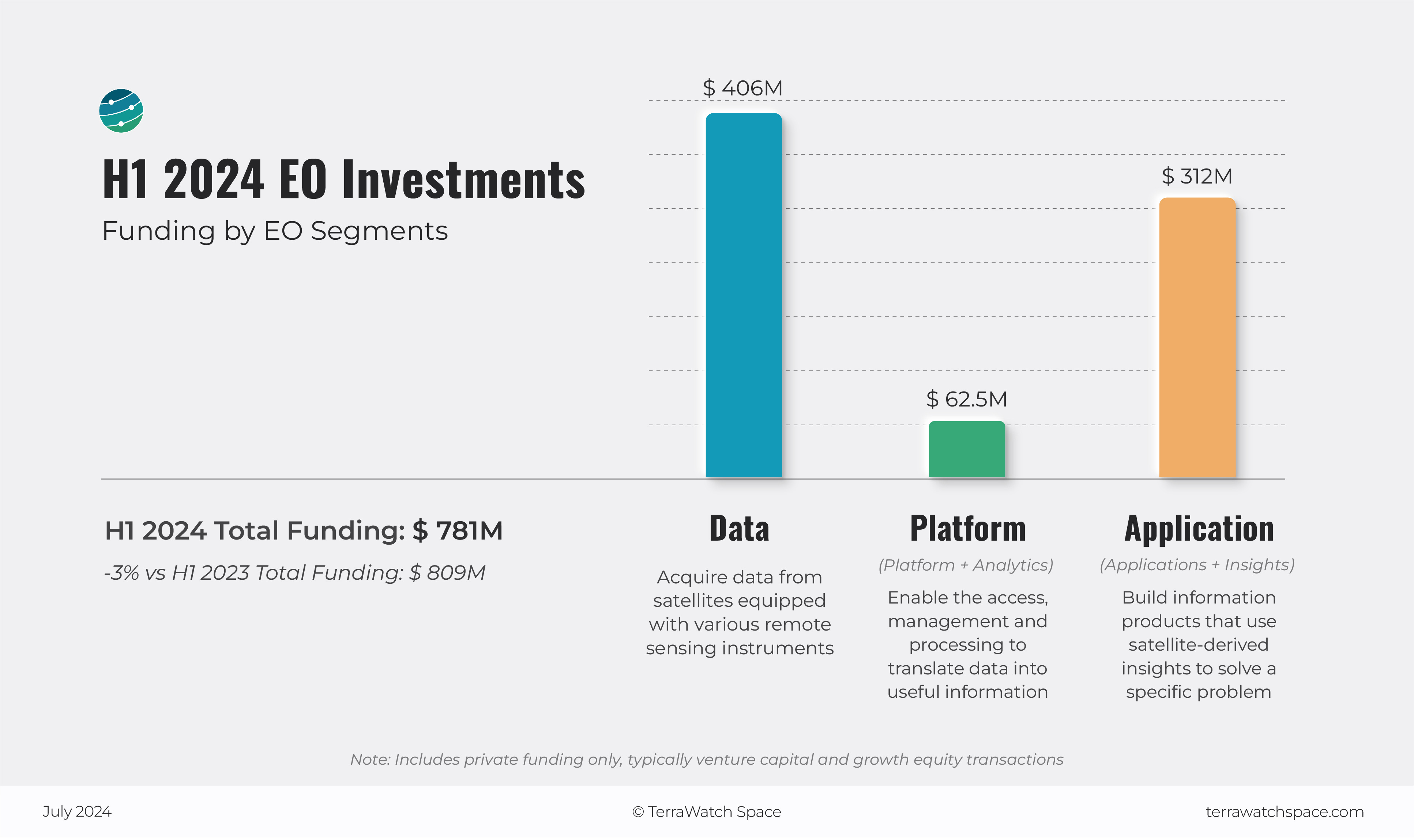

The total investments in EO over H1 2024 are estimated to be $781M, with Data and Application segments contributing to almost all the funding raised.

Companies in the Data segment, which typically include EO satellite companies, had a stronger than expected first half of the year and raised about $406M1, with the largest rounds from: Iceye ($93M), Unseenlabs ($92M), Synspective ($44M), HawkEye 360 ($40M) and Albedo ($35M).

Companies in the Platform segment, which typically include those building EO data marketplaces, EO data management solutions and EO data processing tools, raised $62.5M*, including Danti ($5M) and Fused ($1M). The relative lack of interest in this layer, as I wrote in the EO Platform deep-dive, can be primarily attributed to: a lack of scalable demand for EO data & analytics, unstructured public funding in the past and availability of custom EO solutions.

*Privateer, a startup focused space situational awareness (SSA) acquired Orbital Insight an EO platform provider and raised $56.5M. This is currently attributed as an investment in the EO sector, but it is unclear how much it paid for the deal and whether the company intends to completely pivot away from SSA into EO.

Companies in the Application segment, which typically includes any company that builds products leveraging EO data had a surprisingly sluggish first half of the year, especially compared to the past few years, with a total of $312M in the period. This is also reflected in the weak investment trends in the larger climate tech world. The largest rounds in this category include: Arbol ($60M), AiDash ($58M) and LiveEO ($27M).

Outlook

While the numbers do tell a story, one that does not seem very gloomy, there are some things that are not easy to convey with figures. I speak to entrepreneurs, investors and government officials building the EO industry on a daily basis and I do not walk away with a feeling that things are rosy in EO.

The age-old dilemma of how and when to 'productize' the projects (i.e. say no to more projects and invest in product development) vs continuing to 'projectize' potential products (i.e. do more projects to get more confidence for product development) still remains in the sector.

Scene from Space

One visual leveraging EO

6. Monitoring Nitrogen Dioxide Emissions with Sentinel-2

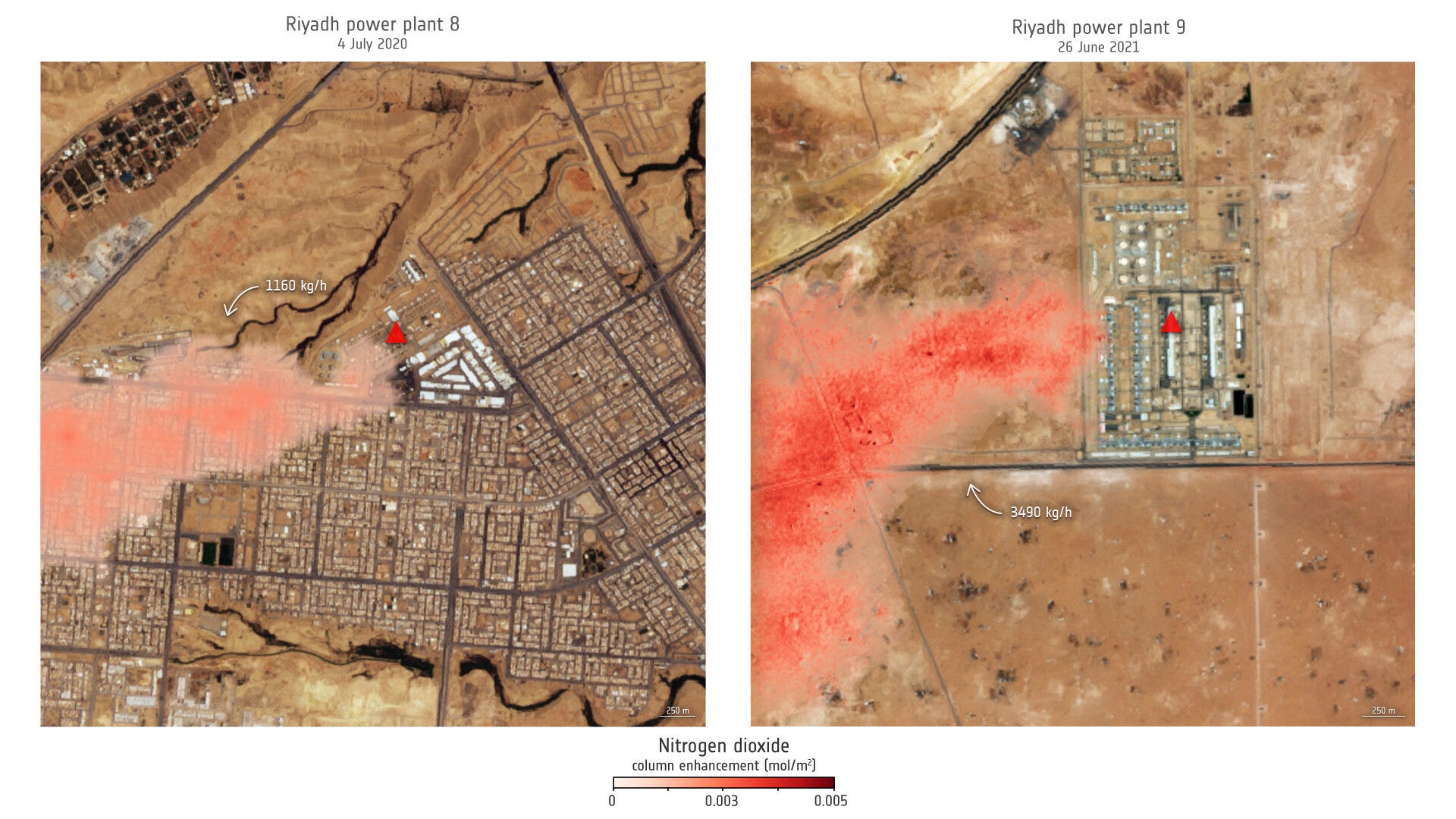

In a recent study, researchers used imagery from the Copernicus Sentinel-2 mission to observe nitrogen dioxide plumes from power plants for the first time – marking a significant advancement in air pollution monitoring. Even though Sentinel-2 is not focused on air pollution monitoring (like Sentinel-5) and does not have a hyperspectral sensor, its relatively high resolution (10m) allows the detection of nitrogen dioxide plumes.

The image shows nitrogen dioxide plumes from two power plants in Saudi Arabia, as captured from the Sentinel-2 satellite, courtesy of ESA.

Until next time,

Aravind.