Welcome to a new edition of ‘Last Week in Earth Observation’, containing a summary of major developments in EO from the last week and some exclusive analysis and insights from TerraWatch.

As there was no weekly newsletter edition last week, we have got a lot to cover in this one. Let’s go!

Four Curated Things

Major developments in EO from the past week

1. Contractual Stuff: Funding, Contracts and Deals 💰

Funding

- EO data search engine Danti, which aims to make EO data more easily accessible by leveraging AI raised $5M in a seed round;

- EO-based infrastructure monitoring solution provider AiDash added $8.5M from new investors to its oversubscribed Series C round (now at $58.5M);

Deals

EO space situational awareness data provider Privateer Space has acquired major EO platform player Orbital Insight and raised $56.5M;

Orbital Insight, founded in 2013, had raised over $130M but had been on the brink of bankruptcy since last year before Privateer bought them out.

Climavision, a multi-sensor weather solution provider, has acquired Intersphere, a startup specialising in subseasonal-to-seasonal forecasting;

Contracts

Finnish hyperspectral EO firm Kuva Space won a €1.8M contract from ESA to provide advanced situational awareness information for monitoring and mitigating civil security and crisis events;

BAE Systems won a $365 million contract to develop an air quality sensor for NOAA’s GeoXO weather satellite;

The UK’s EO DataHub awarded contracts worth £3M in total to five EO firms: Airbus, Earth-i, Planet, Sparkgeo, Spyrosoft and Oxidian;

The Canadian Space Agency awarded $5M in grants to 13 academic institutions for research on developing applications using satellite data;

Spire won a multi-million dollar deal from an undisclosed financial firm to provide its six-day weather forecasting solution enabled by its proprietary GNSS-RO data;

Citadel, the most successful hedge fund in history, built proprietary weather models in-house for gathering exclusive insights. This is yet another example, showing how EO can become a strategic differentiator for an organisation.

2. Strategic Stuff: Partnerships and Announcements 📈

Announcements

- Airbus launched the Pléiades Neo Next programme to expand its very high-resolution EO constellation, following the failed launch of its two Pléiades Neo satellites last year;

- Spire unveiled its Soil Moisture Insights product that leverages GNSS-R (Reflectometry) data from its constellation;

- EO satellite manufacturer Muon Space has announced a new constellation focused on wildfire monitoring - FireSat Constellation - in partnership with the non-profit Earth Fire Alliance;

- Iceye launched its Flood Insights and Flood Early Warning products in Canada and also launched two new application programming interfaces (APIs) to automate the process of tasking and downloading its SAR data;

- Radio-frequency (RF) monitoring satellite firm Unseenlabs has unveiled its next-generation constellation focused on monitoring RF signals across maritime, land and space;

- Satellogic has released an open dataset containing over 6 million high-resolution images to support training of AI models;

Partnerships

- SAR data provider Capella Space has added EO-based geospatial intelligence firm Preliegens to its partner program and launched its automated, Vessel Classification product;

- Hyperspectral imaging satellite firm Pixxel has partnered with Enabled Intelligence, a data labelling solution provider;

- Descartes Labs is partnering with EarthDaily Analytics to supply EO data to power their geospatial analytics and AI solutions.

3. Interesting Stuff: More News 🗞️

- BlackSky reported $24.2M in revenue in the first quarter of 2024, up 32% from the same time last year;

- SpaceX launched Maxar’s first WorldView Legion imaging satellites after years of delays;

- Planet published a validation and comparison report for its Forest Carbon product, detailing the methodology, uncertainties and limitations;

- Switzerland will not be participating in the European Copernicus programme until at least 2027;

- An analysis from BBC showed that half of the water sites in Gaza were damaged or destroyed;

- NASA has selected four proposals of EO science missions for concept studies, of which two will be selected for development;

- The US National Geospatial-Intelligence Agency plans to tap into commercial EO data and analytics for maritime domain awareness;

- Data from the Copernicus Climate Service shows that the world’s oceans are suffering from a record-breaking year of heat;

4. Click-Worthy Stuff: Check These Out 🔗

- This article that shows how methane emissions from gas flaring are being hidden from satellites;

- This piece that discusses the impacts of the loss of data from NASA’s Terra, Aqua and Aura, which will soon reach end-of-life;

- This article on EO for climate in which I was quoted - I decided to reduce the hype and focus on pragmatic thoughts on the future of EO;

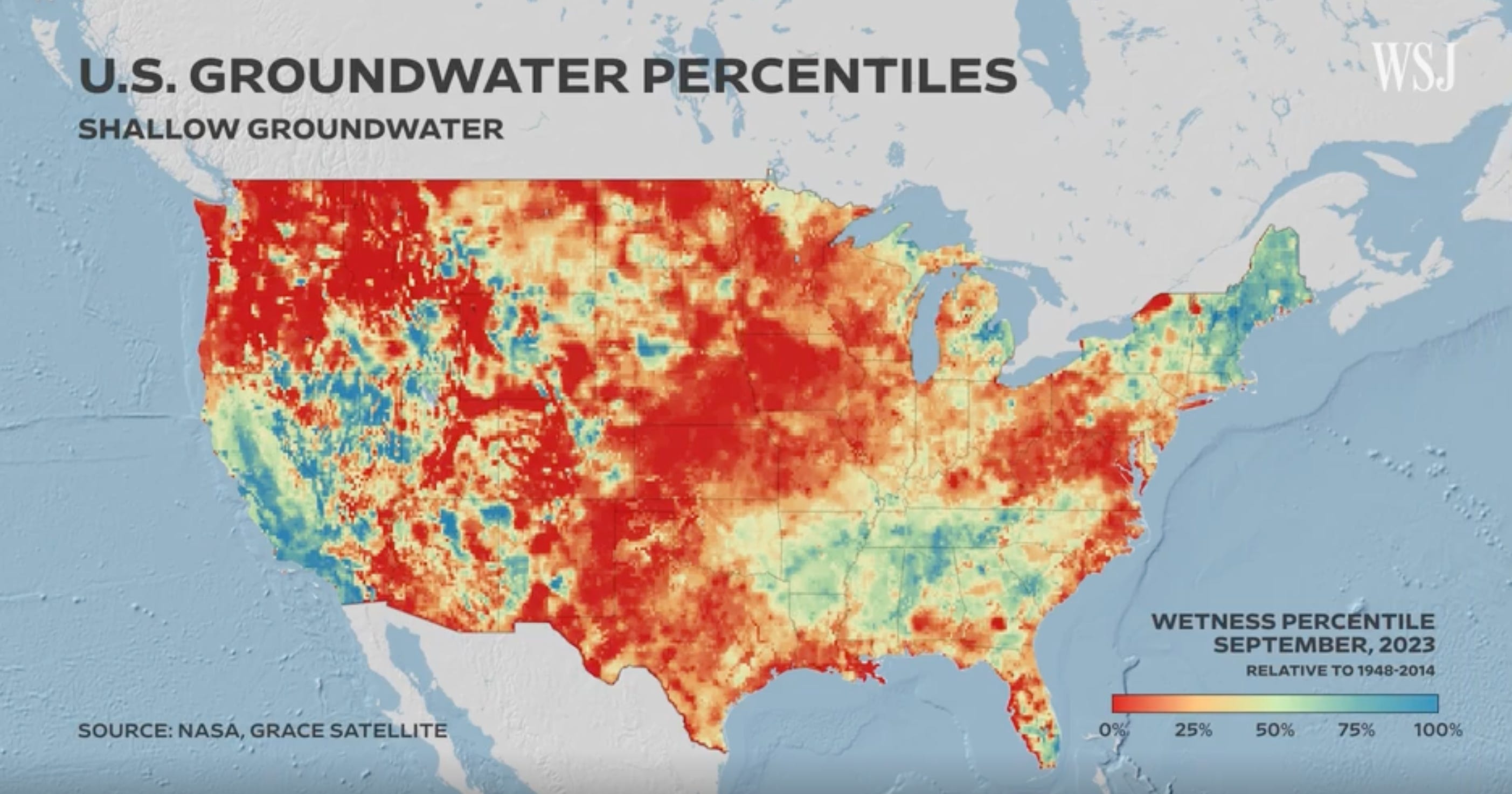

- This video that analyses the impact of declining groundwater in the US and its food security, leveraging data from satellites;

EO Summit: Speakers List

I am extremely glad to have people with diverse roles from various organisations across several sectors, representing EO users, EO industry, investors, and government agencies, participating in EO Summit.

Register before it is too late!

💸 This is the last week to buy your tickets at €299 - hurry up! 💸

One Discussion Point

Exclusive analysis and insights from TerraWatch

5. State of EO Platforms

There have been a lot of recent developments in the usually quiet corner of the EO sector - Platforms.

EO space situational awareness firm Privateer Space pivoted and bought major EO platform player Orbital Insight, another recently acquired EO platform provider Descartes Labs acquired a niche platform Geosite, an EO platform for the insurance sector and Planet launched its Insights Platform following the acquisition of Sinergise (Sentinel Hub).

We also saw startups like Danti, an EO data search engine and Fused, a serverless EO processing and visualisation platform raise funding and others like Astraea getting acquired by Nuview, an EO satellite startup. And there is more to come.

However, EO platforms have never really taken off for several reasons that I dig into in the essay. In the latest, subscriber-only deep-dive on TerraWatch, we look at the state of EO platforms, what has happened so far, why platforms have not taken off and where we are going.

In the piece, I classify the EO Platforms segment into five segments (shown below) and try to demystify ‘platforms.’ We get deeper into identifying the roles of EO platforms, understanding the current market landscape and assessing which providers are solving problems such as accessibility, usability and usability. I also answer some critical questions for the EO market including:

- Why is Platforms the most overlooked segment in the EO market?

- Who are the major EO platform providers in the market and where are they positioned?

- Why haven't EO platforms taken off and what is the outlook for this segment?

- Will we have a horizontal platform that is data-agnostic, sensor-agnostic and enables the pre-processing, processing & visualisation of EO data?

Scene from Space

One visual leveraging EO

6. Monitoring Tigers from Space

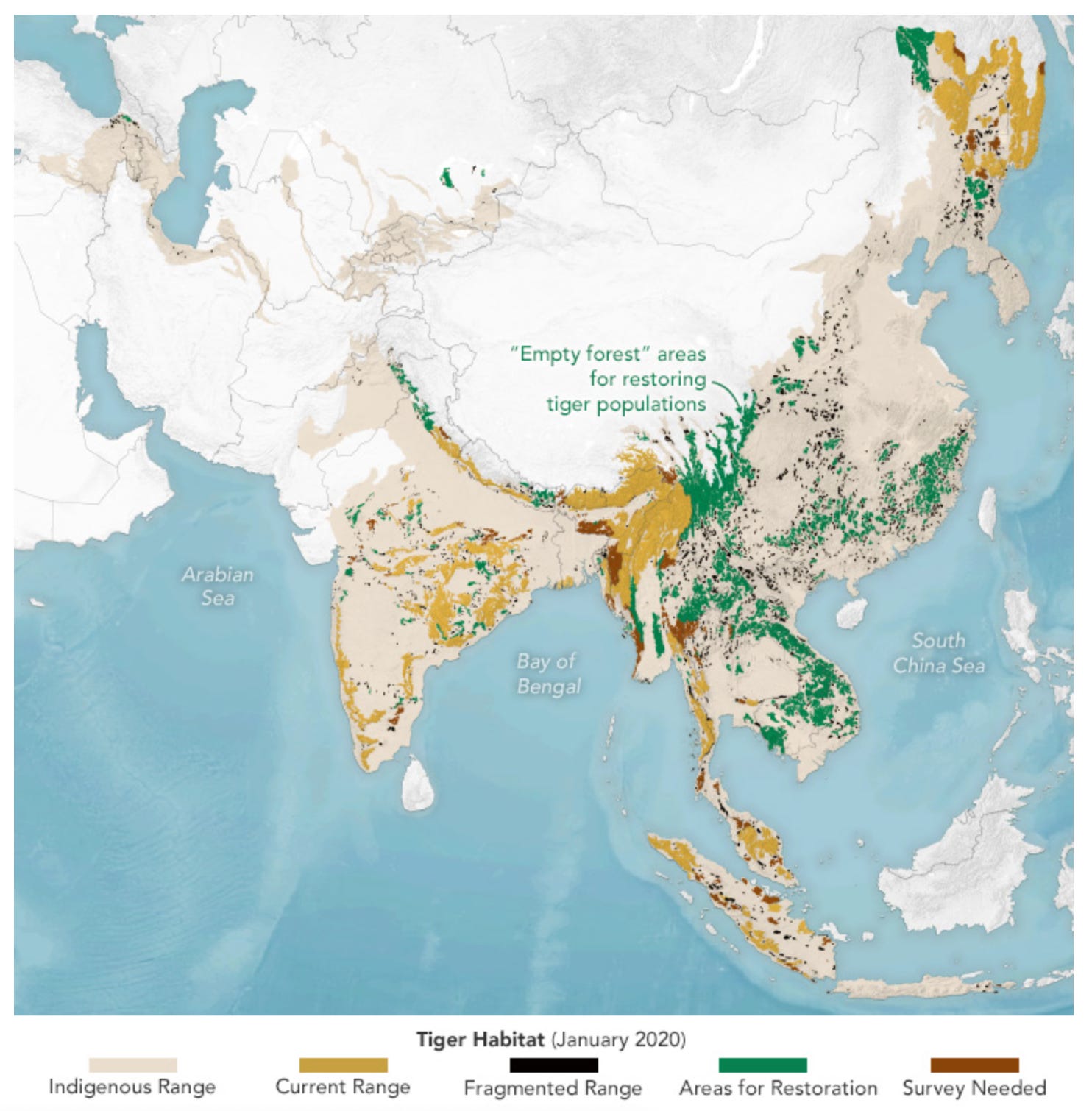

Researchers have mapped tiger habitats and are aiding conservation efforts, using data derived from EO satellites. How? By tracking changes to land use, vegetation height and human footprint, derived from Landsat and Sentinel satellites, and combining that information with ground surveys.

This paper details the methodology, but a bit of good news is that tiger habitats have stabilised recently, even though they have been on the decline since 2001.

Orange areas show zones of suitable habitat where tigers are known to be found. Those are areas to be conserved and expanded, including prey populations, the team concluded. Green areas are “empty forests” where tigers aren’t known to live recently, but because these areas were suitable for tigers in the past and are still big enough to support a tiger population, they are potential landscapes for tiger restoration. The remaining colors show where habitat is potentially suitable but tiger residence is unknown (brown), and areas where habitat is too fragmented to support tigers (black) - NASA.

If this was forwarded, subscribe for free to get your copy every week. Already a free subscriber? Then, become a paid subscriber and get exclusive EO insights.

Until next time,

Aravind.